J. Bradford DeLong's Blog, page 208

March 25, 2019

Lukasz Rachel and Larry Summers: Responding to some of th...

Lukasz Rachel and Larry Summers: Responding to some of the Critiques of Our Paper on Secular Stagnation and Fiscal Policy: "Prefer more reliance on reasonably managed fiscal policies as a response to secular stagnation: government borrowing at negative real rates and investing seems very attractive in a world where there are many projects with high social returns...

#noted

The Fed Board Unmoored: Live at Project Syndicate

Live at Project Syndicate: The Fed Board Unmoored: "In December 2015, the right-wing commentator Stephen Moore, US President Donald Trump���s pick to fill a vacancy on the US Federal Reserve Board of Governors, savagely attacked then-Fed Chair Janet Yellen and her predecessor, Ben Bernanke, for maintaining loose monetary policies in the years following the 'Great Recession'.... On December 26, 2018, he savagely attacked Yellen���s successor, Jerome Powell, for raising interest rates to unwind the very approach that he had condemned three years earlier. 'If you cut engine power too far on a jetliner', he warned, 'it will stall and drop out of the sky'. Moore complained that after having 'risen by 382 points on hopes that the Fed would listen to Trump and stop cutting power', the Dow Jones Industrial Average had ���plunged by 895 points��� on the news of another interest-rate hike. This, he concluded, was evidence that 'the Fed���s monetary policy has come unhinged'...

#projectsyndicate #highlighted #orangehairedbaboons #monetarypolicy

Fairly Recently: Must- and Should-Reads, and Writings... (March 25, 2019)

A Baker's Dozen of Books Worth Reading...

This Has Certainly Been One Crazifying Fed Tightening Cycle...

Now Not Quite so Fresh at Project Syndicate: The Fed Should Buy Recession Insurance

Hoisted from the Archiyes: Why We Hate Chickenhawks: Selections from SFF Author David Drake

Comment of the Day: Graydon: "Education could do with much, much more of 'theory informs; practice convinces'. If you want people to exhibit empathy for those whose state is not theirs and whose expertise is different, you need to make most of education involve failure; do this material thing at which you are unskilled...

David Glasner: James Buchanan Calling the Kettle Black: Weekend Reading: "IIR, back in 1986 I was one of two two people at the MIT economics Wednesday faculty lunch willing to say that I thought the award of the Nobel Prize to James Buchanan was not a travesty and a mistake. I would now like to withdraw that opinion...

For the Weekend: Tiny Dancer: Almost Famous

Note to Self: Still no professional Republicans daring to come out against Steve Moore's Fed nomination, save Greg Mankiw...

Monday Smackdown/Hoisted from Others' Archives from Six-and-a-HalfYears Ago: Dan Drezner on Chuck Lane

Margaret Leslie Davis: The Quest to Acquire the Oldest, Most Expensive Book on the Planet: "The price of the book when it left the printer���s workshop was believed to be about thirty florins, equivalent to a clerk���s wages for three years...

George A. Akerlof: Sins of Omission and the Practice of Economics: "Economics, as a discipline, gives rewards that favor the 'Hard' and disfavor the 'Soft', Such bias leads economic research to ignore important topics and problems that are difficult to approach in a 'Hard' way���thereby resulting in 'sins of omission'.... Greatly increased tolerance in norms for publication and promotion... [is] one way of alleviating narrow methodological biases...

Wikipedia: Quantum Logic Gates

Andy Matuschak: "I want to expand the reach of human knowledge and ability...

Michael Nielsen: Neural Networks and Deep Learning

Michael Nielsen: Interesting problems: The Church-Turing-Deutsch Principle: "Deutsch... propose[d] a revision of the Church-Turing thesis... that every physical process can be simulated by a universal computing device...

Alain Aspect: The future of Quantum Technologies: The Second Quantum Revolution

Barbara Tuchman: ���A Single British Soldier������: "'What is the smallest British military force that would be of any practical assistance to you?' Wilson asked. Like a rapier flash came Foch���s reply, 'A single British soldier���and we will see to it that he is killed'...

Michael Andersen: Six Secrets From the Planner of Sevilla���s Lightning Bike Network: "Sevilla, Spain: It went from having about as much biking as Oklahoma City to having about as much biking as Portland, Oregon. It did this over the course of four years...

I wish it were so, but I see only one professional Republican economist���Greg Mankiw���coming out in opposition to Moore. The rest are very quiet. All honor to Greg Mankiw, yes, but where are the others?: Brendan Greeley: Swift Pushback on Stephen Moore, Trump's Latest Pick for the Fed: "Stephen Moore drew swift and unusually pointed criticism after President Donald Trump picked him to be a governor of the U.S. Federal Reserve, with at least one prominent Republican economist calling on the Senate to block the appointment. 'He does not have the intellectual gravitas for this important job', Greg Mankiw, a Harvard professor who was chairman of the White House Council of Economic Advisers under President George W. Bush, wrote in a blog post on Friday. 'It is time for senators to do their job. Mr. Moore should not be confirmed'...

Paul Krugman Twitter: https://twitter.com/paulkrugman/with_replies

Stephen Moore Twitter: https://twitter.com/search?vertical=default&q=Stephen%20Moore&src=typd

Wikipedia: Battle of Mycale

Wikipedia: Battle of Plataea

Roman expeditions to Sub-Saharan Africa

Martin Wolf: Theresa May Is Taking a Hideous Brexit Gamble: "Why, then is the prime minister so set on getting this deal through parliament? It is surely because she believes it is the only way to achieve three conflicting objectives at one and the same time: keep her party united; agree with the EU; and deliver the promised Brexit. These objectives are not unreasonable.... But sticking so doggedly to this strategy is also extremely risky...

I confess, I do not understand any of these three objections: (1) Weinberg is disturbed by many-worlds just as earlier physicists were disturbed by quantum waves, but the universe does not care and does not avoid every feature that might disturb East African Plains Apes. (2) The Born rule is a problem for all formulations of quantum mechanics, but many-worlds has come closer to it than any other formulation and may well have derived it. (3) The non-locality of EPR, "entanglement", and "spukhafte Fernwirkung" is not a problem for many-worlds, but rather a problem for all other formulations���including instrumentalist ones���as Sidney Coleman said, it's either "quantum mechanics in your face" or non-locality; it's not "quantum mechanics in your face" and non-locality: Steven Weinberg: The Trouble with Quantum��Mechanics: "The realist approach has a very strange implication... Hugh Everett... The vista of all these parallel histories is deeply unsettling, and like many other physicists I would prefer a single history. There is another thing that is unsatisfactory about the realist approach.... We can still talk of probabilities as the fractions of the time that various possible results are found when measurements are performed many times in any one history.... Several attempts following the realist approach have come close to deducing rules like the Born rule that we know work well experimentally, but I think without final success. The realist approach to quantum mechanics had already run into a different sort of trouble... Einstein... Podolsky and... Rosen... 'entanglement'.... Strange as it is, the entanglement entailed by quantum mechanics is actually observed experimentally. But how can something so nonlocal represent reality?...

Leonid Bershidsky: Russia's Annexation of Crimea 5 Years Ago Has Cost Putin Dearly - Bloomberg: "His overconfidence after the successful annexation lured him into a trap where he lost all bargaining power: Five years ago, on March 16, 2014, the Kremlin held a fake referendum in Crimea to justify after the fact the peninsula���s annexation from Ukraine.... The highest cost to Putin came in bargaining power rather than in cash. Immediately after Crimea, geopolitical bargains were still possible for Putin.... After the eastern Ukraine adventure, and especially after the downing of Flight MH17 and all the laughable Russian denials that followed, his credibility was shot. Nobody knew if he would keep his end of any bargain.... Putin���s lack of��credibility is an important reason he can���t build any alliances at all.... At the same time, Russians��� post-Crimea enthusiasm is gone, eroded by six years of falling incomes.... Russia, the world and, likely, parts of the Russian establishment are waiting for Putin to go, even if no one can make him leave.... Meanwhile, Fortress Russia is locked and no one���s coming to parley...

I do not think that Steve Moore was "an amiable guy" to te people of Kansas (except for those who benefitted from his pass-through loophole). I would accept "a seemingly-amiable grifter", bout "an amiable guy" misses the point. Now where are all the other professional Republican economists? Going out against Moore-to-the-Fed is a really cheap and easy virtue signal to make even if you are not virtuous at all. Failing to come out against Moore-to-the_Fed so is to send a strong vice signal to the administration; Greg Mankiw: Memo to Senate: Just Say No: "The president nominates Stephen Moore to be a Fed governor. Steve is a perfectly amiable guy, but he does not have the intellectual gravitas for this important job.... It is time for Senators to do their job. Mr. Moore should not be confirmed...

The great and the good of America's establishment have been unwilling to use the F-word as a label for the political movement that now rules in places like Hungary, Poland, India, and Brazil. But Madeleine Albright goes there: Sean Illing: "Fascism: A Warning" from Madeleine Albright: "A seasoned US diplomat is not someone you���d expect to write a book with the ominous title Fascism: A Warning. But that is what Madeleine Albright, who served as the first female secretary of state from 1997 to 2001, has done���and it���s not a reassuring read. In it, she sounds the alarm about the erosion of liberal democracy, both in the US and across the world, and the rise of what she describes as a 'fascist threat'. And yes, she talks about President Donald Trump...

Over the past three centuries success at economic development has always gone with an absolute conception of property rights. in China today, however ,your property rights are always conditional on your service to the state and on the power of your friends in the party. Thus American corporations and their American shareholders are going to find serving China���s market a very interesting thing indeed over the next generation: Ben Thompson: China Blocks Bing; Tencent, China, and Apple;: "The warning signs for Apple are flashing bright red: not only is Apple the most successful hardware company in China (and, relatedly, the most successful software company), the company also runs by far the most profitable service. China is the biggest market for the App Store, and it is fair to wonder how long China will tolerate Apple���s total control of app installation for the iPhone. Certainly Apple is doing its best to foreclose that possibility: the company kicked out VPN apps in 2017, and purged an additional 25,000 apps that state media claimed were illegal last fall. Then again, Microsoft did its best to keep Bing in China���s good graces as well: now we know how that turned out. If I were Apple I would pretty nervous about the long-term viability of, at minimum, that 30% share of purchases in the App Store, and potentially the exclusivity of the App Store completely...

Mohamed A. El-Erian: Fed Signals No Rate Hikes in 2019, New Approach to Balance Sheet: "The central��bank���s��guidance on interest rates is��more dovish than even the most sanguine��bulls had hoped.... Three months ago, the Fed was still signaling several rate hikes this year...

Lina Glick**: "Excellent new paper by economist Mark Glick arguing that the consumer welfare standard has "unduly circumscribed how advances in our understanding of the economy can be translated into competition policy https://www.scribd.com/document/392624312/The-Unsound-Theory-Behind-the-Consumer-and-Total-Welfare-Goal-in-Antitrust...

Branko Milanovic: A Grand Fresco: Francis Fukuym's "The Origins of Political Order': "When does the political order decay? When the state is incapable to reform itself�� to respond to new challenges (say, a powerful neighbor) and when it gets repatrimonalized. ��The decay section is not exactly novel (to�� be unable to reform is not very original), but the emphasis on repatrimonization as the source of decay allows us to better see that the state remains an unnatural organization in the sense that it is permanently in danger of succumbing to the more atavistic instincts of human nature���to prefer own kin rather than be subject to impersonal rules...

Paul Krugman: Yield Curve Inversion: "Long-term US interest rates are now slightly below short-term rates. This doesn't happen often���and as far as I can tell, each previous instance has been followed by recession...

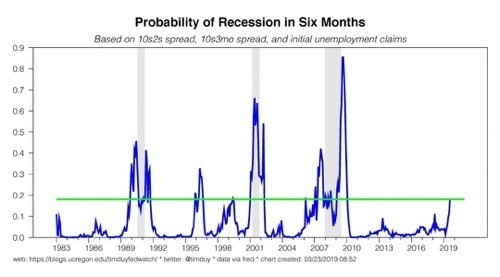

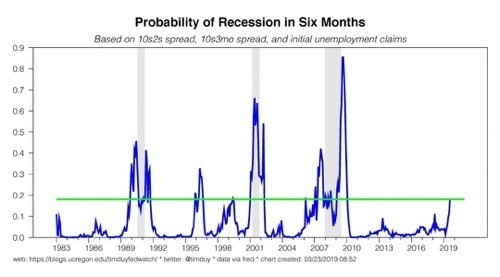

The very sharp Tim Duy comes over to my position on the Fed: Tim Duy: Fed Needs to Get With The Program: "An inverted yield curve is a well-known recession indicator.... Either embrace that relationship in your analysis or reject it on the basis that any signals from the term structure are hopelessly hidden by the massive injections of global quantitative easing.... I... choose the former.... Recession indicator... probability models based on some combination of yield spreads and other leading indicators. Most will be raising red flags like this estimate of the probability of recession in six months...

#noted #weblogs

The very sharp Tim Duy comes over to my position on the F...

The very sharp Tim Duy comes over to my position on the Fed: Tim Duy: Fed Needs to Get With The Program: "An inverted yield curve is a well-known recession indicator.... Either embrace that relationship in your analysis or reject it on the basis that any signals from the term structure are hopelessly hidden by the massive injections of global quantitative easing.... I... choose the former.... Recession indicator... probability models based on some combination of yield spreads and other leading indicators. Most will be raising red flags like this estimate of the probability of recession in six months...

...based on the 10s2s and 10s3mo spreads and initial unemployment claims.... The risk of recession has risen to levels that demand attention from the Federal Reserve. In the two cases of similar spikes in the 1990s, a recession was avoided by the rapid response of the Fed in the form of rate cuts. The times that response was lacking, a recession followed. So now I switch from analyst to commentator: The above leads me to the conclusion that the Fed needs to get with the program and cut rates sooner than later if they want to extend this expansion. Given inflation weakness and proximity to the lower bound, the Fed should error on the side of caution and cut rates now. Take out the insurance policy. It���s cheap. There will be plenty of opportunity to tighten the economy into recession should inflation emerge down the road...

#noted

Paul Krugman: Yield Curve Inversion: "Long-term US intere...

Paul Krugman: Yield Curve Inversion: "Long-term US interest rates are now slightly below short-term rates. This doesn't happen often���and as far as I can tell, each previous instance has been followed by recession...

...Nobody thinks this is a causal relationship: an inverted yield curve doesn't cause a recession. Instead, it's telling you about average investor opinion: bond buyers see economic weakness ahead, and believe that the Fed will be cutting rates. There is, however, a twist right now which makes the inversion even scarier.... Previous inversions took place at much higher short rates.... This matters.... When short rates are near zero, the yield curve HAS to be upward sloping, because rates can go up but not down.... The yield curve inversion in 2006 reflected at least some probability that the Fed might cut rates by 500 basis points. Now, it doesn't have 500 bp to cut. So this inversion actually reflects a worse outlook for the economy than the number itself suggests. Again, it's not a direct read on the economy; it's a read on what the average bond investor thinks is happening to the economy. But still not encouraging...

#noted

Branko Milanovic: A Grand Fresco: Francis Fukuym's "The O...

Branko Milanovic: A Grand Fresco: Francis Fukuym's "The Origins of Political Order': "When does the political order decay? When the state is incapable to reform itself�� to respond to new challenges (say, a powerful neighbor) and when it gets repatrimonalized. ��The decay section is not exactly novel (to�� be unable to reform is not very original), but the emphasis on repatrimonization as the source of decay allows us to better see that the state remains an unnatural organization in the sense that it is permanently in danger of succumbing to the more atavistic instincts of human nature���to prefer own kin rather than be subject to impersonal rules...

#noted

March 24, 2019

Any New York Times Employees Go Up to Bennet and Baquet Today to Say "You Are Really Screwing the Pooch by Keeping Bret Stephens on!"?

Bret Stephens is an ass. As are his bosses. Sister Souljah in context: 1992: In Her Own Disputed Words; Transcript of Interview That Spawned Souljah's Story:

Sister Souljah. Black people from the underclass and the so-called lower class do not respect the institutions of white America, which is why you can cart as many black people out on the television as you want to tell people in the lower and underclass that that was stupid, but they don't care what you say. You don't care about their lives, haven't added anything to the quality of their lives, haven't affectuated anything for the quality of their lives, and then expect them to respond to your opinions which mean absolutely nothing? Why would they?

Q. But even the people themselves who were perpetrating that violence, did they think it was wise? Was that wise, reasoned action?

A. Yeah, it was wise. I mean, if black people kill black people every day, why not have a week and kill white people? You understand what I'm saying? In other words, white people, this government, and that mayor were well aware of the fact that black people were dying every day in Los Angeles under gang violence. So if you're a gang member and you would normally be killing somebody, why not kill a white person? Do you think that somebody thinks that white people are better, or above and beyond dying, when they would kill their own kind?

Q. I'm just asking what's the wisdom in it? What's the sense in it?

A. It's rebellion, it's revenge. You ever heard of Hammurabi's Code? Eye for an eye, a tooth for a tooth? It's revenge. I mean, that seems so simple. I don't even understand why anybody {would} ask me that question. You take something from me, I take something from you. You cut me, I cut you. You shoot me, I shoot you. You kill my mother, I kill your mother.

Q. And the individuals don't matter?

A. What individuals? If you killed my mother, that mattered to me. That's why I killed yours. How could the individuals not matter? You mean the white individuals, do they matter? Not if the black ones don't. Absolutely not. Why would they? If my child dies, your child dies. If my house burns down, your house burns down. An eye for an eye, a tooth for a tooth. That's what they believe. And I see why...

#journamalism #moralresponsibility

Monday Smackdown/Hoisted from Others' Archives from Six -and-a-HalfYears Ago: Dan Drezner on Chuck Lane

Every time I try to get out, they drag me back in...

Now I am being told that nobody with any audience ever thought 15/hour in California was a really bad idea. So time to recall this:

Monday Smackdown/Hoisted from Others' Archives: A correspondent asks me for help: Chuck Lane is being used as an authority on the California's 15/hr by 2023 minimum wage proposal. And Chuck Lane says:

A hot concept in wonkdom these days is ���evidence-based policymaking.������ Gov. Jerry Brown and the state���s labor leaders have announced legislation to raise the state���s minimum wage��� to $15 per hour���. Whatever else might be said about this plan, it does not represent an exercise in evidence-based policymaking. To the contrary: There���s a total lack of evidence that the potential benefits would outweigh potential costs���and ample reason to worry they would not���

Dan Drezner: Why I Don���t Need to Take Charles Lane Seriously: "The Washington Post���s Chuck Lane wrote an op-ed arguing in favor of Jeff Flake���s amendment...

...to cut National Science Foundation funding for political science.��In fact, Lane raised the ante, arguing that NSF should stop funding all of the social sciences, full stop.��Now, I can respect someone who tries to make the argument that the opportunity costs of funding the social sciences are big enough that this is where a budget cut should take place.�� It���s harder, however, to respect someone who:��

Doesn���t comprehend the��differences between the natural sciences and social sciences;

Is unaware that the social sciences are���increasingly���running experiments as well;

Believes that because individual social scientists have normative preferences, the whole enterprise cannnot be objective (or, in other words, doesn���t understand the scientific enterprise at all);

Fails to comprehend the economics of public goods;

Hasn���t really thought through what would happen if all social science was privately funded.

Now, all��columnists can have a bad��day, so that���s fine.�� What I find intriguing, however, is that Lane���s response to criticism from political scientists��to his essay can be��summarized in one tweet:�� 'shorter my critics re poli sci funding:�� we want our money.'�� This is cute, but overlooks the fact that a lot of Lane���s poli sci critics���myself included���haven���t received a dime in�� NSF funding.��

More disconcertingly, it���s intellectually lazy.�� Sources of funding do matter in public discourse, but they do not vitiate the logic contained in the arguments linked to above.�� This is simply Lane���s cheap and easy excuse for not engaging the substance of his critics��� arguments.��

The hard-working folks here at the blog believe strongly in reciprocity, so Lane has done us a small favor���we no longer need to read Chuck Lane���s arguments all that carefully, or take him all that seriously, ever again.��

Thanks, Chuck!!��

Is he right?

On any individual issue, Chuck Lane could be right. But that is not the way to bet. In general, deciding to try to build a career on catering to the prejudices and bigotries of Marty Peretz is not a sign of good judgment. And, in my experience, Chuck Lane is no exception.

And in this case, if I follow Menzie Chinn and take an elasticity of employment with respect to the minimum wage of -0.2, when I crunch the numbers I get[1]:

A likely reduction in employment of low wage workers in California of roughly 6%���200,000 out of 3,000,000 low-wage workers.

A likely reduction in surplus from the low-wage labor market in California of $7.3125M/week.

A likely transfer of surplus from consumers and employers to low-wage workers in California of $210.4M/week.

This is a good thing���as long as:

You think wealth in the hands of employers and consumers is less than 96.5% as worthwhile as income in the hands of low-wage workers...

You think that nothing else major has been left out of the analysis...

It is possible that we will be unlucky���that the true elasticity of labor demand at the low end of the California labor market is not -0.2 but -0.6, in which case we have:

A likely reduction in employment of low wage workers in California of roughly 6%���200,000 out of 3,000,000 low-wage workers.

A likely reduction in surplus from the low-wage labor market in California of $65M/week.

A likely transfer of remaining surplus from consumers and employers to low-wage workers in California of $100M/week.

This is only a good thing if:

You think wealth in the hands of employers and consumers is less than 62.5% as worthwhile as income in the hands of low-wage workers...

You think that nothing else major has been left out of the analysis...

But it is at least as likely that raising the minimum wage will turn out to have no downsides at all���will offset market power on the side of employers and lead not to a reduction but an increase in low-wage employment���as that low-wage employment will turn out to have an elasticity of demand of -0.6 or below.

Not ���a total lack of evidence that the potential benefits would outweigh potential costs���. Rather: substantial evidence that potential benefits would outweigh potential costs.

And what about Dylan Matthews���s claim that raising the minimum wage to $15/hr as of 2023 is a worse policy than:

expanding the EITC and funding it with a new tax on corporations. It could be a carbon tax or a payroll tax or a cash flow tax or a profits tax or a tax on capital income���whatever?

That is probably true: I am a big fan of the expanded EITC. I expanded the EITC. I would support cutting the California minimum wage below $15/hr in 2023 and making it up with an expanded EITC funded by a carbon tax. But that $15/hr in 2023 is not the best policy does not mean that it is not a good policy. You need to put not just a thumb but both elbows on the analytical scale to make it come out as a bad policy move.

������

[1] Brad DeLong: 2016-03-28 Econ 1 Lecture: Slides 16-26

#highlighted #smackdown #hoistedfromthearchives #labormarket #journamalism #minimumwage

Note to Self: Still no professional Republicans daring to...

Note to Self: Still no professional Republicans daring to come out against Steve Moore's Fed nomination, save Greg Mankiw...

#noted

Lina Glick: "Excellent new paper by economist Mark Glick ...

Lina Glick: "Excellent new paper by economist Mark Glick arguing that the consumer welfare standard has "unduly circumscribed how advances in our understanding of the economy can be translated into competition policy https://www.scribd.com/document/392624312/The-Unsound-Theory-Behind-the-Consumer-and-Total-Welfare-Goal-in-Antitrust...

Mark Glick: The Unsound Theory Behind the Consumer (and Total) Welfare Goal in Antitrust: This is the first installment of a two-part commentary on the New Brandeis School (the ���New Brandeisians���) in Antitrust. In this first part, I examine why the New Brandeisians are correct to reject the consumer welfare standard. Instead of arguing, as the New Brandeisians do, that the consumer welfare standard leads to unacceptable outcomes, I argue that the consumer or total welfare standard was theoretically flawed and unrigorous from the start. My basic argument is that antitrust law addresses the impact of business strategies in markets where there are winners and losers. For example, in the classical exclusionary monopolist case, the monopolist���s conduct is enjoined to increase competition in the affected market or markets. As a result of the intervention, consumers benefit, but the monopolist is worse off. One hundred years of analysis by the welfare economists themselves shows that in such situations ���welfare��� or ���consumer welfare��� cannot be used as a reliable guide to assess the results of antitrust policy. Pareto Optimality does not apply in these situations because there are losers. Absent an ability to divine ���cardinal utility��� from observations of market behavior, other approaches such as consumer surplus, and compensating and equivalent variation cannot be coherently extended from the individual level to markets. The Kaldor-Hicks compensation principle which is in standard use in law and economics was created to address problems of interpersonal comparisons of utility and the existence of winners and losers. However, the Kaldor-Hicks compensation principle is also inconsistent. In light of this literature, the New Brandeisians are correct to reject Judge Bork���s original argument for adoption of the consumer welfare standard, but for deeper reasons than they have not expressed thus far.

#noted

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers