J. Bradford DeLong's Blog, page 377

April 12, 2018

Note to Self: This needs to go back into the pile to be r...

Note to Self: This needs to go back into the pile to be reread: Jan deVries (2008): (9780521719254): "In the long eighteenth century, new consumer aspirations combined with a new industrious behavior to fundamentally alter the material cultures of northwest Europe and North America...

...This "industrious revolution" is the context in which the economic acceleration associated with the Industrial Revolution took shape. This study explores the intellectual understanding of the new importance of consumer goods as well as the actual consumer behavior of households of all income levels. De Vries examines how the activation and evolution of consumer demand shaped the course of economic development, situating consumer behavior in the context of the household economy. He considers the changing consumption goals of households from the seventeenth century to the present and analyzes how household decisions have mediated between macro-level economic growth and actual human betterment. Ultimately, de Vries' research reveals key strengths and weaknesses of existing consumer theory, suggesting revisions that add historical realism to economic abstractions...

Live from the Orange-Haired Baboon Cage: Sam Harris convi...

Live from the Orange-Haired Baboon Cage: Sam Harris convinces me that he is not part of what Charles Murray calls the "cognitive elite": Vox: The Sam Harris-Ezra Klein debate - Vox: "Sam Harris: [In] your last piece, you have this whole section on the 'Flynn effect' and how the Flynn effect should be read as accounting for the black-white differences in purely environmental terms. Well, even Flynn rejects that interpretation...

...There are many errors of this kind that you and Nisbett and Turkheimer are making when you criticize me and Murray. You criticize Murray for errors that he didn���t make.... You must imagine bias on my side. Why am I getting it so wrong? Why am I looking at the same facts that Nisbett and Turkheimer and Harden are looking at and I am getting it absolutely wrong? You have to imagine that I have an equal and opposite passion, that I feel equally righteous, but it���s pointing in the opposite direction. I would have to be a grand dragon of the KKK to feel an equal and opposite bias on these data.... Even if we... decide that it���s just, there is no ethical reason to ever look at population differences, we will be continually ambushed by these data....

Ezra Klein: There is so much there. I actually really appreciate that answer, because I think it helps open this up. So let me say a couple things here. One of the things I���ve come to think about you that I actually did not come into this believing is, you���re very quick to see a lot of psychological tendencies, cognitive fallacies, etc. in others that you don���t see applying to yourself, or people you���ve written into your tribe. You say words in there like "confirmation bias", etc., to me about how we���re looking at Murray.... To the extent that I have any biases that flow backwards from political commitments, so does he. We���re all...

Sam Harris: Okay. But what���s my bias?

Ezra Klein: Hold on Sam. I���m going to go through this....

Sam Harris: But what���s my bias?

Ezra Klein: I promise you I will get to your bias very quickly.... You mentioned James Flynn.... I called Flynn... on Monday..... He says:

I think it is more probably than not that the IQ difference between black and white Americans is environmental. As a social scientist, I cannot be sure if they have a genetic advantage or disadvantage.

That is what James Flynn thinks of Monday....

Your view of this debate is that to say that you have a bias in it is to say, in your terms, that you���re like the grand dragon of the KKK. That the only version of a bias that can be influencing what you see here is a core form of racism. That���s actually not my view of you, but I do think you have a bias. I think you have a... lot of difficulty extending an assumption of good faith to anyone who disagrees with you on an issue that you code as identity politics.... One of the things that I hear in you is that, whenever something gets near the questions of political correctness���the canary and the coal mine for the way you yourself have been treated���you get very, very, very strident. They���re in bad faith. They���re not being able to speak rationally. They���re not being able to have a conversation that is actually going forward on a sound evidentiary basis....

I think you���re missing a lot, because you are very radically increasing the salience of things that threaten your identity, your tribe... without admitting, or maybe even without realizing, that���s what you���re doing.... There are a lot of white commentators, of which I am also one, who look at what���s happening on some campuses, or look at what happens on Twitter mobs, or whatever, and they see a threat to them. The concern about political correctness goes way, way, way, way up. Then the ability to hear what the folks who are making the arguments actually say dissolves. The ability to hear what the so-called social justice warriors are actually worried about dissolves. I think that���s a really big blind spot here. I think it���s making it hard for you to see when people have a good faith disagreement with you, and I also think it���s making harder for you to see how to weight some of the different concerns that are operating in this conversation.... I mean, in your whole show, Sam, you���ve had 120-some episodes, and... you���ve had two...

Sam Harris: It���s amazing you would think this is relevant, but yes, you can give me the numbers...

Ezra Klein: I think you���ve had two African Americans as guests. I think you need to explore the experience of race in American more and not just see that as identity politics. See that as information that is important to talking about some of things you want to talk about, but also to hearing from some of the people who you���ve now written out of the conversation to hear.

Sam Harris: So this is the kind of thing that I would be tempted to score as bad faith...

Ezra Klein: I���m shocked!...

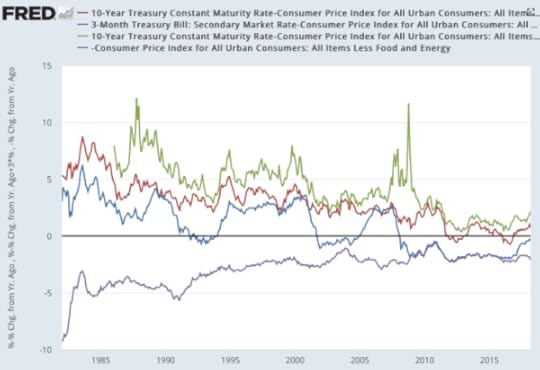

Note to Self: U.S. Real Interest Rates since 1982

Red: real ten-year Treasury bond rate

Blue: real three-month Treasury bill rate���the policy rate

Purple: zero lower bound

NTU Tariff Letter

NTU Tariff Letter: In 1930, 1,028 economists urged Congress to reject the protectionist Smoot-Hawley Tariff Act. Today, Americans face a host of new protectionist activity, including threats to withdraw from trade agreements, misguided calls for new tariffs in response to trade imbalances, and the imposition of tariffs on washing machines, solar components, and even steel and aluminum used by U.S. manufacturers.

Congress did not take economists��� advice in 1930, and Americans across the country paid the price. The undersigned economists and teachers of economics strongly urge you not to repeat that mistake. Much has changed since 1930���for example, trade is now significantly more important to our economy���but the fundamental economic principles as explained at the time have not:

We are convinced that increased protective duties would be a mistake. They would operate, in general, to increase the prices which domestic consumers would have to pay. A higher level of protection would raise the cost of living and injure the great majority of our citizens.

Few people could hope to gain from such a change. Construction, transportation and public utility workers, professional people and those employed in banks, hotels, newspaper offices, in the wholesale and retail trades, and scores of other occupations would clearly lose, since they produce no products which could be protected by tariff barriers.

The vast majority of farmers, also, would lose through increased duties, and in a double fashion. First, as consumers they would have to pay still higher prices for the products, made of textiles, chemicals, iron, and steel, which they buy. Second, as producers, their ability to sell their products would be further restricted by barriers placed in the way of foreigners who wished to sell goods to us.

Our export trade, in general, would suffer. Countries cannot permanently buy from us unless they are permitted to sell to us, and the more we restrict the importation of goods from them by means of ever higher tariffs the more we reduce the possibility of our exporting to them. Such action would inevitably provoke other countries to pay us back in kind by levying retaliatory duties against our goods.

Finally, we would urge our Government to consider the bitterness which a policy of higher tariffs would inevitably inject into our international relations. A tariff war does not furnish good soil for the growth of world peace.

Should-Read: Yggles's attitude toward Paul Ryan is remark...

Should-Read: Yggles's attitude toward Paul Ryan is remarkably close to mine toward Richard Nixon: Matthew Yglesias: House Speaker Paul Ryan���s retirement: good riddance: "The many lives of Paul Ryan: Ryan joined Congress in 1998 but first really made his mark during the Social Security privatization wars of 2004-���05...

...George W. Bush���s administration wanted to use the program���s long-term fiscal deficit as a pretext to alter its fundamental structure away from a guarantee of a decent standard of living in retirement to one where individuals would be reliant on private investment accounts. Ryan emerged as a player... with then-Sen. John Sununu... cost of $2.4 trillion in larger deficits over the first 10 years.... This obviously went nowhere, in part because the cost envisioned was much larger than the Obama stimulus, the Trump tax cuts, or basically anything that Congress ever does. Nevertheless, it did not stop Ryan from rebranding himself a few years later as a deficit hawk. By 2010, he was hailed by journalists like US News���s Paul Bedard and the professional deficit-cutting community as the very model of fiscal responsibility.... "The Fiscy Award judges... David Walker... Maya MacGuineas... Robert Bixby, executive director of the Concord Coalition..."

This award was completely at odds with Ryan���s actual record in Congress, which had featured support for multiple rounds of budget-busting Bush tax cuts, Bush���s deficit-financed 2003 Medicare bill, his wars, and his TARP bank bailout. But the new Ryan was said to be a deficit visionary thanks to his 2010 budget framework, which outlined a long-term plan to reduce the budget deficit. Except as Jonathan Cohn wrote at the time, the plan relied entirely on magic asterisks....

After being tapped as Mitt Romney���s running mate in 2012 and losing, Ryan decided that his fake budget plan had landed him with a reputation as being too mean-spirited. So by 2014, he was garnering gushing coverage from McKay Coppins and others for his newfound commitment to fighting poverty. Ryan���s newfound commitment to fighting poverty didn���t mean he disavowed his support for a large tax cut for the heirs to multimillion-dollar estates. Or his support for a large tax cut for the owners of businesses. Or his support for a large tax cut for high-income individuals. Or his support for reducing spending on poor children���s health care, housing, and nutrition assistance. Indeed, nothing about Ryan���s actual policy agenda of sharply lowering the material living standards of low-income people in order to finance regressive tax cuts had changed But he cared. A lot.

And Ryan is really good at caring. In January 2017, there was a truly heartrending moment at a CNN town hall when he promised a young mother who���d received protections under the Deferred Action for Childhood Arrivals program that she had no need to fear deportation even in the coming Trump era. It was really great television. Of course, Ryan���s reassurances were total bullshit, as Vox���s Dara Lind pointed out at the time.... Trump himself, of course, canceled DACA later that year. In September, though, Ryan told DREAMers they could ���rest easy��� because Congress would soon step in with a fix. They did not.

Back during this past winter���s immigration debate, it was commonplace for Ryan���s tireless apologists in the press corps to note that he would be ���risking his speakership��� if he defied House backbenchers��� opposition to a DACA fix. This might not really have been such a high price to pay to avoid ruining the lives of hundreds of thousands of innocent young people, but regardless���the DREAMers for whom Ryan would not risk his speakership can know that at the end of the day, he was happy to throw it away anyway; he just forgot to help them. Though in his defense, he mostly failed at the things he did try to do too.

Paul Ryan���s career ends in abject failure: If Nancy Pelosi never gets her hands on the speaker���s gavel again, she���ll always have the fact that the 111th Congress was one of the most productive of all time. Ryan���s brief speakership, by contrast, did not amount to much.... Social Security privatization that launched his policy relevance is dead.... Medicare privatization... that relaunched his policy relevance is also dead. His reputation as a deficit hawk has been exposed as a sham. He didn���t repeal the Affordable Care Act.... He didn���t undo the Obama administration���s financial regulations.... Congress has basically abandoned hope of doing anything else. What he got was a tax cut, the thing that every Republican majority gets. And since that���s what his donors wanted in the end, that���s probably the important thing....

Ryan has, of course, also abdicated Congress���s constitutional responsibilities in an unprecedented way...

Comment of the Day: Graydon Saunders: "White Ethnicists" ...

Comment of the Day: Graydon Saunders: "White Ethnicists" and Boston in the 1980s: "Really bad insecurity management signifies incompetence, not lack of insecurity...

...A long-supply-chains world emphasises planning, co-operation, and skill. It does really badly with any of the narratives that emphasize victory through will. Fascism is, perhaps not the last refuge of a scoundrel, but a complicated rationalization for not really having lost. I figure we're many not ten years from a re-melination virus getting loose, too.

Tim H. said in reply to Graydon: Your comment brings to mind an Arthur C. Clarke short story "Reunion", which ends with "If any of you are still white, we can cure you.".

Graydon said in reply to Tim H: If you're not living on oats in the rain without access to vitamin D supplements...

...you do go outside, and you don't think being easily sunburned grants you moral exceptions for rape, murder, and theft, that's an appropriate response! My optometrist has a thoroughly sfnal gadget that takes photographs of the layers of tissues in the back one's eyes; the whole rear hemisphere of the eyeball. It uses a multi-spectral laser and what I presume is software, rather than a lens, to assemble the images. Apparently a big gain in diagnostic power compared to previous methods. Said optometrist was using one of the images to point out that my retinas have effectively no melanin and that this is a health and vision risk. I responded that this is why I use transition lenses and have (with variation for the technology of the time) ever since I started wearing glasses as a child. (Never mind that out of my six immediate ancestors, three died of things related to malignant melanoma.)

Some sort of retrofit melanin would be handy thing. I'd expect OHIP to cover it...

April 11, 2018

Joseph Schumpeter on "Liquidationism": Hoisted from the Archives

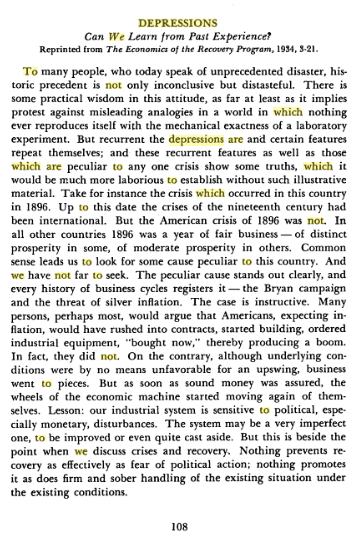

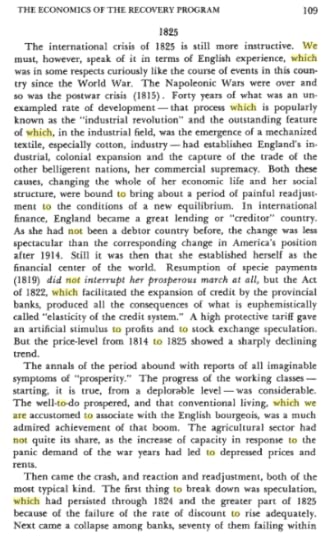

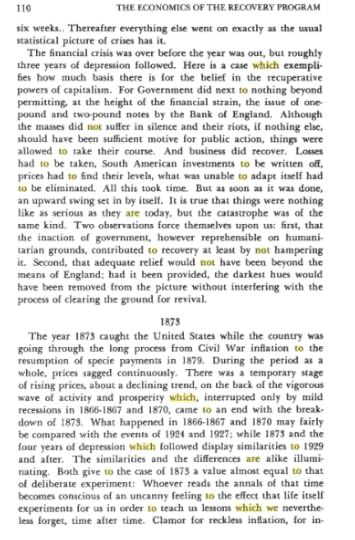

Hoisted from the Archives: Joseph Schumpeter on "Liquidationism": Three things strike me while rereading Schumpeter's 1934 "Depressions" (and also his 1927 Explanation of the Business Cycle):

How much smarter Schumpeter is than our modern liquidationists and austerians--he says a great many true things in and amongst the chaff, which is created by his fundamentally mistaken belief that structural adjustment must be triggered by a downturn and a wave of bankruptcies that releases resources into unemployment. How much more fun and useful it would be right now to be debating a Schumpeter right now than the ideologues calling for, say, more austerity for and more unemployment in Greece!

How very strange it is for Schumpeter to be laying out his depressions-cause-structural-change-and-growth theory of business cycles at the very same moment that he is also laying out his entrepreneurs-disrupt-the-circular-flow-and-cause-structural-change-and-growth-theory of enterprise. It is, of course, the second that is correct: Growth comes from entrepreneurs pulling resources into the sectors, enterprises, products, and production methods of the future. It does not come from depressions pushing resources into unemployment. Indeed, as Keynes noted, times of depression and fear of future depression are powerful brakes halting Schumpeterian entrepreneurship: "If effective demand is deficient... the individual enterpriser... is operating with the odds loaded against him. The game of hazard which he plays is furnished with many zeros.... Hitherto the increment of the world���s wealth has fallen short of the aggregate of positive individual savings; and the difference has been made up by the losses of those whose courage and initiative have not been supplemented by exceptional skill or unusual good fortune. But if effective demand is adequate, average skill and average good fortune will be enough..."

How Schumpeter genuinely seems to have no clue at all that the business cycle is a feature of a monetary economy--how very badly indeed he needed to learn, and how he never did learn, what Nick Rowe and company teach today about the effects of monetary stringency on economic coordination.

Joseph Schumpeter (1934): Depressions: What Can We Learn from Past Experience?

The problems presented by periods of depression may be grouped as follows: First, removal of extra economic injuries to the economic mechanism: Mostly impossible on political grounds. Second, relief: Not only imperative on moral and social grounds, but also an important means to keep up the current of economic life and to steady demand, although no cure for fundamental cases.

Third, remedies: The chief difficulty of which lies in the fact that depressions are not simply evils, which we might attempt to suppress, but--perhaps undesirable--forms of something which has to be done, namely, adjustment to previous economic change.

Most of what would be effective in remedying a depression would be equally effective in preventing this adjustment. This is especially true of inflation, which would, if pushed far enough, undoubtedly turn depression in to the sham prosperity so familiar from European postwar [i.e., World War I] experience, but which, if it be carried to that point, would, in the end, lead to a collapse worse than the one it was called in to remedy.

Fourth, reforms of institutions intended to remedy the situation but suggested by the moral and economic evils of both booms and depressions: The crucial point of these reforms lies in the coincidence of a political atmosphere exceptionally favorable, and an economic situation exceptionally unfavorable to their success. No doubt they will always be carried amidst enthusiastic clapping of hands. But they will also be stigmatized in the future by their tendency to prevent or retard recovery. This should not blind to us to any merits they may have, but it is a plain and undeniable fact.

The Atmosphere of Periods of Depression: We have seen that the course of events in all periods of depression presents a significant family likeness. So do the attitudes of the people. Defeat on the battlefield destroys the prestige of military rulers and their confidence in themselves; crises destroy whatever of both these things business leaders may enjoy. Their cry for help is the more damaging for them the more they disapproved of government interference before. For the time being, the majority of people grows out of humor with the economic system under which they live, and becomes inclined to favor what in some cases we call reaction and in others radicalism. In fact, it makes astonishingly little difference which way they more politically. The consequences are much the same in both cases....

The Upshot: There is on reason to despair--this is the first lesson to be derived from our story. Fundamentally the same thing has happened in the past, and it has--in the only two cases which are comparable to the present one--lasted just as long. We are more keenly alive now to human suffering, and we are dealing with the situation under political pressure by political methods, but substantially we are confronted only with problems which the world was confronted with before.

In all cases, not only the two which we have analyzed, recovery came of itself. There is certainly this much of truth in the talk about the recuperative powers of our industrial system. But this is not all: our analysis leads us to believe that recovery is sound only if it does com of itself. For any revival which is merely due to artificial stimulus leaves part of the work of depressions undone and adds, to an undigested remnant of maladjustment, new maladjustment of its own which has to be liquidated in turn, thus threatending business with another crisis ahead. Particularly, our story provides a presumption against remedial measures which work through money and credit. For the trouble is fundamentally not with money and credit, and policie of this class are particularly apt to keep up, and add to, maladjustment, and to produce additional trouble in the future...

Should-Read: Paul Ryan's rumored retirement means that it...

Should-Read: Paul Ryan's rumored retirement means that it is time to remind people that Donald Trump is not an exception among Republicans in running a fact-free communications operation���one in which if there is a principal value, it is conscious indifference to the truth. Rather, it has���usually with more rhetorical coherence���become the rule in the past decade. For example, here is Ezra Klein on Paul Ryan six years ago: Ezra Klein (2012): A not-very-truthful speech in a not-very-truthful campaign: "Honestly? I didn't want us to write this piece...

...The original pitch was for "the five biggest lies in Paul Ryan's speech." I said no.... I wanted us to bend over backward to be fair, to see it from Ryan's perspective, to highlight its best arguments as well as its worst. So I suggested an alternative: The true, the false, and the misleading in Ryan's speech.... Having read Ryan's speech in an advance text... having watched it... I sat down to read it again, this time with the explicit purpose of finding claims we could add to the "true" category. And I did find one. He was right to say that the Obama administration has been unable to correct the housing crisis, though the force of that criticism is somewhat blunted by the fact that neither Ryan nor Mitt Romney have proposed an alternative housing policy. But I also came up with two more "false" claims. So I read the speech again. And I simply couldn't find any other major claims or criticisms that were true. I want to stop here and say that even the definition of "true" that we're using is loose.... The search wasn't for arguments that were ironclad... just for arguments... based on a reasonable reading of the facts....

For instance: Obama really has expanded the size and generosity of the food stamps program. He really has been picking winners and losers in the energy sector. He really does intend to raise taxes on the rich. He really does foresee the federal government spending more a decade from now than it was spending five years ago. He really did push an unelected board of health-care bureaucrats to make decisions about Medicare reimbursement rates. He really did want to raise the price of dirty energy. He really hasn't released a plan that would ever balance the budget. He really did break his pledge not to raise taxes on people making less than $250,000 when he signed the Affordable Care Act.

But Ryan's claims weren't even arguably true. You simply can't say the president hasn't released a deficit reduction plan.... You simply can't say the president broke his promise to keep your GM plant open. The decision to close the plant was made before he entered office.... You simply can't argue that the Affordable Care Act was a government takeover of the health-care system. My doctor still works for Kaiser Permanente, a private company that the government does not own. You simply can't say that Obama... caused the S&P downgrade, when S&P clearly said it was due to congressional gridlock and even wrote that it was partly due to the GOP's dogmatic position on taxes....

After rereading Ryan's speech, I went back to Sarah Palin's 2008 convention address. Perhaps, I thought, this is how these speeches always are. But Palin's criticisms, agree or disagree, held up. "This is a man who has authored two memoirs but not a single major law or reform���not even in the state Senate." True. She accused Obama of wanting to "make government bigger" and of intending to "take more of your money." That's not how the Obama campaign would have explained its intentions, but the facts are the facts, and they did have plans to grow the size of government and raise more in tax revenues. Palin said that "terrorist states are seeking nuclear weapons without delay" and "he wants to meet them without preconditions," which was true enough.

This has been a central challenge during this election. The Republican ticket, when it comes to talking about matters of policy and substance, has some real��problems... that have nothing to do with whether you like their ideas. Romney admits that his tax plan "can't be scored" and then he rejects independent analyses showing that his numbers don't add up. He says���and Ryan echoes���that he'll bring federal spending down to 20 percent of GDP but refuses to outline a path for how well get there. He mounts a massive ad assault based on a completely discredited lie about the Obama administration's welfare policy. He releases white papers quoting economists who don't agree with the Romney campaign's interpretations of their research. All this is true irrespective of your beliefs as to what is good and bad policy, or which ticket you prefer. Quite simply, the Romney campaign isn't adhering to the minimum standards required for a real policy conversation....

I don't like that conclusion. It doesn't look "fair" when you say that. We've been conditioned to want to give both sides relatively equal praise and blame, and the fact of the matter is, I would like to give both sides relatively equal praise and blame. I'd personally feel better if our coverage didn't look so lopsided. But first the campaigns have to be relatively equal. So far in this campaign, you can look fair, or you can be fair, but you can't be both.

Comment of the Day: DLM: Dan Drezner (2014): WHAT NICK KR...

Comment of the Day: DLM: Dan Drezner (2014): WHAT NICK KRISTOF DOESN'T GET ABOUT THE IVORY TOWER: "Having now completed the sinful trifecta (academic -> govt -> private, in econ rather than foreign policy) I think Drezner is pretty spot on. Understanding the policy making process and the facts on the ground that will complicate negotiations is a legit strength of beltway types...

...This was good:

Academics are the best at playing Whac-a-Mole with the unending analogies.... Beltway and market folk like to disdain theories as abstract and unrealistic. Of course, these tribes then go on to articulate their own implicit theories... ���analogies��� or ���rules of thumb��� or ���granular analysis��� or ���projections.���

Maybe it was the rarefied air of the particular federal agency I spent time in and the groups I interacted with, but I generally found the beltway's implicit theorizing to be more aware (though not necessarily better) than the private sector's...."

April 10, 2018

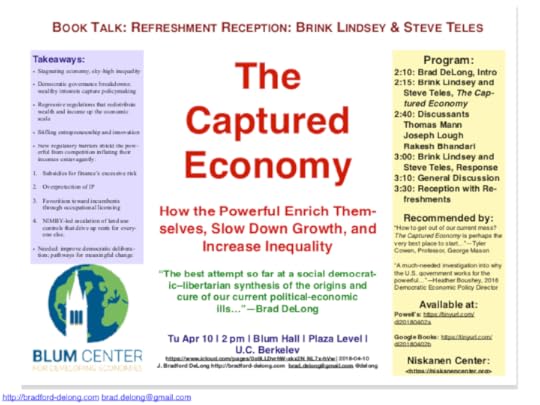

The Captured Economy: Berkeley Blum Center Event Notes

I���m Brad Delong I���m chief economist here at the Blum Center and a professor in the Economics Department. I���m incredibly happy here to have Brink Lindsey and Steve Teles, authors of The Captured Economy: How the Powerful Enrich Themselves, Slow Down Growth, and Increase Inequality https://tinyurl.com/dl20180402b.

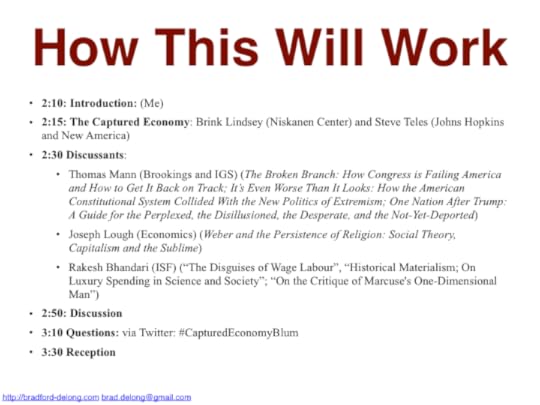

How this will work: I���m going to give a short introduction. Then Brink and Steve are going to present their show for fifteen or twenty minutes. Then we have three discussants who will take another twenty minutes.

We have Tom Mann, who was a long time fell senior fellow at the Brookings Institution, and is now a refugee out here in California, sitting at the Institute of Governmental Studies. He is the author of books with titles like:

The Broken Branch: How Congress is Failing America and How to Get It Back on Track

It���s Even Worse Than It Looks: How the American Constitutional System Collided With the New Politics of Extremism

One Nation After Trump: A Guide for the Perplexed, the Disillusioned, the Desperate, and the Not-Yet-Deported

and the forthcoming Run for Your Lives!

We have Joseph Lough, who teaches history of economic thought and other things in the Economics Department, who is the author of Weber and the Persistence of Religion: Social Theory, Capitalism and the Sublime.

We have Rakesh Bhandari, who runs ISF, and the works of his I value most are ���The Disguises of Wage Labour���, ���Historical Materialism: On Luxury Spending in Science and Society���; and ���On the Critique of Marcuse's One-Dimensional Man���.

Following that the authors will attack the discussants for misrepresenting their argument, and the discussants will attack the authors for misrepresenting their book.

Following that we will have questions���via Twitter. Hashtag #CapturedEconomyBlum. This is an innovation of the very sharp Josh Barro. Taking questions via Twitter and screening them means that (a) questions are asked, and (b) the questions asked are less than 280 characters.

Following that we will have our reception.

https://www.icloud.com/keynote/09fA1MJLSvCgJyJcfTttg3KXw

On Twitter: At @Blum_Center, Plaza Level for a presentation by Brink Lindsey and Steve Teles on their book, The Captured Economy. What factors have led to the high level of inequality that characterizes the American economy today? Speakers include Thomas Mann, Joseph Lough, and Rakesh Bhandari from Berkeley in addition to Lindsey and Teles.

Brink: The double malaise of slow growth and high inequality. Declining upward mobility: men born in 1940: 90% doing better than parents; now only 30% expect that; problem for American democracy.

Lots of structural forces. One piece of the puzzle. Powerful insiders throwing sand in the gears to make growth and inequality worse. The story of bad regressive capture: finance, IP, NIMBY. What is wrong with America:

Slow growth + High levels of inequality = Low levels of social mobility

Plenty of structural problems that have led to where we stand.

But the main focus is on government's role in exacerbating the issue

From 30k feet. Emerging chokepoints in US economy squeezed by powerful rich insiders.

IP monopolies; coastal concentration of economic activity & NIMBYism; occupational licensing in services; financial hypertrophy; opportunistic rent-seeking squeezing growth, advancing the rich. Population misallocation. First generation of migration inversion ever. The regulatory burdens that have resulted in a misallocation of resources:

Misallocation of capital due to a bloated financial sector enabled by home-ownership oriented policies.

Excessive healthcare spending.

Restrictive zoning laws

Get Manhattan, SF, & San Jose down to medium land use restriction: +10% US national income.

But how are we to reform? Tell us, Steve.

Steve Teles: 40 years���massive use of state to extract resources upward. Democracy: rule by the organized. Politicians attend to those who attend to them. Creation of classes of people who are in it for themselves. The organized able to invest in persuasive fictions. Fool others. Fool themselves. Generate fear in minds of risk averse political officials. The rich only have to play defense. Upper class are organized. Others not. Stand in way of creative destruction. What got us here and how has the state generated inequality: Democracy is ruled by those hyper-focused on specific issues who convince policymakers that their interests are aligned with the public. There exists a massive upper-class bias on such organization.

There has been a collapse of democratic creative deliberation���of the public sphere. The solution is to structure democratic deliberation in a useful way.

Tom Mann: Brink & Steve modest, examining only sins of commission. Book is a noble undertaking, but one I find unconvincing. Financialization: can it be blamed on government regulation. Licensing increase not a big factor. Read Mike Konczal... The final chapter isvery thought provoking... Conclusion: We have the ability to institute policies that reduce the influence of special interests so as to reintroduce high levels of growth and low levels of inequality.

Joseph Lough: As a post-Marxist economic historian trained at Chicago, I say: neoclassical economics all rests on a canon of shared models. Misregulation. Always regulated: by whom, & to whose benefit? What PhrMA wanted: PhrMA got from GWB. Models in urban economics are confirmed by zoning laws imposed in Portland and Berkeley. Low-income individuals are hurt the most and costs tend to rise.

Rakesh: a private ruling class a lumpenbourgeoisie. A public sphere that is a lumpenintelligentsia. Many structural barriers to participation. The essence of the state is corruption. Kleptocracy... Key question surrounding lack of investment despite high profits and low-interest rates.

Brink: Financial regulation���basic model of the financial sector. Debt. Crisis. Danger of insolvency. Governments regularly prop it up...

@postdiscipline: Thanks to Brad for inviting me to discuss Lindsey and Telles The Captured Economy. I also raised questions abt how to square record profits with low investment and long term interest rates

Questions:

CapturedEconomyBlum Re: increase in licensure of jobs causing misallocation. What do you think about the rapid rise of software engineering as a profession (basically non-regulated) in the last 40 or so years? Seems to buck the trend.

capturedeconomyblum How do questions of regulatory capture apply to issues like Net Neutrality or mega-mergers (AT&T-Time Warner, etc) in the world of technology and business?

capturedeconomyblum If organized wealthy interests can influence the economy and public policy to enrich themselves, how does campaign finance reform play a role in curbing the influence of these powerful few in the political process? What would effective reform policies be?

CapturedEconomyBlum Which forces are capturing the financial system with its bailouts of banks and how to un-capture it?

capturedeconomyblum With regards to "boosting countervailing power", would policies to strengthen labor unions serve as an effective way of giving workers a way of balancing out organized corporate interests?

CapturedEconomyBlumAre there any Trump policies made or in making that you would approve of?

https://www.icloud.com/pages/0o9LLDvrhW-xkx2N_NL7x-hVw | 2018-04-10

���The best attempt so far at a social democratic���libertarian synthesis of the origins and cure of our current political-economic ills���������Brad DeLong

The Captured Economy: How the Powerful Enrich Themselves, Slow Down Growth, and Increase Inequality

Brink Lindsey and Steve Teles

Niskanen Center: https://niskanencenter.org

"A compelling and original argument about one of the most pressing issues of our time, The Captured Economy challenges readers to break out of traditional ideological and partisan silos and confront the hidden forces that are strangling opportunity in the contemporary United States."���Matthew Yglesias http://vox.com

"Are you looking for how to get out of our current mess? The Captured Economy is perhaps the very best place to start."���Tyler Cowen, Professor of Economics, George Mason University

"American politics is mired in endless arguments about how much downward redistribution we want and how to provide it. But as Brink Lindsey and Steven Teles point out in this engaging, powerfully argued book, the reality of our political economy often looks much more like upward redistribution. In one arena after another, public policy enriches the already rich and advantages the already advantaged."���Yuval Levin, editor of National Affairs

"Steven Teles and Brink Lindsey ask one of the most important questions of our times: What are the political reforms we need to reduce the ability of the wealthy to maintain their capture of our government? Combining the analytic forces of liberalism and libertarianism, they provide a much-needed investigation into why the U.S. government works on behalf of the powerful and the steps we can take to address rising inequality and regressive regulation so that it instead acts in the public interest."���Heather Boushey, Democratic Economic Policy Director, 2016

Available at Powell���s: https://tinyurl.com/dl20180402a

Available at Google Books: https://tinyurl.com/dl20180402b

Takeaways:

Today: a stagnating economy and sky-high inequality

Breakdowns in democratic governance: wealthy special interests capture the policymaking process

Regressive regulations that redistribute wealth and income up the economic scale

Stifling entrepreneurship and innovation

New regulatory barriers shield the powerful from competition inflating their incomes extravagantly:

Subsidies for finance���s excessive risk taking

Overprotection of copyrights and patents

Favoritism toward incumbents through occupational licensing schemes

The NIMBY-led escalation of land use controls that drive up rents for everyone else.

Needed: improve democratic deliberation to open pathways for meaningful change

Synopsis

For years, America has been plagued by slow economic growth and increasing inequality. Yet economists have long taught that there is a tradeoff between equity and efficiency-that is, between making a bigger pie and dividing it more fairly. That is why our current predicament is so puzzling: today, we are faced with both a stagnating economy and sky-high inequality.

In The Captured Economy , Brink Lindsey and Steven M. Teles identify a common factor behind these twin ills: breakdowns in democratic governance that allow wealthy special interests to capture the policymaking process for their own benefit. They document the proliferation of regressive regulations that redistribute wealth and income up the economic scale while stifling entrepreneurship and innovation. When the state entrenches privilege by subverting market competition, the tradeoff between equity and efficiency no longer holds.

Over the past four decades, new regulatory barriers have worked to shield the powerful from the rigors of competition, thereby inflating their incomes-sometimes to an extravagant degree. Lindsey and Teles detail four of the most important cases: subsidies for the financial sector's excessive risk taking, overprotection of copyrights and patents, favoritism toward incumbent businesses through occupational licensing schemes, and the NIMBY-led escalation of land use controls that drive up rents for everyone else.

Freeing the economy from regressive regulatory capture will be difficult. Lindsey and Teles are realistic about the chances for reform, but they offer a set of promising strategies to improve democratic deliberation and open pathways for meaningful policy change. An original and counterintuitive interpretation of the forces driving inequality and stagnation, The Captured Economy will be necessary reading for anyone concerned about America's mounting economic problems and the social tensions they are sparking.

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers