J. Bradford DeLong's Blog, page 1155

September 3, 2014

Over at Equitable Growth: Pick-Up Symposium: Why the Love of Hard Money?: Wednesday Focus for September 3, 2014

Over at Equitable Growth: My four biggest intellectual mistakes over the past decade--and all four are huge--are:

Over at Equitable Growth: My four biggest intellectual mistakes over the past decade--and all four are huge--are:

My belief from 2003-2007 that the serious threat to the American financial system came from universal banks that had used their derivatives books to sell lots of unhedged puts against the dollar rather than universal banks accepting lots of house-value puts without doing any due diligence about the quality of the underlying assets.

My fear from 2008-2010 that although nominal wages were downward-sticky they were not that downward-sticky and we were on the point of tipping over into absolute deflation.

My confidence in 2009-2010 that the major policymakers--Bernanke, Obama, and what turned out to be Geithner--both understood how to use the ample monetary, fiscal, banking, and housing finance tools at their disposal to effectively target nominal GDP and understood the urgency of doing whatever it took to return nominal GDP to its pre-2008 growth path.

My failure to even conceive that "Washington" starting in 2010 could possibly be sufficiently happy with the pace of recovery that serious measures to further boost demand would vanish from the agenda.

(1) and (2) and (3) I have written about elsewhere. Today we have a piece of (4) to deal with--why do so many people prioritize low-pressure economy policies that they regard as the only safeguard of hard money over economic recovery? Paul Krugman constitutes himself the συμποσιαρχ, decides that we will be drinking κρασί ακρατος, and poses the question: READ MOAR

Paul Krugman: Three Roads to Hard Money: "A hedge fund manager, a right-wing politician, and a freshwater economist walk into a restaurant...

...and order wine. No, this isn’t the setup for a joke--it’s a real story.... All three [of Cliff Asness, Paul Ryan, and John Cochrane] have been prominent in warning that the Fed is embarked on a dangerously inflationary path.... This inflation paranoia has proved remarkably resilient... despite five-plus years of utter empirical failure. Why?... Three seemingly different stories....

[1] The wealthy... [fear] monetary expansion... reduce[s]... returns and erode[s] their wealth.... [3] Movement conservatism['s]... closed intellectual space... [where] political figures... imagine... economic [truth is]... in Atlas Shrugged. [3] And... the internal...devolution of... economics... [the] great forgetting of even the most basic macroeconomic concepts....

These seem like disjoint stories, with their convergence at precisely the moment they could do the most harm a coincidence. But there has to be more. I’m thinking, I’m thinking. Maybe some wine will help.

My view is that [3] is simply unprofessionalism at work, plus an eagerness to provide academic support for politicians who share ideology. As Simon Wren-Lewis says, the naive quantity-theory of fiscal-price-level-theory models you need to construct an inordinate fear of inflation today are simply not serious:

Simon Wren-Lewis: Simplistic theories of inflation: "Monetarism [was] so popular until governments actually tried it...

...[because of] its simplicity... a stable demand for... M/P, so if you can control M you must control P.... There are lots of problems.... Money can be saved as well as buy goods... even if there was a stable long run demand... we cannot say what the future quantity of money will be... base money and... Quantitative Easing.... The Fiscal Theory of the Price Level is... another simplistic theory.... But... future primary surpluses [and the real factors at which they are discounted] are not fixed.... The Fiscal Theory of the Price Level, like monetarism, is not a terribly helpful way of thinking about future inflation... one variable, or one equation [economics]... is a fantasy. What is surprising is that this fantasy has been, and still remains, so attractive for some economists.

My view is that [2] is in some ways a corollary of [3]. In my time in and around Washington I have seen many Democratic economists pull a Martin Luther and refuse to give politicians the advice they want, preferring: Hier stehe ich, Ich kann nicht anders, Gott helfe mir! Amen!

It is my impression--and I may be wrong--that on the Republican side of the aisle it is more like: Of course we didn't advise that. If we had it would have been a very short conversation...

I am still actively looking for examples of Republican economists besides Martin Felstein and Glenn Hubbard who have done otherwise.

As for [1]... that is the puzzle. To the extent that Cliff Asness's clients suffer from inflation illusion, he should like inflation. To the extent that his clients do not suffer from inflation illusion, since he is long real risk and long real assets, a high-pressure economy is his and his clients' friend. As I said to Barry Eichengreen in my office last week:

I used to teach that before World War I with restricted suffrage and difficulties of political mobilization the working-class was effectively disenfranchised, and there was a very large rentier component of the upper classes whose assets were in nominal bonds or in land rented out on long-term nominal leases to serve as a heart money lobby. Thus the attachment to the gold standard. But with the coming of universal suffrage and of broad portfolio diversification the material interest of the rich in hard money vanished, the material interest of the working-class and the entrepreneurial class in a high-pressure economy advanced, and we acquired a strong political bias toward fiat money and moderate inflation and against price stability or deflation. But what do I teach now?

Barry's comment:

You are not the only one who has taught that...

The American Federation of Labor-Congress of Industrial Organizations, the National Association of Manufacturers, and the American Bankers Association--who need an inflation spread between the real interest they must pay to depositors and the real interest they can charge to borrowers--should make up a powerful pro-moderate-inflation pro-high-pressure-economy lobby. And nobody should be on the other side.

So what gives?

Nick Rowe thinks that it is all inflation illusion:

Nick Rowe: It's the Inflation Fallacy, Duh!: "Paul Krugman is wasting his time trying to figure out...

...why the rich and powerful don't like inflation..... Just ask a non-economist.... 'Because if all prices rise 10% we will only be able to afford to buy 10% less stuff. Duh!'... That's the inflation fallacy.... Economists... talk about shoeleather costs, menu costs, relative price distortions, difficulties of indexing taxes, confused accountants, etc [as costs of inflation]. How many non-economists have you heard mentioning any of those things as the reason why inflation is a bad thing? Ours the task eternal...

But it didn't used to be that way. I cannot remember anybody in the 1990s or 2000s complaining that inflation--2.2%/year from January 1990 to January 2000, 2.3%/year from January 2000 to January 2008 according to the PCE--was too high. (Inflation has averaged 1.5%/year since January 2008.) It's true that with the collapse of the union movement only a small minority of America's politicians ever meet seriously with anyone out of the top 5%, and most of their one-on-one time is spent with the top 0.1%. But why are they so attached to hard money? And why are so many not in the top 5% who have no serious assets and for whom the major threat to their well-being is joblessness fodder for goldbugs?

False consciousness sounds good to me.

Steve Randy Waldmann, however, thinks it is risk aversion plus the fact that the top 0.1% are playing not for absolute but for relative wealth:

Steve Randy Waldmann: Hard money is not a mistake: "Krugman tentatively concludes that 'it... looks like a form of false consciousness'...

...I wish that were so, but it isn’t.... “Wealth”... [is] bundles of social and legal claims derived from... the past.... Unexpected inflation is noise in the signal.... “Inflation”... unsettle[s] the value of past claims.... Almost by definition, the status of the past’s “winners”--the wealthy--is made uncertain by this.... Regression to the mean is a bitch. You have managed to put yourself in the 99.9th percentile, once. If you are forced to play again in anything close to a fair contest, the odds are stacked against you....

The moderately affluent... rationally prefer to tilt towards debt... because they will need to convert their assets into liquid purchasing power over a relatively short time frame.... To the extremely rich, wealth is primarily about status and insurance, both of which are functions of relative rather than absolute distributions... [thus] a booming economy offers little upside unless they are positioned to claim a disproportionate piece of it.... Soft money types--I’ve heard the sentiment from Scott Sumner, Brad DeLong, Kevin Drum, and now Paul Krugman--really want to see the bias towards hard money and fiscal austerity as some kind of mistake. I wish that were true. It just isn’t...

Steve's points are powerful, but I think ultimately wrong. Yes, policies that run risks of inflation disrupts the current ordering of wealth. But policies that guard against risks of inflation by creating a low-pressure economy that manifests itself in either high real interest rates or an output gap or both also disrupt the current ordering of wealth, and do so in a negative-sum fashion as opposed to the zero-sum effects of inflation. "False consciousness" is still the favorite, in my view at least.

And, to back me up, just in time around the turn comes Ken Rogoff--neither a votary of the simplistic, rigid quantity theory that Milton Friedman denounced nor a worshipper of the naive fiscal theory of the price level--to tell us that even country with floating exchange rates possessing the exorbitant privilege of issuing reserve currencies should fear inflation right now:

Ken Rogoff: The Exaggerated Death of Inflation: "Is the era of high inflation gone forever?...

...Today, high inflation seems so remote that many analysts treat it as little more than a theoretical curiosity. They are wrong to do so.... A country’s long-term inflation rate is... the outcome of political choices.... As the choices become more difficult, the risk to price stability grows. A quick tour of emerging markets reveals that inflation is far from dead.... Yes, advanced economies are in a very different position today, but they are hardly immune. Many of the same pundits who never imagined that advanced economies could have massive financial crises are now sure that advanced economies can never have inflation crises....

I am not arguing that inflation will return anytime soon in safe-haven economies such as the US or Japan. Though US labor markets are tightening, and the new Fed chair has emphatically emphasized the importance of maximum employment, there is still little risk of high inflation in the near future. Still... there is no guarantee... any central bank will be able to hold the line in the face of... slow productivity growth, high debt levels, and pressure to reduce inequality through government transfers.... Recognizing that inflation is only dormant renders foolish the oft-stated claim that any country with a flexible exchange rate has nothing to fear from high debt, as long as debt is issued in its own currency...

What Ken is doing here is resorting to not a naive but a sophisticated fiscal theory of the price level: if (a) central banks fail to hold the line and prevent governments from resorting to the inflation tax, well then the inflation tax is one way that governments can get hold of resources--and governments that find that their finances have become unbalanced because of (b) slow productivity growth reducing the tax base, (c) higher demands for redistribution to fight rising market income and wealth inequality, or (d) high debt today may resort to it. My natural next question is: how big are the numbers we are talking about? Suppose that we want to amortize all of the U.S.'s current debt over, say, 50 years. How much of a claim on resources does today's 69% of potential GDP's worth of debt impose? At today's 30-year TIPS rate of 0.8%/year and with a potential GDP growth rate of 2.5%/year, we get 0.86% of GDP as the burden--the share of GDP that must be raised in taxes as a real surplus--to completely retire our current debt by 2064.

And if we were happy with our debt at 69% of potential GDP? Then we could afford to run a real deficit of 1.2% of GDP per year and a nominal deficit of 2.6% of GDP per year.

Those are not big numbers. Those are not big threats. Those don't justify a focus on today's current debt levels--rather than a focus on, say, exploding medical-care costs, the desirability of funding pensions through Social Security given the manifest inadequacies of 401(k)s, and the fear that if education is not funded by the government it will become a tool of social status rather than of opportunity as the true sources of our long-run fiscal dilemmas.

Debt as a threat to price stability and inflation dormancy is not what I would write about. It's not what I do write about. From what dark star comes the gravitational attraction that makes it what Ken wants to write about today?

That remains a mystery to me...

More:

Steve Randy Waldmann on the place of the 1970s:

Steve Randy Waldmann: "Krugman cites Kevin Drum and coins the term...

...“septaphobia” to describe the conjecture that elite anti-inflation bias is like an emotional cringe from the trauma of 1970s. That’s bass-ackwards.... Prior to the 1970s... soft money had an overt, populist constituency.... The “misery” of the 1970s has been trumpeted by elites ever since, a warning and a bogeyman.... The 1970s were unsurprisingly underwhelming on a productivity basis for demographic reasons.... The economics profession... ignored demographics, and the elite consensus... was allowed to discredit a lot of very creditable macroeconomic ideas. Ever since, the notion that the inflation of the 1970s was “painful for everyone” has been used as a cudgel by elites...

Peter Dorman on the Kaleckian business cycle:

Peter Dorman: Big Money Wants Hard Money--But Why?: "It is an indisputable fact that the rich have a strong bias in favor of tight monetary policy...

...In no country today is there a significant portion of the capitalist class that is willing to align with working class movements (if they even exist) in favor of aggressive full employment policy.... Krugman’s question--why don’t the rich recognize a positive effect of expansionary monetary policy on their equity holdings?--converges with this second one--why has the Keynesian coalition vanished from modern politics?...

Is Krugman right to see a predictable positive response of profits, and therefore equities, to Keynesian fiscal and monetary policy in the slump? Consider the profit boom of the last few years.... Demand has remained weak... investment is paltry.... But... workers settle for less and less. The upshot is a much higher profit share of a non-growing pie...

More musings from Paul Krugman:

Paul Krugman: Inflation, Septaphobia, and the Shock Doctrine: The bad news from Europe is a reminder...

...that the basic insight some of us have been trying to convey, mostly in vain, ever since 2008 remains valid: the great danger facing advanced economies is that governments and central banks will do too little, not too much. The risk of elevated inflation or fiscal difficulties is dwarfed by the risk of ending up trapped in a deflationary vortex. This view has been overwhelmingly supported by recent experience--if you acted on what they were saying on CNBC or the WSJ editorial page, you would have lost a lot of money. Yet the power of the hard money/fiscal austerity orthodoxy (yes, market monetarists want one without the other, but they have no constituency) remains immense. Why?...

One thought I’ve had and written about is that the one percent (or actually the 0.01 percent) like hard money because they’re rentiers. But... this is foolish... they have much more to gain from asset appreciation than they have to lose from the small chance of runaway inflation... compare stock prices in the US, with its aggressively easing Fed, with Europe, [and] you can see the difference.... Kevin Drum suggested that it’s all about septaphobia, fear of the 1970s.... But weren’t the one percent equally devoted to the gold standard in the 1930s, with no Jimmy Carter?... And why does the inflation of 1979 remain seared in memory, while the boom after Volcker loosened money in 1982 is forgotten? (This is like the question of why Germans remember 1923 but not Bruening.) Finally, there’s the notion that... crises are a chance to force “reforms” that strip away worker protections and the welfare state, and any suggestion that technical solutions, monetary or fiscal, could do the job is rejected.... It sure looks like a form of false consciousness on the part of elites...

And:

Paul Krugman: Class Interests and Monetary Policy, Take II: "Steve Randy Waldman has a long, thoughtful take...

...While monetary expansion might be expected on average to be a good thing in a weak economy, that’s a risky proposition for wealth holders.... Loose money, despite its direct adverse effects on creditors, will produce large gains indirectly; but those indirect effects are less certain than the direct effects, and assessing them depends on your model of the economy. So wealthy creditors may go for the direct stuff.... But I’m not entirely prepared to give up on the false consciousness notion, in part because I keep being struck by the enormous appetite of the one percent for really bad economic analysis. Think about CNBC economics (aka Santellinomics, aka the finance macro canon). This stuff, with its prediction of soaring inflation and interest rates, has been utterly wrong for more than five years. Yet it remains very popular among wealthy investors.

I think this may in part reflect the problem that always comes with wealth and power: people tell you what you want to hear. CNBC economics stays on the air....

What I’m doing here is groping toward a story about why policy botched the Lesser Depression so badly. More...

Liveblogging World War II: September 3, 1944: Brussels Liberated

BBC People's War: Brussels liberated: Frank Clark in the Guards Armoured Brigade:

BBC People's War: Brussels liberated: Frank Clark in the Guards Armoured Brigade:

We drove on, liberating town after town, village after village, and we were madly cheered on our way. Some of the places we went through had been occupied by the Germans less than ten hours ago. The excitement was intense! The journey across the battlefields of 1914-18 was most interesting — the Somme, Arras, Vimy Ridge.

The whole of that area is now fertile farming land, peaceful and beautiful and it is ghastly to imagine that thirty years ago, those fields were littered with the smashed bodies of good men. Their bones ploughed into the earth by shell-fire! No wonder the soil is fertile. Along the route we passed a number of war cemeteries, housing their wasted dead, and they were a vivid reminder of the futility of war. The Canadian memorial on Vimy Ridge looked most impressive.

We continued, riding right through the long days, stopping only a few hours each night for refuelling and a bit of sleep. The pace was terrific, V and all the time we were heading for the Belgium border. Then on Saturday night, we were told that early next morning, we would be setting out for Brussels. What an objective, for it was 90 miles away! It seemed impossible that we would ever make it, for if we did, we would achieve the distinction of advancing faster in one day than any other formation before us.

We set out early and we were soon being cheered on our way, some people even waving to us in their pyjamas and nightshirts. It was amazing! But the most amazing part was yet to come when we crossed the border in Belgium. The French people were glad to see us but the Belgians went mad. Their villages and towns were gaily festooned with flags, Belgian and Allied, and the streets were a mass of colour.

Before we had gone many miles, our vehicles were covered with flowers and every time we halted, we had fruit and wine showered on us. We looked like flying greengrocer’s shops. From early morning till we arrived I ate, ate, ate cakes and biscuits, fruit and wine. My god how hysterically crazy and excited were these people to see us. Across the roads were banners, “Welcome to our Allies,” etc. and bands played in the path of this advancing army.

On and on we drove towards Brussels, the excitement getting more intense every hour. The people were getting frantic! The route was a blaze of colour and my arm fair ached with waving to the excited crowds. At times it was almost impossible to move through the seething masses, for they climbed on to the trucks kissing us and crying. These people had been four years beneath the Nazi yoke, suffering, unhappy and now they were free. The Allies had fulfilled their promise. Liberation was theirs.

And then we entered the suburbs of the capital! Our Brigade was the first formation to go in. Well V I don’t know how to describe it. It is almost impossible for I can never put into words the reception that greeted us. To put it mildly, it was stupendously terrific. The city went raving mad. Bands, screams, singing, crying, all these sounds rent the air.

It was the proudest moment of my life. We had brought freedom and happiness to these good people. As we progressed further in the crowds began to get out of hand for they climbed into the trucks, on the tops kissing and hugging everyone. The vehicles were absolutely covered with flags and streamers. It was the most amazing sight!

As we neared the centre of the city, progress got very slow for the crowds were blocking the roads. The whole of Brussels had come out to welcome us. It took us over three hours to get from the suburbs to the Centre. We entered the town at 8.00 pm and we parked at about 11.00 pm. It got dark but lights were blazing in the cafes, the noise got even louder as radios blared out their greetings.

Eventually we reached our destination. There was a red glow surrounding the centre of the city, for the Germans had set fire to the tremendous magnificent Palace of Justice. It was a blazing inferno! The red ominous glow was the Germans’ welcome to us. High up in buildings we could hear the occasional crack of rifles. Snipers! The enemy was still with us.

And now came the most amazing sight of all V. In the cellars of the Palace of Justice, had been stored by the Germans, thousands and thousands of bottles of wine and champagne. They were all brought up into the streets and Brussels fairly swam in wine. The celebration was tremendous.

We spent the night under our trucks on the fine squares and boulevards of that grand city. So ended a remarkable journey, – an awe-inspiring day.

Vera, I shall never, never forget Brussels. It was the most exciting moment of my life. A moment I shall always remember. Our Division had made history. I shall never forget Sunday the 3rd September 1944.

Over at Project Syndicate: When Do We Start Calling This "The Greater Depression"?

When Do We Start Calling This "The Greater Depression"?

When Do We Start Calling This "The Greater Depression"?

We started by calling it the financial crisis of 2007. Then it became the financial crisis of 2008. Next it was the downturn of 2009-2009. By the middle of 2009 it was clearly the biggest thing since the 1930s, and acquired the name of "The Great Recession". By the end of 2009 the business cycle trough had been passed, and people breathed a sigh of relief: "The Great Recession" would be its stable name--we would not have to change its name again, and move on to labels containing the D-word. READ MOAR at Equitable Growth:

But we breathed our sigh of relief too soon. Although politicians and their senior aides went on speaking tours playing up "recovery summer", the United States did not experience a rapid V-shaped recovery carrying it back to the previous growth trend of potential output. In this the post-2009 recovery was lightyears different from the post-1982 recovery. Between the start of 2005 and the end of 2007 U.S. real GDP grew at 3.1%/year. The recession trough in 2009 saw the U.S. real GDP level 11% lower than the 2005-2007 trend. Today it stands 16% below.

Things have been even worse in Europe. The Eurozone experienced not recovery but renewed recession with a second-wave downturn starting in 2010--an event that shifted the consensus name of the current episode to "The Great Recession". Eurozone real GDP stood 8% below its 1995-2007 trend at the recession trough. It now stands 15% below.

Cumulative output losses relative to the 1995-2007 trends now stand at 78% of a year's GDP for the United States, and at 60% of a year's GDP for the Eurozone. These are extraordinary magnitudes of foregone prosperity--prosperity that we were all confident was in our grasp back in 2007: nobody back in 2007 was forecasting anything like what the decade starting in 2008 will turn out to have been like; nobody back in 2007 was forecasting any extraordinary decline in the rate of growth of potential output that statistical and policymaking agencies are now baking into their estimates. These magnitudes made me conclude at the start of 2011 that "The Great Recession" was no longer adequate: it was time to start calling this episode "The Lesser Depression".

Now, however, we face two additional downward shocks to the North Atlantic economy. Consider the page that Lorcan Roche Kelly of Agenda Research noted Mario Draghi ad-libbing in his late-August Jackson Hole speech:

Inflation has been on a downward path from around 2.5% in the summer of 2012 to 0.4% most recently.

I comment on these movements about once a month in the press conference, and I have given several reasons for this downward path in inflation, saying it is because of food and energy price declines; because after mid-2012 it is mostly exchange rate appreciation that has impacted on price movements; more recently we have had the Russia-Ukraine geopolitical risks, which will also exert a negative impact on the euro area economy; and of course we had the relative price adjustment that had to happen in the stressed countries as well as high unemployment. I have said in principle most of these effects should in the end wash out because most of them are temporary in nature--though not all of them.

But I also said if this period of low inflation were to last for a prolonged period of time, the risk to price stability would increase. Inflation expectations exhibited significant declines at all horizons. The 5-year/5-year swap rate declined by 15 basis points to just below 2%--this is the metric that we usually use for defining medium term inflation. But if we go to shorter- and medium-term horizons, the revisions have been even more significant. The real rates on the short and medium term have gone up, on the long term they haven't gone up because we are witnessing a decline in long-term nominal rates, not only in the euro area but everywhere really.

The Governing Council will acknowledge these developments and within its mandate will use all the available unconventional instruments needed to ensure price stability safeguard the firm anchoring of inflation expectations over the medium to long term.

In the Eurozone, the pretense that recovery was in train is now gone, and there is no way to read the financial markets other than as anticipating a Eurozone triple dip recession. In the United States, the Federal Reserve under Janet Yellen has moved from wondering whether it will ever be appropriate to cease asset purchases and raise interest rates without a significant upturn in the employment share to ceasing asset purchases and wondering when it will raise interest rates--even without either a significant upturn in the employment share or a significant upward breakout in inflation.

A year and a half ago, when some of us were expecting a return to whatever the path of potential output was by 2017, our guess was that the Great Recession would wind up costing the North Atlantic in lost production about 80% of one year's output--call it $13 trillion. Today a five-year return to whatever the new normal might be looks optimistic--and even that scenario carries us to $20 trillion. And a pessimistic scenario of five years that have been like 2012-2014 plus then five years of recovery would get us to a total lost-wealth cost of $35 trillion.

At some point we will have to stop calling this thing "The Great Recession" or "The Lesser Depression" and start calling it "The Greater Depression". When?

Appendix: Data and Calculations: http://delong.typepad.com/20140825-financial-crisis-to-great-recession-to-lesser-depression-to-greater-depression.rmd | http://delong.typepad.com/20140825_financial_crisis_to_great_recession_to_lesser_depression_to_greater_depression.html

937 words

September 2, 2014

Over at Equitable Growth: Why Haven't Long-Term Interest Rates Started to Normalize?: Tuesday Focus for September 2, 2014

Over at Equitable Growth: The extremely-sharp Jérémie Cohen-Setton has a roundup:

Jérémie Cohen-Setton: Blogs review: The bond market conundrum redux: "Are we seeing a new version of the Greenspan 2005 conundrum?...

Fed tapering was widely expected to push up US yields. Instead, US yields have fallen since the beginning of the year.... A successful explanation of this new conundrum cannot just rely on a flight to safety... it also needs to rationalize why 5-year... and 10-year yield[s] have diverged.... READ MOAR

Jeff Sommer... David Beckworth... Marc to Market.... James Hamilton writes that as the U.S. economy returns to healthier growth, many of us expected long-term interest rates to return to more normal historical levels. But the general trend has been down.... In... 2005... Greenspan noted that long-term interest rates [had] trended lower in recent months even as the Federal Reserve [had] raised the level of the target federal funds rate by 150 basis points... [in apparent contradiction] to the expectations theory of interest rates were long rates are the geometric average of expected future short rates plus a risk premium that would usually increase with duration of the instrument....

David Beckworth uses a decomposition of the long term interest rate into an average expected real short-term interest rate, average expected inflation, and a term premium to argue that it’s the term premium has been steadily falling.... James Hamilton writes that... while the... 10-year Treasury has been falling... the 5-year yield has held fairly steady.... Something happened this year to persuade people that rates in the future (for 5 to 10 years from now) were going to be lower than they had been expecting. Robin Harding and Michael Mackenzie write that this is unprecedented.... James Hamilton writes that it’s hard to attribute it to changing perceptions about the Fed...

We are very far away from anything I would like to call "social science" or even "forecasting" here--"haruspicy", or perhaps "plastromancy" captures it better...

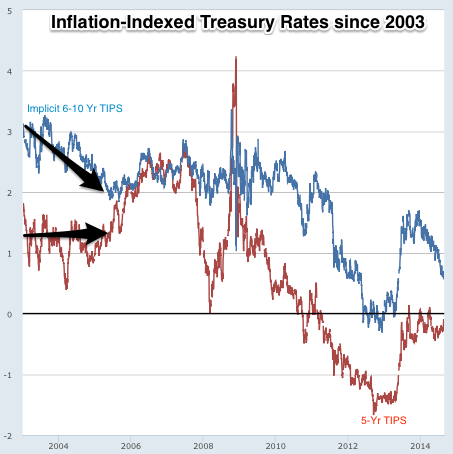

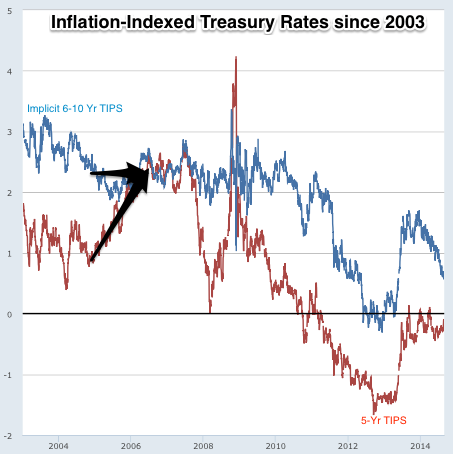

With that caveat, I have been struck for a while by what we see when we break up the 10-Year TIPS rate into its 5-Year TIPS and its 6-10-Year Forward TIPS components:

If you read this graph as showing the expectations of Ms Market over the next five and the subsequent five years, we get the following for the market's ideas about the real interest rate:

1) Over 2003 to mid-2005, a constant 0-5 year rate and a 6-10 year expected rate+term premium that falls from 3%/year to 2.3%/year, presumably as Ms Market adjusts to the idea that there might actually be a global savings glut and hence a lower Wicksellian real natural interest rate in the long run:

2) Over mid-2005 to 2006, a rise in the 0-5 year rate to 2.3%/year or so and a 6-10 year expected rate+term premium that remains steady, presumably as Ms Market now expects more of a full-employment economy and a stronger demand for funds to finance real investment than had seemed likely before mid-2005:

3) Over 2007 to mid-2010, a constant 6-10 year expected rate+term premium of 2.3%/year (save for the height of the financial crisis itself, with the yield spike from fears of TIP illiquidity). Ms Market appears confident that whatever happens, by 6-10 years out the ocean will be calm and flat again at the global savings glut Wicksellian real natural rate of 2.3%/year. And over 2007 to 2010 we have (a) the steep fall in the 5-Year TIPS yield as Ms Market expects aggressive monetary policy over a five-year horizon, (b) the step rise in the yield as Ms Market thinks something very bad might and then is happening to TIPS liquidity, (c) the return to normal slow-recovery views of the 5-Year TIPS yield like these previously seen over 2003 to mid-2005, and (d) the further collapse of the 5-Year TIPS yield to zero as Ms Market recognizes that this is not your normal slow recovery, that there are few if any of Tim Geithner's "green shoots", and that it will be a long slog:

4) Over mid-2010 to mid-2013, the collapse in the 5-Yr TIPS yield to -1.4%/year and the collapse in the 6-10 year expected rate+term premium to 0%/year as Ms Market recognizes that this time--with QE∞, permanent underemployment, and secular stagnation--really is different:

4) In 2013, taper-talk: Bernanke's announcements interpreted as signaling that the FOMC thinks the question is not whether but when to normalize, and the consequent rapid semi-normalization of the 6-10 year expected rate+term premium and rapid rise of the 5-Year TIPS to near 0%/year:

5) Since late 2013, a belief by Ms Market that the Federal Reserve is still planning to start serious normalization--but with a start date that seems to be pushed out an extra week for every week that passes--coupled with a dawning recognition that we are unlikely to be anywhere close to normal in years 6-10, hence the late-2013 belief that you should bet on the economy being at a semi-normal Wicksellian real natural interest rate in 2020 was probably wrong:

Is there actually an intelligent entity--some kind of distributed anthology intelligence suffering from some sort of aphasia--that we call Ms Market that actually has expectations and whose expectations we can read off of bond yields? And if there is such an entity, is there any reason we should pay any attention to her expectations either as guides to some central tendency of investor sentiment or as forecasts that are in their own right worth incorporating into our own information sets, and hence into our own forecasts? Who knows? I don't.

What I do know is that if we are willing to divine some market-sentiment-macro-expectations factor out of TIPS and other yields, the past eight months or so have seen Ms Market become much more pessimistic about the state of the real economy and thus of real interest rates six to ten years hence.

The one thing casting doubt on this interpretation is the failure of the 6-10 year inflation break-even to decline. It has been hanging out there at 2.5%/year (with notably rare exceptions) since 2004:

If I were an inflation hawk I would say that right now Ms Market expects us to get the economy in five years to a place where it is then doing its normal thing that it does when we target 2%/year inflation--and that is a powerful sign that our current taper policy is on the right track. But when I look at the sub-zero 5-Year TIP and at the 0.6%/year 6-10 Year TIP I read that as Ms Market decoupling its inflation expectations from its real growth and real interest rate expectations, and not in a good way.

The new bond market conundrum is thus yet another reason for the sun to appear dark in my eyes...

Red States Inflict Suffering on Their Citizens to Spite Obama: Hoisted from 53 and 79 Years Ago/Live from The Roasterie CCCXXI: September 2, 2014

OK. It's time to try to pull everything together on the Red States, the Republican Party, ObamaCare, "repeal and replace", and starting at the top of the evil tree and hitting every branch all the way down...

OK. It's time to try to pull everything together on the Red States, the Republican Party, ObamaCare, "repeal and replace", and starting at the top of the evil tree and hitting every branch all the way down...

Let's start with a catch from Austin Frakt last January:

Austin Frakt: These two tweets tell you all you need to know about the politics of health reform: January 29, 2014 at 12:30 pm: Two of Avik Roy’s tweets yesterday...

...pertaining to the recently released Senate GOP health reform plan (the Patient CARE Act [of Burr (R-NC) Coburn (R-OK), and Hatch [R-UT) and discussion thereof, are very revealing.

@matthewherper: @Avik it still seems to me that this is going to hit a lot of voters harder. Even if it makes economic sense.

@Avik: .@matthewherper By repealing and replacing Ocare, the plan is more disruptive than it needs to be. But repeal needed for Right viability.

And, of course, it had no right-wing viability at all even so.

Their plan was to deliver a couple of major tweaks to ObamaCare--but in the process to tear down a bunch of existing mechanisms and bureaucracies in ObamaCare and then build new ones made for inefficiencies. It was, as Avik Roy says, not "repeal and replace"--although it was framed that way. But those inefficiencies that made it a technocratic non-starter. The resulting pointless churning in the health insurance market with a very large number of people losing their plans made it a political non-starter. The grinchiness of the supported benefits levels made it a social-insurance non-starter.

And with all of that they did not get any right-wing viability.

Why not?

You see, Boehner and McConnell--and if not them, certainly Burr, Coburn, Hatch, Voinovich, Snowe, and Collins--should have declared victory on health care in the fall of 2009, when Obama dropped the public option and put Nationwide RomneyCare forward as ObamaCare. They should have said that they had faced the president down, got him to accede what McCain would have proposed had McCain won the presidential election, and that this was a victory for good Republican governance and common-sense--a Republican, not a Democratic policy victory.

The problem from Boehner and McConnell's perspective, however, was that to tell that story was also to tell the story that the president was a sensible guy with centrist leanings who you could negotiate with. And they did not dare tell their base not for fear that the money and the phone-bank hours would stop flowing. Instead, they needed the base terrified of Kenyan Muslim Socialism. And so where RomneyCare had been a much-needed restructuring of health-care regulation so that the fee market could work, ObamaCare became a socialist government takeover of the health-care sector that had to be repealed root-and-branch before you could even begin to talk. Never mind that to two significant figures ObamaCare = RomneyCare

Thus, of course, where the rubber hits the road Burr, Coburn, and Hatch do not want to repeal ObamaCare: it is close to what they want to do. But they cannot admit that it is close. And so they cannot even propose what they really want to do--when they try, they abandon their own plan and run for the hills within 72 hours.

Similarly, at the state level the Red State governments found themselves trapped in a horrible box by John Roberts's lawless Sibelius Medicaid expansion decision. They could accept the Medicaid expansion--and so cooperate with the Kenyan Muslim Socialismization of America, and see their base turn against them. They could reject the Medicaid expansion--and see their rural safety-net hospitals close as the DPS payments to hospitals for treating the uninsured were phased-out, see a bunch of their citizens excluded from the system's subsidies while the subsidies flow to immigrants with green cards, still have to cost-shift to somehow raise funds to treat the poor while blue states can rationalize payments, and see their economies shrink relative to baseline by perhaps four percent per the next decade because they dare not be complicit in ObamaCare and because Roberts did not understand the law he was rewriting from the bench.

But what is the chance that they turn around and tell their base: "We lied to you. ObamaCare is not such a disaster after all"?

I must confess that I have some affection for Ronald Reagan. He really tried to do the right thing. And he was willing to conclude that when one group of advisors' plans had not worked out it was time for different advisors. Plus there was that moment when a gang of misfits--an astrologer, a first-lady, and a slightly-Alzheimer's addled president--set out to end the Cold War and try to rid the world of nuclear weapons. But did Ronald Reagan ever admit he had lied when he said that if Medicare passed:

we will awake to find that we have socialism. And... one of these days, you and I are going to spend our sunset years telling our children, and our children's children, what it once was like in America when men were free...

?

Did Herbert Hoover ever admit he had lied when he said that although Social Security:

may produce an efficient economic or Governmental unit by a manufactured, regimented, imposed environment... you will not produce a free individual... you will not produce an American.... Economic security... we can find in our jails. The slaves had it. Our people are not ready to be turned into a National zoo... classified, labelled, and directed by a form of self-approved keepers....

They must be taught not to change their souls and spirits for the fallacious promises of material comforts... in such an exchange the individual finds himself robbed of all, both spiritually and materially.... Merely to feed, clothe, and house the unemployed and the unemployable... could [be] do[ne] by the simple methods of bread lines, barracks, and dungarees.... If we stifle the freedom of spirit which builded our productivity we shall be distributing poverty instead of distributing plenty.

?

Scott Lemieux:

Scott Lemieux: Red States Inflict Suffering on Their Citizens to Spite Obama "The most direct consequence of states refusing to accept the Medicaid expansion is people suffering...

...because they don’t have medical insurance. The problems are going beyond this as well:

While record numbers of Americans sign up for the larger Medicaid health insurance program for the poor, financial issues are emerging for medical care providers in the two dozen states that didn’t go along with the expansion under the Affordable Care Act.... he moves against expansion are 'beginning to hurt hospitals in states that opted out', a report last week from Fitch Ratings said.... 'We expect providers in states that have chosen not to participate in expanded Medicaid eligibility to face increasing financial challenges in 2014 and beyond. Nonprofit hospitals and healthcare systems in states that have expanded their Medicaid coverage under the Patient Protection and Affordable Care Act have begun to realize the benefit from increased insurance coverage'....

Although the Medicaid portions of Sebelius used exceedingly unpersuasive reasoning to produce a horrible outcome... the states remain free to take the expansion. The fact that Republican-controlled ones generally aren’t tells you everything you need to know about the contemporary Republican Party.

I must say that as I look forward to having my base of operations here in the Lower Missouri Valley for the next three months, my big task is going to maintain my political equilibrium (such as it is). Berkeley tends to slowly and gradually push me toward being a domestic-policy neoconservative. But three months from now it will be a miracle if I am not a Trotskyist.

"Awesome in its evilness" was how Jon Gruber characterized the Republican power structure that now surrounds me...

Liveblogging the American Revolution: September 2, 1776: George Washington Laments

September 1, 2014

Noted for Your Evening Procrastination for September 1, 2014

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

Evening Must-Read: Bloomberg View: Stopping Europe's Descent Into Deflation - Washington Center for Equitable Growth

Evening Must-Read: Paul Krugman: Inflation, Septaphobia, and the Shock Doctrine - Washington Center for Equitable Growth

#FF America's Best, Most Substantive, and Most Accurate Center-Left Polemicist Is... Jonathan Chait: Monday Focus for September 1, 2014 - Washington Center for Equitable Growth

Morning Must-Read: Free Exchange: Germany's Hyperinflation-Phobia - Washington Center for Equitable Growth

Plus:

Things to Read on the Evening of September 1, 2014 - Washington Center for Equitable Growth

Must- and Shall-Reads:

Jonathan Chait: Feast of the Wingnuts

Steven Greenhouse: More Workers Are Claiming ‘Wage Theft’

Peter Watts: Are We There Yet? En Route to Dystopia with the Angry Optimist

Paul Krugman: Inflation, Septaphobia, and the Shock Doctrine: "The bad news from Europe is a reminder that the basic insight some of us have been trying to convey, mostly in vain, ever since 2008 remains valid: the great danger facing advanced economies is that governments and central banks will do too little, not too much.... Yet the power of the hard money/fiscal austerity orthodoxy (yes, market monetarists want one without the other, but they have no constituency) remains immense. Why?... The one percent (or actually the 0.01 percent)... have much more to gain from asset appreciation than they have to lose from the small chance of runaway inflation. In fact, if you compare stock prices in the US, with its aggressively easing Fed, with Europe, you can see the difference.... An alternative is selective historical memory. Some time ago Kevin Drum suggested that it’s all about septaphobia, fear of the 1970s.... Finally, there’s the notion that it’s implicitly about politics: crises are a chance to force “reforms” that strip away worker protections and the welfare state, and any suggestion that technical solutions, monetary or fiscal, could do the job is rejected. The thing is, it sure looks like a form of false consciousness on the part of elite. But I’m still trying to figure it out."

Bloomberg View: Stopping Europe's Descent Into Deflation: "Until recently it was debatable whether Europe's economy was recovering. No longer. Its recovery has stopped. The question now is whether the stagnation will tip over into something worse.... The preliminary estimate of euro-area inflation in August from a year earlier is 0.3 percent.... There's no growth in the euro area.... What can the ECB do? Draghi says the bank has already acted.... Yet the package of measures the ECB unveiled in June didn't amount to much.... It's past time for Draghi to push through those difficulties and test the limits of what politics and the law will allow.... Europe also needs to rethink its fiscal policy.... If Europe's long recession gets worse, it will be because its leaders saw what was happening yet chose not to act."

Mark Thoma sends us to Justin Fox: What Unions No Longer Do: "Forty years ago, about quarter of American workers belonged to unions, and those unions were a major economic and political force.... This isn’t exactly news... What doesn’t get talked about so much, though, are the consequences.... Jake Rosenfeld,... is out to change that. His book What Unions No Longer Do.... [H]ere, for Labor Day, are the four big things that, according to Rosenfeld, unions in the U.S. no longer do: 1. Unions no longer equalize incomes.... 2. Unions no longer counteract racial inequality.... 3. Unions no longer play a big role in assimilating immigrants.... 4. Unions no longer give lower-income Americans a political voice.... The decline of unions in the U.S. has often been painted as inevitable.... But... that still leaves those tasks unions once accomplished--which on the whole seem like things that are good for society, and good for business--unattended to. Who’s going to do them now?"

Free Exchange: Germany's Hyperinflation-Phobia: "John Maynard Keynes, as early as 1919, recognised the threat inflation posed to modern capitalist societies: 'Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency… [he] was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.' The German public, it seems, is particularly fearful of letting inflation getting out of control. This is, in part, due to the legacy of the German hyperinflation of 1922-3.... Present discomfort within Germany with policies designed to reflate the euro-zone economy has been stoked by the assertion of a linkage between hyperinflation and the rise to power of the Nazis.... Yet academics paint a very different picture... than the story... in the German press. The Nazi party did not become a popular political force until long after the hyperinflation period ended. The Nazis only won 32 Reichstag seats in the election of May 1924, and just 12 in 1928. As Paul Krugman has pointed out, 'the 1923 hyperinflation didn’t bring Hitler to power; it was the Brüning deflation' of the early-1930s.... The hyperinflation of 1923 created winners and losers among the middle classes.... Middle-class votes subsequently splintered between several different parties.... Yet virtually all classes lost out when Brüning’s government reacted to a projected fiscal deficit and gold outflows in 1930 with deflationary policies.... The experience of deflation made Hitler’s promises to conquer unemployment and stabilise prices by any means necessary attractive to a wide range of groups.... Deflation is now a greater risk than inflation in Europe.... A selective memory of the past may prove worse than no memory at all.... [See:] T. Balderston (2002): Economics and Politics in the Weimar Republic... A. Fergusson (1975): When Money Dies: The Nightmare of the Weimar Hyper-Inflation... J. M. Keynes (1919): The Economic Consequences of the Peace... A. Tooze (2006): *The Wages of Destruction: The Making and Breaking of the Nazi Economy... F. Taylor, (2013): The Downfall of Money: Germany’s Hyperinflation and the Destruction of the Middle Class"

Jared Bernstein: On Labor Day, a call for courage: "especially by those of us, and I include myself, who are shy to the point of apologetic about what needs to change, about re-balancing labor’s power with respect to that of capital. That framing itself... has become a 'no-no' in polite company... 'class warfare'... Marxism. Rep. Paul Ryan (R-Wis.) argues that framing the argument this way is akin to 'preying on the emotions of fear, envy and resentment' and 'sowing social unrest'. It’s a fascinating counterattack.... It is not incidental that budgets written by Ryan propose to cut trillions in spending on those in need and trillions in taxes on the wealthy. And to do so at a time when the share of income going to the top 1 percent is twice what it was before inequality began inexorably climbing (households in the top 1 percent now hold 22 percent of the national income compared with 10 percent in 1979). I reject the arguments of those bemoaning class warfare when they themselves are envoys of the winning class..."

Morgan Housel: You Are the Problem: "Here's the truth: The last five years will probably be the best five-year period you'll ever experience as an investor. The last decade has been average. If you've struggled through this period, or keep telling yourself that buy and hold doesn't work, or that the market is a scam, it's your own fault. Stocks have done over the last decade what stocks have done for countless decades: offered a pretty decent return with lots of volatility mixed in the middle. The fact that the average investor has been oblivious to this progress shows that the average investor is participating in a game he or she does not understand and doesn't agree with. That's unfortunate. But it means there's a simple answer to all the stories you hear about investors not trusting the market: the market isn't the problem. You, and your expectations, are the problem. You are your own worst enemy..."

And Over Here:

Monday Smackdown: DeLong Self-Smackdown: The "Greeks" (Brad DeLong's Grasping Reality...)

Over at Equitable Growth: #FF America's Best, Most Substantive, and Most Accurate Center-Left Polemicist Is... Jonathan Chait: Monday Focus for September 1, 2014 (Brad DeLong's Grasping Reality...)

Liveblogging World War I: September 1, 1914: Tannenberg: Aftermath (Brad DeLong's Grasping Reality...)

Liveblogging the American Revolution: August 31, 1776: George Washington Explains... (Brad DeLong's Grasping Reality...)

Weekend Reading: Over at Jacobin: Christian Parenti: Reading Hamilton From the Left (Brad DeLong's Grasping Reality...)

Liveblogging World War II: August 30, 1944: Total War (Brad DeLong's Grasping Reality...)

For the Weekend: The Safety Dance (Brad DeLong's Grasping Reality...)

Should Be Aware of:

Ken Liu: The Litigation Master and the Monkey King

Sam Youngman: Mitch McConnell's campaign manager resigns after Iowa bribery scandal deepens "Jesse Benton, the campaign manager for U.S. Senate Minority Leader Mitch McConnell, will resign his post as a bribery scandal from the 2012 presidential campaign threatens to envelop Benton and become a major distraction for McConnell's campaign..."

Stanley Kurtz: How the College Board Politicized U.S. History | John Holbo: American Exceptionalism--A Double-Edged Word: "I’m not surprised some conservatives are upset about the AP American History test. But I am bemused by the strength of the axiom Stanley Kurtz would oblige us to adopt, to keep things from getting politicized: 'America is freer and more democratic than any other nation'.... This is a comparative thesis about the international order, so it is noteworthy that Kurtz simultaneously forbids the ‘internationalization’ of US history. Comparative ‘transnational narratives’, the only sort of thing that could empirically support the validity of Kurtz’ exceptionalist axiom, are out! But I suppose Kurtz is just trying to avoid confusion. (It is wrong to allow that there could be empirical disconfirmation of any aspect of a result that has been transcendentally deduced from an impulse to amour-propre.).... What we obviously want is: 3) It makes sense to single out for special study features that make (or seem to make) the US an outlier, among nations, relatively speaking. Culturally, politically, geographically, in terms of not having its industrial base shattered after W.W. II, on and on and on. Studying 3), in a serious way, is incompatible with catechizing students... while depriving them of any comparative basis for judgment.... [This] is only good for doing the one thing Kurtz says he doesn’t want to do: 'ensure that students think a certain way about contemporary events'.... Kurtz is just kicking up partisan dust, obviously.... While penning the present post, I find this post at Powerline (wow, haven’t visited in years!).... As G. K. Chesterton remarks: '"My country, right or wrong", is a thing that no patriot would think of saying except in a desperate case. It is like saying, "My mother, drunk or sober".'" | John Quiggin: "Interestingly, while insistent that the USA is more democratic than any other country, the National Review is also partial to the line that the USA is a republic, not a democracy, which is important when justifying restrictions on the right to vote. As with 'people’s democratic republics', the 'republic' bit is needed to ensure that a truly democratic government represents the genuine Will of the American People, rather than the transient preference of a mere majority (who might, for example, be Democrats)..."

Chico Harlan: America’s coal heartland is in economic freefall--but only the most desperate are fleeing: "For 51 years he’d lived in the same hollow and for two decades he’d performed the same job, mining coal from the underground seams of southern West Virginia. Then, on June 30, Michael Estep was jobless.... What has come since... a job-hunt in a region whose sustaining industry is in an unprecedented freefall.... Miners, modestly educated but accustomed to high pay, are among the hardest group of American workers to retrain. They also tend to challenge one of the tenets of economics logic--that people will go elsewhere to find jobs.... 'This is where you grew up; you can fish, you can hunt. Land is cheap. Chances are your grandfather owned that property', said Ted Boettner, executive director of the West Virginia Center on Budget and Policy. 'So leaving that to go somewhere else where you’ll be stuck in Toledo doesn’t sound very attractive'.... Estep often talks about... the cave-ins he escaped, the safety regulations his bosses never heeded, the neck and back injuries he sustained and never officially claimed, for fear of losing his nonunionized job..."

Monday Smackdown: DeLong Self-Smackdown: The "Greeks"

It is kinda scary that I only knew what seven out of these fifteen were:

It is kinda scary that I only knew what seven out of these fifteen were:

Delta measures the rate of change of option value with respect to changes in the underlying asset's price....

Vega is the derivative of the option value with respect to the volatility of the underlying asset.... The glyph used is the Greek letter nu... [looks] like a Latin vee.... Another possibility is that it is named after Joseph de la Vega, famous for Confusion of Confusions....

Theta... [is] the amount of money per share of the underlying that the option loses in one day [at a constant underlying price]....

Rho... is the derivative of the option value with respect to the risk-free interest rate....

Lambda... is the percentage change in option value per percentage change in the underlying price....

Gamma... is the second derivative of the value function with respect to the underlying price....

Vanna... is a second order derivative of the option value, once to the underlying spot price and once to volatility....

Vomma... is the second derivative of the option value with respect to the volatility... measures the rate of change to vega as volatility changes....

Charm... or delta decay, measures the instantaneous rate of change of delta over the passage of time....

Veta... measures the rate of change in the vega with respect to the passage of time... is the second derivative of the value function; once to volatility and once to time....

Vera... measures the rate of change in rho with respect to volatility... is the second derivative of the value function; once to volatility and once to interest rate....

Color... measures the rate of change of gamma over the passage of time... is a third-order derivative of the option value, twice to underlying asset price and once to time....

Speed... measures the rate of change in Gamma with respect to changes in the underlying... the third derivative of the value function with respect to the underlying spot price....

Ultima... measures the sensitivity of the option vomma with respect to change in volatility... a third-order derivative of the option value to volatility....

Zomma... measures the rate of change of gamma with respect to changes in volatility... the third derivative of the option value, twice to underlying asset price and once to volatility...

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers