J. Bradford DeLong's Blog, page 1104

December 19, 2014

Hoisted from Other People's Archives from 2010: David Blanchflower: Welcome Back to 1930s Britain

David Blanchflower:

Welcome Back to 1930s Britain:

"I am writing this from beautiful Hong Kong...

...having arrived here late at night on a flight from Beijing. It was a pleasant shock to wake this morning to see double-decker buses driving on the left-hand side of the road so far from home.

I came to Beijing for the launch of Bloomberg's Chinese-language service and to sit on a panel to discuss China's role in the new world order. The throng of Chinese tourists at the Forbidden City somehow made it more real to us that China is a country of 1.3 billion people. The highlight of the trip so far was a visit to the Great Wall - something I have always wanted to do. The most comprehensive archaeological survey has recently concluded that the entire Great Wall, with all of its branches, stretches for 5,500 miles. We didn't walk all of it.

As for the awful traffic jams, I understand that the number of cars in Beijing is increasing by 2,000 a day and as a consequence air quality in the city is very bad. Most of them seemed to be German - BMWs, Audis and VWs were everywhere. From our hotel room on the 49th floor, we could only just see the ground because of the dense smog. It did eventually clear on the fourth day of our visit and then we had a great view across the city to the mountains. Next stop Singapore, where they also drive on the left.

The 20 October Spending Review was much as I expected. According to the Chancellor, George Osborne, the country had run out of money and was close to bankruptcy, and the cuts of over £80bn were fair. This was all spin. We were never close to bankruptcy; the country has not run out of money and the cuts are unfair.

The independent Institute for Fiscal Studies quickly showed that the poor would be hit hardest in the years ahead. The Deputy Prime Minister, Nick Clegg, bleated that the institute's comments about fairness were unfair, but nobody takes any notice of what he says any longer. Students in his Sheffield constituency, who were instrumental in getting him elected, are now, because of his flip-flop over tuition fees, apparently gathering signatures calling for the local election to be rerun, in the spirit of Clegg's own proposals to allow MPs accused of financial impropriety to be recalled.

Meanwhile, Britain's new Nobel prizewinner in economics, Chris Pissarides, my old friend and colleague from the LSE, quickly put to rest Osborne's claim that everyone from the Dalai Lama to the Pope supported his mad cull of jobs. 'No one doubts that the Chancellor is taking risks with the recovery,' Pissarides wrote in the Sunday Mirror. 'These risks were not necessary at this point. He could have outlined a clear deficit reduction plan over the next five years, postponing more of the cuts, until re covery became less fragile. The 'sovereign risk' would have been minimal.'

Unsurprisingly, support for the cuts is beginning to crumble as reality bites. A YouGov survey found that 44 per cent of respondents thought the cuts were too harsh, compared to 38 per cent who said they were about right. The majority, 55 per cent, said they agreed that 'the government's plans to cut public spending amount to a desperate gamble with people's livelihoods'.

There is a growing consensus against the cuts among commentators, from Martin Wolf and Samuel Brittan in the Financial Times to Anatole Kaletsky in the Times (none of whom can be called a left-winger), as well as from the first ministers, deputy first ministers and finance ministers of Scotland, Wales and Northern Ireland.

In addition, the Nobel Prize-winning economists Paul Krugman and Joseph Stiglitz have both written stinging critiques of Osborne's dangerous gamble. In the New York Times, Krugman warned: 'The best guess is that Britain in 2011 will look like Britain in 1931, or the United States in 1937, or Japan in 1997. That is, premature fiscal austerity will lead to a renewed economic slump. As always, those who refuse to learn from the past are doomed to repeat it.'

By contrast, Osborne's expectation is that the private sector will step in to create lots of jobs and maintain growth. He hopes, too, that the Chinese will start buying British goods like gangbusters. Yet there is little sign that is going to happen any time soon, as it depends on an appreciation in the yuan. Despite his protestations, the US treasury secretary, Timothy Geithner, made little progress on that front at the recent G20 meeting in South Korea.

There was further bad news for the government from Markit's regional purchasing managers' index (PMI), published after the Spending Review, which showed a sharp deterioration in household finances. Negative sentiment about the 12-month outlook was most prominent among public-sector workers. Markit also found that 'an air of anxiety continued to seep into the private sector'. A decline in consumer spending would be one of Osborne's nightmare scenarios, as that would slam growth.

The GDP figures for the third quarter of 2010, published on 26 October, were much better than expected, with growth at 0.8 per cent, though they suggest the economy has slowed since the second quarter. The figures show that Alistair Darling's strategy was working well, contrary to what the coalition government has claimed. The question now is whether it will be blown off course by Osborne's austerity package. The puzzle remains why this growth figure is much stronger than suggested by the various business surveys, especially the PMI. Given that it is a preliminary estimate, it could still be revised downwards as more data comes in.

It seems likely that the economy will slow further in the fourth quarter, despite being boosted by spending brought forward to avoid the VAT increase to 20 per cent in January, and there is concern that GDP growth will be negative in the first quarter of 2011.

Cameron's claims of a new economic dynamism, but with no money, are just more weasel words. Success or failure will be determined by the data. The Q3 figures are a start. The worry is that it is downhill from here.

Morning Must-Read: David Jolly: Swiss National Bank to Adopt a Negative Interest Rate

David Jolly:

Swiss National Bank to Adopt a Negative Interest Rate:

"Switzerland is introducing a negative interest rate...

...on deposits held by lenders at its central bank, moving to hold down the value of the Swiss franc amid turmoil in global currency markets and expectations that deflation is at hand. The Swiss National Bank said in a statement from Zurich on Thursday that it would begin charging banks 0.25 percent interest on bank deposits exceeding a certain threshold, effective Jan. 22...

December 18, 2014

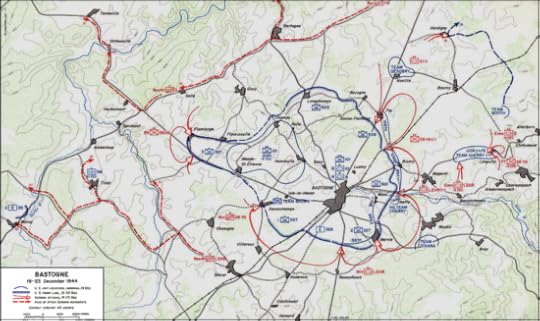

Liveblogging World War II: December 19, 1944: Siege of Bastogne

Wikipedia:

Wikipedia:

Siege of Bastogne:

The 101st [Airborne Division] left Camp Mourmelon on the afternoon of 18 December, with the order of march the division artillery, division trains, 501st Parachute Infantry Regiment (PIR), 506th PIR, 502nd PIR, and 327th Glider Infantry. Much of the convoy was conducted at night in drizzle and sleet, using headlights despite threat of air attack to speed the movement, and at one point the combined column stretched from Bouillon, Belgium, back to Reims.

The 101st Airborne was originally supposed to go to Werbomont on the northern shoulder but was rerouted to Bastogne, located 107 mi (172 km) away on a 1,463 ft (446 m) high plateau, while the 82nd Airborne, because it was able to leave sooner, went to Werbomont to block the critical advance of Kampfgruppe Peiper. The 705th Tank Destroyer Battalion—in reserve 60 mi (97 km) to the north—was ordered to Bastogne to provide anti-tank support to the armor-less 101st Airborne on the 18th and arrived late the next evening. The first elements of the 501st PIR entered the division assembly area 4 mi (6.4 km) west of Bastogne shortly after midnight of 19 December, and by 09:00 the entire division had arrived.

Gen. McAuliffe sent the 501st PIR southeast through Bastogne at 06:00 to develop the situation. By 09:00, it had advanced and deployed on either side of the highway to Magéret and Longvilly, where the Panzer-Lehr-Division was engaged in an all-day action to destroy the armor-infantry combat teams assigned to slow the German advance. The 506th followed shortly thereafter, its 1st Battalion was sent to Noville to re-enforce Maj Desobry's team from the 10th Armored CCB while the other two battalions were ordered to act as reserves north of Bastogne. The 502nd PIR marched north and northwest to establish a line from Champs east to cogne, while the 327th GIR, newly arrived, protected the division service area southwest of Bastogne until German intentions could be deciphered.

On 19–20 December, the 1st Battalion of the 506th PIR was ordered to support Team Desobry (Maj. William R. Desobry), a battalion-sized tank-infantry task force of the 10th Armored Division assigned to defend Noville located north-northeast of both Foy and of Bastogne just 4.36 mi (7.02 km) away. With just four M18 tank destroyers of the 705th Tank Destroyer Battalion to assist, the paratroopers attacked units of the 2 Panzerdivision, whose mission was to proceed by secondary roads via Monaville (just northwest of Bastogne) to seize a key highway and capture, among other objectives, fuel dumps — for the lack of which the overall German counter-offensive faltered and failed. Worried about the threat to its left flank in Bastogne, it organized a major combined arms attack to seize Noville. Team Desobry's high speed highway journey to reach the blocking position is one of the few documented cases in which the top speed of the M18 Hellcat (55 mph (89 km/h)) was actually used to get ahead of an enemy force as envisioned by its specifications.

The attack of 1st Battalion and the M18 Hellcat tank destroyers of the 705th TD Battalion together destroyed at least 30 German tanks and inflicted 500-1,000 casualties on the attacking forces in what amounted to a spoiling attack. The 3rd Battalion was ordered forward from a reserve position north of Bastogne to ease the pressure on 1st Battalion by occupying a supporting position in Foy to the south.

The heavy losses inflicted by the tank-destroyers induced the German commander into believing the village was being held by a much stronger force and he recoiled from further attacks on the village, committing a strategic error while seeking tactical advantage — significantly delaying the German advance and setting the stage for the Siege of Bastogne just to the south. This delay also gave the 101st Airborne Division enough time to organize defenses around Bastogne. After two days, the 2nd Panzer Division finally continued on its original mission to the Meuse River. As a consequence of its involvement at Bastogne, and its failure to dislodge the airborne forces, the column ultimately ran out of fuel at Celles, where it was destroyed by the U.S. 2nd Armored Division and the British 29th Armoured Brigade.

By the time the 1st Battalion pulled out of Noville on the 20th, the village of Foy half-way to Bastogne center had been captured from the 3rd Battalion by a separate attack, forcing the 1st Battalion to then fight its way through Foy. By the time 1st Battalion made it to the safety of American lines, it had lost 13 officers and 199 enlisted men, out of about 600 troops, and was assigned as the division reserve. Team Desobry lost a quarter of its troops and was reduced to just four medium tanks when it passed through the lines of 3rd Battalion...

Afternoon Must-Read: Alan Blinder: ‘What’s the Matter with Economics?’

As I see it, the real point at issue here is that Alan Blinder on the one hand and Jeff Madrick and Arnold Packer on the other have very different ideas of what the "mainstream" of modern American economics is.

Alan Blinder believes that the "mainstream" is his brand of economics--MIT-Princeton-Berkeley. That economics is, in my view, very sensible about both market failure and government failure, and somewhat sensible (we here at Berkeley being most so) about long-run intellectual strategy. We also have--as the past ten years have taught us--remarkably little influence on policy, either macroprudential or macroeconomic, considering how smart and right we are.

Jeff Madrick and Arnold Packer, on the other hand, believe that the "mainstream" is Chicago-Minnesota-Stanford economics, which is not sensible about market failure, extremely wrongheaded about long-run intellectual strategy, and distressingly influential on issues of economic policy, especially considering how wrong and unwilling to do their proper homework they are.

I guess the next twenty years will show whether we or they were the true mainstream today...

Alan Blinder:

‘What’s the Matter with Economics?’: An Exchange:

According to both Jeff Madrick and Arnie Packer...

...I claim ‘that except for some right-wingers outside the ‘mainstream’…little is the matter’ with economics.... But it’s not true. I think there is lots wrong.... My review explicitly agreed with Madrick that (a) ideological predispositions infect economists’ conclusions far too much; (b) economics has drifted to the right... and (c) some economists got carried away by the allure of the efficient markets hypothesis.

I also added a few... we economists have failed to convey even the most basic economic principles to the public; and that some of our students turned Adam Smith’s invisible hand into Gordon Gekko’s ‘greed is good.’... the propensity to elevate modeling technique over substance... [and others that] (a) are not germane to policy, (b) are only slightly related to Madrick’s complaints, and (c) are very much ‘inside baseball’ stuff—and hence boring to readers of this Review....

Both Madrick and Queen Elizabeth are right that hardly any economists saw the financial crisis and the ensuing Great Recession coming... not realizing how large the subprime mortgage market had grown... how dodgy the mortgages packaged into mortgage-backed securities were... the crazy quilt of exotic derivatives... not believing that house prices would fall as far as they did.... However, faulty macroeconomic management was not among the causes of the horrors. That... does not exonerate the Fed, whose supervisory and regulatory performance was dreadful. My point is that the Great Moderation... ended because of... an overleveraged, overly complex, and underregulated financial system.

Yes, underregulated—which brings me back to the invisible hand. I thought I had laid this issue to rest by agreeing with Madrick that ‘the Invisible Hand is an approximation, usually not applicable in the real world without significant modification’... [like] antitrust laws, consumer protection, fair labor standards, health and safety regulation, financial regulation, and much more.... Yet Madrick still insists that ‘economists rely on a fairly pure version of the invisible hand most of the time.’ Not us mainstreamers....

Packer’s letter begins, and Madrick’s concludes, by disputing my claim that economists’ influence on policy decisions is greatly exaggerated.... [But] ven today, seventy-eight years after Keynes taught the world how to end recessions, many politicians in many countries refuse to follow his (now very mainstream) advice. That’s not a good show for what Packer calls ‘a powerful force in policy circles.’

Afternoon Must-Read: Ed Luce: Too Big to Resist: Wall Street’s Comeback

Edward Luce:

Too big to resist: Wall Street’s comeback - FT.com:

"It was right to let Citigroup stay in business in 2009...

...even though it was effectively bankrupt. But should it be so much larger than it was six years ago? Is it healthy that Citi lobbyists wrote the clause, almost word for word, that was tucked into last week’s spending bill?

The question answers itself. It also points to two glaring deficiencies that will come back to haunt Washington when the next crisis strikes.... There has been no improvement in Wall Street’s culture--or in Washington’s revolving door habits. Bankers dismiss Elizabeth Warren, the Democratic senator from Massachusetts, as a populist. Perhaps they should listen to Bill Dudley, president of the New York Federal Reserve and a former Goldman Sachs partner....

At some point there will be another Wall Street crisis. It could be a decade away, or maybe next year. Markets run in psychological cycles in which fear gives way to greed and then hangover. Greed is once more in the ascendant. No law can stop the next bomb from detonating. No regulator can foresee it. But they could do much more to be ready for it when it comes. Here Mr Geithner’s moral fundamentalists have a point...

Noted for Your Afternoon Procrastination for December 18, 2014

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

I Hate Those Blurred Lines! Monetary Policy and Fiscal Policy: Daily Focus

This Time, It Is Not Different: The Persistent Concerns of Financial Macroeconomics

Paul Krugman: The Limits of Purely Monetary Policies

Itzhak Gilboa et al.: Economic Models as Analogies

Brett Norman: ACA Employer Mandate: Not as Bitter in Better Economy

Nick Bunker:

Wealth inequality and the marginal propensity to consume

Plus:

Things to Read on the Afternoon of December 18, 2014

Must- and Shall-Reads:

Jared Bernstein:

"Why this obsession with raising at all in the near term?.... Look at the yield of the 10-year treasury... 2.05%... low inflation expectations... strong demand for a safe harbor... oil. Look at 'Strips'... market actors are willing to bet real money that inflation will be low for years to come..."

Stephen Cecchetti:

"Regulators forced up capital requirements... triggering fears in the banking industry of dire effects... [but] the capital increases had little impact on anything but bank profitability....Perhaps the requirements should be raised further..."

Greg Ip:

The Federal Reserve Meets: The Best of All Worlds

http://www.economist.com/blogs/freeexchange/2014/12/federal-reserve-meets

Jim Tankersley:

"There are two entrepreneurship problems... both are bad for the middle class. The country doesn’t have enough of the kind of entrepreneurship that creates jobs, and it has too much of the kind that boosts rich executives at the expense of everyone else..."

http://www.washingtonpost.com/sf/business/2014/12/17/the-great-start-up-slowdown/

Leighton Ku et al.:

The Economic and Employment Costs of Not Expanding Medicaid in North Carolina: A County-Level Analysis

Mike the Mad Biologist:

How Republican Craziness Is Undermining the South’s Massive Keynesian Stimulus

Tim Duy: Quick FOMC Recap

Brett Norman: ACA Employer Mandate: Not as Bitter in Better Economy

Itzhak Gilboa et al.: Economic Models as Analogies

Paul Krugman: The Limits of Purely Monetary Policies

Lynn Yarris:

Back to the Future with Roman Architectural Concrete

And Over Here:

Buck v. Bell: Live from The Roasterie

Liveblogging World War II: December 18, 1944: St. Vith

Hoisted from Other People's Archives: Perry Anderson's (1976) Hanging Judgment on "Western Marxism"

This Time, It Is Not Different: The Persistent Concerns of Financial Macroeconomics

Over at Equitable Growth: I Hate Those Blurred Lines! Monetary Policy and Fiscal Policy: Daily Focus

Tim Duy:

Quick FOMC Recap:

"In normal times the Federal Reserve moves slowly and methodically. Policymakers were apparently concerned that removal of 'considerable time' by itself would prove to be disruptive. Instead, they opted to both remove it and retain it: "Based on its current assessment, the Committee judges that it can be patient.... The Committee sees this guidance as consistent with its previous statement that it likely will be appropriate to maintain the 0 to 1/4 percent target range for the federal funds rate for a considerable time following the end of its asset purchase program in October....' If you thought they would drop 'considerable time,' they did. If you thought they would retain 'considerable time,' they did. Everyone's a winner.... The April meeting is still on the table [for a rate increase], although I still suspect that is too early. Yellen... dismissed falling market-based inflation expectations as reflecting inflation 'compensation' rather than expectations... dismissed the disinflationary impulse from oil... indicated that inflation did not need to return to target prior to raising rates, only that the Fed needed to be confident it would continue to trend toward target... unconcerned about the risk of contagion either via Russia or high yield energy debt.... The Federal Reserve... have their eyes set firmly on June... see the accelerating economy and combine that with, as Yellen mentioned, the long lags of monetary policy.... Believe it or not, the Fed is seriously looking at mid-2015 to begin the normalization process. And there is no guarantee that it will be a predictable series of modest rate hikes. As much as you think of the possibility that the hike is delayed, think also of the possibility of 1994."

Brett Norman:

ACA Employer Mandate: Not as Bitter in Better Economy:

"Contrary to the once dire predictions of health law critics and the business community, employers are not dropping coverage en masse and steering workers into the federally subsidized plans on the new Obamacare exchanges. In advance of the mandate finally kicking in, many are already increasing the number of employees offered coverage to ensure compliance. ‘The economic reality has changed,’ said Paul Fronstin, a senior associate at the Employee Benefit Resource Institute. Unemployment’s below 6 percent, down from the double-digit days in which the mandate was first debated. ‘Employers are remembering why they offered benefits in the first place--to compete for workers.’ The mandate is the Affordable Care Act’s last big piece of coverage expansion to be put into place. The Obama administration twice delayed it in the face of furious lobbying by the business community and repeated votes by the House to kill it.... ‘As we’ve gone along, I think there are other factors that have come into play – employee morale, retention of managers,’ said Michelle Neblett, director of labor and workforce policy for the National Restaurant Association. ‘I don’t hear people talking about dropping coverage, I hear about people figuring out how to afford to offer coverage.’..."

Itzhak Gilboa et al.:

Economic Models as Analogies:

"Why [do] economists analyze models whose assumptions are known to be false[?]... Economists feel that they learn a great deal from such exercises.... Economists often analyze models that are 'theoretical cases', which help understand economic problems by drawing analogies between the model and the problem.... Models... data, experimental results, and other sources of knowledge... all provide cases to which a given problem can be compared. We offer complexity arguments that explain why case-based reasoning may sometimes be the method of choice and why economists prefer simple cases..."

Paul Krugman:

The Limits of Purely Monetary Policies:

"I understand where Evans-Pritchard is coming from, because I’ve been there.... I had my road-to-Damascus moment... in 1998.... Back in 1998 I... believed that the Bank of Japan could surely end deflation if it really tried. IS-LM said not, but I was sure that if you really worked it through carefully you could show... doubling the monetary base will always raise prices even if you’re at the zero lower bound.... (By the way, I screwed up the aside on fiscal policy. In that model, the multiplier is one.) To my own surprise, what the model actually said was that when you’re at the zero lower bound, the size of the current money supply does not matter at all.... Doubling the current money supply and all future money supplies will double prices. If the short-term interest rate is currently zero, changing the current money supply without changing future [money] supplies... matters not at all. And as a result, monetary traction is far from obvious. Central banks can change the monetary base now, but can they commit not to undo the expansion in the future, when inflation rises? Not obviously.... But, asks Evans-Pritchard, what if the central bank simply gives households money? Well, that is, as he notes, really fiscal policy.... I’m pretty sure that neither the Fed nor the Bank of England has the legal right to just give money away as opposed to lending it out; if I’m wrong about this, put me down for $10 million, OK?..."

Lynn Yarris:

Back to the Future with Roman Architectural Concrete:

"The concrete walls of Trajan’s Markets in Rome have stood the test of time and the elements for nearly 2,000 years.... A crystalline binding hydrate prevents microcracks from propagating.... The mortars that bind the concrete composites used to construct the structures of Imperial Rome are of keen scientific interest not just because of their unmatched resilience and durability, but also for the environmental advantages they offer.... Roman architectural mortar... is a mixture of about 85-percent (by volume) volcanic ash, fresh water, and lime, which is calcined at much lower temperature than Portland cement..."

Should Be Aware of:

Liz Seccuro:

I Was Gang Raped at a U-VA Frat 30 Years Ago, and No One Did Anything

Michael Schiavo**: If you want a government that’s gonna intrude... force their personal views on you... Jeb Bush is your man..." http://thinkprogress.org/election/2014/12/17/3604615/michael-schiavo-jeb-bush/

XPostFactoid:

It's the wages, stupid | Piketty: U.S. sold its middle class birthright for a mess of Reaganite pottage | Is the tax code the best route to attacking wage stagnation?

Paul Lombardo (2008): Three Generations, No Imbeciles: Eugenics, the Supreme Court, and Buck v. Bell http://www.amazon.com/gp/product/0801898242/ref=as_li_tl?ie=UTF8&camp=1789&creative=9325&creativeASIN=0801898242&linkCode=as2&tag=brde-20&linkId=TJ3XP7ZYQDBJTDLH

Alex Strick:

Note-Taking Jujitsu, Or How I Make Sense Of What I Read--A Different Place

http://www.alexstrick.com/a-different-place/2014/10/note-taking-jujitsu-or-how-i-make-sense-of-what-i-read

Francis Wilkinson:

The CIA Torture Report and George Washington's Waterboard

Daniel Larison:

Jeb Bush and Our Bankrupt Cuba Policy:

"Jeb Bush is reconfirming that he is just as conventional and ideological as any other hawk in the GOP... not only reaffirmed his support for the U.S. trade embargo, but said America should consider strengthening it. It’s no great surprise that a Florida Republican is still committed to continuing a failed Cuba policy, but it seems worth noting because it is so completely at odds with his normal self-presentation as a pragmatist.... That tells us much more about the kind of foreign policy that Jeb Bush would conduct if he were somehow to become president than anything else he said in his speech yesterday. When faced with policy failure, he urges more of the same failed policy, and faults those that are making any attempt to change the policy for the better. We already saw where this tendency to persist in foreign policy error got the country under his brother. There is no need to risk repeating that experience."

John Abraham:

2014 will be the hottest year on record :

"I predict the annual temperature anomaly will be 0.674°C. This beats the prior record by 0.024°C. That is a big margin in terms of global temperatures... [and] this year wasn’t supposed to be particularly warm... [it] didn’t even have an El Niño.... Among the experts, there is little fixation on the record. On the other hand, there was little fixation on the so-called ‘halt’ to global warming that the climate-science deniers have been trumpeting for the past few years.... The Earth is warming. The oceans are warming, the land is warming, the atmosphere is warming, the ice is melting, and sea level is rising.... Climate science deniers have had a bad year.... The so-called ‘halt’ to global warming was never true.... Of course, the science deniers will look for something new to try to cast doubt on the concept of global warming. Whatever they pick will be shown to be wrong. It always is. But perhaps we can use 2014 as a learning opportunity. Let’s hope no one is fooled next time when fanciful claims of the demise of climate change are made."

Nick Murray:

The First Casualty of a Bear Market:

"$6,200,000,000. Yes, that’s right, it’s six billion two hundred million dollars. A very large sum of money, wouldn’t you say? Now what, you ask, does it represent? It is roughly how much Warren Buffett’s personal shareholdings in his Berkshire Hathaway, Inc. declined in value between July 17 and August 31, 1998. And now for the six billion dollar question. During those forty-five days, how much money did Warren Buffett lose in the stock market? The answer is, of course, that he didn’t lose anything. Why? That’s simple: he didn’t sell..."

Kevin Drum:

Torture Is Not a Hard Concept | Mother Jones:

"Like all of us, I've had to spend the past several days listening to a procession of stony-faced men—some of them defiant, others obviously nervous—grimly trying to defend the indefensible, and I'm not sure how much more I can take. How hard is this, after all? Following 9/11, we created an extensive and cold-blooded program designed to inflict severe pain on prisoners in order to break them and get them to talk. That's torture. It always has been, and even a ten-year-old recognizes that legalistic rationalizations about enemy combatants, 'serious' physical injury, and organ failure are transparent sophistry. Of course we inflicted severe pain. Moderate pain would hardly induce anyone to talk, would it? And taking care not to leave permanent marks doesn't mean it's not torture, it just means you're trying to make sure you don't get caught. Christ almighty. Either you think that state-sanctioned torture of prisoners is beyond the pale for a civilized country or you don't. No cavils. No resorts to textual parsing. And no exceptions for 'we were scared.' This isn't a gray area. You can choose to stand with history's torturers or you can choose to stand with human decency. Pick a side."

Afternoon Must-Read: Tim Duy: Quick FOMC Recap

Tim Duy:

Quick FOMC Recap:

"In normal times the Federal Reserve moves slowly and methodically...

...Policymakers were apparently concerned that removal of 'considerable time' by itself would prove to be disruptive. Instead, they opted to both remove it and retain it: 'Based on its current assessment, the Committee judges that it can be patient.... The Committee sees this guidance as consistent with its previous statement that it likely will be appropriate to maintain the 0 to 1/4 percent target range for the federal funds rate for a considerable time following the end of its asset purchase program in October....'

If you thought they would drop 'considerable time,' they did. If you thought they would retain 'considerable time,' they did. Everyone's a winner.... The April meeting is still on the table [for a rate increase], although I still suspect that is too early.

Yellen... dismissed falling market-based inflation expectations as reflecting inflation 'compensation' rather than expectations... dismissed the disinflationary impulse from oil... indicated that inflation did not need to return to target prior to raising rates, only that the Fed needed to be confident it would continue to trend toward target... unconcerned about the risk of contagion either via Russia or high yield energy debt.... The Federal Reserve... have their eyes set firmly on June... see the accelerating economy and combine that with, as Yellen mentioned, the long lags of monetary policy....

Believe it or not, the Fed is seriously looking at mid-2015 to begin the normalization process. And there is no guarantee that it will be a predictable series of modest rate hikes. As much as you think of the possibility that the hike is delayed, think also of the possibility of 1994.

Buck v. Bell: Live from The Roasterie

Rather far, I must say, from "to secure these rights governments are instituted..."

Rather far, I must say, from "to secure these rights governments are instituted..."

Oliver Wendell Holmes:

We have seen more than once that the public welfare may call upon the best citizens [i.e., young healthy men] for their lives [in war via the draft]. It would be strange if it could not call upon those who already sap the strength of the State for these lesser sacrifices, often not felt to be such by those concerned, in order to prevent our being swamped with incompetence...

Paul Lombardo (2008): Three Generations, No Imbeciles: Eugenics, the Supreme Court, and Buck v. Bell http://www.amazon.com/gp/product/0801898242/ref=as_li_tl?ie=UTF8&camp=1789&creative=9325&creativeASIN=0801898242&linkCode=as2&tag=brde-20&linkId=TJ3XP7ZYQDBJTDLH

SUPREME COURT OF THE UNITED STATES. No. 292. - October Term, 1926.

Carrie Buck, by R.G. Shelton, her Guardian and Next Friend, Plaintiff in Error, vs. J.H. Bell, Superintendent of the State Colony for Epileptics and Feeble Minded. In Error to the Supreme Court of Appeals of the State of Virginia. May 2, 1927.

Mr. Justice Holmes delivered the opinion of the Court:

This is a writ of error to review a judgment of the Supreme Court of Appeals of the State of Virginia, affirming a judgment of the Circuit Court of Amherst County, by which the defendant in error, the superintendent of the State Colony for Epileptics and Feeble Minded, was ordered to perform the operation of salpingectomy upon Carrie Buck, the plaintiff in error, for the purpose of making her sterile. 143 Va. 310. The case comes here upon the contention that the statute authorizing the judgment is void under the Fourteenth Amendment as denying the plaintiff in error due process of law and equal protection of the laws.

Carrie Buck is a feeble minded white woman who was committed to the State Colony above mentioned in due form. She is the daughter of a feeble minded mother in the same institution, and the mother of an illegitimate feeble minded child. She was eighteen years old at the time of the trial of her case in the Circuit Court, in the latter part of 1924.

An Act of Virginia approved March 20, 1924, recites that the health of the patient and the welfare of society may be promoted in certain cases by the sterilization of mental defectives, under careful safeguard, &c.; that the sterilization may be effected in males by vasectomy and in females by salpingectomy, without serious pain or substantial danger to life; that the Commonwealth is supporting in various institutions many defective persons who if now discharged would become a menace but if incapable of procreating might be discharged with safety and become self-supporting with benefit to themselves and to society; and that experience has shown that heredity plays an important part in the transmission of insanity, imbecility, &c.

The statute then enacts that whenever the superintendent of certain institutions including the above named State Colony shall be of opinion that it is for the best interests of the patients and of society that an inmate under his care should be sexually sterilized, he may have the operation performed upon any patient afflicted with hereditary forms of insanity, imbecility, &c., on complying with the very careful provisions by which the act protects the patients from possible abuse.

The superintendent first presents a petition to the special board of directors of his hospital or colony, stating the fact and the grounds for his opinion, verified by affadavit. Notice of the petition and of the time and place of the hearing in the institution is to be served upon the inmate, and also upon his guardian, and if there is no guardian the superintendent is to apply to the Circuit Court of the County to appoint one. If the inmate is a minor notice also is to be given to his parents if any with a copy of the petition. The board is to see to it that the inmate may attend the hearings if desired by him or his guardian. The evidence is all to be reduced to writing, and after the board has made its order for or against the operation, the superintendent, or the inmate, or the guardian, may appeal to the Circuit Court of the County. The Circuit Court may consider the record of the board and the evidence before it and such other admissible evidence as may be offered, and may affirm, revise, or reverse the order of the board and enter such order as it deems just. Finally any party may apply to the Supreme Court of Appeals, which, if it grants the appeal, is to hear the case upon the record of the trial in the Circuit Court and may enter such order as it thinks the Circuit Court should have entered.

There can be no doubt that so far as procedure is concerned the rights of the patient are most carefully considered, and as every step in this case was taken in scrupulous compliance with the statute and after months of observation, there is no doubt that in that respect the plaintiff in error has had due process of law.

The attack is not upon the procedure but upon the substantive law. It seems to be contended that in no circumstances could such an order be justified. It certainly is contended that the order cannot be justified upon the existing grounds. The judgment finds the facts that have been recited and that Carrie Buck

is the probable potential parent of socially inadequate offspring, likewise afflicted, that she may be sexually sterilized without detriment to her general health and that her welfare and that of society will be promoted by her sterilization...

and thereupon make the order. In view of the general declarations of the legislature and the specific findings of the Court obviously we cannot say as matter of law that the grounds do not exist, and if they exist they justify the result.

We have seen more than once that the public welfare may call upon the best citizens for their lives. It would be strange if it could not call upon those who already sap the strength of the State for these lesser sacrifices, often not felt to be such by those concerned, in order to prevent our being swamped with incompetence.

It is better for all the world, if instead of waiting to execute degenerate offspring for crime, or to let them starve for their imbecility, society can prevent those who are manifestly unfit from continuing their kind. The principle that sustains compulsory vaccination is broad enough to cover cutting the Fallopian tubes. Jacobson v. Massachusetts, 197 U.S. 11.

Three generations of imbeciles are enough.

But, it is said, however it might be if this reasoning were applied generally, it fails when it is confined to the small number who are in the institutions named and is not applied to the multitudes outside. It is the usual last resort of constitutional arguments to point out shortcomings of this sort.

But the answer is that law does all that is needed when it does all that it can, indicates a policy, applies it to all within the lines, and seeks to bring within the lines all similarly situated so far and so fast as its means allow. Of course so far as the operations enable those who otherwise must be kept confined to be returned to the world, and thus open the asylum to others, the equality aimed at will be more nearly reached.

Judgment affirmed.

Mr. Justice Butler dissents.

Lunchtime Must-Read: Brett Norman: ACA Employer Mandate: Not as Bitter in Better Economy

Brett Norman:

ACA Employer Mandate: Not as Bitter in Better Economy:

"Contrary to the once dire predictions...

...of health law critics and the business community, employers are not dropping coverage en masse and steering workers into the federally subsidized plans on the new Obamacare exchanges. In advance of the mandate finally kicking in, many are already increasing the number of employees offered coverage to ensure compliance. ‘The economic reality has changed,’ said Paul Fronstin, a senior associate at the Employee Benefit Resource Institute. Unemployment’s below 6 percent, down from the double-digit days in which the mandate was first debated. ‘Employers are remembering why they offered benefits in the first place--to compete for workers.’

The mandate is the Affordable Care Act’s last big piece of coverage expansion to be put into place. The Obama administration twice delayed it in the face of furious lobbying by the business community and repeated votes by the House to kill it.... ‘As we’ve gone along, I think there are other factors that have come into play – employee morale, retention of managers,’ said Michelle Neblett, director of labor and workforce policy for the National Restaurant Association. ‘I don’t hear people talking about dropping coverage, I hear about people figuring out how to afford to offer coverage.’...

December 17, 2014

Nighttime Must Read: Itzhak Gilboa et al.: Economic Models as Analogies

Itzhak Gilboa et al.:

Economic Models as Analogies:

"Why [do] economists analyze models...

...whose assumptions are known to be false[?]... Economists feel that they learn a great deal from such exercises.... Economists often analyze models that are 'theoretical cases', which help understand economic problems by drawing analogies between the model and the problem.... Models... data, experimental results, and other sources of knowledge... all provide cases to which a given problem can be compared. We offer complexity arguments that explain why case-based reasoning may sometimes be the method of choice and why economists prefer simple cases...

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers