J. Bradford DeLong's Blog, page 207

March 26, 2019

Fairly Recently: Must- and Should-Reads, and Writings... (March 26, 2019)

Economics, Identity, and the Democratic Recession: Tuesday April 9, 2019, 9:45-11:00 AM

Hoisted from the Archives: Thoughts on David Frum's Excellent Review of Adam Tooze

Live at Project Syndicate: The Fed Board Unmoored

Shelly Hagan and Wei Lu: San Francisco's `Super Rich' Lead a Widening U.S. Wealth Divide: "The Income Gap Is Getting Worse in American Cities. U.S. income gap between top 5% and middle 20% grew by 118,000. Boise City, Idaho, and Knoxville, Tennessee, have robust gaps: The tech hub���s 'super-rich versus middle-class' gap swelled by $118,000 to $529,500 over the past five years, as the top 5 percent of households earned $632,310 in 2017, compared with $102,785 for the middle class, according to the Bloomberg analysis of U.S. Census data...

Richard Samans: Better Labor Standards Must Underpin the Future of Work: "As technology and deregulation continue to shape the labor market, maintaining strong worker protections is as important as ever...

Hess Chung and Eric Engen (20134): Identifying the Sources of the Unexpectedly Weak Economic Recovery Using the FRB/US Model

Abhijit V. Banerjee and Esther Duflo: The Economic Lives of the Poor

Daniel Alpert: What the Federal Reserve Got Totally Wrong about Inflation and Interest Rate Policy: Getting Real About Rents

Jared Bernstein: On the Economy

Katrin G��dker, Peiran Jiao, and Paul Smeets: Investor Memory: "Self-serving memory bias... distorts beliefs and drives investment choices. Subjects who previously invested in a risky stock are more likely to remember positive investment outcomes and less likely to remember negative outcomes. In contrast, subjects who did not invest but merely observed the investment outcomes do not have this memory bias. Importantly, subjects do not adjust their behavior to account for the fallibility of their memory...

Wired: How Animators Created the Spider-Verse

Mark Thoma: Links (3/24/19)

Ben Thompson: Apple���s Services Event: "The problem, though, is that there will never be a product like the iPhone again; Apple may have found its product future (good for developers and customers), but its financial future is less certain (not so good for Wall Street)...

Data For Progress: A Green New Deal. New Consensus: Green New Deal

Menzie Chinn: "Stop Stephen Moore from being appointed to the Fed. Here is a non-exhaustive recounting of Moore���s reign of error...

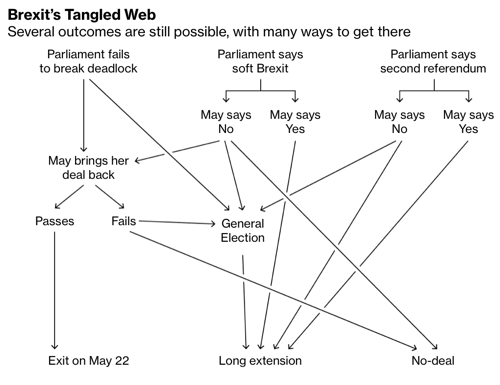

Marina Hyde: Get Set for Brexit: Indicative Day���The One Where the Grand Wizards Turn on Each Other: "On Sunday it was all looking so good for the Brexit ultras. Then came Monday, and that parliamentary vote.... Like all initiatives handled by Oliver Letwin since the 1980s, it promises to go spectacularly wrong in ways we haven���t even thought of yet, but let���s pretend otherwise before the shitstorm gets properly under way on Wednesday...

Catherine Rampell: The Op-Ed that Got Stephen Moore His Fed Nomination Is Based on Two Major Falsehoods: "Trump has nominated to the world���s most powerful central bank a guy who has trouble telling whether prices are going up or down, and struggles to remember how the most famous Fed chair in history successfully stamped out inflation. But hey, Republican senators still seem keen on him because 'the establishment' keeps pointing out how inept he is...

Nick Timiraos: @NickTimiraos: "Ben Sasse supports Moore: 'Steve���s nomination has thrown the card-carrying members of the Beltway establishment into a tizzy, and that says little about Steve and his belief in American ingenuity, but a lot about central planners��� devotion to groupthink'...

Catherine Rampell: Stephen Moore Could Inflict More Long-Term Damage than Any of Trump���s Other Nominations: "President Trump has made a lot of ill-advised nominations. But perhaps no single choice could inflict more long-term damage than the one he announced Friday: Stephen Moore, Trump���s pick to join the Federal Reserve Board...

Jo Walton (2010): The Suck Fairy

Martin Cahill: A Stunning Debut: Arkady Martine���s "A Memory Called Empire"

UCL Institute for Innovation and Public Purpose: @IIPPUCL_: "Watch as @bankofengland Chief Economist Andy Haldane explores 10 monetary myths that will help present and future generations to rethink and reframe the way we organise our economies, our financial systems and our societies https://www.youtube.com/watch?time_continue=1&v=Ul0pTVl8l98...

Paul Krugman: Trump���s Kakistocracy Is Also a Hackistocracy: "Trump said he planned to nominate Stephen Moore for the Fed���s Board of Governors. Moore is manifestly, flamboyantly unqualified for the position. But there���s a story here that goes deeper than Moore, or even Trump; it���s about the whole GOP���s preference for hucksters over experts, even partisan experts...

Cathy Young: Who���s Afraid of The Bulwark?: "The conservative media wars heat up���but miss the point.... I don���t know what The Bulwark���s endgame is, but right now, it���s among a deplorably small number of outlets that get high marks for intellectual diversity and integrity. That should be good enough...

Lukasz Rachel and Larry Summers: Responding to some of the Critiques of Our Paper on Secular Stagnation and Fiscal Policy: "Prefer more reliance on reasonably managed fiscal policies as a response to secular stagnation: government borrowing at negative real rates and investing seems very attractive in a world where there are many projects with high social returns...

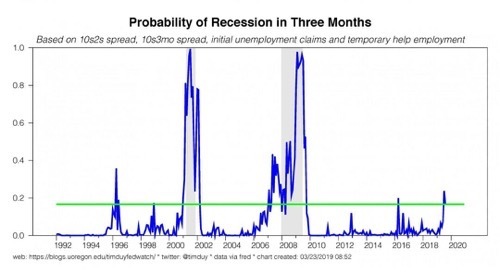

The very sharp Mohamed A. El-Erian misses one important thing here: almost always, recessions are much deeper than any naive computation of the size of the initial shock minus the sum of monetary and fiscal offset would predict. Why? Because businesses and investors are forward-looking, and take recession signals seriously. As Tim Duy says: everyone's "recession indicator... probability models... [are] raising red flags". It's a multiple-equiibrium thing. So while a recession in the next year is not certain and may not be probable it is not unlikely: Mohamed A. El-Erian: Inverted Yield Curve Doesn't Necessarily Mean Recession Is Nigh: "This rather benign economic outlook conflicts with the traditional signal of an inverted curve for four main reasons.... [1] Europe... puts downward pressure on U.S. yields.... [2] The Fed... a remarkable and rapid U-turn.... Other segments of the bond market are not signaling a major economic slowdown.... The erosion in inflationary expectations may... [be a] realization that many of the underlying drivers are structural.... This curve inversion is unlikely to be the traditional signal of a U.S. recession...

Brad Setser: Why China's Incomplete Macroeconomic Adjustment Makes China 2025 a Bigger Risk: "China... wants to 'localize' the production of the bulk of the high tech goods that its economy needs... Made in China 2025... a mix of subsidies (some disguised, as they flow through state-backed investment funds and the financial sectors) and 'Buy China' preferences.... Losses... China is good at both hiding them���and, well, absorbing what at the time seems like large losses as an inevitable cost of its rapid growth. The usual argument against such a mix of industrial policy and protectionism is that it just won���t work. A country that subsidizes its industries ends up with inefficient industries.... But China, is, to use Philip Pan���s phrase, the state that failed to fail...

Robert Hutton: Indicative Votes: How Parliament Will Try to Change Brexit: "Members of Parliament will have put forward proposals they think should be voted on and it���s up to Bercow to choose which go forward.... At 7 p.m., Bercow will draw proceedings to a close and announce the vote. This won���t be like the usual House of Commons votes, where MPs walk through different lobbies to express their views. Instead, they���ll be given a piece of paper listing the options, and asked to vote Aye or No on each one. They���ll have half an hour.... Counting the indicative votes will probably take around an hour, and it will be up to Bercow whether he interrupts the government debate to announce the result, or waits until later. So some time before 10 p.m. The results will show how many MPs voted for and against each motion, and what happens next depends on that. Under Letwin���s proposals, Parliament will next have control of its own agenda on Monday April 1. That could be used to narrow options further, or to order the government to pursue a particular course of action...

Charles Pierce: Khalid Shaikh Mohammad Tapes Went Unreviewed in Lead-Up to 9/11 in Latest Bush Administration Blunder: "'Terry McDermott, co-author of ���The Hunt for KSM,��� said his research found that United States satellites ���randomly scooped up��� calls between Mr. Mohammed and an alleged deputy, Ramzi bin al-Shibh. ���The N.S.A. intercepted calls but didn���t listen to them or translate them until after 9/11,��� he said. ���Afterward, they went through this stuff and found out what it was.���' It is here where we remind everyone that one of the first things John Ashcroft did after being named attorney general by President C-Plus Augustus was to reorient the Justice Department's priorities toward porn and busting Tommy Chong for weed... how clustered was the fck that was the intelligence community... in the summer of 2001... how desperate were the efforts to cover up all of the above, and more, in the wake of the attacks themselves...

Economics, Identity, and the Democratic Recession: Tuesday April 9, 2019, 9:45-11:00 AM

John Judis and Catherine Rampell are the best people:

Council on Foreign Relations (CFR)... symposium on 'The Future of Democracy' on Tuesday, April 9, 2019 at CFR���s headquarters at 58 East 68th Street in New York. You will be speaking on panel two, 'Economics, Identity, and the Democratic Recession', from 9:45 a.m. to 11:00 a.m. We have confirmed John Judis and Catherine Rampell to join you on this panel. We are still working to confirm a presider.

A session on the state of democratic government in different regions of the world will take place from 8:00 to 9:45 a.m., followed by your session at 10:00 a.m. A few minutes before the session begins, you will be seated onstage with your fellow panelists.

At 10:00 a.m., the presider will introduce the panel and engage you all in conversation for about thirty minutes. At 10:30 a.m., the presider will turn to the audience for a question and answer session for the remainder of the hour. The meeting will conclude promptly at 11:00 a.m. A detailed agenda of this session and of the entire symposium is included.

Please be aware that this meeting will be on the record and in addition to CFR members, invited members of the press will be present. Please sign and return the attached release form if you agree to its terms. Please note that the CFR makes audio and/or video recordings of its meetings for archival purposes. In order to include CFR members outside of New York and Washington, some meetings may also be videoconferenced, teleconferenced, streamed live, or posted on the CFR's website...

The Future of Democracy

Presented by the Council on Foreign Relations and made possible by the generous support of the Hauser

Monday, April 8, 2019: 5:30: Reception

6:00: Are Democracies Dying?: Daniel Ziblatt

7:15: Private roundtable dinner and discussion featuring symposium speakers, presiders, and invited

guests.

Tuesday, April 9, 2019: 8:00: Breakfast Reception

8:30: The Global Democratic Recession: Michelle Gavin, Matthias Matthijs, Shannon O���Neil, Dan Slater, Gary Rosen

9:45: Coffee Reception

10:00 : Economics, Identity, and the Democratic Recession: John B. Judis, Catherine Rampell, J. Bradford Delong

11:00: Coffee Reception

11:30: Technology and the Future of Democracy: Shanthi A. Kalathil, Laura M. Rosenberger, Adam Segal, Vijay V. Vaitheeswaran

12:30: Lunch

1:00: Can Democracy Be Saved?: Thomas Carothers, Joshua Kurlantzick, Adrienne LeBas, Carol Giacomo

#notetoself #fascism #politics #politicaleconomy

Charles Pierce: Khalid Shaikh Mohammad Tapes Went Unrevie...

Charles Pierce: Khalid Shaikh Mohammad Tapes Went Unreviewed in Lead-Up to 9/11 in Latest Bush Administration Blunder: "'Terry McDermott, co-author of ���The Hunt for KSM,��� said his research found that United States satellites ���randomly scooped up��� calls between Mr. Mohammed and an alleged deputy, Ramzi bin al-Shibh. ���The N.S.A. intercepted calls but didn���t listen to them or translate them until after 9/11,��� he said. ���Afterward, they went through this stuff and found out what it was.���' It is here where we remind everyone that one of the first things John Ashcroft did after being named attorney general by President C-Plus Augustus was to reorient the Justice Department's priorities toward porn and busting Tommy Chong for weed... how clustered was the fck that was the intelligence community... in the summer of 2001... how desperate were the efforts to cover up all of the above, and more, in the wake of the attacks themselves...

#noted

Thoughts on David Frum's Excellent Review of Adam Tooze: Hoisted from the Archives

Hoisted from the Archives: Thoughts on David Frum's Excellent Review of Adam Tooze's Superb "The Deluge" and "The Wages of Destruction": David Frum:

The Real Story of How America Became an Economic Superpower: In 1870... the populations of the United States and Germany was roughly equal.... Just before the outbreak of World War I the American economy... [was] roughly twice the size of that of Imperial Germany. By 1943... almost four times.... Germany was a weaker and poorer country in 1939 than it had been in 1914. Compared with Britain, let alone the United States, it lacked the basic elements of modernity... just 486,000 automobiles in Germany in 1932.... Yet this backward land, with an income per capita comparable to contemporary ���South Africa, Iran and Tunisia,��� wagered on a second world war even more audacious than the first.

The reckless desperation of Hitler���s war provides context for the horrific crimes of his regime. Hitler���s empire could not feed itself, so his invasion plan for the Soviet Union contemplated the death by starvation of 20 to 30 million Soviet urban dwellers after the invaders stole all foodstuffs.... On paper, the Nazi empire of 1942 represented a substantial economic bloc. But pillage and slavery are not workable bases for an industrial economy.... The Hitlerian vision of a united German-led Eurasia equaling the Anglo-American bloc proved a crazed and genocidal fantasy.

Tooze���s story ends where our modern era starts.... Yet nothing lasts forever.... America���s... unique economic predominance... is now coming to an end as China does what the Soviet Union and Imperial Germany never could.... When it does, the fundamental basis of world-power politics over the past 100 years will have been removed. Just how big and dangerous a change that will be is the deepest theme of Adam Tooze's profound and brilliant grand narrative...

Adam Tooze does, I think, have the geo-political-economic history of the twentieth century largely right.

And David Frum does gives a very, very nice summary of the major themes that emerge from Tooze's two volumes.

Great Britain, the hyperpower of the 1815-1916 19th century, shaped the globe in the 19th-century in the interest of industrialization, free-trade, and its own imperialist predominance.

The United States, the hyperpower of the 1916-2025 20th century, shaped the globe in the interest of anti-Naziism, anti-imperialism, anti-Communism, free trade, industrialization, and democratization if not democracy--and if its form of anti-imperialism turned into a soft Cold War neoimperalism of its own.

China, the likely hyperpower-to-be of the 21st century, will shape the globe in... what?

But there is another story--one that, I think, Winston Churchill would have stressed and rightly stressed.

In 1846 British Prime Minister Robert Peel accepted the U.S. proposal to draw the border between British Columbia and the Oregon Territory at the 49th Parallel, rather than doing what the British government usually did in the mid-nineteenth century: insist on its own proposal (the Columbia River or the northern boundary of California) and if the counterparty did not agree, send the British navy to burn its capital. This inaugurated an unusual era of... forbearance in geopolitics, coupled with a 70 year cultural wooing of the United States, of which the Rhodes Scholarships are a reminder to this day.

As a result, when 1916 came, Americans perceived Britain as their friend. Americans perceived the British Empire as by and large a force for good in the world. This is in striking contrast to how Britain was perceived in 1850: the cruel corrupt ex-colonial power that had just starved a quarter of all Irishmen to death.

This mattered a lot.

This meant that when Britain got into trouble in the twentieth century--whether with Wilhelm II or Hitler or Stalin and his successors--it had wired aces as its hole cards in the poker game of seven-card stud that is international relations.

The willingness of the United States to send Pershing and his army Over There, to risk war with and then to fight Hitler, and to move U.S. tanks from Ft. Hood, TX, to the Fulda Gap--these were all powerfully motivated by America's affinity with Britain, Britain's geostrategic causes, and Britain's security. Even after Britain was no longer the world's hyperpower, it had banked its hyper power for the future by a very wise use indeed of soft power in the second half of the 19th-century. It had then created a world in which the 20th century's hyperpower would use its muscle to make the world comfortable for Britain to live in.

Is the United States using its soft power now with the same skill and foresight?

Not really--and really not really back in the George W. Bush administration before 9/11, when confrontation with China was the rage.

Alexis de Tocqueville projected before the Civil War that the U.S. and Russia were likely to become twentieth-century superpowers. We project today that at least one of India and China--perhaps both--will become late-twenty first century superpowers. And so we have an interest in building ties of affinity now: it is very important for the late-twenty first century national security of the United States--and the global security of the world--that, fifty years from now, schoolchildren in India and China be taught that America is their friend that did all it could to help them become prosperous and free. It is very important that they not be taught that America wishes that they were still barefoot, powerless, and tyrannized, and has done all it can to keep them so.

This matters a lot.

In the long run we all have an enormous mutual common interest in peace, tolerance, and prosperity. And we have virtually no interest in most of what governments choose to fight about. Who cares today whether the signs in Strasbourg say "Strasbourg" or "Strassburg"? Who today is willing to fight and die to make Vancouver part of the United States of America? Who cares today whether the eighteenth century saw members of the Bourbon or the Habsburg dynasty seated on the throne of Spain?

When diplomats talk about international trade and finance, they talk about them as carrots and sticks: we give people we want to reward access to our markets; we punish people who we want to punish by slapping on trade embargos. "Economic diplomacy" is like bombing, only less so. And arguments that it is much more important to build large and profitable positive-sum games that align interests than to win zero- (or negative!) sum games that lead to the domination of one government's conception of its momentary interest over another's? They blow right past the diplomats, the State Department people as if they were just gentle breezes.

Economists, when they talk about international trade and finance, at least focus on building institutions to allow for mutually-beneficial acts of economic exchange. They talk about diminishing barriers and increasing confidence. They talk about playing positive-sum games with people in other countries that increase wealth, trust, and confidence and that ultimately align interests: the larger is the surplus from international trade and finance, the bigger is that stake that everyone has in continuing the free-trade-and-finance game.

But neither side today focuses on the long-run game of cultural and ideological influence that every temporary hyperpower needs to play: on trying to make it so that the next hyperpower seeks to create a prosperous, free, and peaceful world for the ex-hyperpower to be comfortable in.

#history #strategy #hoistedfromthearchives #highlighted

Robert Hutton: Indicative Votes: How Parliament Will Tr...

Robert Hutton: Indicative Votes: How Parliament Will Try to Change Brexit: "Members of Parliament will have put forward proposals they think should be voted on and it���s up to Bercow to choose which go forward.... At 7 p.m., Bercow will draw proceedings to a close and announce the vote. This won���t be like the usual House of Commons votes, where MPs walk through different lobbies to express their views. Instead, they���ll be given a piece of paper listing the options, and asked to vote Aye or No on each one. They���ll have half an hour.... Counting the indicative votes will probably take around an hour, and it will be up to Bercow whether he interrupts the government debate to announce the result, or waits until later. So some time before 10 p.m. The results will show how many MPs voted for and against each motion, and what happens next depends on that. Under Letwin���s proposals, Parliament will next have control of its own agenda on Monday April 1. That could be used to narrow options further, or to order the government to pursue a particular course of action...

#noted

Brad Setser: Why China's Incomplete Macroeconomic Adjustm...

Brad Setser: Why China's Incomplete Macroeconomic Adjustment Makes China 2025 a Bigger Risk: "China... wants to 'localize' the production of the bulk of the high tech goods that its economy needs... Made in China 2025... a mix of subsidies (some disguised, as they flow through state-backed investment funds and the financial sectors) and 'Buy China' preferences.... Losses... China is good at both hiding them���and, well, absorbing what at the time seems like large losses as an inevitable cost of its rapid growth. The usual argument against such a mix of industrial policy and protectionism is that it just won���t work. A country that subsidizes its industries ends up with inefficient industries.... But China, is, to use Philip Pan���s phrase, the state that failed to fail...

#noted

Wired: How Animators Created the Spider-Verse:

#noted

The very sharp Mohamed A. El-Erian misses one important...

The very sharp Mohamed A. El-Erian misses one important thing here: almost always, recessions are much deeper than any naive computation of the size of the initial shock minus the sum of monetary and fiscal offset would predict. Why? Because businesses and investors are forward-looking, and take recession signals seriously. As Tim Duy says: everyone's "recession indicator... probability models... [are] raising red flags". It's a multiple-equiibrium thing. So while a recession in the next year is not certain and may not be probable it is not unlikely: Mohamed A. El-Erian: Inverted Yield Curve Doesn't Necessarily Mean Recession Is Nigh: "This rather benign economic outlook conflicts with the traditional signal of an inverted curve for four main reasons.... [1] Europe... puts downward pressure on U.S. yields.... [2] The Fed... a remarkable and rapid U-turn.... Other segments of the bond market are not signaling a major economic slowdown.... The erosion in inflationary expectations may... [be a] realization that many of the underlying drivers are structural.... This curve inversion is unlikely to be the traditional signal of a U.S. recession...

#noted #forecasting

March 25, 2019

Cathy Young: Who���s Afraid of The Bulwark?: "The conserv...

Cathy Young: Who���s Afraid of The Bulwark?: "The conservative media wars heat up���but miss the point.... I don���t know what The Bulwark���s endgame is, but right now, it���s among a deplorably small number of outlets that get high marks for intellectual diversity and integrity. That should be good enough...

#noted

Paul Krugman: Trump���s Kakistocracy Is Also a Hackistocr...

Paul Krugman: Trump���s Kakistocracy Is Also a Hackistocracy: "Trump said he planned to nominate Stephen Moore for the Fed���s Board of Governors. Moore is manifestly, flamboyantly unqualified for the position. But there���s a story here that goes deeper than Moore, or even Trump; it���s about the whole GOP���s preference for hucksters over experts, even partisan experts...

...Moore... has been wrong about everything. I don���t mean the occasional bad call, which all of us make. I mean... predicting that George W. Bush���s policies would produce a magnificent boom, Barack Obama���s policies would lead to runaway inflation, tax cuts in Kansas would produce a ���near immediate��� boost to the state���s economy, and much more. And, of course, never an acknowledgment of error or reflection on why he got it wrong.... Moore isn���t some random guy who caught Trump���s eye. He has long been a prominent figure in the conservative movement: a writer for the Wall Street Journal editorial page, chief economist of the Heritage Foundation, a fixture on the right-wing lecture circuit. Why?

You might say that the G.O.P. values partisan loyalty above professional competence. But... there are plenty of conservative economists with solid professional credentials���and some of them are pretty naked in their partisanship... rushed to endorse the Trump administration���s outlandish claims about the benefits from its tax cut, claims they knew full well were unreasonable. Nor has their partisanship been restrained and polite.... Alan Krueger... increases in the minimum wage don���t usually seem to reduce employment.... James Buchanan denounced those pursuing that line of research as ���a bevy of camp-following whores.��� So conservatives could... turn... to highly partisan economists with at least some idea of what they���re doing. Yet these economists, despite what often seem like pathetic attempts to curry favor with politicians, are routinely passed over for key positions, which go to almost surreally unqualified figures like Moore or Larry Kudlow...

#noted

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers