J. Bradford DeLong's Blog, page 2148

November 30, 2010

A Platonic Dialogue on the Failure of Economics Education

Thrasymakhos: You have to realize, Monetaristoteles, that only 4% of the American people and 10% of Washington elites believe what you and I do: that our current macroeconomic disorder of high unemployment is a serious but curable disease of the industrial market economy--a disease curable by strategic interventions to rebalance financial markets through appropriate monetary, fiscal, and banking policies. 96% of the American people and 90% of elites believe, by contrast, that our current macroeconomic disorder and high unemployment is--in some sense they cannot fully explain--just punishment for our sins against financial prudence, that we must take our just punishment like manly men, and that we must not attempt to evade punishment through financial trickery. Think of David Brooks: that argument, on that level, with that degree of background knowledge, and that degree of certainty.

Monetaristoteles: Do I have to?

Thrasymakhos: Yes.

Monetaristoteles: Very well. I do find this astonishing. Professional economists would go the other way. 90% or more of professional economists think times of high unemployment are cases of a disease that can be cured by strategic interventions to rebalance financial markets. They disagree about how and what those rebalancing policies should be. But they agree that there is a cure, and that it is to undertake the right strategic intervention in financial markets.

Thrasymakhos: I think you are wrong about professional economists...

Monetaristoteles: May I finish?

Thrasymakhos: It is what they would think if they understood their discipline, its foundations, and hits history, but...

Monetaristoteles: MAY I FINISH? Thank you. As I was saying, only a small but vocal minority of economists--starting with Karl Marx and continuing with his left-wing disciples like Rudolf Hilferding and his right-wing disciples like Joseph Schumpeter claim that the episodes of high unemployment are a disease that has no cure--that downturns and depressions are functional and necessary for any industrial market economy. And they have never been able to make their arguments in a form that makes any sense to the rest of us.

Thrasymakhos: And your point is?

Monetaristoteles: Simply this: the Marxists and the Austrians, the theorists of the Pointless Pain Caucus in their various flavors, have not had control over the Econ 1 curriculum. We have had control over the Econ 1 curriculum. If there are two lessons we want people to remember from the "Intro Macro" part of Econ 1, they are (a) that government can stabilize the price level and prevent inflation by stabilizing the money stock over the long-term, and (b) that downturns--episodes of high unemployment--are usually cases of a disease that can be cured by the right strategic interventions in financial markets. Keynesians and monetarists, classicals and neoclassicals, credit-channelers and post-Keynesians--this is what we all believe: that while Say's Law can be broken, the only thing that can break it is some imbalance in financial markets that produces excess demand for some category of financial assets, and that a competent and nimble technocratic government can conduct strategic interventions that make Say's Law--even though false in theory--roughly true in practice. That is what we all think...

Thrasymakhos: But you fight over what the right strategic interventions in financial markets are...

Monetaristoteles: Only the Marxists and their mutant Austrian descendants believe that times of high unemployment must be suffered through if the industrial market economy is to function, and they have never had control over the Econ 1 curriculum...

Thrasymakhos: Yes but...

Monetaristoteles: So why has what we have to say gone in one ear and out the other?

Thrasymakhos: Because your discipline has had an amazing educational failure on a remarkably fundamental level?

Sokrates: Aren't you a member of the Institute for New Economic Thinking's Education Committee?

November 29, 2010

Paul Krugman on Today's Obama Photo-Op

PK:

Yep, that's exactly what we needed: a transparently cynical policy gesture, trivial in scale but misguided in direction, and in effect conceding that your bitter political opponents have the right idea.

Econ 1: Fall 2010: Econ 1 Lecture

Former Chair of the President's Council of Economic Advisors and National Economic Council Principal Chistina D. Romer: "Fiscal Policy in the Obama White House: Reasoning, Results, and Challenges Going Forward"

Yes, there will be a question about her talk on the final exam...

The Left Opposition Has a Budget-Balancing Plan

And it is a very good one--a much better one than the amateurish, unthought-through and far-right Simpson-Bowles or the professional but inequality-increasing and right-wing Domenici-Rivlin.

Matthew Yglesias has beat me to the punch and already written about the thing:

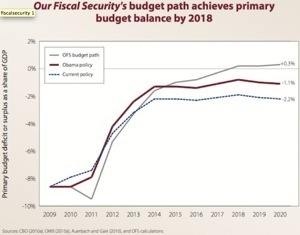

Yglesias » The Left and the Budget: Liberals didn’t like the Simpson-Bowles deficit plan largely because neither Simpson nor Bowles is a liberal.... Today the Our Fiscal Security coalition, comprised of Demos, the Economic Policy Institute, and the Century Foundation have released their fiscal blueprint which shows you would that liberal take would look like... the heavy (and appropriate) emphasis in the short term on mobilizing excess capacity to increase growth and decrease unemployment rather than austerity budgeting that will only increase resource-idling... No Cost Shifting, namely:

Policies that simply shift costs from the federal government to individuals and families may improve the government’s balance sheet but may worsen the condition of many Americans, leaving the overall economy no better off...

[M]edium term balance can be achieved basically entirely on the tax and defense sides. For the longer-term, like all long-term budget plans they need to rely... [on hand-waving to control] health care costs. .. OFS offers the least hand-waving on this point of any plan....

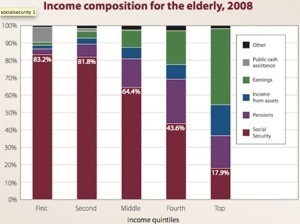

This chart from OFS is an excellent illustration of what the Social Security debate is about:

Note that the bottom 40 percent don’t live as long as richer people, so the impact of raising the retirement age is especially regressive.

Document at: http://epi.3cdn.net/b3c2500a206a5ea13a_n7m6vzdpr.pdf

A Temporary Federal Pay Freeze Might Be Part of an Acceptable Long-Term Deficit Reduction Deal with Republicans

But it makes no sense at all as a preemptive pre-negotiation concession.

Larry Mishel:

Federal pay cuts: A bad idea for what gain?: In the context of the deficit, Obama will get chump change from freezing federal pay, and will only enlarge the degree to which federal pay lags that of the private sector (a gap of 22%, according to the federal pay agent’s report. See Table 4.) This is another example of the administration’s tendency to bargain with itself rather than Republicans, and in the process reinforces conservative myths, in this case the myth that federal workers are overpaid. Such a policy also ignores the fact that deficit reduction and loss of pay at a time when the unemployment rate remains above 9% will only weaken a too-weak recovery.

Why oh why can't we have better Democratic presidents?

Our Health Care Cost Problem Is Overwhelmingly a Private Cost Problem

Ezra Klein sends us to N.C. Aizenman:

Want an appointment with kidney specialist Adam Weinstein of Easton, Md.? If you're a senior covered by Medicare, the wait is eight weeks. How about a checkup from geriatric specialist Michael Trahos? Expect to see him every six months: The Alexandria-based doctor has been limiting most of his Medicare patients to twice yearly rather than the quarterly checkups he considers ideal for the elderly. Still, at least he'll see you. Top-ranked primary care doctor Linda Yau is one of three physicians with the District's Foxhall Internists group who recently announced they will no longer be accepting Medicare patients.... Doctors across the country describe similar decisions, complaining that they've been forced to shift away from Medicare toward higher-paying, privately insured or self-paying patients in response to years of penny-pinching by Congress...

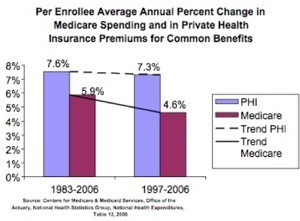

As Ezra points out, this fits very ill with the Republican talking point that the government cannot control Medicare costs:

Ezra Klein - What happens when Medicare controls costs too well: One of the dirty little secrets of the health-care system is that Medicare has done a much better job controlling costs (pdf) than private health insurers.

The problem is that Medicare can't control costs too much better than private insurers or, as you see from the article above, doctors will simply abandon Medicare.... [T]he dominant opinion is that Medicare can't control its spending. A lot of this... has to do with the failure of the Medicare Sustainable Growth Rate... a small formula that Republicans inserted into the 1997 Balanced Budget Act that was meant to save a bit of money.... The formula was wrong, and it quickly required massive cuts that would destroy the program, and that the SGR's authors never intended. So congresses controlled by both parties have repeatedly kept them from going into effect. Meanwhile, the SGR formula actually has cut costs in Medicare dramatically.... As James Van Der Water and Jim Horney document, the byproduct of the compromises required to keep the formula's cuts from taking effect is that "the reimbursement rate for physicians next year will still be 17 percent below the rate paid in 2001, adjusted for subsequent increases in the costs that physicians incur in providing services as measured by the [Medicare Economic Index]." This is why physicians are so upset. Meanwhile, the vast majority of Medicare cuts passed in the last 20 years have been implemented as scheduled...

Milton Friedman Supports Ben Bernanke on Quantitative Easing

David Beckworth relays a catch by Doug Irwin:

http://macromarketmusings.blogspot.com/2010/11/case-closed-milton-friedman-would-have.html Case Closed: Milton Friedman Would Have Supported QE2: The debate over what Milton Friedman would say about QE2 can now be closed. Below is a Q&A with Milton Friedman following a speech he delivered in 2000. In this excerpted exchange with David Laidler, we learn that Friedman's prescription for Japan at that time is almost identical to what the Fed is doing now with QE2:

David Laidler: Many commentators are claiming that, in Japan, with short interest rates essentially at zero, monetary policy is as expansionary as it can get, but has had no stimulative effect on the economy. Do you have a view on this issue?

Milton Friedman: Yes, indeed. As far as Japan is concerned, the situation is very clear. And it's a good example. I'm glad you brought it up, because it shows how unreliable interest rates can be as an indicator of appropriate monetary policy.

During the 1970s, you had the bubble period. Monetary growth was very high. There was a so-called speculative bubble in the stock market. In 1989, the Bank of Japan stepped on the brakes very hard and brought money supply down to negative rates for a while. The stock market broke. The economy went into a recession, and it's been in a state of quasi recession ever since. Monetary growth has been too low. Now, the Bank of Japan's argument is, "Oh well, we've got the interest rate down to zero; what more can we do?"

It's very simple. They can buy long-term government securities, and they can keep buying them and providing high-powered money until the high powered money starts getting the economy in an expansion. What Japan needs is a more expansive domestic monetary policy.

The Japanese bank has supposedly had, until very recently, a zero interest rate policy. Yet that zero interest rate policy was evidence of an extremely tight monetary policy. Essentially, you had deflation. The real interest rate was positive; it was not negative. What you needed in Japan was more liquidity.

So Milton Friedman said in 2000 that the Bank of Japan should do what the Federal Reserve would be doing 10 years later! In fact, if names, dates, and places were changed in the above excerpt one could get a 2010 Ben Bernanke Q&A. Friedman's belief that a zero policy interest rate could be contratctionary and thus required the central bank to buy long-term securities shows that he understood unconventional monetary policy long before it was vogue. He truly was a great economist.

Note, though, that his emphasis is still on expanding the monetary base as much as needed to start and maintain an economic expansion. This implies he saw an excess money demand problem in Japan, just as there is one today in the United States. He understood, though, the need to expand the monetary base through purchases of long-term securities rather than short-term ones. This is because short-term securities are close to a perfect substitute for the monetary base at a zero percent policy rate. Swapping perfect substitutes does not change anything in one's portfolio of assets and therefore has no effect on spending. Thus, Friedman saw the need for purchasing long-term securities, which are not perfect substitutes with the monetary base.

Although Milton Friedman probably would have preferred a rule-based approach to QE2, this excerpt is the smoking gun that ends all debate on whether he would have supported QE2. The case is closed.

Thanks to Doug Irwin for locating this gem.

Milton Friedman Suppors Ben Bernanke on QE

David Beckworth relays a catch by Doug Irwin:

Case Closed: Milton Friedman Would Have Supported QE2: The debate over what Milton Friedman would say about QE2 can now be closed. Below is a Q&A with Milton Friedman following a speech he delivered in 2000. In this excerpted exchange with David Laidler, we learn that Friedman's prescription for Japan at that time is almost identical to what the Fed is doing now with QE2:

David Laidler: Many commentators are claiming that, in Japan, with short interest rates essentially at zero, monetary policy is as expansionary as it can get, but has had no stimulative effect on the economy. Do you have a view on this issue?

Milton Friedman: Yes, indeed. As far as Japan is concerned, the situation is very clear. And it's a good example. I'm glad you brought it up, because it shows how unreliable interest rates can be as an indicator of appropriate monetary policy.

During the 1970s, you had the bubble period. Monetary growth was very high. There was a so-called speculative bubble in the stock market. In 1989, the Bank of Japan stepped on the brakes very hard and brought money supply down to negative rates for a while. The stock market broke. The economy went into a recession, and it's been in a state of quasi recession ever since. Monetary growth has been too low. Now, the Bank of Japan's argument is, "Oh well, we've got the interest rate down to zero; what more can we do?"

It's very simple. They can buy long-term government securities, and they can keep buying them and providing high-powered money until the high powered money starts getting the economy in an expansion. What Japan needs is a more expansive domestic monetary policy.

The Japanese bank has supposedly had, until very recently, a zero interest rate policy. Yet that zero interest rate policy was evidence of an extremely tight monetary policy. Essentially, you had deflation. The real interest rate was positive; it was not negative. What you needed in Japan was more liquidity.

So Milton Friedman said in 2000 that the Bank of Japan should do what the Federal Reserve would be doing 10 years later! In fact, if names, dates, and places were changed in the above excerpt one could get a 2010 Ben Bernanke Q&A. Friedman's belief that a zero policy interest rate could be contratctionary and thus required the central bank to buy long-term securities shows that he understood unconventional monetary policy long before it was vogue. He truly was a great economist.

Note, though, that his emphasis is still on expanding the monetary base as much as needed to start and maintain an economic expansion. This implies he saw an excess money demand problem in Japan, just as there is one today in the United States. He understood, though, the need to expand the monetary base through purchases of long-term securities rather than short-term ones. This is because short-term securities are close to a perfect substitute for the monetary base at a zero percent policy rate. Swapping perfect substitutes does not change anything in one's portfolio of assets and therefore has no effect on spending. Thus, Friedman saw the need for purchasing long-term securities, which are not perfect substitutes with the monetary base.

Although Milton Friedman probably would have preferred a rule-based approach to QE2, this excerpt is the smoking gun that ends all debate on whether he would have supported QE2. The case is closed.

Thanks to Doug Irwin for locating this gem.

November 28, 2010

Mark Thoma Watches Barack Obama and His Political Advisors Go Off Message Yet Again...

Can we please get the White House back on message?

Mark Thoma:

Economist's View: The Administration's "Communication Problem": I find it incredible and disturbing that on the eve of the recent election in which Democrats got trounced, the administration was still trying to figure out if the unemployment problem is structural or cyclical. Even if you attribute a large fraction of the unemployment to structural factors, there is still plenty of cyclical unemployment left over to target with policy. For example, the SF Fed estimates that only about 1.25% of the rise in the unemployment rate is due to structural factors.... Even if you attribute half of the rise in unemployment to structural factors, that still leaves between 2% and 3% of the rise in unemployment to cyclical problems. Since neither monetary or fiscal policy is likely to be large or aggressive enough to fully solve the cyclical problem... there was no real need to debate this issue, particularly on the eve of the election.... The administration needed to be out there pushing for employment policies, doing everything it could to signal to people that it was on their side, not the side of corporations and big banks. That requires that you figure out that you have a cyclical unemployment problem before the election is all but over, and that you begin pushing for solutions in public forums. That push needs to start at the very top with Obama, and it needs to be reinforced every single day by other administration officials. One mention by Obama in a Saturday address to the nation doesn't get the job done...

And Mark Sends us to Richard Wolffe:

Obama could learn from Bush: The day before his party's shellacking in this month's elections, President Obama sat down with his economic team to examine the single most important issue for voters across the country: jobs. But... the president had called the meeting to grapple with what he and his propeller-head economists have been debating for some time: the wonkish question of whether today's high unemployment rate is structural or cyclical.... Two years into this presidency, and many months into a sluggish recovery, may be a little late to try to agree on the root cause of today's high unemployment. This lack of agreement on economic fundamentals is a primary factor behind one of this White House's most obvious failures: communications. As one senior Obama advisor told me the day after the disastrous midterms:

It was hard to find a single economic message when the economic team couldn't agree on a single economic policy...

However, a new economic team will not resolve the communications problems.... Obama told me six months ago that poor communications had hampered his ability to execute his policies.... But the White House has failed to realize that the communications problem is a symptom of Obama's problems, not a cause.... Reports of Obama's political death have been greatly exaggerated. To prove the pundits wrong, he needs to take control of writing his own story once more...

Let me point out that I think that the senior Obama advisor quoted is a liar.

Given who they were and what I know of how they all think, all the members of Obama's original economic policy team--except, I suspect, Peter Orszag--did indeed have different views of what would be the best policy to try to generate jobs in the short run, but they all agreed that anything was better than nothing. (Peter thought, I think, that only policies that promised credible long-term deficit reduction were better than nothing.)

"Could Be a Lot Worse!" Macroeconomic Situation Blogging

A correspondent with senior experience in government emails with respect to Battered but Not and Beaten:

You should be a lot less depressed, and a lot prouder of the economics profession's role over the past three years. Remember Barry Eichengreen's and Kevin O'Rourke's observation: because of the extraordinary leverage of the shadow banking system and the complete lack of control of senior management over their firms' derivative books, we had an initial shock that was larger than that which produced the Great Depression.

But we do not have 23% unemployment.

We do not even have the 16% unemployment of the Zandi-Blinder baseline.

Instead, we have only 10% unemployment.

That is a great victory. It is not the victory that we would have wanted to have. But it is a great victory.

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers