J. Bradford DeLong's Blog, page 375

April 17, 2018

Matthew Yglesias: "In defense of Trump,: I learned in my ...

Matthew Yglesias: "In defense of Trump,: I learned in my deductive logic class that any conditional statement with a false predicate is true."

A great many tears and a great deal of terror have been created by the fact that formal logic has called its two state values true and false rather than 1 and 0, grue and bleen, or even T and F...

#ontwitter

Should-Read: Leonardo Bursztyn, Thomas Fujiwara, and Aman...

Should-Read: Leonardo Bursztyn, Thomas Fujiwara, and Amanda Pallais: 'Acting Wife': Marriage Market Incentives and Labor Market Investments: "Do single women avoid career-enhancing actions because these actions signal undesirable traits, like ambition, to the marriage market?...

...While married and unmarried female MBA students perform similarly when their performance is unobserved by classmates (on exams and problem sets), unmarried women have lower participation grades. In a field experiment, single female students reported lower desired salaries and willingness to travel and work long hours on a real-stakes placement questionnaire when they expected their classmates to see their preferences. Other groups' responses were unaffected by peer observability. A second experiment indicates the effects are driven by observability by single male peers.

Steve M.: NEEDY, RAGE-FILLED TRUMP IS THE PERFECT CANDIDA...

Steve M.: NEEDY, RAGE-FILLED TRUMP IS THE PERFECT CANDIDATE FOR CONSERVATIVES NOW: "Past presidents, most of whom were emotional adults, knew they'd be attacked and tried to appear above the fray...

...not just reveling in the admiration of their supporters but ignoring, or appearing to ignore, their antagonists and critics. Trump can't do that because he's so emotionally needy���when he's under attack, the attack is completely distracting to him. And that's precisely what resonates with his admirers. They wouldn't want the Reagan of "Morning in America" and the 49-state landslide; they certainly wouldn't want a Barack Obama, who tried to remain presidential even as antagonists endeavored to drag him down. Trump happens to have a whiny, aggrieved personality, and that suits heartland white voters perfectly. They feel sorry for themselves, and they like a president who feels the same way about himself. Every attack on Trump resurfaces his sense of grievance, and that strengthens the bond between Trump and his base. So no wonder the anti-Trump movement is failing. Attacks are nutrients to the Trumpers.

#livefromtheorangehairedbabooncage

April 15, 2018

How can this possibly end other than with the bulk of the...

How can this possibly end other than with the bulk of the administration in jail?: https://twitter.com/RVAwonk/status/985692703626326017 Caroline O. @RVAwonk: "NEW: Trump reportedly raged at staffers when the expulsion of 60 Russian diplomats was announced. He was so furious about the # of diplomats & about the U.S. being portrayed as taking a tough stance on Russia that he screamed expletives at WH officials." https://t.co/3VZMYexrWW

livefromtheorangehairedbabooncage

What Does Economics Need to Learn Next?

Prospect Magazine: Back to school: top economists on what their subject needs to learn next: Learn to prevent���we���re out of cure:

The crisis and its aftermath showed that the North Atlantic economies could not maintain full employment by following the Keynesian road. The idea that when the private sector sits down the public sector should stand up���that consistent durable prosperity can be achieved by having government step in as a spender of last resort���proved unsustainable. It also showed that full employment could not be maintained by following the monetarist road: the idea that successful regulation could keep finance on a sound footing, or at least a steady enough footing for central banks to manage, also proved unsustainable.

Ultimately prosperity is unlikely to be maintained without competent democratic government, and that has proven shaky since the slump. The big question is: what institutional���and perhaps political���changes are necessary to avoid another wild swing? In all likelihood we���ve only a decade to build better institutions of economic management. And we have not yet begun...

What other people say:

Larry Summers: Get to grips with vicious cycles: The central lesson of 21st century economic experience is that modern economies are not self-equilibrating systems. Indeed, modern economies are often dominated by positive feedback effects that destabilise. Margin calls, bank runs, portfolio insurance, option hedging all cause more selling of assets as their values go down. When selling causes lower prices, which cause more selling, the market mechanism is in trouble. We now understand how it can give way to long-term economic problems such as secular stagnation, where excessive saving drags down demand and economic growth slows.

The challenge is to prevent vicious cycles from developing and to contain them when they start. This will mean more, smarter government policy, not a retreat into market fundamentalism.

Deirdre McCloskey: Cheer up: Don���t believe the gloomsters claiming that the sky is falling, and that we are doomed to stagnation. No it isn���t, and no we aren���t. The gloom produces policies of zero sum, protecting what we have. But the recent history tells of spectacular positive sums. China and India produce riches and engineers at astonishing rates. Wages in the old rich countries are said to be stuck, but they���ve actually kept rising, once allowance is made for the immense rise in the quality of goods and services.

As for the robots taking our jobs, since modern growth got going���around the year 1800���technological unemployment has never happened, so don���t believe that some half-understood phantom of artificial intelligence is going to put you out on the streets. Be of good cheer. Since 1800, real income has increased 3,000 per cent in many countries, and soon the world. Let it happen.

Martin Wolf: Pathology, prophylactics and palliatives: Macroeconomics needs to grapple with three linked questions. First, what causes financial crises? Second, what policies would best reduce the risks of such crises? Third, what should the policy response be to crises once they have happened?

On the first, how should we understand the interaction between the financial and monetary systems and the real economy? Sometimes the economy seems to depend on a combination of asset-price bubbles with the unsustainably rapid growth of debt. Why should this be so? On the second, are there more sustainable ways to generate demand? Might redistribution of income towards spenders be the answer? What role can government spending play?

On the third, are there alternatives to a combination of heavy government borrowing with supportive monetary policy? This combination has brought recovery. But the indebtedness built up before the crisis has, in part, just shifted onto the public sector. Moreover, even the private sector���s deleveraging has been modest. Economies remain fragile. Macroeconomics is, alas, not healthy.

Robert Gordon: Technology isn���t working: While we often hear that rising inequality is the greatest problem facing western economies, in the long run a greater problem is slow productivity growth. The slow rate of increase in the amount businesses can produce per worker accounts for wage stagnation and the growing fiscal burden of welfare payments, relative to the economy���s ability to raise taxes to pay for these entitlements.

In the US, compare annual productivity growth in the past seven years of 0.5 per cent with the 2.8 per cent over the 50 years between 1920 and 1970. What is the difference? The middle five decades of the twentieth century benefitted from an amazing multiplicity of great inventions���electricity and all it made possible, the internal combustion engine that replaced the horse with motor vehicles and air transport, and the whole realm of entertainment and communication inventions, such as the telephone, phonograph, radio, motion pictures, and TV.

In comparison, computers and the internet boosted productivity growth only briefly in 1996-2004, but since that era, in which paper and file cabinets were replaced by flat screens, search engines, and the internet, business methods have seen little further progress. So far, robots and artificial intelligence have made little difference in the daily lives of workers and consumers.

Barry Eichengreen: Get to work on jobs: The global crisis and populist backlash laid bare the fact that American ���blue-collar workers��� had been left behind by technology and globalisation. President Trump promises to rescue them by ���making coal great again��� and taxing steel imports. We need a better way.

The conventional wisdom used to be that if manufacturing jobs can���t be recaptured from robots and China, then the solution is better service-sectors jobs���jobs that were presumed to be safe from automation and import competition because they require situational adaptability, interpersonal skills and oral communication. But now advances in artificial intelligence raise questions about the future of even those jobs.

Still, jobs requiring workers to combine practical services, communication and empathy���care workers, for example���should remain safe for the foreseeable future. So the pressing question becomes how to better prepare workers for these particular tasks. This requires rethinking education, training and the nature of work itself���a process that has only just begun.

Jim O���Neill: Learn to learn from China: The presumption used to be that China would have to learn from the west if it wanted to keep developing, especially when it comes to the political system. But 20 per cent of the Chinese now pull in a western-style income of $40,000-plus per year���that���s 260m people living on western-style incomes, far more than in any actual western country except the US. So the question becomes: what can we learn from China?

In addition to detailed areas like maths tuition (where the UK is already running pilots based on the best Chinese schools) two big areas stand out. First, when it comes to big changes, we should ensure everyone is informed and prepared; the circumstances of the EU referendum is the kind of thing that makes Beijing doubt the wisdom of western-style democracy.

And then there is macro-economic policy. For at least 20 years, Beijing has shown it can head off problems, and deal with crises. Western experts have repeatedly predicted a UK-style housing bubble-and-burst for China, but its authorities have pricked bubbles before they grew too big. Bankers and hedge funds bemoan how hard it is to predict what Chinese policymakers will do next. But the Chinese authorities see their role as being to fix real problems, not to provide clarity to market participants.

Adair Turner: Clip property���s wings: In an automated economy, without intervention, the rewards are inevitably concentrated in various forms of rent���especially for those who own land in urban centres, technologies that benefit from network effects (Google, Facebook) and inventions. All of these things are concentrated in relatively few hands, fuelling the income gap.

So far, we���ve left land as a free-for-all, greatly benefiting its holders, and increased the advantages of those with intellectual property, for example by extending copyrights for decades after an artist has died. If we���re serious about inequality, we need to change course; economics should concentrate on devising new, smart taxes and regulations to put property back in its place.

:

John Kay: Embrace radical uncertainty: Between 1920 and 1950, a debate took place which defined the future of economics in the second half of the 20th century. On one side were John Maynard Keynes and Frank Knight; on the other, Frank Ramsey and Jimmie Savage.

Knight and Keynes believed in the ubiquity of ���radical uncertainty���. Not only did we not know what was going to happen, we had a very limited ability to even describe the things that might happen. They distinguished risk, which could be described with the aid of probabilities, from real uncertainty���which could not. In Knight���s world, such uncertainties gave rise to the profit opportunities which were the dynamic of a capitalist economy. Keynes saw these uncertainties as at the root of the inevitable instability in such economies.

Their opponents insisted instead that all uncertainties could be described probabilistically. And their opponents won, not least because their probabilistic world was convenient: it could be described axiomatically and mathematically.

It is difficult to exaggerate the practical consequence of the outcome of that technical argument. To acknowledge the role of radical uncertainty is to knock away the foundations of finance theory and much modern macroeconomics. But the reigning consensus is beset with glaring weaknesses. Keynes and Knight were right, and their opponents wrong. And recognition of that is a necessary preliminary to the rebuilding of a more relevant economic theory.

Tim Congdon: Figuring out (again) where the banks fit in: Some big questions in economics come and go, but one is there all the time: how are national income and output determined, and what does the answer mean for unemployment and inflation? Economists flopped this exam question when it was put to them in the Great Recession of 2008. In the coming decade, they will be trying to do better.

Keynes is supposed to have supplied a good reply. Unfortunately, in the last 20 years, central banks have instead preferred ���New Keynesianism,��� a three-equation model which has been widely described as the workhorse of modern macroeconomic analysis.

But in 2008, it was useless. Not one of the equations referred to the banking system, or the quantities of bank credit and money, even though it is obvious that banks were important in the Great Recession. One of the equations (the so-called ���Taylor rule���) prescribed heavily negative interest rates to deal with the slump. This would have been fine, except that interest rates cannot go much beneath zero. New Keynesianism ought long ago to have been sent to the knacker���s yard.

The main intellectual challenge for economics now, just as it was when Keynes was writing, is to identify how the banking system���with its alleged masters of the universe, and its undoubted manias, delinquencies and pathologies���interacts with the rest of the liberal capitalist democracies of today.

April 14, 2018

Trump's Tariffs: No Longer Fresh at Project Syndicate

Project Syndicate: Trump���s Tax on America: After a year of serving as a useful idiot for congressional Republicans and their wealthy donors to push through tax cuts and deregulation, US President Donald Trump is now following through on his protectionist promises. Sooner or later, Republicans might realize that inept kleptocracy is not the best form of government after all:

"2017 was the best year for conservatives in the 30 years that I���ve been here. The best year. On all fronts". So said Senate Majority Leader Mitch McConnell (R-KY). "This has turned out to be a very solid, conservative, right of center, pro-business administration. And we���re seeing the results of it." The same sentiments have been echoed over and over again by Republican donors over their shrimp hors d'oevres: the rollback of environmental regulations, and tax cuts for the rich. What is not to like? That Donald Trump and his family are would-be kleptocrats means that they little like the government taking what they want to be their wealth, and so are allies of all those who think America's big problem is that the distribution of income and wealth is not unequal enough. That the Donald Trump administration is incompetent���the tax cut bill was the worst drafted bill anybody can remember seeing���is not a drawback, for incompetence creates opportunities for lawyers to further enlarge loopholes.

2017 was, in the eyes of Mitch McConnell and of large Republican donors, truly the best year in the memory of man: incompetent erratic kleptocracy would appear to be the best of all forms of government for them. Who knew?

Or, at least, the best form of government until March 1, 2018.

Senator Pat Roberts (R-KS), at least, may have changed his mind about Trump:

This is not going to go down well in farm country. What���s really ironic here���it���s a real paradox of irony ��� that we have a tax reform package that���s bringing a lot of benefits to the business community not the mention individuals, and this is a policy move that is contrary to that....I hope we���re not seeing a trade policy that will basically result in all the benefits of the tax reform being taken away by higher manufacturing costs being passed on to consumers. The consumers are going to pay for this. All manufacturers are going to be affected by this, and they���re not going to pay for it. They���re going to pass that cost onto consumers, so it���s a consumer tax, not a tariff. These are the people who voted for the president. These are his people. One county in Kansas even voted for him 90 percent, and they���re not going to be happy at all about this...

Lindsay Wise of the Kansas City Star wrote that Roberts: "struggled to find words to describe his state of mind.... He and other Republican senators received no formal heads-up from the White House before Trump said he would impose import tariffs���25 percent on steel and 10 percent on aluminum..."

The stock market dropped 1.5% on the news.

House of Representatives Speaker Paul Ryan said: "He hoped the President will consider the unintended consequences of this idea and look at other approaches before moving forward".

The decision has been taken against the advice of and over the objections of National Economic Advisor Gary Cohn, National Security Advisor H.R. McMaster, Treasury Secretary Steve Mnuchin, and Defense Secretary James Mattis. For it, apparently, are Commerce Secretary Wilbur Ross���but it is not at all clear why, for the view from the Commerce Department sees many more who benefit and who benefit more from low steel and aluminum prices as they seek to invest than it sees those who benefit from higher steel prices. For it, apparently, is trade advisor Peter Navarro���but Navarro has not yet set out a framework by which externalities from the creation of a larger domestic steel industry are a net benefit to the economy. For it, apparently, is Special Trade Representative Robert Lighthizer���but it is really not clear why, for his reputation depends on the administration's having a successful rather than a stupid trade policy.

Perhaps America's plutocrats���and their senators and representatives���will come to the realization that wealth flourishes most under a competent rather than an erratic and incompetent government? And perhaps they may start to wonder whether plutocrats are the allies of would-be kleptocrats���or their prey?

Crisis, Rinse, Repeat: No Longer Fresh at Project Syndicate

Crisis, Rinse, Repeat: Key economic data from the periods following the 1929 stock-market crash and the 2007-2008 financial crisis suggest that the current recovery has been unnecessarily anemic. If policymakers refuse to heed the lessons of the New Deal era, then the next crisis is destined to be as prolonged as the last.

When the economic historians of the late 21st-century compare the Great Recession that started in 2007 with the Great Depression that started in 1929, they will write two things:

They will write that the initial policy response to the crises by the Federal Reserve and the Treasury was first rate in 2007 and after but fifth rate in 1929 after���what could have been a post-2007 repeat of the Great Depression in terms of the crash in production and employment was instead moderated to a painful episode.

But they will also write that while the post-business cycle trough policy response of President Franklin Roosevelt, the Congress is elected by American voters in the Federal Reserve was if not first at least second rate and laid the foundations for rapid recovery and satisfactory equitable growth; the post-business cycle trough policy response of President Barack Obama���s, the Congresses elected by American voters, and the Federal Reserve was at best third rate and did not lay foundations for rapid recovery or satisfactory equitable growth.

United States national income and national income per capita peaked in 2007 just before the Great Recess Ion. Two years later, into thousand nine, national income per capita was 5% below its peak. Four years later, in 2013, output per capita retained its peak. And this year, 2018, if we are lucky, national income per capita will stand 8% above its previous peak of 11 years ago.

There is no comparison with the Great Depression. Four years after the business cycle peak of 1929 national income per capita was down 28% from its peak. In the great depression, output per capita did not retain its peak level for a full decade.

Thus there is no comparison with the Great Depression���save that 11 years after the pre-Great Depression Business cycle peak output for worker was 11% higher and growing rapidly, well this year output per worker is only 8% higher than the pre-Great Recession peak and growing slowly. Plotting relative performance since the peak on the same axes, this year the lines will cross. And given how much better a relative starting position policymakers had in late 2009 than Franklin Delano Roosevelt and his team had in early 1933, that is appalling.

Democrats blame Republicans for turning off the fiscal stimulus spigot in 2010 and then refusing to turn it back on. Republicans say... nothing comprehensible or coherent. They say things like:

It must be the fault of Barack Obama, via Dodd-Frank or ObamaCare.

Maybe it's the fault of all those people who want to work but are useless���the "zero marginal product workers".

Anyone who does not have a job must not really want one.

There is much more truth in the Democratic assignment of blame. But not everything can be blamed on fiscal austerity. And a considerable amount of inappropriate fiscal austerity in the early stages of the recovery is properly laid at the door of Barack Obama and his team.

Most worrisome, however, is that policy during the anemic recovery is not perceived as a failure by either those at the tiller at the time or by their successors. With a few honorable exceptions, Federal Reserve policymakers tend to say that they did the best they could given the fiscal headwinds imposed on them. With a few honorable exceptions, Obama administration policymakers tend to say that they stopped a second Great Depression, and that during the recovery they did their best given how they were hobbled by the Republican congressional majorities. And Republican economists tend to either be silent or say that the policies���both fiscal and monetary���pursued by the Obama administration and by the Bernanke Fed were dangerously inflationary, and that we have been lucky to escape the fate of Greece���or Zimbabwe.

Christina and David Romer tell us that in the post-WWII period economies that run into a serious financial crisis have levels of production ten years later fully 10% lower if they had neither monetary nor fiscal policy space to deal with the crisis. We will run into a serious financial crisis: that has been the rule for modern capitalist economies since at least 1825. And there is nothing in view that suggests that, when we do, we will have both the will to use monetary and fiscal policy and the space available.

Should-Read: Bridget Ansel: Weekend reading: ���Equal Pay...

Should-Read: Bridget Ansel: Weekend reading: ���Equal Pay Day��� edition: "A new report, ���Gender wage inequality: What we know and how we can fix it,��� by Sarah Jane Glynn...

...The report details the multiple drivers of pay inequality, and what steps need to be taken at the state and local level to address it. Sarah Jane Glynn also authored an op-ed published in the Lansing State Journal with Heather Boushey. The authors discuss why pay inequality is not just a ���women���s issue,��� but rather one that affects entire families and the economy as a whole.

Kate Bahn unpacks the arguments used to support legislation that would impose work requirements on government programs that support low-income workers and their families... details the research showing that work requirements are counterproductive and harmful.... Texas charter schools from 2001-2011. The authors find that while charter schools were on average of lower quality than public schools at the beginning of the time period, charters eventually surpassed public schools in effectiveness by the latter half of the decade.... More job vacancies in the United States are still producing fewer hires even after accounting for the strength of the U.S. labor market. In a new issue brief, Nick Bunker explains why ���employer complaints about being unable to find workers to fill jobs should be taken with a grain of salt��� because employers themselves may be the problem...

Should-Read: Nick Bunker: JOLTS Day Graphs: February 2018...

Should-Read: Nick Bunker: JOLTS Day Graphs: February 2018 Report Edition: "The quits rate continues to hold steady at 2.2 percent. The rate has been 2.2 percent on average for the past 3 months as well as the past year...

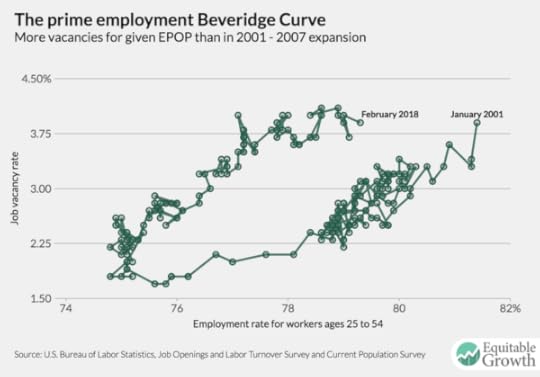

...The ratio of unemployed workers to vacant jobs is no longer at an all-time low as it ticked up slightly, but the three-month average is still at 1.1. Consider that number to the ratio���s peak of 6.5 unemployed workers per job vacancy. Job vacancies have produced fewer and fewer hires for employers during the current economic recovery, but the pace of the decline seems to have slowed recently and may even have stalled. The three-month average is 0.93, while the 12 month-average is currently 0.92. Despite concerns about a structural increase in unemployment during the recovery from the Great Recession, the Beveridge Curve shows a current relationship between unemployment and job openings that���s very similar to the one before the recession...

Should-Read: That prime-age employment-to-population has ...

Should-Read: That prime-age employment-to-population has been increasing without vacancies increasing tells us, I think, that the economy is not "overheating", but rather getting closer to some medium-run concept of full employment as the hysteresis effects of the Great Recession are slowly being repaired: Nick Bunker: "What does this tell us?: ".@de1ong asked so here it is: the Beveridge Curve with the prime employment rate instead of U3...

...What does this tell us? Notice that most of the movement recently has been sideways as prime EPOP has increased & vacancies haven���t increased much. Like the U3 curve did as it started shifting back. In other words: this could be just another sign of remaining slack. Graphs collected here https://t.co/Hu6JPSorXJ. See you all on May 8th! (back to JOLTS Tuesdays!)...

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers