Gennaro Cuofano's Blog, page 66

July 10, 2025

Mapping the Three AI Strategy Archetypes

The 2025 artificial intelligence landscape reveals a fundamental shift in how technology companies compete.

Rather than converging on a single winning strategy, the industry has crystallized into three distinct strategic archetypes: Full-Stack Integrators, Specialized Dominators, and Strategic Enablers.

This strategic divergence represents a sophisticated evolution from the early days of AI competition, where companies raced to achieve similar capabilities.

The most successful AI companies are those that have recognized their unique strengths and positioned themselves accordingly rather than attempting to compete across every dimension.

This strategic AI map offers crucial insights into understanding not only current competitive dynamics but also the likely evolution of the AI industry over the next decade.

Now, let’s focus on the three strategic archetypes and how they play out within the strategic AI map.

The Emergence of Strategic Archetypes From Convergence to DivergenceThe early phase of the AI revolution saw most major technology companies pursuing remarkably similar strategies: building better models, acquiring more data, and deploying AI across existing products.

This convergence created a zero-sum competitive dynamic, where model performance benchmarks and market share primarily measured success in similar applications.

By 2025, however, the landscape has undergone a fundamental transformation.

This strategic sophistication has given rise to three distinct archetypes, each with its competitive dynamics, success factors, and sustainability profile.

The Strategic Trinity

The three strategic archetypes that have emerged represent fundamentally different philosophies about how to create and capture value in the AI economy:

Full-Stack Integrators believe that controlling the entire AI value chain—from silicon to consumer applications—creates insurmountable competitive advantages through synergy and integration. These companies accept the complexity and capital requirements of competing across multiple layers in exchange for the potential to dominate entire ecosystems.Specialized Dominators focus on achieving category leadership in specific layers of the AI stack, whether models, infrastructure, or platforms. These companies bet that depth beats breadth, and that world-class capabilities in focused areas create more value than mediocre performance across many.Strategic Enablers position themselves as essential infrastructure providers that enable others’ success rather than competing with potential customers. These companies have discovered that the most profitable position in a gold rush might be selling shovels rather than mining for gold.This is playing out as part of The Strategic Map of AI.Read The Full Analysis

The post Mapping the Three AI Strategy Archetypes appeared first on FourWeekMBA.

The Strategic Map of AI [Workshop]

The artificial intelligence industry entered an unprecedented period of upheaval in 2025, fundamentally reshaping the strategic landscape that defined the sector for the past five years. What began as a collaborative ecosystem of specialized players has rapidly devolved into a battlefield of broken partnerships, emergency consolidations, and billion-dollar acquisition wars.

Check out The Strategic Map of AI

Three seismic events in the first half of 2025 have accelerated the industry’s transformation beyond all predictions:

OpenAI’s $500 billion Stargate Project – The most ambitious infrastructure investment in tech historyMeta’s $14.8 billion Scale AI acquisition – Triggering an immediate exodus of major clients and market reshufflingThe Microsoft-OpenAI partnership crisis – Once the industry’s model relationship is now “fraying at the seams”These developments have shattered the conventional wisdom about AI strategy, proving that partnerships are fragile, neutrality is impossible, and vertical integration isn’t just preferred—it’s essential for survival.

The Death of the Partnership EraFrom Collaboration to Competition OvernightFor years, the AI industry operated on a foundational assumption: that specialized companies could maintain productive partnerships while focusing on their core competencies. Microsoft and OpenAI were the poster children of this model—a $13 billion partnership that seemed to benefit both parties while advancing the entire industry.

That era is over.

The Microsoft-OpenAI Crisis

By June 2025, the relationship between Microsoft and OpenAI had deteriorated to the point where OpenAI executives were reportedly considering the “nuclear option”—publicly accusing Microsoft of anticompetitive behavior. The breaking point came over OpenAI’s $3 billion acquisition of Windsurf, an AI coding startup that competes directly with Microsoft’s GitHub Copilot.

Under their 2023 agreement, Microsoft has broad access to all OpenAI technology, including acquisitions. But OpenAI no longer wants to share Windsurf’s intellectual property, creating an unprecedented standoff. Microsoft’s position, according to sources close to the negotiations: “Give us money and compute and stay out of the way”—a demand that OpenAI executives now view as evidence of “bad partner attitude” and “arrogance.”

The irony is profound. Microsoft’s Mustafa Suleyman, who heads the company’s AI division, is now actively “plotting a future without OpenAI,” testing alternatives from xAI, DeepSeek, and Meta. Meanwhile, OpenAI’s $500 billion Stargate project represents a direct challenge to Microsoft’s dominance in Azure.

The Scale AI Disruption

The fragility of AI partnerships became even clearer with Meta’s $14.8 billion acquisition of Scale AI in June 2025. Scale had positioned itself as the Switzerland of AI data—a neutral provider serving everyone from OpenAI to Google to Microsoft. The company’s founder, 28-year-old Alexandr Wang, was widely respected for maintaining this neutrality while building a $29 billion business.

Meta’s acquisition shattered that illusion overnight. Within days of the announcement, both OpenAI and Google began severing their relationships with Scale, fearing that their proprietary training data could give Meta competitive insights. The exodus was so swift that competitors like Uber, Turing, and Handshake reported demand for their services tripling literally overnight.

The message was unmistakable: in the AI industry of 2025, there are no neutral players. Every provider is either an ally or a potential threat.

The Great Consolidation AcceleratesThree Strategic Archetypes Under PressureThe AI industry has coalesced around three strategic archetypes, each facing unique pressures from the 2025 upheaval:

Full-Stack Integrators: The Vertical Powerhouses

Google and Microsoft represent the companies attempting to control the entire AI value chain, from custom silicon to consumer applications. However, their strategies have diverged dramatically in response to 2025’s crises.

Google has doubled down on consolidation, moving all AI teams under DeepMind’s unified command. CEO Demis Hassabis now controls Google’s entire AI apparatus, from research to product development. This centralization allows for faster decision-making and clearer strategic direction, as evidenced by Google’s swift exit from Scale AI relationships.

Microsoft, by contrast, faces an existential crisis. The company’s AI strategy was built around the OpenAI partnership, but that foundation is crumbling. Suleyman’s emergency efforts to diversify—testing models from four different providers—reveal the strategic vulnerability of over-dependence on a single partner.

Specialized Dominators: The Category Kings Under Siege

Companies like Meta, Amazon, and Perplexity have focused on dominating specific layers of the AI stack. But 2025 has proven that specialization without control creates dangerous dependencies.

Meta’s response has been the most aggressive: the Scale AI acquisition for $14.8 billion, attempts to buy Safe Superintelligence for $32 billion, and efforts to recruit top talent like GitHub’s former CEO Nat Friedman. The message is clear—Meta is no longer content to compete on open-source models alone.

Amazon continues to thread the needle with its “neutral platform” strategy through AWS, but even Amazon is moving up the stack with its Nova model family. The company’s Trainium chips represent an insurance policy against NVIDIA dependence.

Perplexity has become the industry’s most coveted acquisition target, with Apple conducting internal discussions about a potential $14+ billion purchase—which would be Apple’s largest acquisition ever. Meta previously approached Perplexity before pivoting to Scale AI, showing how quickly strategic priorities can shift.

Strategic Enablers: The Foundation Builders

NVIDIA, Apple, and Anthropic have positioned themselves as enablers of others’ success, but even they face new pressures.

NVIDIA remains in the strongest position, with 80%+ market share in AI training hardware and customers who literally cannot abandon the company without abandoning AI leadership. The Stargate project alone will generate billions in NVIDIA revenue.

Apple’s potential Perplexity acquisition would mark a dramatic pivot from its privacy-first, on-device strategy to competing directly in AI search—a recognition that its current approach may not be sufficient for the AI era.

Anthropic’s safety-first positioning remains defensible, but the company faces growing pressure as Microsoft reportedly considers acquisition to diversify beyond OpenAI.

The $500 Billion Infrastructure Arms RaceStargate: OpenAI’s Declaration of IndependenceOpenAI’s Stargate project represents the most ambitious infrastructure investment in technology history—$500 billion over four years to build exclusive AI infrastructure. The project’s scale is staggering: 10+ data centers in Texas alone, with plans for expansion across the United States and internationally.

But Stargate is more than an infrastructure play—it’s OpenAI’s declaration of independence from Microsoft. By building its own computing infrastructure, OpenAI reduces its Azure dependence from nearly 100% to potentially less than 30% by 2027. The 60-70% cost savings are significant, but the strategic autonomy is priceless.

The project’s timing, announced at the White House with President Trump’s backing, reflects the new geopolitical reality of AI competition. With China investing heavily in AI infrastructure, the U.S. government views projects like Stargate as essential for national competitiveness.

The Partnership Renegotiation

Stargate has forced a fundamental renegotiation of the Microsoft-OpenAI relationship. Microsoft now has “right of first refusal” on OpenAI’s cloud capacity rather than exclusivity—a significant reduction in its leverage. OpenAI can now work with Oracle (Stargate’s infrastructure partner) and even Google Cloud for specific workloads.

The restructuring negotiations reveal the high stakes involved. OpenAI reportedly wants Microsoft to accept a roughly 33% equity stake in the restructured company rather than its current profit-sharing arrangement. Microsoft, having invested $13 billion, wants guarantees about future technology access and revenue sharing.

The outcome will determine whether this partnership survives or becomes another casualty of the AI industry’s brutal consolidation.

The Search Wars: AI’s Next BattlegroundApple’s Potential Game-ChangerApple’s internal discussions about acquiring Perplexity represent a potential earthquake in the search industry. At $14+ billion, the deal would be Apple’s largest acquisition ever, signaling CEO Tim Cook’s recognition that the company needs to move beyond its current AI approach.

The strategic logic is compelling. Apple currently earns an estimated $20 billion annually from making Google the default search engine on its devices. But that arrangement faces regulatory threats, and AI-powered search is rapidly challenging traditional search paradigms.

Perplexity, with 780 million queries processed in May 2025 alone, has proven that consumers want conversational, AI-powered search experiences. An Apple acquisition would give the company instant credibility in AI while creating a genuine alternative to Google’s search dominance.

The Ripple Effects

An Apple-Perplexity deal would trigger massive industry realignment:

Google would lose its most lucrative partnership and face a formidable new competitorMicrosoft’s Bing would face increased pressure from a well-funded Apple search engineThe entire online advertising model could shift toward AI-mediated interactionsOther tech giants would scramble to acquire remaining AI search capabilitiesMeta’s earlier approach to Perplexity—before pivoting to Scale AI—shows how quickly strategic priorities can change. In today’s environment, companies must move quickly or risk losing opportunities.

The Data Wars: The End of NeutralityScale AI: From Switzerland to BattlefieldScale AI’s transformation from neutral data provider to Meta subsidiary represents a broader industry shift: the end of true neutrality in AI. Founded in 2016, Scale built its business by serving all major AI companies, processing and labeling the data needed to train cutting-edge models.

That model worked when AI companies viewed each other as friendly competitors racing toward common goals. But as the industry has matured and stakes have risen, competitive paranoia has replaced collaborative spirit.

The Immediate Fallout

Meta’s Scale AI acquisition triggered the fastest mass exodus in recent tech history:

OpenAI began phasing out Scale relationships within days of the announcementGoogle reportedly decided to “cut ties” completelyUber, previously a ride-sharing company, suddenly found itself pitched as an AI data labeling alternativeTuring and Handshake, Scale competitors, saw demand triple overnightThe lesson is clear: in high-stakes AI competition, there’s no such thing as a neutral supplier. Every vendor is either helping you win or helping your competitors beat you.

The New Data Reality

The Scale AI disruption has forced every AI company to reconsider its supply chain vulnerabilities:

Diversification is mandatory: No company can rely on a single data providerVertical integration becomes attractive: Companies need to own critical capabilitiesAcquisition timing matters: Scale’s competitors became valuable overnightTrust is temporary: Today’s neutral partner could be tomorrow’s competitor assetGoogle’s Unified Response: The DeepMind ConsolidationDemis Hassabis Gains ControlWhile Microsoft struggles with partnership fragmentation and OpenAI builds independence, Google has chosen radical simplification. All AI teams now report to DeepMind CEO Demis Hassabis, creating a unified command structure for the company’s AI efforts.

The reorganization is comprehensive:

AI Studio teams moved from Google’s Knowledge & Information division to DeepMindGemini API development now falls under DeepMind controlResponsible AI teams relocated from Research to DeepMindPlatform and hardware teams unified under a single Platforms & Devices unitStrategic Advantages

This consolidation provides Google with several advantages in the current competitive environment:

Faster decision-making: No more coordination between competing internal teamsResource optimization: Clearer priorities and resource allocationCompetitive response speed: Ability to quickly pivot strategies and partnershipsUnified vision: Single leadership for all AI initiativesThe proof is in Google’s swift response to the Scale AI situation. Within days of Meta’s announcement, Google had made the strategic decision to sever ties and identify alternatives. This kind of rapid response would have been impossible under the previous fragmented structure.

The Acquisition Feeding FrenzyTargets, Hunters, and Strategic RationalesThe first half of 2025 has seen unprecedented M&A activity in AI, with deal values reaching levels that would have been unthinkable just two years ago:

Completed and Announced Deals:

Meta acquires 49% of Scale AI: $14.8 billionOpenAI acquires Windsurf: $3 billion (triggering Microsoft conflict)Meta attempts Safe Superintelligence acquisition: $32 billion (unsuccessful)Active Negotiations:

Apple-Perplexity discussions: $14+ billion potentialMicrosoft rumored to consider Anthropic acquisitionVarious companies pursuing remaining data labeling providersThe Strategic Logic

Each acquisition serves a specific strategic purpose:

Scale AI: Meta gains data moat and disrupts competitors’ supply chainsWindsurf: OpenAI acquires coding capabilities to compete with GitHub CopilotPerplexity: Apple would gain AI search to challenge Google and achieve independenceAnthropic: Microsoft would diversify beyond OpenAI partnershipThe key insight is that companies are no longer just buying technology—they’re buying strategic position and denying capabilities to competitors.

Regulatory Challenges and Geopolitical ImplicationsThe Antitrust Wild CardThe rapid consolidation of AI has attracted regulatory attention, but enforcement remains inconsistent. Meta’s Scale AI deal structured as a 49% acquisition specifically to avoid traditional merger review requirements. However, the Department of Justice has begun investigating whether such “acquihire” deals are designed to evade antitrust scrutiny.

OpenAI’s consideration of antitrust accusations against Microsoft represents a new wrinkle—using regulatory threats as negotiating leverage in partnership disputes. This “nuclear option” could backfire by attracting regulatory attention to OpenAI itself.

The Trump Factor

The Trump administration’s involvement in Stargate reflects a new reality: AI infrastructure is viewed as a matter of national security. Trump’s personal announcement of the $500 billion project, alongside OpenAI’s Sam Altman and SoftBank’s Masayoshi Son, signals governmental support for American AI dominance.

This backing may provide regulatory cover for further consolidation, especially if framed as necessary for competing with China. However, it also creates expectations for domestic job creation and technological leadership.

Investment and Market ImplicationsThe New Math of AI InvestingThe scale of current AI investments has fundamentally changed the financial calculations for the industry:

Infrastructure Costs

Training frontier models: $5+ billion per modelStargate total investment: $500 billion over 4 yearsGPU requirements: 100,000+ for next-generation modelsAnnual compute spending: $50+ billion across major playersValuation Impacts

Perplexity valuation: $14 billion (from $9 billion in November 2024)Scale AI valuation: $29 billion (from $14 billion in May 2024)Infrastructure companies seeing massive demand increasesSpecialized AI companies facing acquire-or-die scenariosThe Winner-Take-Most Dynamic

While the AI industry isn’t purely winner-take-all, it’s increasingly winner-take-most. Companies with access to massive capital and infrastructure advantages are pulling away from the field:

NVIDIA maintains 80%+ market share in AI training hardwareOpenAI’s Stargate creates a moat comparable to hyperscale cloud providersMeta’s Scale acquisition disrupts competitors while strengthening its own positionGoogle’s DeepMind consolidation creates unified competitive response capabilityThe Human Factor: Talent Wars and Cultural ShiftsThe $100 Million Signing BonusThe competition for AI talent has reached unprecedented levels. Reports suggest that Meta offered OpenAI employees signing bonuses as high as $100 million, with even larger annual compensation packages. This represents a fundamental shift in how companies value and compete for technical talent.

The Alexandr Wang Effect

Meta’s recruitment of Scale AI’s 28-year-old founder Alexandr Wang to lead its “superintelligence” efforts reflects a new model: acquiring entire companies primarily to secure key individuals. Wang’s compensation likely exceeds $1 billion when including his Scale equity and Meta compensation.

This “acquihire” model extends beyond individual contributors to entire teams. Meta also recruited GitHub’s former CEO, Nat Friedman, and is gaining stakes in his venture capital firm, NFDG, as part of the package.

Cultural Transformation

The industry’s shift from collaborative to competitive has profound cultural implications:

Open-source projects face pressure from commercial imperativesResearch sharing between companies has dramatically decreasedAcademic partnerships are scrutinized for competitive implicationsEmployee mobility between companies is increasingly viewed with suspicionTechnical Implications: The Infrastructure-Model NexusHardware-Software Co-Design AdvantagesThe 2025 consolidation has accelerated the trend toward hardware-software co-design, where companies control both infrastructure and models:

Google’s TPU Integration Google’s Ironwood TPU v7, delivering 42.5 ExaFLOPS of compute power, is explicitly optimized for Transformer architectures and Gemini models. This vertical integration provides 30-40% performance advantages over general-purpose hardware.

OpenAI’s Custom Silicon Plans Stargate includes plans for OpenAI to develop custom chips optimized for its specific model architectures. This would reduce dependence on NVIDIA while enabling architecture-specific optimizations.

Amazon’s Trainium Strategy AWS’s Trainium3 chips promise 4x performance improvements, providing infrastructure cost advantages for companies training on Amazon’s platform.

The Model Commoditization ParadoxIronically, as infrastructure becomes more important, model capabilities are converging. OpenAI’s GPT-4.1, Meta’s Llama 4, and Google’s Gemini 2.5 achieve similar benchmark scores, making deployment efficiency and integration quality more important than raw model performance.

This convergence explains why infrastructure control has become paramount—when models perform similarly, success depends on cost structure, deployment speed, and ecosystem integration.

Looking Forward: Three Scenarios for 2030Scenario 1: The Oligopoly Endgame (70% probability)By 2030, 3-4 vertically integrated AI giants control 90%+ of the market:

OpenAI-Stargate: Completes infrastructure buildout, becomes full-stack competitor to cloud providersGoogle-DeepMind: Leverages unified AI command and hardware integrationMicrosoft-Diversified: Successfully reduces OpenAI dependence through multi-vendor strategyMeta-Data Moat: Scale acquisition provides sustainable competitive advantageSpecialized players either get acquired or relegated to niche markets. The industry resembles today’s cloud computing oligopoly but with higher barriers to entry.

Scenario 2: The Partnership Wars Continue (20% probability)Companies fail to achieve full vertical integration, leading to continued partnership instability:

Constant renegotiation of major partnerships creates ongoing uncertaintyRegulatory intervention prevents large acquisitionsSmaller players survive by rapidly switching between larger platform providersInnovation accelerates due to continued competitive pressureThis scenario maintains more competition but at the cost of platform stability and long-term investment.

Scenario 3: The Search Revolution (10% probability)Apple’s potential Perplexity acquisition succeeds and fundamentally reshapes the industry:

AI search becomes the dominant interface, marginalizing traditional searchThe $20 billion Google-Apple search deal collapses, forcing industry realignmentMultiple specialized AI assistants emerge for different use casesAdvertising models shift toward AI-mediated interactionsWhile less likely, this scenario would create the most dramatic industry transformation.

Strategic RecommendationsFor Technology CompaniesImmediate Actions:

Audit partnership dependencies: Map all critical suppliers and assess acquisition riskDevelop contingency plans: Prepare for sudden partnership terminationsAccelerate integration decisions: The window for building full-stack capabilities is closingConsider acquisition opportunities: Identify targets before competitors actMedium-term Strategy:

Build redundant capabilities: Never depend on a single vendor for critical functionsInvest in switching capabilities: Make vendor transitions as frictionless as possiblePrepare for oligopoly: Position for a world dominated by 3-4 AI giantsFor EnterprisesRisk Management:

Diversify AI vendors: Don’t put all AI investments in a single platformMap indirect dependencies: Understand your suppliers’ suppliers (Scale AI lesson)Plan for partnership failures: Assume major partnerships will eventually break downInvest in internal capabilities: Build some AI competencies in-houseStrategic Positioning:

Choose platforms carefully: Today’s decisions will have 10+ year implicationsMaintain optionality: Avoid deep lock-in to any single vendorBuild relationships with multiple AI providers: Don’t rely on single sourcesFor InvestorsThemes to Watch:

Infrastructure providers: Power, cooling, networking for AI data centersSwitching cost creators: Companies that make vendor changes difficultAcquisition targets: Specialized AI companies before they get boughtPlatform enablers: Tools that work across multiple AI providersRisks to Avoid:

Single-vendor dependencies: Companies locked into failing partnershipsLate-stage integration plays: The consolidation window is closingNeutral provider myths: No such thing as Switzerland in AI anymoreThe End of InnocenceThe AI industry’s transformation in 2025 represents the end of its innocent phase. The collaborative spirit that characterized the early years has given way to brutal competition for control of the most transformative technology since the internet.

The lessons are stark:

Partnerships are temporary: Even the strongest relationships can fracture when strategic interests diverge. The Microsoft-OpenAI crisis proves that no partnership is too important to fail.

Neutrality is impossible: Scale AI’s fate shows that every vendor eventually becomes part of someone’s competitive strategy. There are no Switzerland solutions in AI.

Infrastructure is destiny: OpenAI’s $500 billion Stargate bet demonstrates that controlling infrastructure trumps partnerships. Companies that own their stack control their fate.

Speed matters more than perfection: Microsoft’s frantic testing of four model alternatives shows that rapid adaptation beats careful planning in the current environment.

Consolidation is inevitable: The economics of AI development—with $5+ billion model training costs and massive infrastructure requirements—favor integrated giants over specialized players.

The AI industry of 2030 will look fundamentally different from today’s landscape. Success will go to companies that recognize this reality and adapt quickly, rather than those clinging to the partnership models of AI’s collaborative past.

The strategic map of AI has been redrawn, with new boundaries marked by infrastructure control, data moats, and the wreckage of broken partnerships. In this new world, the only constant is change—and the only strategy is to be ready for anything.

Recap: In This Issue!Three Major Shockwaves

OpenAI’s $500 billion Stargate Project, the largest infrastructure investment in tech, aims for independence from Microsoft.Meta’s $14.8 billion acquisition of Scale AI ends industry neutrality, triggers a mass client exodus, and scrambles data supply chains.Microsoft-OpenAI crisis, their once-ideal partnership is collapsing due to IP conflicts (Windsurf) and Stargate directly challenging Azure dominance.Key Themes

End of the Partnership Era: Trust in collaborative AI partnerships has collapsed. Neutrality is now impossible; vertical integration is essential for survival.The Great Consolidation: Big tech companies are racing to control the full AI stack — from custom hardware to training data to deployment platforms.Infrastructure Arms Race: Stargate exemplifies how control over computing resources is now the ultimate strategic moat. Custom chips and hyperscale data centers are no longer optional.Data Wars: Scale AI’s rapid transformation from neutral provider to Meta asset shows that every supplier is now a potential competitive threat. Companies are scrambling to diversify or acquire data partners.Strategic Implications

Partnerships can break overnight — companies must build internal capabilities and have contingency plans.Specialized players risk being acquired or marginalized — integration and speed matter more than perfection.Expect a winner-take-most market by 2030, dominated by 3–4 vertically integrated giants.Investors and enterprises should watch infrastructure suppliers, switch-cost solutions, and emerging acquisition targets.With massive  Gennaro Cuofano, The Business Engineer

Gennaro Cuofano, The Business Engineer

Check out The Strategic Map of AI

The post The Strategic Map of AI [Workshop] appeared first on FourWeekMBA.

The New Competitive Landscape for Agentic AI

The agentic AI revolution has fundamentally changed the rules of competitive advantage in technology.

Unlike previous software eras where moats were built through proprietary code or network effects alone, agentic AI companies must navigate a complex landscape where the underlying intelligence is commoditized. Still, the orchestration layers offer unprecedented opportunities for differentiation.

The companies that will dominate the next decade won’t be those with the best AI models—they’ll be those who build the strongest moats around their specific market positions. Understanding how to construct these defensive barriers is the difference between sustainable market leadership and being swept away by the next wave of innovation.

The Eight Pillars of Agentic AI Moats

The Eight Pillars of Agentic AI Moats

The post The New Competitive Landscape for Agentic AI appeared first on FourWeekMBA.

July 9, 2025

The AR Wars: Apple Vision Pro’s Struggle as Meta and Google Race Ahead

The augmented reality landscape is experiencing a pivotal moment. Apple is planning to introduce its first upgrade to the $3,499 Vision Pro headset as early as this year Apple Vision Pro – Apple, while competitors Meta and Google/Samsung are rapidly advancing with more accessible AR glasses and headsets. The race is shifting from expensive mixed reality headsets to lightweight, AI-powered smart glasses—a transition that may leave Apple’s premium strategy vulnerable.

The State of Play: Apple’s Premium IsolationApple Vision Pro: Incremental Updates in a Changing Market

The State of Play: Apple’s Premium IsolationApple Vision Pro: Incremental Updates in a Changing MarketThe updated Vision Pro will include a faster processor and components that can better run artificial intelligence Apple Vision Pro – Apple, along with a new strap to make it easier to wear the headset for long periods of time Apple Vision Pro – Apple. However, these updates feel more like damage control than innovation.

The Reality Check:

Apple was winding down production of the Vision Pro, with plans to stop making it at the end of 2024 Apple to Upgrade Vision Pro in Two Ways Later This Year – MacRumorsApple believes that it has a sufficient number of Vision Pro headsets to meet demand through the device’s remaining lifespan Apple Vision Pro 2: What the rumor mill expects, and when it might arrieApple CEO Tim Cook described the Vision Pro as an “early-adopter product” for people who want to have tomorrow’s technology today Apple to Upgrade Vision Pro in Two Ways Later This Year – MacRumors—a diplomatic admission of limited market appealThe Roadmap ConfusionApple’s AR/VR strategy appears increasingly fragmented:

Near-term (2025): Minor Vision Pro refresh with M5 chipMid-term (2026-2027): “smart glasses” that are similar to the Meta Ray-Bans Apple Vision Pro 2: What the rumor mill expects, and when it might arrie without displaysLong-term (2028): A true second-generation Vision Pro will launch in late 2028 Apple Vision Pro 2: What the rumor mill expects, and when it might arrieThis timeline reveals a critical strategic gap—Apple won’t have competitive AR glasses until 2027, while Meta and Google are launching theirs now.

Meta’s Momentum: From VR to Smart Glasses DominanceThe Ray-Ban Success StoryMeta has found product-market fit with its Ray-Ban smart glasses:

2+ million units sold since late 2023Expanding to Oakley brand (launched June 2025)Meta is seemingly set to be the first mainstream company to actually launch Android XR has finally broken cover, here are 4 key details we learnt about the Google glasses software display-equipped AR glassesStrategic AdvantagesFashion-First Approach: Partnering with EssilorLuxottica ensures style credibilityPrice Accessibility: $299-399 vs Apple’s $3,499Ecosystem Building: Opening Horizon OS to third partiesAI Integration: Meta AI built into every interactionGoogle/Samsung’s Android XR: The Platform PlayThe Ecosystem StrategyAndroid XR is Google’s new operating system for extended reality devices. It’s intended for use with virtual reality (VR) and mixed reality (XR) headsets, as well as smart glasses My favorite smart glasses are getting a surprise update as Meta announces June 20 event.

Key Developments:

Samsung Project HAEAN smart glasses Android XR: Everything you need to know | Tom’s Guide demonstrated at TED 2025Multiple hardware partners: Samsung, XREAL, Gentle Monster, Warby ParkerSamsung’s Project Moohan headset set to launch in 2025 There’s no need to wait for Google’s Android XR smart glasses – here are two amazing AR glasses I’ve tested that you can try now | TechRadarThe Gemini AdvantageDuring the presentation, Google product manager Nishtha Bhatia asked Gemini where she had left her hotel room key card, to which the AI promptly responded Android XR: Everything you need to know | Tom’s Guide. This “memory” feature showcases practical AI applications that make AR useful in daily life—something Apple’s Vision Pro hasn’t achieved.

Strategic Analysis: Why Apple is Losing the AR Race1. Form Factor MisalignmentApple’s Problem:

Bulky, expensive headset requiring dedicated use sessionsLimited battery life and comfort issuesSocial acceptability challengesCompetitors’ Solution:

Lightweight glasses for all-day wearFashion-forward designsSubtle integration into daily life2. Price Point ParadoxMarket Reality:

Vision Pro at $3,499 limits to ~100K users globallyMeta Ray-Bans at $299 can reach millionsAndroid XR targeting $1,000-2,000 sweet spotThe Network Effect: AR’s value increases with user adoption. Apple’s premium pricing creates a chicken-and-egg problem—developers won’t build for small user bases.

3. AI Integration LagWhile Apple focuses on spatial computing, competitors emphasize AI assistance:

Meta: Real-time translation, object identificationGoogle: Gemini memory and context awarenessApple: Limited Siri integration, no Apple Intelligence on Vision Pro4. Developer Ecosystem ChallengesvisionOS 26 is packed with groundbreaking spatial experiences, including widgets that become spatial Apple Vision Pro: Should You Buy? Reviews, Features, and Price, but developers aren’t biting:

Limited user base doesn’t justify development costsCompetitors offer easier paths to monetizationCross-platform development favors Android XRMarket Dynamics: The Next 18 Months2025: The Inflection PointQ3 2025: Samsung Project Moohan launchesQ4 2025: Apple Vision Pro refresh (minor update)Year-end: Meta’s display-equipped glasses rumored2026: Mass Market ArrivalAndroid XR glasses from multiple manufacturersMeta’s next-gen AR glasses with displaysApple still without lightweight AR solution2027: Platform ConsolidationApple will launch the glasses in 2027 Apple Vision Pro 2: What the rumor mill expects, and when it might arrie—likely too lateAR ecosystems mature around Meta and GoogleEnterprise adoption acceleratesInvestment ImplicationsWinners:Component Suppliers: Micro-OLED displays, AR chipsFashion Brands: Licensing deals for smart glassesAI Infrastructure: Every AR query needs processingLosers:Premium AR/VR: High-price strategies failingStandalone VR: Market shifting to lightweight ARLate Movers: Missing the platform establishment phaseWild Cards:Apple’s Response: Could acquire AR startup or accelerate timelineKiller App: One breakthrough use case could shift entire marketPrivacy Backlash: Always-on cameras face regulatory scrutinyStrategic RecommendationsFor Apple:Accelerate Timeline: 2027 is too late for smart glassesPrice Aggressive: Sub-$1,000 product needed for scalePartner Strategy: Fashion brands for credibilityAI First: Apple Intelligence must be central, not peripheralFor Competitors:Land Grab: Secure exclusive apps and experiences nowEnterprise Focus: Business use cases drive early adoptionPrivacy Leadership: Proactive approach before regulationDeveloper Investment: Subsidize creation of killer appsThe Bottom Line: Apple’s Kodak Moment?Apple faces its most serious platform threat since missing social media. The Vision Pro’s premium positioning mirrors Kodak’s focus on high-end digital cameras while smartphones democratized photography.

The brutal truth: In platform wars, perfect products lose to good-enough products with massive distribution. While Apple perfects spatial computing at $3,499, Meta and Google are putting AI on millions of faces at $299.

The critical question: Can Apple abandon its premium playbook fast enough to compete in a market where ubiquity trumps excellence?

History suggests the answer is no. Apple’s DNA drives margin over market share, integration over openness, perfection over speed. These strengths built the iPhone empire but may prove fatal in the AR platform war where network effects dominate.

The clock is ticking. By 2027, when Apple finally ships affordable AR glasses, the war may already be over. The winners will be those who understood that AR’s killer feature isn’t spatial computing—it’s being there, on your face, every day, getting smarter with each interaction.

The AR wars have begun. And for the first time in a decade, Apple isn’t leading—it’s following.

The post The AR Wars: Apple Vision Pro’s Struggle as Meta and Google Race Ahead appeared first on FourWeekMBA.

The Browser Wars 2.0: Perplexity’s Comet Launches as OpenAI Prepares Counter-Strike

The theoretical became reality today. Perplexity on Wednesday launched its first AI-powered web browser, called Comet Comet Browser by Perplexity, while OpenAI announced its browser will launch in the coming weeks OpenAI is reportedly releasing an AI browser in the coming weeks | TechCrunch. These aren’t incremental improvements—they’re fundamental reimaginings of how humans interact with the internet.

Perplexity Comet: First Mover Advantage in ActionThe Launch DetailsAt launch, Comet will be available first to subscribers of Perplexity’s $200-per-month Max plan, as well as a small group of invitees that signed up to a waitlist Comet Browser by Perplexity. Currently available on Mac and Windows platforms, with mobile versions in development.

Core Features: Beyond Traditional BrowsingAI Search as Default: Comet’s headline feature is Perplexity’s AI search engine, which is pre-installed and set as the default, putting the company’s core product — AI generated summaries of search results — front and center Comet Browser by PerplexityComet Assistant: Users can also access Comet Assistant, a new AI agent from Perplexity that lives in the web browser and aims to automate routine tasks. Perplexity says the assistant can summarize emails and calendar events, manage tabs, and navigate web pages on behalf of users Comet Browser by PerplexityContext-Aware Intelligence: Comet personalises responses based on a user’s browsing history and open tabs, all stored locally, and not used for model training OpenAI ready to launch its own AI browser to challenge Google Chrome’s dominance: a new paradigm for intelligent web navigationProductivity Integration:When users launch Comet’s AI assistant, it gains access to the information in open tabs Perplexity Launches Comet | AI-Powered Browser That Challenges GoogleEmail analysis and meeting preparationAutomated note-takingShopping comparison across platformsStrategic PositioningCEO Aravind Srinivas revealed the strategic thinking: “Becoming the default browser for users can translate to ‘infinite retention'” Comet Browser by Perplexity. This isn’t just about search—it’s about owning the entire user journey online.

The Business Model Play:

Freemium Strategy: Free version promised, but power features behind $200/month paywallData Advantage: Local storage of browsing data creates personalization moatPlatform Lock-in: The more you use it, the more indispensable it becomesOpenAI’s Counter-Strike: The 400 Million User AdvantageThe Imminent LaunchIn July 2025, multiple independent sources report that the release of the new browser is imminent and could occur by the end of the month ChatGPT: OpenAI Challenges Google with AI-Driven Browser Launch – Forex News by FX Leaders. Unlike Perplexity’s measured rollout, OpenAI appears to be preparing for a massive launch leveraging its existing user base.

Technical ArchitectureThe browser is expected to be built on Chromium, the open-source codebase that underpins Chrome and most other browsers except Firefox, but with AI tightly integrated into the user experience How OpenAI’s Plan for an AI Web Browser Could Upend the Online Ad Market

Revolutionary FeaturesNative ChatGPT Integration: The browser is designed to keep some user interactions within a ChatGPT-like native chat interface instead of clicking through to websites OpenAI is launching its own AI-centric web browser very soon, per report – 9to5MacOperator Integration: A key feature may include the integration of Operator, OpenAI’s web-browsing AI agent OpenAI set to release Chromium-based browser built around AI agent – SiliconANGLE. This creates autonomous capabilities far beyond Perplexity’s current offering.Task Automation: The OpenAI browser is said to include a chat-style assistant that can perform complex tasks on behalf of the user, such as summarizing pages, autofilling forms, booking travel or completing online purchases, without requiring users to click through websites manually How OpenAI’s Plan for an AI Web Browser Could Upend the Online Ad MarketThe Platform VisionOpenAI’s potential entry into the browser market may also signal broader ambitions to own the front-end interface that people use to interact with the web How OpenAI’s Plan for an AI Web Browser Could Upend the Online Ad Market. This isn’t just a browser—it’s potentially an “AI operating system for everyday digital tasks.”

Head-to-Head: Comet vs. OpenAI BrowserDistribution StrategyPerplexity Comet:

Limited beta rollout to $200/month subscribersSrinivas recently said that Perplexity saw 780 million queries in May 2025 Comet Browser by PerplexityGradual expansion from power usersOpenAI Browser:

With 400 million weekly active users, OpenAI’s browser could significantly impact Google’s advertising revenue OpenAI set to release Chromium-based browser built around AI agent – SiliconANGLEMass market launch leveraging ChatGPT’s installed baseImmediate scale advantageTechnical CapabilitiesPerplexity Comet:

Focus on research and knowledge workLocal data storage for privacyTab management and productivity toolsThere’s also a feature called Labs that automates tasks such as generating data visualizations Perplexity Launches Comet | AI-Powered Browser That Challenges GoogleOpenAI Browser:

Operator agent for complex task completionDeeper AI integration into browsing flowPotential e-commerce partnershipsMore ambitious automation scopeMonetization ModelsPerplexity:

$200/month for full featuresEnterprise tier plannedFocus on high-value usersOpenAI:

Likely freemium with ChatGPT Plus integrationPotential transaction fees on completed tasksBroader market appealMarket Impact: The Domino EffectImmediate Consequences (Next 30 Days)Google’s Response: Alphabet’s ad division accounts for nearly three-quarters of its total revenue OpenAI set to release Chromium-based browser built around AI agent – SiliconANGLE—they can’t afford to waitPublisher Panic: Traffic redirection to AI interfaces threatens content monetizationUser Migration: Early adopters and power users begin switchingDeveloper Interest: New APIs and integration opportunities emergeThe SEO ApocalypseTraditional SEO becomes obsolete when the browser will keep some user interactions within ChatGPT rather than directing users to external websites OpenAI set to release Chromium-based browser built around AI agent – SiliconANGLE. This represents:

$68 billion SEO industry facing existential threatContent marketing requiring fundamental rethinkingE-commerce needing direct AI partnershipsPrivacy and Data ConcernsComet has faced early criticism about privacy. In a recent podcast, Srinivas suggested that Comet could “get data even outside the app to better understand you.” That raised alarms online Perplexity’s Comet Browser is Now Available in Beta | AIM

This highlights the central tension: personalization requires data, but users increasingly value privacy. The winner may be whoever best balances these competing demands.

Strategic Analysis: The New Browser EconomicsValue Chain DisruptionTraditional Model: User → Browser → Search Engine → Website → Ads → Revenue

AI Browser Model: User → AI Browser → Direct Answer/Action → Subscription/Transaction Fee

Network Effects at PlayData Network Effects: More usage → Better AI → More value → More usageDeveloper Ecosystem: APIs create third-party innovationHabit Formation: Daily use creates switching costsThe Platform Wars ParallelThis mirrors the mobile OS wars of 2007-2012:

2007: iPhone launches, skeptics dismiss it2010: Android scales, market splits2012: Winners clear, losers exitWe’re likely seeing:

2025: AI browsers launch, skeptics dismiss2027: Market leaders emerge2029: Consolidation completeInvestment Implications: Playing the Browser WarsDirect BeneficiariesInfrastructure: Every AI query requires massive computeAPI Platforms: Browsers need data sourcesAuthentication Services: Identity becomes crucialCasualtiesAd Tech Stack: $600B industry faces disruptionSEO Tools: Semrush, Ahrefs become obsoleteTraditional Publishers: Traffic evaporatesHedging StrategiesLong: AI infrastructure (NVDA), Cloud providers (MSFT, AMZN)Short: Ad-dependent platforms, SEO toolsWatch: Apple’s response, regulatory interventionThe Trillion-Dollar ConclusionWe’re witnessing the birth of a new $100B+ market. The browser wars aren’t about features—they’re about who controls the AI era’s primary interface.

Perplexity’s CEO Arvind Srinivas positioning “Comet” as a breakthrough move to reach out to users without Google’s mediation does tell his goals Perplexity launches AI-powered browser Comet (NVDA:NASDAQ) | Seeking Alpha. But OpenAI’s 400M user advantage and deeper AI capabilities suggest this may be a David vs. Goliath story where Goliath also has a slingshot.

The key insight: First-mover advantage matters less than execution and scale in platform wars. Perplexity moved first, but OpenAI’s combination of users, technology, and capital may prove decisive.

The next 90 days will determine:

Whether users embrace AI-first browsingHow quickly Google can respondIf regulators will interveneWhich monetization model winsThe browser wars have begun. By 2027, we’ll look back at July 2025 as the month everything changed—when the web stopped being about pages and started being about intentions.

The post The Browser Wars 2.0: Perplexity’s Comet Launches as OpenAI Prepares Counter-Strike appeared first on FourWeekMBA.

The Great AI Consolidation: From Chips to Interfaces, the Moat Wars Begin

1. Nvidia’s $4 Trillion Milestone: The AI Infrastructure Monopoly

1. Nvidia’s $4 Trillion Milestone: The AI Infrastructure MonopolyNvidia became the first company in history to achieve a $4 trillion market valuation on Wednesday BloombergNBC News, with shares jumping 2.8% to $164.42 Nvidia (NVDA) Hits $4 Trillion Value as Stock Rallies – Bloomberg before closing just shy of the milestone at $3.97 trillion.

Strategic Analysis:

This historic valuation reflects more than market exuberance—it’s a validation of Nvidia’s infrastructure monopoly thesis. The 1,015% growth since the beginning of 2023 Nvidia Reaches a Milestone $4 Trillion Valuation – Bloomberg demonstrates how the AI boom’s value accrues disproportionately to the infrastructure layer, much like how cloud computing enriched AWS more than individual SaaS companies.

The $350 billion in projected capital expenditures from tech giants including Microsoft, Meta, Amazon, and Alphabet Nvidia Hits $4 Trillion Valuation Milestone – Sharecafe essentially locks in Nvidia’s revenue pipeline. These companies account for over 40 percent of Nvidia’s total revenue Nvidia Hits $4 Trillion Valuation Milestone – Sharecafe, creating a symbiotic relationship where big tech’s AI ambitions directly fund Nvidia’s R&D moat.

Business Model Implications:

Pricing Power: GPU scarcity maintains 70%+ gross marginsNetwork Effects: CUDA ecosystem creates switching costsCapital Efficiency: Customers bear the capex while Nvidia captures recurring revenue2. Meta’s $3.5B EssilorLuxottica Investment: Hardware as the New PlatformMeta Platforms acquired just under 3% of the Ray-Ban maker, a stake worth around €3 billion ($3.5 billion) Meta Invests $3.5 Billion in World’s Largest Eye-Wear Maker in AI Glasses Push, marking a strategic shift from pure software to hardware-software integration.

Strategic Analysis:

Meta’s investment signals a fundamental platform strategy evolution. After being constrained by Apple and Google’s mobile OS duopoly, Meta is betting that AI-powered wearables represent the next computing platform where they can own the full stack.

The early traction is promising: 2 million pairs of Meta Ray-Ban glasses sold since late 2023 Meta invests $3.5 billion in Ray-Ban-maker EssilorLuxottica with ambitions to increase annual production to 10 million units by the end of 2026 Meta invests $3.5 billion in Ray-Ban-maker EssilorLuxottica. This 5x scaling target suggests Meta sees product-market fit emerging.

Platform Economics:

Direct Distribution: Bypasses app store fees and restrictionsData Advantage: First-party hardware data improves AI trainingEcosystem Control: Oakley and Prada expansions create multi-brand moatRevenue Diversification: Hardware margins supplement ad revenue3. OpenAI’s Browser Launch: The Battle for AI’s Default InterfaceOpenAI is planning to release an AI-powered web browser to challenge Google Chrome in the coming weeks OpenAI is reportedly releasing an AI browser in the coming weeks | TechCrunch, with the browser designed to keep some user interactions within a ChatGPT-like native chat interface instead of clicking through to websites OpenAI is launching its own AI-centric web browser very soon, per report – 9to5Mac.

Strategic Analysis:

This move represents the most direct assault on Google’s $200+ billion search monopoly to date. By controlling the browser, OpenAI gains what Google has leveraged for decades: default status and first-party user intent data.

The timing is critical. With 400 million weekly active ChatGPT users, OpenAI has sufficient scale to drive browser adoption. More importantly, the product philosophy—answers over links—could fundamentally disrupt the ad-supported web economy.

Disruption Vectors:

User Experience: Eliminates the “10 blue links” paradigmMonetization: Subscription-first model vs. ad-dependentData Moat: Browser data improves AI, creating virtuous cycleDeveloper Platform: Potential for AI-native web applications4. Perplexity’s $200 Premium Tier: Testing AI’s Pricing CeilingPerplexity launched a $200-per-month subscription plan called Perplexity Max Perplexity launches a $200 monthly subscription plan | TechCrunch, even as the company is in late-stage talks to raise $500 million at a $14 billion valuation Perplexity AI wrapping talks to raise $500 million at $14 billion valuation.

Strategic Analysis:

The 10x pricing premium over standard tiers ($20/month) represents a critical market experiment in AI monetization. With just under $100 million in annual recurring revenue Perplexity AI wrapping talks to raise $500 million at $14 billion valuation, Perplexity’s 140x revenue multiple valuation depends entirely on capturing enterprise and power-user segments.

The $200 price point mirrors OpenAI’s ChatGPT Pro, suggesting market consensus on premium AI pricing. However, this creates a precarious position: too low for true enterprise deployment, too high for most prosumers.

Revenue Model Stress Test:

Unit Economics: Must prove $200 ARPU sustainable at scaleCompetitive Pressure: Google, OpenAI, Anthropic all launching browsersValue Proposition: “Comet” browser becomes distribution differentiatorBurn Rate: High compute costs require rapid revenue scaling5. OpenAI’s Open Model Delay: The Commoditization ParadoxOpenAI’s first open model in years will be delayed until later this summer Model Spec (2025/04/11), with CEO Sam Altman citing an “unexpected and quite amazing” breakthrough that needs more time Model Spec (2025/04/11).

Strategic Analysis:

OpenAI faces an existential strategic dilemma. With Meta’s Llama achieving over 1 billion downloads OpenAI plans to release a new ‘open’ AI language model in the coming months | TechCrunch and DeepSeek capturing developer mindshare, OpenAI risks losing the developer ecosystem that drives long-term platform value.

The delay suggests OpenAI recognizes that incremental improvements won’t suffice—they need a step-function advancement to justify developers choosing their “open” model over truly open alternatives. This creates a prisoner’s dilemma: open-source to maintain relevance but risk cannibalizing API revenues.

Ecosystem Dynamics:

Developer Mindshare: Critical for long-term platform dominanceRevenue Cannibalization: Open models compete with paid APIQuality Bar: Must significantly outperform Llama 3.1 to matterTiming Risk: Each month of delay loses developers to alternativesMarket Synthesis: The Great AI ConsolidationToday’s news reveals a clear pattern: value in AI is consolidating around hard-to-replicate moats.

Infrastructure (Nvidia) captures value through physical scarcityDistribution (browsers) wins through default user accessHardware (Meta glasses) creates new platform control pointsPremium Services (Perplexity) test pricing power limitsOpen Source becomes table stakes, not differentiatorInvestment Thesis: The AI boom’s second phase rewards companies with defensible distribution and capital-intensive moats, not pure software plays. Watch for further consolidation as cash-rich incumbents acquire distribution channels and smaller players face commoditization pressure.

The FourWeekMBA Daily provides strategic analysis of technology business models and market dynamics. Visit fourweekmba.com for more insights.

The post The Great AI Consolidation: From Chips to Interfaces, the Moat Wars Begin appeared first on FourWeekMBA.

Google’s Full-Stack AI Advantage

From custom silicon design to consumer applications used by billions, Google has methodically built an end-to-end AI value chain that creates formidable competitive advantages and barriers to entry.

This analysis examines how Google’s vertical integration across six critical layers —hardware, infrastructure, platforms, models, services, and applications —positions the company as the most comprehensively integrated AI powerhouse in the world.

The Architecture of AI Dominance

Google’s vertical integration in AI encompasses the entire technology stack, creating what the company refers to as its “AI Hypercomputer” ecosystem.

This isn’t merely about owning different pieces of the AI puzzle; it’s about optimizing each layer to work seamlessly with others, creating compound advantages that would be nearly impossible for competitors to replicate.

This is playing out as part of The Strategic Map of AI.

Layer 1: Custom Hardware Foundation

Layer 1: Custom Hardware FoundationAt the foundation of Google’s AI empire lies its custom silicon strategy, most notably exemplified by its Tensor Processing Units (TPUs).

Google’s latest Ironwood TPU (v7), released in 2025, represents a quantum leap in AI-specific hardware, explicitly designed for inference workloads with an unprecedented 42.5 ExaFLOPS of compute power.

This isn’t just impressive on paper; it represents a fundamental shift in how AI hardware is conceived.

Unlike general-purpose processors, Google’s TPUs are explicitly architected for the matrix operations that dominate AI workloads.

The evolution from TPU v1 through the latest Ironwood demonstrates Google’s commitment to hardware innovation, with each generation delivering exponential improvements in performance per watt.

This custom silicon approach provides several critical advantages:

Innovation Speed: Custom hardware allows Google to implement new AI techniques in silicon, potentially years before they become available in commercial processors.

Performance Optimization: By designing chips specifically for their AI models, Google can achieve better performance per dollar and per watt than competitors relying on general-purpose hardware.

Cost Control: Owning the entire hardware stack means Google isn’t subject to the pricing power of external chip vendors, providing significant cost advantages at scale.

The post Google’s Full-Stack AI Advantage appeared first on FourWeekMBA.

Jensen Huang’s Radical Anti-1-on-1 Leadership Style

Many businesses thrive on 1-on-1 meetings to build trust within the organization.

There is a massive expectation of that, which is what NVIDIA’s CEO Jensen Huang’s anti-1-on-1 Leadership style is.

Indeed, in multiple interviews, Huang revealed that he “really discourages 1-on-1s” while managing 60 direct reports, he challenged one of management’s most sacred practices.

His reasoning cuts to the heart of what separates high-performing organizations from the rest: the fundamental choice between information hoarding and radical transparency.

The Trust Foundation Prerequisite

The Trust Foundation PrerequisiteHuang’s framework only works because NVIDIA operates as a high-trust organization, a critical distinction that explains why copying this approach superficially would fail in most companies.

High-trust organizations share several characteristics that make transparent leadership viable:

The post Jensen Huang’s Radical Anti-1-on-1 Leadership Style appeared first on FourWeekMBA.

The AI Stack Wars

The artificial intelligence industry stands at a historic inflection point in 2025.

What began as a diverse ecosystem of specialized players competing across different layers of the AI stack is rapidly consolidating into a battle between vertically integrated giants.

This transformation, driven by astronomical infrastructure costs, technical complexity, and competitive pressures, will reshape the technology landscape for decades to come.

Our analysis reveals that the AI industry is undergoing its “Great Convergence,” a fundamental restructuring where companies must either expand across the entire AI value chain or face extinction.

The most dramatic example is OpenAI’s Project Stargate, a $500 billion infrastructure initiative that signals the company’s transformation from a model provider to a full-stack AI giant.

This move, unthinkable just two years ago, exemplifies how the economics of AI are forcing radical strategic shifts across the industry.

By 2030, we project the AI landscape will be dominated by 3-4 vertically integrated empires, with specialized players either absorbed or relegated to niche positions.

This consolidation pattern mirrors historic transformations in the technology industry, but at an unprecedented speed and scale.

The implications extend far beyond corporate strategy to questions of innovation, competition, and the fundamental structure of the digital economy.

We’ll cover it all!

The weekly newsletter is in the spirit of what it means to be a Business Engineer:

We always want to ask three core questions:

What’s the shape of the underlying technology that connects the value prop to its product?What’s the shape of the underlying business that connects the value prop to its distribution?How does the business survive in the short term while adhering to its long-term vision through transitional business modeling and market dynamics?These non-linear analyses aim to isolate the short-term buzz and noise, identify the signal, and ensure that the short-term and the long-term can be reconciled.

AI Is Eating The World Workshop

The post The AI Stack Wars appeared first on FourWeekMBA.

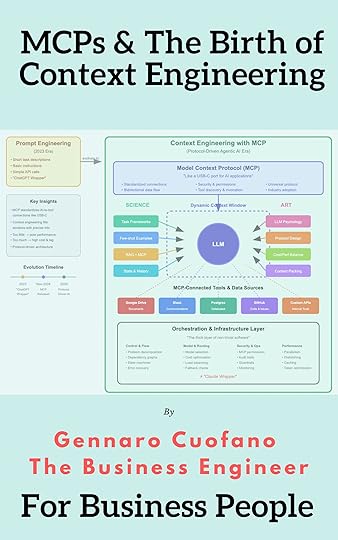

The Model Context Protocol Revolution

In November 2024, Anthropic quietly released something that would fundamentally transform how AI applications are built: the Model Context Protocol (MCP).

While the AI world was obsessed with model capabilities and benchmarks, MCP addressed a different problem entirely, the messy, expensive reality of connecting AI to the world’s data.

Think of MCP as the USB-C port for AI applications. Just as USB-C created a universal standard that replaced dozens of proprietary connectors, MCP provides a standardized way for AI models to connect to any data source or tool.

This isn’t just another API specification; it’s the infrastructure backbone that makes true context engineering possible at scale.

Get MCPs & Context Engineering Now

The N×M Problem: Why MCP Was InevitableBefore MCP, every AI integration was a custom engineering project.

Each AI model needed bespoke connections to each data source, creating what engineers call an N×M problem (or the combinatorial explosion):

4 AI models × 10 data sources = 40 custom integrationsAdd a new model? Build 10 new integrationsAdd a new data source? Build 4 new integrationsScale to enterprise? The complexity becomes unmanageableThis wasn’t sustainable. Companies were spending more time building plumbing than solving actual problems.

Security was implemented differently everywhere. Switching models meant rewriting entire codebases. The promise of AI was being strangled by integration complexity.

What MCP Actually DoesMCP is an open protocol that standardizes how AI systems interact with external tools and data sources. Instead of building custom connectors for every combination, developers can now:

Build Once, Connect EverywhereWrite a single MCP server for your data source, and it instantly becomes accessible to any MCP-compatible AI model. Google Drive, Slack, GitHub, Postgres, they all speak the same language now.

Standardized SecurityAuthentication, permissions, and access control are built into the protocol. No more scattered API keys or inconsistent security implementations. MCP handles secure, bidirectional connections with proper authorization flows.

Dynamic Tool DiscoveryAI models can discover available tools and their capabilities at runtime. The model knows what it can do without hardcoded instructions. This enables truly adaptive behavior; the AI can utilize tools it has never seen before if it follows the MCP standard.

Resource ManagementMCP doesn’t just pass data; it manages resources intelligently. Streaming large files, handling pagination, managing rate limits—all standardized at the protocol level.

The post The Model Context Protocol Revolution appeared first on FourWeekMBA.