J. Bradford DeLong's Blog, page 1102

December 26, 2014

Morning Must-Read: Martin Feldstein: The Fed’s Needless Flirtation With Danger

Martin Feldstein:

The Fed’s Needless Flirtation With Danger:

"The risks involved in... quantitative easing...

...[which] reduced long-term interest rates and raised... equities and real estate... caused lenders and investors to reach for yield... taking greater risks through lower-quality loans... and accepting narrower spreads.... The risks... were unnecessary. Well-designed tax policies... an enlarged investment tax credit... converting the deduction for business interest to a credit... allowing deductions for dividends on common or preferred equity.... The resulting revenue loss could be balanced by a temporary rise in the corporate income-tax rate... taxing more highly the return on old capital while stimulating new investment.... A direct tax incentive to home builders.... The... deduction of mortgage interest... extended to non-itemizers... converted to an optional tax-credit.... Quantitative easing increase[s] the risk of financial instability.... Increased government spending and reduced tax revenue increase budget deficits and national debt.... Changes in the tax structure could stimulate spending... without raising... deficits.

Why It Is Likely to Be Really Bad for Bloomberg as a Journalistic Enterprise to Have John Micklethwait at Its Head: Hoisted from Other People's Archives

John Holbo (2005):

Intelligent Design:

"A few days ago I finished The Right Nation, by Micklethwait and Wooldridge...

...a pair of 'Economist' writers. Perhaps you recall their June 21, 2005 WSJ op-ed, ‘Cheer Up Conservatives, You’re Still Winning,’ in which they declare ‘the right has walloped the left in the war of ideas.’ Ahem:

One of the reasons the GOP manages to contain Southern theocrats as well as Western libertarians is that it encourages arguments rather than suppressing them. Go to a meeting of young conservatives in Washington and the atmosphere crackles with ideas, much as it did in London in the heyday of the Thatcher revolution. The Democrats barely know what a debate is.

Well, the book is not such a polemical and high-handed affair as that portends. Mostly. It’s really--like a long 'Economist' article.

At many points it has that signature ‘it’s a golden age but there are storm clouds on the horizon/it’s cloudy but there’s a silver-lining’ rhythm. It’s worth reading, like an ‘Economist’ article, but affords many irritations to the non-conservative reader:

In this exercise, we may have many weaknesses, but we would like to claim one strength: we are not members of either of the two great political tribes that dominate the American commentariat. Throughout this book, we have tried to avoid using any of the jibes that are commonplace on both sides of the debate (p. 24).

This is mostly true, but the authors still enjoy toying with the idea that America is a 50/50 nation, half of which isn’t really American, but more… European. They equivocate between using ‘right nation’ as a tag for America, and a tag for half of America:

To people who wonder 'What sort of place is Texas?' the simplest answer is that it is America exponentiated. Texas is America’s America, or at least conservative America’s America (p. 134).

Lots of little nudges like that. Also: American conservatism is given credit for resisting the emergence of extreme forms of itself, but the fact that the American left stayed moderate is credited to the constraining effects of the ‘conservative’ American Constitution. The authors basically have a Louis Hartz ‘liberal consensus’ argument. Do a change-all ‘liberal’ to ‘conservative’. Which is really a substitution they ought to think through a bit harder. Since they cite much of the same evidence Hartz cited for his thesis way back when.

All in all, they don’t belly up to the bar and drink the conservative kool-aid, but they do take many a debonair, pinky-raised sip. Then, on p. 159-60 these Brits do some Texas-style kool-aid bong hits. (PZ Meyers is going to go spare! He’ll throw a wobbly! as Nobby Nobbs might say):

Discovery is also the leading proponent of an increasingly influential idea on the Right: 'intelligent design.' The intelligent design movement, according to Chapman [Bruce Chapman, Discovery founder], holds that:

certain features of the universe and of living things are best explained by an intelligent cause, not as a part of an undirected process, such as natural selection.

In other words, Darwinian theory does not wholly explain either the origin of life or the development of species. Chapman, a committed Christian, first got interested in the subject because of worries about free speech: in 1995 he rallied to the defense of a California science professor who was threatened with the sack merely for arguing that evolution does not explain everything. [Anyone know the real details of this case?] Most orthodox scientists dismiss intelligent design as upmarket creationism. But books and papers spew out of Discovery’s Center for Science and Culture, and Chapman points to several victories in his battle against what he calls the neo-Darwinists

…

The intelligent design movement is an example of the Right’s growing willingness to do battle with what it regards as the liberal 'science establishment' on its own turf, using scientific research of its own. Right-wing think tanks have attacked scientific orthodoxy on stem cells, arguing that there is no need to harvest embryos, as it should be possible to extract stem cells from adults. They have also pored over the data on global warming. Bjorn Lomborg, the author of The Skeptical Environmentalist (2001), an indictment of green overstatement, is a cult hero in places like the AEI and Discovery.

There are also battles brewing on animal rights, euthanasia and the scientific origins of homosexuality [science causes gays?] So far the science establishment has given little ground to the conservative upstarts, particularly on intelligent design. In Ohio, some scientists equatted supporters of intelligent design with the Taliban. But the Right is clearly extending the battle of ideas into new territories, just as Milton Friedman and others did in economics forty years ago.

Puts the ‘crack’ back in ‘crackle of ideas’, you might say.

This encapsulates the main problem with the whole ‘conservatives are winning the battle of ideas’ thesis/meme. There isn’t any intellectual quality control in the strategic assessment. Of course the authors would reply that it is very hard for anyone to assess whether the quality of left or right ideas is better absolutely. Leftists say the left is better, the right says the right – obviously, otherwise the sides would switch. But, still: if you are going to count any effective rhetoric as ‘winning the war of ideas’ – if you don’t even make any attempt to test, prima facie, for intellectual seriousness and credibility – then you ought to just ‘fess up that you mean ‘winning the culture war’, which sounds less intellectually high-toned.

In What’s the Matter with Kansas?, Thomas Frank has a description of the Second Annual Darwin, Design, and Democracy Symposium, at Rockhurst College , Kansas City.

Modeled after an academic conference, the keynote speeches and panel discussions all aimed to publicize the much ballyhooed theory of Intelligent Design. The inevitable Jack Cashill [see below] kicked things off with a denunciation of Hollywood for accepting a God-free vision of the universe. He kept things lively by showing clips from sinful films supposedly influenced by the doctrines of Darwin, such as Hud and High Plains Drifter.

Cashill was followed, however, by an Intelligent Design theorist who lectured monotonously on the faked evidence supposedly used by evolutionists, and heads began to nod. To everyone’s relief, the speaker finally yielded the stage to the Mutations, 'three fine Christian ladies' in pink dresses who strutted and whirled like an early-sixties girl group and proceed to sing 'Overwhelming Evidence,' a ditty set to the pulsing beat of 'Ain’t No Mountain High Enough.' Comically assuming the voice of the arrogant science establishment, the women pretend-derided the audience, singing that 'the truth is what we say' and that, as professional scientists, 'we don’t have to listen to you!' The audience had plainly been bored by the preceding recitation of science’s errors, but this lighthearted bit of presecuto-tainment hit exactly the right note, and sent everyone home with a smile on his or her face. (p. 214)

Ah, if only the Democrats remembered what a debate is: namely, an expression of populist ressentiment at perceived cultural elites. It really is very shameful that these British Tories, who I don’t suppose believe in ID, find it sufficiently amusing that liberalism is taking kidney shots from these people that they are willing to check their intellectual consciences at the door, for the sake of ‘enemy of my enemy is my friend’. (Who doubts this is the reason why Southern theocrats and economic libertarians are under the same tent? Who thinks they are really staying for the rigorous arguments, across their respective positions?)

Oh, and Cashill – the guy Frank mentions – is a Kansas City publisher and pundit; and author (in 1996) of a novel, 2006. [You can read the first five pages at Amazon.] Here is Frank’s summary:

America is enduring the second term of the Al Gore presidency and the common people lie prostrate beneath the iron heel of liberalism. The old-school Populists were fond of a novel called Caesar’s Column, a vision of a hideous future in which nineteenth-century capitalism had expanded without restriction. And Cashill gives us the contermporary equivalent: a vision of a hideous future in which all the elements of the conservative persecutation fantasy have flowered just as grotesquely.

The government has forced Rush Limbaugh off the airwaves, Supreme Court justice Antonin Scalia has been assassinated, and SUVs are no longer being manufactured. Runaway trial lawyers have destroyed the tobacco industry, and the wineries are next. Laws against 'hate crimes' are being used to punish ordinary speech, motorcycle riders have to wear helmets, as do Amish factory workers, and jack-booted federal thugs dispense stiff jail sentences to patriotic Americans. It’s what the world would look like if some evil sorcerer made reality conform to the op-ed apge of the Wall Street Journal.

So anyhow, Cashill’s protagonists – a bunch of Latin-mass Catholics, Indians, and gun fanciers, all led by a sportswriter – form a militia, stage a heroic rebellion, and capture several of the nations most ee-vil liberals. One of these soulless creatures has to be shot, and a special South African gun for which considerable admiration has been expressed gets to do the honors. Before its steely Boer chastisement, this liberal scoundrel, his body as hollow and corrupt as his politics, simply flies to pieces. (p. 163-4)

Another passage from Micklethwait and Wooldridge:

Yet from the first, Bush saw that conservative intellectuals could be useful – much in the same way that an R&D department is useful to a chief executive. His formative experience in Washington was to watch his father’s administration disintegrating, in large part for want of 'the vision thing.' …. Nobody would pretend that Bush, a man who regarded Yale University as a drinking competition (which he damn-near won), spends his evenings reading Strauss’s Xenophon’s Socratic Discourse. But he knows the importance of people who do. (p. 156-7)

This reminds me of a quote from Mill I like:

Speculative philosophy, which to the superficial appears a thing so remote from the business of life and the outward interests of men, is in reality the thing on earth which most influences them, and in the long run overbears every other influence save those which it must itself obey.

Well, it all depends on what influences it must obey. If it has to obey politicians, who treat philosophers more like PR consultants than R&D researchers…

One last passage from Micklethwait and Wooldridge:

Here it is worth making a subtle distinction. Bush’s enthusiasm has generally been for business, particularly big business, rather than for the free market. His own career was a textbook example of Texas crony capitalism, characterized by a succession of takeover deals in which outside investors with ties to his father periodically stepped in to save one floundering oil company after another. Arbusto Energy became Bush Exploration, which merged with Spectrum 7, which merged with Harken Energy. Bush’s equity magically increased in value, despite a dismal oil market. Then in 1990 he sold 212,000 shares in Harken stock for $848,560 to pay for his investment in the TExas Rangers baseball team. Construction of a spanking-new ballpark in Arlington was subsidized by an increase in the local city sales tax.

This sort of buddy capitalism is hardly the stuff of Harvard Business School case sudies. Yet Bush still saw himself as a businessman, and his base has always been the business class. Texas was an ideal state for such a politician because the state’s campaign-finance laws placed almost no limits on contributions. In his 1994 and 1998 gubernatorial campaigns, more than half the contributions came from corporate executives (including hefty contributions from Ken Lay, the boss of Enron). And he eventually used his business connections to create the most successful fund-raising machine in presidential history. (p. 142)

It is worth pointing out that the difference between the free market and cronyism is not really subtle – and getting less subtle by the minute, as the resumes of FEMA execs. rise to the surface of the floodwaters. (Maybe someone should write a post-apocalyptic novel 'ripped from the headlines' about how, in the last years of the Bush administration, the United States of America was reconstituted as Iraq-or-Bust-o-Energy, then Bush Exploration, then Remnant 7, the …) OK, one final stray note for the night.

It’s interesting that, less than a year ago, Newt Gingrich was playing this tune: 'Given an electorate in which values really do matter to a large segment, one wonders how comfortable many Democrats will be having a minority leader (Rep. Nancy Pelosi) from San Francisco, one of the most liberal districts in the United States.' [link to an old post of mine. The original link within the post is dead or down.] But now (via Kos):

Gingrich argues that the values debate that has divided America so sharply during the past decade is over. There’s a broad consensus about most issues, and anyway people realize that the country’s big problems aren’t about morality but performance. 'We’re not in a values fight now but over whether the system is working,' Gingrich told me. 'The issue is delivery.' And that’s true at every level—city, state and federal.

Yet surely the result of ‘winning the war of ideas’ – this sea to shining sea (except for the coasts) coalition of drown it in the bathtubbers and God-botherers – is a big tent of conservative rhetoric that forbids precisely this shift in favor of an ethic of competence. The very notion: that government might be subject to intelligent design! After 40 years in the wilderness, conservatives seize control of all the levers of the government only to realize that the liberal consensus was right all along?

Neither Grover Norquist nor James Dobson can possibly stump for a government (large or small) of elite, performing technocrats who have managed to put ideology behind them, or to one side, for the sake of figuring out how government can solve the nation’s (non-moral) problems.

And if you’ve lost Norquist and Dobson, who’ve you got? Olympia Snowe and whose army? Are we going to start hearing about neo-Rockefeller Republicans. (Modern Rock-cons, they might call themselves.)

Didn’t Dukakis run on the slogan: 'competence not ideology'? I would like to think Democrats could win on such a platform, but the past suggests caution. I suppose the next thing we’ll hear is that only Nixon can go to China. Only the Republicans can be the party of 'competence not ideology'. Honestly, if they would even try it, I wouldn’t mind losing to them so much.

December 24, 2014

Noted for Your Evening Procrastination for December 24, 2014

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

James Heckman (1995): Cracked Bell

Paul Krugman: Recession, Recovery, and Gold

Matt O'Brien: Now that the Dow Has Hit 18,000, Let Us Remember the Worst Op-Ed in History

Is the Fed in a Trap?: I Really Cannot See It...s

David Weigel: Republicans Block Reappointment of CBO Chief Doug Elmendorf

Bridget Ansel:

Evaluating labor standards and employment outcomes

Bridget Ansel:

Creating a new understanding of economic growth and well-being

Plus:

Things to Read on the Evening of December 24, 2014

Tim Duy:

Fed Watch: Asked and Answered. Mostly.

Barry Eichengreen and Petra Geraats:

The Bank [of England] currently provides a drip-feed of releases... replacing a drip feed with a deluge will make the information provided harder to digest... leave most observers less well informed... indeed, the Bank itself will no longer be able to identify the separate impact of the policy decision..

Peter F. Drucker (20040:

What Makes an Effective Executive

Martin Wolf:

Let us enjoy the greatest human escape of all

Miles Kimball:

Righting Rogoff on Japan's Monetary Policy

Jesse Livermore:

A Critique of John Hussman’s Chart of Estimated Future Equity Returns

Cullen Roche:

"John Cochrane... ‘An Autopsy for the Keynesians’... doesn’t ever define ‘Keynesian’, and because he doesn’t he’s able to engage in a series of dishonest generalizations.... I am mad at myself for even wasting the time to respond to such an obviously misleading article."

James Heckman** (1995): Cracked Bell

Paul Krugman:

Recession, Recovery, and Gold

Matt O'Brien: Now that the Dow has hit 18,000, let us remember the worst op-ed in history

David Weigel: Republicans Block Reappointment of CBO Chief Doug Elmendorf

Duncan Black (2004): Minitrue Sullivan

And Over Here:

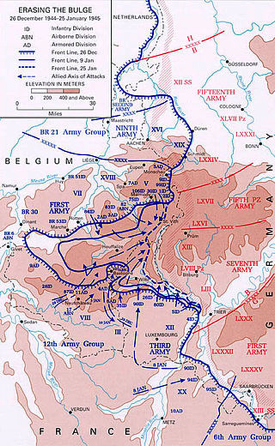

Liveblogging World War II: December 24, 1944: Battle of the Bulge

Hoisted from the Archives: Stephan Grundy's "Rhinegold"

Is the Fed in a Trap?: I Really Cannot See It...: Daily Focus

If You Had Told Me Twenty Years Ago That the People the Wall Street Journal Put on Its Op-Ed Page Would Only Get Less Hinged as Time Passed...

Liveblogging World War II: December 23, 1944: Eisenhower at Versailles

The New Republic Editor-in-Chief Gabriel Snyder's Note to Readers:

Liveblogging World War II: December 22, 1944: Malmedy

Rick Perlstein in Democracy Journal on Why Jacob Weisberg's Reviewing License Should Be Withdrawn

Must- and Shall-Reads:

Tim Duy:

Fed Watch: Asked and Answered. Mostly.

Barry Eichengreen and Petra Geraats:

The Bank [of England] currently provides a drip-feed of releases... replacing a drip feed with a deluge will make the information provided harder to digest... leave most observers less well informed... indeed, the Bank itself will no longer be able to identify the separate impact of the policy decision..

Peter F. Drucker (20040:

What Makes an Effective Executive

Martin Wolf:

Let us enjoy the greatest human escape of all

Miles Kimball:

Righting Rogoff on Japan's Monetary Policy

Jesse Livermore:

A Critique of John Hussman’s Chart of Estimated Future Equity Returns

Cullen Roche:

"John Cochrane... ‘An Autopsy for the Keynesians’... doesn’t ever define ‘Keynesian’, and because he doesn’t he’s able to engage in a series of dishonest generalizations.... I am mad at myself for even wasting the time to respond to such an obviously misleading article."

James Heckman** (1995): Cracked Bell

Paul Krugman:

Recession, Recovery, and Gold

Matt O'Brien: Now that the Dow has hit 18,000, let us remember the worst op-ed in history

David Weigel: Republicans Block Reappointment of CBO Chief Doug Elmendorf

Duncan Black (2004): Minitrue Sullivan

James Heckman (1995);

Cracked Bell:

"The same remarks apply to [Herrnstein and Murray's Bell Curve's] study of racial and ethnic differentials in socioeconomic outcomes.... Evidence that racial differentials weaken when ability is controlled for using regression methods does not rule out an important role for the environment.... In the presence of measurement error in the environment, the authors' analysis will overstate the 'true' effect of ability on those outcomes. There are methods for addressing these problems, but Murray and Herrnstein do not use them.... By its very construction... the 'two-standard deviation' range in measured IQ... [covers] 95 percent of the population. A 'two-standard deviation' range of their family background index does not include 95 percent of the population, because that measure does not come from a bell curve.... By restricting the range of the environmental variable they understate the role of the environment in affecting outcomes relative to the role allocated to IQ..."

Paul Krugman:

Recession, Recovery, and Gold:

"Dave Weigel notes that when President Obama get reelected, the usual suspects told us to run for the hills, buying gold along the way. Zimbabwe! Or, actually, not.... Gold prices are down.... Why they were high in the first place[:] Gold is not, in fact, a hedge against inflation. It’s something people buy when real returns on alternative assets are low.... Gold went up as real interest rates turned negative, thanks to a depressed economy.... As recovery has gathered strength, real rates have gone up and gold has gone down..."

Matt O'Brien:

Now that the Dow has hit 18,000, let us remember the worst op-ed in history:

"The stock market... isn't the best barometer.... And the Dow isn't even the best barometer of the stock market.... But if arbitrary round numbers are your thing, the Dow... above 18,000 for the first time. And that brings us to the worst op-ed in history. On March 6, 2009, former George W. Bush adviser Michael Boskin offered whatever the opposite of a prophecy is when he said that 'Obama's Radicalism Is Killing the Dow.'... Boskin... didn't think that this once-in-three-generations financial crisis was to blame for the market meltdown. Instead, he blamed it on Obama for... talking about raising taxes? 'It's hard not to see the continued sell-off on Wall Street and the growing fear on Main Street,' Boskin philosophized, 'as a product, at least in part, of the realization that our new president's policies are designed to radically re-engineer the market-based U.S. economy.' What followed was the usual conservative jeremiad against higher taxes on the rich, lower taxes on the poor, and deficit spending. Obama's trying to turn us into Europe, and that's why markets are pricing in the possibility of a Great Depression—not the dying economy he inherited. It was... extraordinarily ill-timed.... Obama's radicalism has killed the Dow to the tune of a 171 percent return since Boskin's op-ed.

David Weigel:

Republicans Block Reappointment of CBO Chief Doug Elmendorf:

"Incoming Republican leaders in Congress won’t reappoint Doug Elmendorf to another term as head of the Congressional Budget Office, according to a party aide.... Elmendorf, 52, an economist with experience at the Treasury Department and the Federal Reserve, was appointed to run the CBO in 2009 when then-director Peter Orszag was picked by President Barack Obama to run the White House Office of Management and Budget. In 2011, Elmendorf won a full four-year term, after Republicans took control of the House while Democrats retained the Senate. A CBO conclusion that Obama’s signature domestic achievement -- the 2010 Affordable Care Act -- was cutting costs pleased Democrats, while Republicans appreciated the office’s finding that the health-care law and a proposed minimum wage increase would cost jobs..."

Duncan Black (2004):

Minitrue Sullivan:

"Not to beat a dead horse which no one much cares about anyway, but I was a bit puzzled earlier when I was having some trouble hunting down a particular story with a mention of [Andrew] Sullivan's 5th column nonsense. A reader reminds me why--Sullivan, as he tends to do, edited the article he had publishsed in the Times of London before posting it in his 'best of' section on his website. On his site: 'The decadent Left in its enclaves on the coasts is not dead--and may well mount what amounts to a fifth column...' Original quote: 'The decadent left in its enclaves on the coasts is not dead -and may well mount a fifth column...' The former at least has one little toe in the land of metaphor, the latter doesn't. Sullivan literally and explicitly suggested that the 'decadent Left' and their soulmates, Muslims advocating theocracy, would join hand in hand."

Should Be Aware of:

Salami by Creminelli

Paul Krugman:

Putin, Neocons and the Great Illusion

Ricardo Hausmann:

The Productivity of Trust

Adam Gopnik:

"The insight that one is not obliged to enroll in a perpetual cycle of violence and reprisal is not apolitical or escapist"

Barkley Rosser:

The People the Wall Street Journal Put on Its Op-Ed Page... Get Less Hinged as Time Passe[s]:

"It has never been clear that Cochrane is even all that good at studying asset pricing. Even to this day, his famous grad textbook, called, well, Asset Pricing, does not have any of the following words in its index (or enywhere in the book, for that matter): kurtosis, leptokurtosis, fat tails. Nowhere, nada, even though supposedly financial traders all know that most financial returns exhibit those characteristics, which came home to roost big time in 2008. Of course at that time he publicly declared that... Fama would talk about them in his classes, having first heard of them in from Benoit Mandelbrot of all people. But, that has somehow still not gotten Cochrane to mention them himself anywhere in his supposedly wonderful textbook."

Duncan Black:

Eschaton: Innumeracy:

"Silly [Andrew] Sully[van] is back on his Bell Curve kick because Coates wrote some hurtful things which failed to realize the overall importance of being incredibly civil in the high minded intellectual debate about whether black people are, in fact, stupid, and whether the innumerate editor of a prominent magazine might have some responsibility for catapulting racist pseudoscience he's incapable of understanding into the discourse.... I'd often try to find an excuse to sneak a Bell Curve lecture into my courses. By the end of my teaching career none of my students had actually heard of it, which was good, but it still provided a way of teaching various lessons.... And I knew it was a zombie superhero, destined to return again and again no matter how many bullets we put into its brain."

Comments:

Noted for Your Morning Procrastination for December 27, 2014

Liveblogging World War II: December 24, 1944: Battle of the Bulge

Wikipedia:

Battle of the Bulge:

On 23 December, the weather conditions started improving, allowing the Allied air forces to attack. They launched devastating bombing raids on the German supply points in their rear, and P-47 Thunderbolts started attacking the German troops on the roads. Allied air forces also helped the defenders of Bastogne, dropping much-needed supplies—medicine, food, blankets, and ammunition. A team of volunteer surgeons flew in by military glider and began operating in a tool room.

By 24 December, the German advance was effectively stalled short of the Meuse. Units of the British XXX Corps were holding the bridges at Dinant, Givet, and Namur and U.S. units were about to take over. The Germans had outrun their supply lines, and shortages of fuel and ammunition were becoming critical. Up to this point the German losses had been light, notably in armor, which was almost untouched with the exception of Peiper's losses. On the evening of 24 December, General Hasso von Manteuffel recommended to Hitler's Military Adjutant a halt to all offensive operations and a withdrawal back to the West Wall. Hitler rejected this.

However disagreement and confusion at the Allied command prevented a strong response, throwing away the opportunity for a decisive action. In the center, on Christmas Eve, the 2nd Armored Division attempted to attack and cut off the spearheads of the 2nd Panzer Division at the Meuse, while the units from the 4th Cavalry Group kept the 9th Panzer Division at Marche busy. As result, parts of the 2nd Panzer Division were cut off. Panzer Lehr tried to relieve them, but was only partially successful, as the perimeter held...

Hoisted from the Archives: Stephan Grundy's "Rhinegold"

The raw ingredients out of which J.R.R. Tolkien fashioned The Lord of the Rings are equal parts Norse-Anglo-Saxon-Germanic myth, chivalric romance, and Christian apocalyptics (evil personified and mighty, but also powerful guardian spirits, and over all a God who arranges things so that the highest prizes fall to those who suffer). The mix is extraordinarily powerful.

But if you want the Norse-Anglo-Saxon-Germanic myth itself, akratos--unmixed, undiluted--you have to go elsewhere: to a place like Stephan Grundy (1994), Rhinegold (New York: Bantam: 0553095455: 1994).

The dwarf scuttled away between the rocks, slithering into them until Loki could no longer see where dwarf ended and stone began. Only the red sparks of his eyes glowed out of the darkness as his voice hissed:

My curse on the ring I made, on all who wear it! Gold fired in blood, ruby blood-red, be you bathed in your holders' blood again and again, the death of athelings and the sorrow of women. Death to every man who takes you, make each woman who keeps you the bringer of death to her kind. Be strife of kinsmen, be breaker of bonds, let no gift and no oath hold where the river's fire burns, let no love bear lasting fruit, but cut all kin of your keepers down. My curse on the hoard I kept, held by the ring! Let no craft work its might to weal, let no need turn round nithing's might, but smith-craft's torch and need-fire's glow burn but to funeral pyres. Brother's bane and drighten's doom: thus Andward names the hoard! Norns, lay this orlog from the Rhine's depths. Write this wyrd--so shall it be!

Then what hope is there for us?" asked Alfarik quietly. "To die like Walsungs," Wynberht answered, then started to chant softly:

If our wyrd is crueler, let our courage be keener

harder be hearts and higher be souls

unweakened by fear though with horror fraught

then shall Wals's sons all worthy be named.

Now I shall sing a song for you which is seldom heard on the Rhine these days... of the Rhine's gold: how it was drawn forth... how the children of Hraithamar fought over it till at last it was won by Sigifrith the son of Sigimund and Herwodis:

Wodan and Hoenir wandered with Loki

to Middle-Garth as men by the Rhine.

There an otter eating saw they

a goodly fish the flood beside...

No hero, say men, higher has lived

Than Sigifrith Fadhmir's Bane slaying the wyrm

to get for himself the gold's red-bright fire,

glittering by the banks of the Rhine.

Wyrd love no fosterling more long than a moment,

and no man may breathe for more than his days,

Nor trust long in Wodan Walhall's high drighten,

for raven and wolf wait for his thanes aye.

Now lies the weregild all lost by the Rhine,

and no man may say nor see where it's hid.

For only two living owned Fadhmir's secret,

now that secret's kept in cairn with the dead.

Stephan Grundy is not to everybody's taste--I'm not even sure that he is to my taste: I have never picked up Rhinegold again since I read it for the first (and only) time perhaps six years ago. But the memory of reading it still haunts me, and it is not an experience that I would have foregone.

December 23, 2014

Over at Equitable Growth: Is the Fed in a Trap?: I Really Cannot See It...: Daily Focus

Over at Equitable Growth: The very sharp and smart Stephen Roach is seriously alarmed--and I think he is wrong.

Stephen Roach:

Stephen S. Roach:

The Fed Sets Another Trap:

"America’s Federal Reserve is headed down a familiar...

...and highly dangerous path... the same incremental approach that helped set the stage for... 2008-2009. The consequences could be similarly catastrophic... incremental approach... condoning mounting excesses in financial markets and the real economy.... [The] macro-prudential tools... approach... fails to address the egregious mispricing of risk brought about by an overly accommodative monetary policy.... READ MOAR

The Fed’s $4.5 trillion balance sheet... no inclination to scale back... passed the quantitative-easing baton to the BoJ and the ECB.... The longer central banks promote financial-market froth, the more dependent their economies become on these precarious markets.... What do independent central banks stand for if they are not prepared to face up to the markets and make the tough and disciplined choices that responsible economic stewardship demands?... Now it is time for the Fed and its counterparts elsewhere to abandon financial engineering and begin marshaling the tools they will need to cope with the inevitable next crisis...

A financial crisis happens when something leads to a sharp fall in the risk tolerance of the market; that fall in risk tolerance reduces the price of risky assets in such a way that highly-leveraged financial intermediaries become illiquid and possible insolvent; that possible insolvency produces a sharp shift in the riskiness of assets as many previously classified as safe are no longer so; thus the fall in the demand for risky assets (and the rise in the demand for safe assets) triggers a huge rise in the supply of risky assets (and a huge fall in the supply of safe assets), and the downward spiral commences.

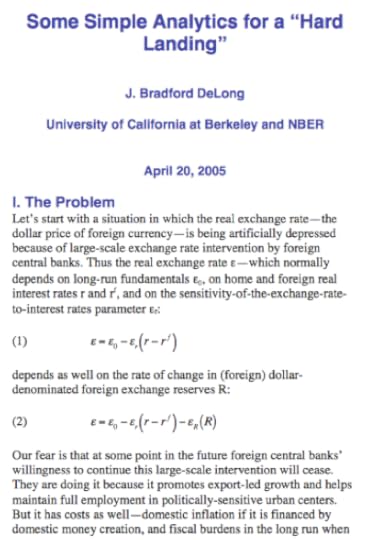

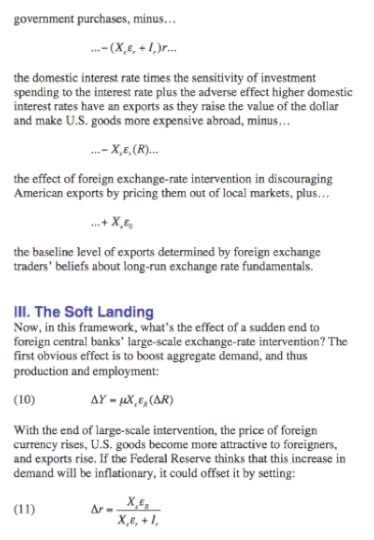

Those of us watching financial markets in 2005 worried about such a financial crisis triggered by a full-scale run on the dollar. See, for example, me from March to May:

Dials Moving Into the Red Zone

http://delong.typepad.com/sdj/2005/07/dials_moving_in.html

2005-07-13

A Short Dialogue on the Price of the Long Treasury Bond

http://delong.typepad.com/sdj/2005/06/_a_short_dialog.html

2005-06-08

Paul Krugman Gets in Touch with His Inner Friedrich Hayek

http://delong.typepad.com/sdj/2005/05/paul_krugman_ge.html

2005-05-27

The Global Savings Glut Argument

http://delong.typepad.com/sdj/2005/05/the_global_savi.html

2005-05-22

Hard Landings II...

http://delong.typepad.com/sdj/2005/04/hard_landings_i.html

2005-04-20

Our Twin Financial Puzzles: The Long Run May Come Like a Thief in the Night

http://delong.typepad.com/sdj/2005/04/our_twin_financ.html

2005-04-13

The "Hard Landing" Scenario...

http://delong.typepad.com/sdj/2005/03/the_hard_landin.html

2005-03-30

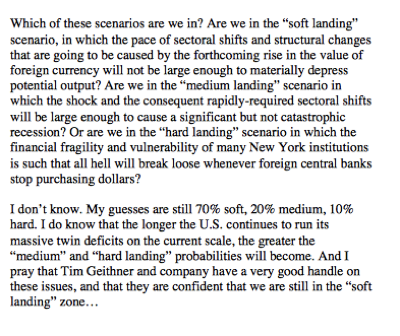

Perhaps the clearest statement I made is this: Our Twin Financial Puzzles: The Long Run May Come Like a Thief in the Night:

The optimists... have only one economic argument: long-term interest rates are relatively low, and are not pricing the dollar-collapse and the U.S.-interest-rates-spike scenarios as having any substantial probability at all. The pessimists on Wall Street are puzzled at why this economic argument is supposed to have force. From their perspective, demand for long-duration dollar-denominated securities is high because the Asian central banks are buying as if there were no tomorrow in order to keep the value of their currencies down, the U.S. Treasury is borrowing short (it is not issuing that many long-duration securities), and U.S. companies are cautious and are not undertaking the kinds of investments that would lead them to issue lots of long-duration bonds.

We economists respond by saying that for every market mispricing there is an open profit opportunity: if long-term interest rates are indeed too low--if long-term bonds are indeed priced too high--there is money to be made by shorting long-term U.S. bonds, parking the money in some other investment vehicle that is not underpriced [and] waiting for bond prices to return to fundamentals.... But the Wall Street types have a counterargument: For any one financial institution to make the international bet--to bet on the decline of the dollar against the yuan over the next five years in a very serious, leveraged way is to put its survival at risk should the trades somehow go wrong. And trades do go wrong....

We economists believe that market forces drive prices to fundamentals. But we are not careful enough to distinguish situations in which equilibrium-restoring forces are strong from those in which equilibrium-restoring forces are weak. At the moment those forces are weak. And this adds an additional danger: at any moment those forces may become strong. The long run in which the dollar falls and U.S. long-term interest rates rise may come like a thief in the night as a very sudden shock.... On that day the long run future will be, as football coach George Allen (not the "macaque" one) used to say, now.... Should that day come, keeping a financial crisis from becoming a major disaster may well require swift and rapid action by a Federal Reserve and a Treasury Department that have powerful and unconditional White House and Congressional support....

That is me back in 2005. Was I then sounding enough like Stephen Roach sounds now--in 2014?

So why am I so much more sanguine now?

Note what I said then: "Should that day come, keeping a financial crisis from becoming a major disaster may well require swift and rapid action by a Federal Reserve and a Treasury Department that have powerful and unconditional White House and Congressional support..." May well require--a full-blown run on the dollar could, I thought, be successfully managed by competent technocrats. In fact, I put the chances of a truly hard landing conditional on a major dollar crisis at only 10%. Why so low? Back then I wrote down the argument at an undergraduate level:

Some Simple Analytics for a Hard Landing:

I still think that looks pretty good as a thinking-through back in 2005 of how a financial crisis could be generated by a run on the dollar, and why it probably would not produce a hard landing.

What is the equivalent argument at the undergraduate or graduate level supporting Stephen Roach's fears? I just do not see it.

Of course, we did not get the dollar-run crisis: we got a very different one...

Live from La Farine: If You Had Told Me Twenty Years Ago That the People the Wall Street Journal Put on Its Op-Ed Page Would Only Get Less Hinged as Time Passed...

I would not have believed you. But is is true.

And so I gotta ask: Does John Cochrane have no friends? It is intervention time here: Cochrane is doing himself and his reputation no good by this.

He ought to simply say that he was clearly underbriefed back in 2007-9 and said some stupid things, that he recognizes that the world has evolved since 2007 in ways strikingly inconsistent with the beliefs he had then, apologize, and go back to doing what he does (or perhaps used to appear to do) well, asset pricing, and do that well--if he still can).

His friends need to tell him this.

Frances Coppola is not his friend:

Frances Coppola:

The Gullible Economist:

"I think John Cochrane has lost his marbles...

..has written one of the worst op-eds I have ever seen... quotes George Osborne as an authority on.... Keynesian economics. You couldn't make it up. Cullen fisked about half the article but gave up in disgust when he encountered this little gem:

By Keynesian logic, fraud is good; thieves have notoriously high marginal propensities to consume.

Noah... has a stronger stomach, read all of it... and summed it up in one word. But not being British, both Cullen and Noah missed the sheer idiocy of....

With the 2013 sequester, Keynesians warned that reduced spending and the end of 99-week unemployment benefits would drive the economy back to recession. Instead, unemployment came down faster than expected, and growth returned, albeit modestly. The story is similar in the U.K.

Oh no it isn't.... The UK and the US don't look very similar... do they?... The effect of the sequester is clearly visible on the US line. What had been rather good GDP growth suddenly fell. So much for Cochrane's claim that austerity caused "modest" growth to return.... The UK was recovering nicely until towards the end of 2010, when it was hit by some kind of shock that clobbered both growth and employment. It did not start to recover from this second shock until 2013.

There are a number of theories.... Monetary tightening... oil price shocks, and the crisis in the Eurozone.... And... fiscal consolidation.... GDP flattened and unemployment rose in the UK as a direct consequence of fiscal consolidation by both Labour and Coalition governments. Yes, a DIRECT consequence.... Growth finally returned at the beginning of 2013. Exactly why is unclear.... The Chancellor's 2012 Autumn Statement announced plans to increase expenditure on infrastructure and provide support for housebuyers, which was followed up in the 2013 Budget with tax threshold rises, pension increases and the Help to Buy programme for first-time buyers. The 2014 Budget continued this theme: more tax reductions, pensions reform, extension of Help to Buy (now laughably known as Help to Buy Votes), promises of infrastructure investment. Now, correct me if I am wrong, but infrastructure investment, tax cuts, pension increases and help for homebuyers are fiscal stimulus, are they not? And of course expectations matter. Austerity starts with its announcement, and so does stimulus....

So the Chancellor whom Cochrane quotes approvingly as saying that Keynesians wanting fiscal stimulus were "wrong" has actually been doing, er, fiscal stimulus - though more for political than economic reasons. It's amazing what effect the growing proximity of an election has on economic policy. And it's also amazing how gullible a Keynes-hating (or perhaps more accurately Krugman-hating) US economist can be.

And Paul Krugman is not his friend:

Paul Krugman:

Commies Like Me:

"I’ll just say that the past five-plus years of macroeconomic debate...

...have been a learning experience. But not so much about economics--I didn’t see the crisis coming, but post-crisis macroeconomics has actually worked pretty much the way I expected and predicted. (Yes, deflation is surprisingly hard to achieve, but I took that on board early.) No, it has been a lesson in human nature--on the ability, or lack thereof, of people to admit when they are wrong, or at least to stop digging when they’re in a hole. And the lesson has not been encouraging.

But Noah Smith is least of all his friend:

Noah Smith:

Commie Commie Commie Commie Commie K-Keynesian (sung to the tune):

"I suspect that much of the motivation for John Cochrane...

...to write this latest blast comes from his ongoing personal feud with Paul Krugman, generally acclaimed as the champion of "Keynesianism". Of course, the Wall Street Journal eats it up, since to most WSJ readers, "Keynesian" is a code-word for "commie" (thanks, Friedrich Hayek).... A few good points buried deep inside... but... mostly wrong. To wit:

No government is remotely likely to spend trillions of dollars or euros in the name of “stimulus,” financed by blowout borrowing.

Sure, but that's always true. Then when the crash comes, "everyone's a Keynesian in a foxhole," as Robert Lucas said.... This is a time-stationary process, dude....

Keynesians told us that once interest rates got stuck at or near zero, economies would fall into a deflationary spiral. Deflation would lower demand, causing more deflation, and so on.

Well, that's a good point! Where IS the deflation? When you have to patch up a theory after every contrary fact, you get a degenerating research program. See also: Every other macroecnomics research program.

Our first big stimulus fell flat, leaving Keynesians to argue that the recession would have been worse otherwise. George Washington’s doctors probably argued that if they hadn’t bled him, he would have died faster.

By what measure did the stimulus "fall flat"? Arguing about macro counterfactuals may be a mug's game, but a Booth Business School survey of economists found that 92% thought the ARRA lowered the jobless rate. Check out the list. That's an awful lot of well-respected doctors....

With the 2013 sequester, Keynesians warned that reduced spending and the end of 99-week unemployment benefits would drive the economy back to recession. Instead, unemployment came down faster than expected, and growth returned, albeit modestly. The story is similar in the U.K.

But didn't a 3% sales tax hike send Japan spiraling into recession? Oh, the competing anecdotes! WHO DO I BELIEVE??

Keynesians forecast depression with the end of World War II spending. The U.S. got a boom.

Well, you know, except for that 12.7% fall in GDP in 1945.

The Phillips curve failed to understand inflation in the 1970s and its quick end in the 1980s, and disappeared in our recession as unemployment soared with steady inflation.

We'll always have Paris.

Hurricanes are good, rising oil prices are good, and ATMs are bad, we were advised: Destroying capital, lower productivity and costly oil will raise inflation and occasion government spending, which will stimulate output. Though Japan’s tsunami and oil shock gave it neither inflation nor stimulus, worriers are warning that the current oil price decline, a boon in the past, will kick off the dreaded deflationary spiral this time.

This is a good point! Liquidity trap models with all those paradoxes are hard to square with reality. though Japan's growth did certainly rise after the 2011 tsunami and has been rising faster than America's since, and they've switched from deflation to inflation, so that might not have been the best example....

I suspect policy makers heard this, and said to themselves “That’s how you think the world works? Really?” And stopped listening to such policy advice.

Well I suspect policymakers would be caught dead in bed with Siamese twins before they'd open up a New Keynesian DSGE paper and try to work out its implications, but hey.

Keynesians tell us not to worry about huge debts

Except in, say, Krugman's paper with Eggertsson, which is all about how debt is baaaad. I guess Cochrane means government debt. But I have heard self-identified Keynesians say that government debt isn't as bad as private debt after a recession, and that governments should run deficits in busts and then do austerity in booms. Is that crazy?

Stimulus advocates: Can you bring yourselves to say that the Keystone XL pipeline, LNG export terminals, nuclear power plants and dams are infrastructure?

I bet they could...

Can you bring yourselves to mention that the Environmental Protection Agency makes it nearly impossible to build anything in the U.S.?

This is not necessarily a good point.... Infrastructure costs are weirdly high in the U.S... but it's local NIMBY landowners, not the EPA).

...Wait, what did this have to do with Keynesians? Oh, yeah, I forgot. Commies, etc.

Now you like roads and bridges. Where were you during decades of opposition to every new road on grounds that they only encouraged suburban “sprawl”? If you repeat in your textbooks how defense spending saved the economy in World War II, why do you support defense cutbacks today? Why is “infrastructure” spending abstract or anecdotal, not a plan for actual, valuable, concrete projects that someone might object to?

COMMIES

Keynesians tell us that “sticky wages” are the big underlying economic problem. But why do they just repeat this story to justify inflation and stimulus? Why do they not advocate policies to undo minimum wages, labor laws, occupational licenses and other regulations that make wages stickier?

If I recall correctly, Keynesians think getting rid of sticky wages in the middle of a recession is bad. Also if I recall correctly, if you take sticky wages out of a New Keynesian model, you still get a recession when a bad demand shock hits, the recession just reduces people's hours instead of sending them into involuntary unemployment.

Inequality was fashionable this year. But no government in the foreseeable future is going to enact punitive wealth taxes.

Wait, how is this related to stabilization policy? Besides COMMIES, I mean.

So here is my assessment.... I'm sure Cochrane does really, honestly believe that self-identified Keynesians are a bunch of, essentially, commies. Which means that when he says "Keynesians", he's not thinking of Bob Hall, Emi Nakamura, Jordi Gali, or Roger Farmer. But maybe he should.... The WSJ editorial page readership seem mentally stuck in the 1970s. Or at least, some of them do. We live in a Malmendier & Nagel world....

Also: COMMIES!!!

Also: I stole the title of this blog post from @cellsatwork on Twitter, and I'm not sorry."

Liveblogging World War II: December 23, 1944: Eisenhower at Versailles

Harry Butcher:

Harry Butcher:

World War II Today:

I went out to Versailles and saw Ike today. He is a prisoner of our security police and is thoroughly but helplessly irritated by the restriction on his moves. There are all sorts of guards, some with machine guns, around the house, and he has to travel to and from the office led and at times followed by an armed guard in a jeep.

He got some satisfaction yesterday in slipping out for a walk around the yard in deep snow, in the eyes of the security officers quite the most dangerous thing for him to do, but he had the satisfaction of doing something he wanted to do. I told him he now knows how it must feel to be President and be guarded day and night by ever-watchful secret-service men.

The restriction is caused by information from Intelligence officers of Hodges’ First Army, who cross-examined a German officer captured at Liége the night of December 19. He was one of a group of English-speak ing Krauts [Shows I’ve recently been with GIs who were in Italy and Africa] who had infiltrated through Allied lines in American uniform, driving an American jeep and carrying American identification papers.

The leader of this group, which specializes in kidnaping and assassination of high personages, is a character named Skorzeny, who, reputedly, rescued Mussolini. He is said to have passed through our lines with about sixty of his men and had the mission of killing the Supreme Commander.

One of their rendezvous points is said to be the Café de la Paix in Paris, just around the corner from the Scribe. There German sympathizers and agents are supposed to meet Skorzeny’s gang and to furnish information about General Ike’s abode, movement, and security guard.

The men were described as completely ruthless and prepared to sacrifice their lives to carry out their mission. All personnel speak fluent English. Similar attacks on other high officers have been given to other infiltrators, numbering about 150.

Some units might have with them in their vehicle a German officer in uniform and, if questioned, would tell a false story that they were taking an important German prisoner to higher headquarters in the rear. They carry capsules of acid to be thrown in the faces of MPs or others to facilitate escape. Skorzeny’s group may be in staff cars, civilian cars, command and reconnaissance cars, as well as jeeps.

Already about 150 parachutists wearing American uniforms or civilian clothes have landed in the U. S. First Army’s area. Many of them have been captured, but some are still at large. Those in uniform are not wearing dog tags, but all carry explosives and have a new type of hand grenade discharged from a pistol.

Our security officers are always supercautious, and with this alarming information, I can readily understand why they have thrown a cordon around the Supreme Commander, yet he is thoroughly disgusted at the whole procedure and seemed pleased to have someone to talk with like me, seemingly from the outside World.

…

Ike was as calm as he ever is, and, except for the irritation caused by his confinement, was cheerful and optimistic.

…

Over all, he felt that the situation was well in hand; that there was no need for alarm; that he and his senior commanders had taken prompt steps to meet what he figured was the Germans’ dying thrust, and if we would be patient and the Lord would give us some good flying weather, all would be well and we would probably emerge with a tactical victory.

He added that it is easier and less costly to us to kill Germans when they are attacking than when they are holed up in concrete fortifications in the Siegfried Line, and the more we can kill in their present offensive, the fewer we will have to dig out pillbox by pillbox.

December 22, 2014

The New Republic Editor-in-Chief Gabriel Snyder's Note to Readers: Live from La Farine

Gabriel Snyder:

Note to Readers: "Shortly before the first issue of The New Republic...

...went on sale a little over a century ago, our founding editor Herbert Croly outlined his vision to a reporter from The New York Times:

The magazine, which is to be a weekly review of current political and social events and a discussion of the theories they involve, is to represent progressive principles, but it is to be independent of any party, or individual in politics.

From that mild-seeming statement of purpose has emerged perhaps America’s most argumentative publication—a journal brimming with strong opinions beautifully elaborated (as well as a few duds). Croly’s vision is durable (perhaps because it's vague), giving his inheritors wide latitude to both adhere to his principles and fight over the specifics.

It is an old and maybe foolish gambit, to reach back for guidance to some figure of the past, whom we imagine to be wiser and less corrupt than the people of the present. And yet, I see nothing in Croly's original statement of purpose that is not worth sticking to. This magazine most certainly should espouse progressive views while keeping itself beyond the embrace of any party or politician who is lately up in the polls. He also had specific ideas worth revisiting, like his promise that The New Republic would:

devote a good deal of attention to the feminist movement, in general.

But if our founders sat down today to settle on the best way to achieve this mission, they would not have picked a weekly printed magazine and ignored a vast array of digital publishing possibilities. And just like any publication with hopes of success in the world of 2014, they would want The New Republic to be better at welcoming into our fold readers, writers, and editors who reflect the American experience as it exists today.

I started reading The New Republic when I was a high school kid in Nashville, Tennessee. I worked in a chain bookstore (since razed) on Harding Pike and found myself pulled into these pages during my breaks from stocking shelves. Being named editor-in-chief of The New Republic is that kid's dream, but during another one of our periods of tumult, it is also a humbling responsibility.

The New Republic has always been both in love and at war with its prior self. The magazine’s early decades were marked by abrupt ownership changes, unceremonious dismissals of editors, shifting policy positions, and uprooted headquarters, all accompanied by masthead upheavals.

In 1974, Martin Peretz, a 35-year-old social studies lecturer at Harvard College, bought The New Republic. He pledged to leave things as they were and to keep then-editor Gilbert Harrison ‘for a minimum of three years,’ as Harrison told the Times. Sooner than that, however, Peretz installed himself as editor, resignations followed, and much of the staff was replaced by his former students. They would go on to dominate the masthead for the rest of the century.

A decade into Peretz’s tenure, Michael Straight, the owner-editor after World War II and son of the magazine’s first financial backer, wrote a letter to The New York Review of Books announcing ‘the spirit which Croly created and which Gilbert Harrison maintained in recent years was shattered.’ Peretz, who stood accused of endorsing Israel’s 1985 bombing of Beirut, rightly ridiculed this appeal to constancy. ‘What spirit of The New Republic exactly would they be violating?’ he replied to the letters page. ‘The magazine has had a long and complicated history.’ Last year Peretz was the one complaining, writing in a Wall Street Journal op-ed that the current owner, Chris Hughes, is ‘not from the world of Herbert Croly.’ A survey of the many deaths and rebirths of The New Republic shows, if anything, that its most important survival skill has been to attract new champions from beyond its inner sanctum.

The best way for any new editor of this magazine to respect the spirit of the institution is to first recognize its defining characteristic is a habit of reinvention. The task before us is to ask what The New Republic should be one hundred years after its founding. We set out with many advantages: first, an owner who has committed to investing in quality journalism and who has granted his editorial staff the creative freedom to find a new path. We have an impressive editorial team that has demonstrated exceptional mettle and we will be adding to their ranks. And we have the heritage of sustaining a continuous conversation about America's promise.

As we revive one proud legacy of The New Republic—the launching of new voices and experts—those new voices and experts will be diverse in race, gender, and background. As we build our editorial staff, we will reach out to talented journalists who might have previously felt unwelcome at The New Republic. If this publication is to be influential, and not merely survive, it can no longer afford to represent the views of one privileged class, nor appeal solely to a small demographic of political elites.

As it always has, The New Republic will be a home for ambitious journalism, trenchant argument, provocative ideas, and innovative storytelling. What will change is that our biggest stories will be the beginning of our efforts, not their finale: they will be commitments for change, set the agenda for our daily coverage, and shape the conversations we have on social media. In the final years of the Obama presidency, during which big-hearted idealism withered in front of cynicism about the present and pessimism about the future, we must be pragmatic, forward-looking, and tireless pursuers of solutions, not only the bearers of problems.

‘Summed up,’ Croly said, ‘the new publication is to be radically progressive.’ He would bill his debut issue as ‘A Journal of Opinion which Seeks to Meet the Challenge of a New Time,’ and, a century on, I am astonished by the durability of the thinking that gave birth to this place. But it’s the thinking that matters, not the form in which it is conveyed. The challenges of our new time seek a new New Republic.

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers