J. Bradford DeLong's Blog, page 2183

October 8, 2010

Karl Smith Takes Brian Westbury to School

Karl:

A Teachable Moment: Westbury on Stimulus: Really quickly, this Brian Westbury quote is brilliant because it is so perfectly, delectably wrong. Its the kind of thing you dream a student will say so that you correct the entire class’s misunderstandings in one fell swoop.

Money for stimulus programs has to come from somewhere and he argues that stimulus spending is similar to the old adage: “borrowing from Peter to Paul.”

“They (the government) either had to tax it from somewhere or borrow it from somewhere," says Westbury and “by moving resources out of one sector into another you have now messed up the natural order of things and you’ve influenced it in a negative way."

Wesbury says THAT is the mistaken belief about government stimulus.

Different professors will approach this different ways but I prefer to go at it like this:

You’re exactly right Brian. The money has to come from somewhere. However, remember money and production are not the same thing. In the case of money, we have a technology known as the printing press which allows us to print money as much money as we want. So creating money is no problem.

Won’t that cause inflation?

Yes, but we are below inflation targets right now, not above. We want more inflation. Right now the Fed is trying to get more inflation but is having trouble. Stimulus spending will help them out with that.

But, you can’t get something from nothing, can you?

No, you most certainly can’t. However, we aren’t getting something from nothing. We are getting something by combining together unemployed workers and idle factories. Remember a recession is a time when we have increasing unemployment and declining capacity utilization.

We have factories without workers and workers without factories. Those are resources that could be used to produce things but are not being used. If we can get those resources to work will be able to make more things.

Unfortunately, we can’t and ultimately its because the economy doesn’t have enough money. Luckily we can print as much of that as we need.

October 7, 2010

Is Yale Professor David Gelernter a Forum-Shopping Patent Troll?

I certainly would never have thought that coverflow was patentable.

And if I were on the jury, I would say that Irving Fisher's Rolodex is prior art.

I Am Going to Keep This Comment and Frame It! I Am Going To Keep This Comment for Life!!

Hoisted from Comments: Fifi writes:

Econ 1: Files for October 11 introduction to Microeconomics Lecture - Grasping Reality with Both Hands: Same as Nathanael.

And the notion that market failures are addressed by the rise of big business implementing command and control, come on ...

Sorry but I found the deck simplistic to the point of being offensive, even Randroidian.

PS: I know, harsh words, but this is Econ-1 and the whole of what many of your students will see of economics. First impressions matter.

Econ 1: Files for October 13 Fundamentals of Supply and Demand Lecture

links for 2010-10-07

Opposition to the rule of law - Glenn Greenwald - Salon.com

Apt. 11D: Update on Ian

Realtime: The Dangers of Insufficient Stimulus

The Two Rebalancing Acts « iMFdirect – The IMF Blog

Macro and Other Market Musings: More Evidence That There is a Serious AD Problem

Financial Shock and Awe - by Barry Eichengreen | Foreign Policy

xkcd’s Updated Map of Online Communities / Tor.com / Science fiction and fantasy / Blog posts

The costs of rising economic inequality

Interview with Laurence Meyer :: :: <img src="http://feedproxy.google.com/Forefront/images/forefront_w.jpg" alt="Forefront" /> :: 10.06.2010 :: Federal Reserve Bank of Cleveland

Econ 1: Files for October 11 introduction to Microeconomics Lecture

The Answer Is: Because No Weblog Post Could Possibly Live Up to That Title

Daniel Davies writes:

D-squared Digest -- FOR bigger pies and shorter hours and AGAINST more or less everything else: Day of the Triffins: I am mildly surprised that Paul Krugman hasn't used this as a title for a blog post about the US$/yuan exchange rate yet. I donate it as open source to the community.

That is all.

How Much Does the Market Organization of Economic Life Matter?

How much does the use of markets as a decentralized social planning mechanism for economic life matter? How much richer are we because we live in a market economy rather than in a command-and-control bureaucratic economy?

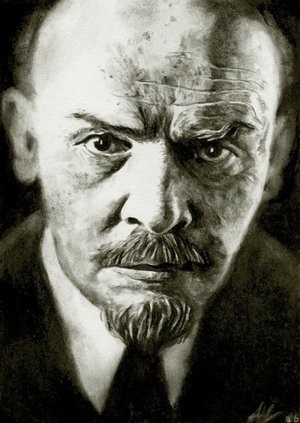

We are fortunate--if that is the word--to be able to answer this question because the twentieth century provided us with a natural experiment in the form of High Stalinist central planning. Karl Marx, you see, completely missed the utility of markets as devices for providing decision makers with proper incentives and for achieving allocative efficiency. (Why he missed this is, I think, a result of his crazy metaphysics of value, but I won't go there today.) He saw markets only as surplus extraction devices--ways to quickly and fully separate the powerless from the value that they had created and that ought to have been theirs.

So when the Communists took over, they followed Marx and said: "we don't want no stinking markets in our economies." This naturally raised the question of how they were then to coordinate economic activity. And they hit on the clever plan of attempting to reproduce the Rathenau-Ludendorff Imperial German war economy of World War I. And they did so.

In 1989, the Iron Curtain came down, and we could see what a difference it made as we could examine levels of material well-being on both sides of the Curtain. This is as close to a perfect natural experiment as anyone could wish: the Iron Curtain's location was determined by where Stalin's and Mao's and Giap's armies marched--which is as exogenous to other determinants of economic well-being as anyone could wish.

Here are the results:

Material Well-Being in 1991: Matched Countries on Both Sides of the Iron Curtain

Eschewing markets robs you of between 80% and 90% of your potential economic productivity.

Now you can argue that the difference in human well-being is less than this gap in material wealth. Cuba, after all, has a high life expectancy and a low level of inequality.

Or you can argue that the difference in human well-being is much, much greater than this gap in material wealth:

Put me down on the much, much greater side of the argument.

Hoisted from Archives: Satiation?

Sated?: Archive Entry From Brad DeLong's Webjournal from August 15, 2002: At what level of material wealth does one become, completely, totally, utterly sated? How much stuff--how many things--how much power to buy and control does one have to have before one can say "enough is enough," stop playing the game for increased wealth, and start playing some other, different game?

Here is discouraging psychological evidence from publishing magnate and Rolling Stone founder Jann Wenner. It turns out that--at least as far as he is concerned--wealth in nine figures isn't enough yet to make him not care...

Premium Blend: A group weblog from the editors of Corante: What's your number? How much is enough? It may be more than you think: ''I had a fascinating conversation recently with Jann Wenner, the founder of Rolling Stone. Here's a guy who's probably got three or four hundred million dollars--he's got a Gulfstream II and a house here and a house there, and you can't imagine what trappings he could want from the next level. But he's got this gleam in his eye because he's telling me about how he spent the weekend with Paul Allen. He said that Paul Allen didn't have a GII, he had two 757s. They flew over to, like, Nice, and then they got into Paul's helicopter, which took them to Paul's boat, which stays sort of off the coast of southern France. And I could tell that Jann was picturing himself at the next level--the multi-billionaire. And I was fascinated by that because, holy shit, if that's not enough for Jann, why do I think I'm going to be able to get off the conveyor belt?''

The Ferocious Invisible Bond Market Vigilantes Are Back!

Sue Chang:

Freddie Mac: 30-year mortgage slides to record low - MarketWatch: Thursday the 30-year fixed-rate mortgage average fell to a new record low of 4.27% with an average 0.8 point for the week ending Oct. 7. In the previous period, the average was 4.32%, and the year-ago average was 4.87%. "The 12-month growth rate in the core price index for personal consumption, which the Federal Reserve closely tracks, has been drifting lower over the past six months ending in August and suggests inflation is running at a tepid pace at best. This allowed mortgage rates to ease to new or near record lows this week," said Frank Nothaft, Freddie Mac chief economist, in a statement. "Housing affordability increased for the second month in a row in August to tie April's level, according to the National Association of Realtors. As a result, pending existing home sales also rose for the second consecutive month in August to the strongest pace in four months, the NAR also reported. Furthermore, since the end of August, mortgage applications for home purchases were up over 14% for the week ended October 1."

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers