J. Bradford DeLong's Blog, page 2145

December 3, 2010

I Think Jane Hamsher Has Got It

JH: "It's been clear for some time that President Obama made the political calculation that he does not want any of the Bush tax cuts to expire. He doesn't have to be the guy in 2012 running for President on having 'raised taxes during a time of recession.' But the President also doesn't want the political blowback of angering people who cheered him on the campaign trail when he promised to let the tax cuts expire. And so rather than just come out and just say that, he's been actively trying to kill a Chuck Schumer deal to keep them from expiring on income of more than $1 million a year. It was a plan that put the GOP in an awkward position, and had thrown them off message in recent days — hard to be the people fighting for the 315,000 families who fall into that category over the 2 million set to lose their unemployment benefits by the end of the year..."

Department of "Huh?!" (Is Barack Obama Stupid? Edition)

Matthew Yglesias reads the latest from President Obama:

This morning, my budget director, Jack Lew, spoke with Chairman Bowles and invited the entire Commission in to meet with him and Secretary Geithner to discuss the Commission’s proposals. Overall, my goal is to build on the steps we’ve already taken to reduce our deficit, like slowing the growth of health care costs, proposing a three-year freeze in non-security discretionary spending and a two-year pay freeze for federal civilian workers, and restoring the rule that we pay for all of our priorities.

and he comments:

Yglesias » Mental Prisoner of the Congress: [T]his... illustrates the extent to which the former-Senator President and his senior staff... [are] mental prisoners of the legislative process. “Restoring the rule that we pay for all of our priorities” is a references to re-adopting statutory PAYGO rules in the congressional process.... [I]f the President does think it’s a good idea he can adopt the same thing unilaterally. He just needs to say “I will veto any bill that increases the deficit relative to current law.” He needs to really, really mean it. When people say “what about the AMT patch?” he could say “I’m for AMT patches, but only if they’re paid for.” When people say “what about the Bush tax cuts?” he could say “I’m for middle class tax cuts, but only if they’re paid for.” When people say “whata bout the doc fix?” he could say “I’m against cutting Medicare reimbursement rates, but only if it’s paid for.” Repeat that enough times and suddenly it becomes congress’ problem. Congress wants an AMT patch? Fine, then congress needs to pay for it. There are lots of things the President can’t do in the legislative process, but refusing to sign deficit-increasing bills is something he definitely can do.

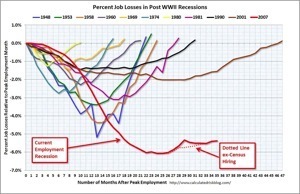

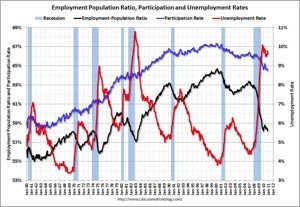

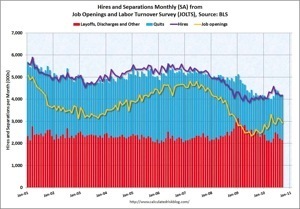

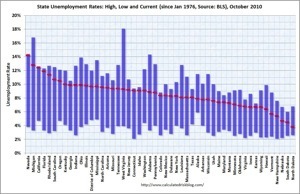

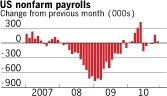

We Have Now the Same Employment-to-Population Ratio We Had Eleven Months Ago

Barack Obama Once Again Goes Off Message

From the White House, on the employment report:

Does One Month Make a Trend?: Fact is, we need much more robust job creation, which leads you directly to the president’s agenda to make sure taxes stay low for middle-class families and small businesses. At the same time, one month does not a new trend make, and we’d be saying the same thing if we got an unexpectedly high payroll number.

That is not what the White House should be saying. The White House should be saying:

We told you so. We need much more aggressive macroeconomic policies--massive quantitative easing by the Federal Reserve, another round of money for TARP II, and pulling government expenditures forward into the present and pushing taxes back into the future--and we need them right now. If the Republicans had not blocked our recovery agenda throughout 2009 and 2010 we would be in much better shape right now.

And Mark Thoma attempts to use Jedi Mind Tricks to change the White House's mind:

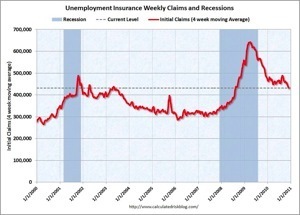

The Employment Report: This is not the unemployment report we've been looking for. Unemlpoyment has risen from 9.6 percent to 9.8 percent, and job growth is very low.... We should have done something about this months and months ago. But instead, it was easier to rely on the hope that things were getting better and avoid the hard work and difficult politics of trying to spur job creation. What do we hear from the White House now? Are they ready to embrace a less optimistic but more realistic path for employment? Nope. The White House view is that "one month does not a new trend make." When bad news is always discounted as an aberration, and good news embraced as though it is the trend, this is the policy outcome you get -- too little, too late, if at all. The White House needed to push as hard as they could for more help, and it should have started long ago. I realize that they probably wouldn't have been successful due to opposition in Congress, but you don't know that unless you try, and the battle itself would have had value even if it wasn't successful.

A Deficit Hawk Writes...

DH:

How could someone like Max Baucus who claims to care about reducing the deficit above all things vote against the Simpson-Bowles committee proposal because it cuts agricultural subsidies? That is just too embarrassing for words.

Much more embarrassing is all of official Washington--President, Senators, Members of the House, journalists, staffers--who are screaming at their top of their lungs that on the one hand we need to cut the deficit and on the other hand we have to permanently extend the 2001 tax cuts without paying for them.

Economists Learning Nothing and Forgetting Nothing

Paul Krugman:

Bourbon Economics: Reading articles about New Ideas In Economics, I often have a sense of deja vu: haven’t we been through all this before? Justin Fox does the legwork, and finds a 1988 article about New Ideas that could, with a few tweaks, have been written today.

In this case, though, the problem is not with the new ideas of 1988, still being marketed as new ideas of 2010: in particular, Shiller was right about market irrationality then, and he’s still right now — with two big bubbles that he called correctly under his belt.

The question we should ask, however, is why the economics profession has been so resistant to the obvious.

I remember 1988; 1988 was a friend of mine. By 1988, it was already obvious that equilibrium business cycle theory had failed. Shiller had already circulated his devastating demonstration that asset prices were much too volatile to be explained by fundamentals, and the 1987 market crash had provided an object lesson in panic. Also, by the way, the savings and loan mess was illustrating the problems with inadequate financial regulation.

And nothing happened. Real business cycle theory continued to prosper, developing an increasing stranglehold over the professional journals. Behavioral finance stayed on the margins. The equilibrium guys had learned nothing and forgotten nothing; and by the time 2008 came around, the ravages of time had left people who actually understood demand-side shocks much thinner on the ground than they had been 20 years earlier.

Our problem, in short, isn’t lack of nifty new ideas; it’s the refusal of too many economists to face up to the fact that some of their preferred theories don’t work, a fact that has been obvious for decades.

Can Obama Really Lose a Fight When He Has Two-Thirds of Voters on His Side?

Faiz Shakir:

TCBS Poll Finds Only 46 Percent Of Republicans Support GOP’s Stand On Extending Bush Tax Cuts For Rich: A CBS News poll released last night finds that 53 percent of Americans want the Bush-era tax cuts “extended only for households earning less than $250,000 per year,” a position that was advanced by a House vote yesterday. Another 14 percent want to expire all of the Bush tax cuts. Taken together, two-thirds of Americans (67 percent) want to end the Bush tax cuts for the rich. One interesting statistic from the survey indicates that the GOP’s push for giving the richest 2 percent an additional tax cut is not even supported by its own base:

Only ten percent of Democrats and one in four independents back the GOP proposal to extend the tax cuts for all. Even among Republicans, support for extending all the cuts is less than half at 46 percent.

Nevertheless, the White House is indicating to the GOP leadership in private negotiations that it is willing to acquiesce on its views and temporarily extend the tax cuts for the rich.

Econ 1: Fall 2010: Files for December 3 "Politics and Economics" Lecture

Another Bad Employment Report

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers