Farnoosh Torabi's Blog, page 49

January 24, 2013

Creating the Best Pins & Passwords

[image error]A new survey shows that there’s a major gap between Americans’ online security perceptions, and their actual practices. In a poll conducted by the National Cyber Security Alliance, the majority of those surveyed said they share passwords across their accounts and about half of users never change their pins and passwords unless they’re forced to.

In yet another poll by security company Confident Technologies, more than half of respondents reported never using a password or PIN to lock their smart phone or tablet.

Bad move. One tactic cyber-criminals take is to steal PINs or passwords from places or websites where there’s very little security, and then try them out in more secure environments, such as banking websites. Using the same username and password on multiple websites is not unlike handing a thief a master skeleton key to your life, which opens every door — if hackers grab your password from one place, no doubt they’ll use it to crack in to anything that’ll open.

High level criminals have technology to help: intruders install keyboard sniffers that help them gather information like your most common keyboard strokes; they can also conduct dictionary attacks against a host’s password database, which allows them to try out tens of thousands of potential passwords per second – this is why English words, and simple variants of those words (alone), do not make safe passwords.

Your cell phone — just a tiny computer – is no less vulnerable. Experts say losing an unlocked phone can actually be worse than losing a wallet, and that’s because of the sensitive information our cell phones contain. Emails alone can reveal a wealth of information about you, including where you bank, where you live, the names of your family members, and more. According to the same survey by Confident Technologies, even though only 10% of workers have a corporate-issued device, 65% of users receive corporate data on their phone, where competitive information like salaries and system passwords are readily available. Even worse – links in emails or the apps on your phone can connect a thief directly into your accounts with one click, be it into a website, Facebook or a even a corporate portal.

Most vulnerable of all, your ATM password is a needle that plunges directly into your financial vein – in mere seconds a thief can drain your accounts to zero. So just how easy is it for someone to correctly guess your PIN? A lot easier than you think, says data scientist Nick Berry, founder of Data Genetics, a Seattle technology consultancy. An average thief, guessing randomly, only has a 1 in 10,000 chance of guessing an ATM PIN…. but for an intelligent criminal, who realizes that a high proportion of PINs are birthdates — specifically those after 1950– those odds go WAY up. That’s right: despite warnings from banks, a shockingly high percentage of PINs –close to 20 percent–are extremely simple combinations. The most popular? “1234″ with an 11 percent frequency, followed by “1111,” and “0000.” This means that if a thief picks up your ATM card off the street, he or she has a 1 in 5 chance of unlocking it by experimenting with just five different PINs.

A good, common sense guideline for selecting PINs is to avoid numbers or words that appears in your wallet (such as name, birth date, or phone number), or any number which can be found out – the last four digits of your social security number, for example. And for online passwords, standard recommendations are to choose one that’s at least 8 characters long, and that includes both letters and numbers and more commonly now, a special character or punctuation. It’s also a good idea to change your PINs and passwords every six months. But the best strategy is to ensure your passwords and PINs are fortresses to begin with – by adding length, complexity, and that certain ”je ne sais quoi”.

To ensure your PINs and passwords are hard to crack, or to spin your existing passwords into something much safter, try the following:

For PINs:

Create it From a Word

Think of the numbers and letters on your telephone. Then think about how you “dial-by-name” in a company’s phone system. If you use a word for your PIN number, it will be easier to remember.

Use Numbers Only You Know

Instead of including part of your address or any number easily found on your license, use part of an expired childhood phone number or a number you call all the time but isn’t guessable, like your local pizza delivery joint.

Use Favorite Holidays

If you’re looking for a four digit PIN number such as a date, use your favorite holiday instead of a birth date, or a momentous occasion in your life that isn’t tied to anything on the “record” like your children’s birthdates, your anniversary or your even you parent’s anniversary. (Instead try the day you retired, the day you broke a 7-minute mile, etc).

For PASSWORDS:

Use Phrases

By far, the most powerful and secure online passwords are those that use a lot of characters (in fact, you should use as many characters as the portal allows– the more characters you add, the safter your password is), so much so that many experts say: dump the coded mumbo-jumbo, and simply use a sentence, phrase, or a few random words strung together in a memorable way. Phrases, though they include English dictionary words, include so many letters that even computers have a hard time breaking the code (and they’re also the easiest to remember, which makes them a win-win!). For a surprisingly succinct explanation of why this is true, see this XKCD comic, or for a more journalistic version, see CNN. Try a long phrase with or without spaces, normal capitalization, and of course numbers and punctuation as the website requires.

Build on a Base

Another personal favorite, this tactic allows you to create passwords (and remember them) on the fly. You don’t have to keep track of 100 passwords if you have one rule set for generating them.

One way to create unique sequences is to choose a base password, and then apply a rule around it that includes some coded form of the vendor. Try, for example, the first letter of a phrase or song refrain. If you wanted to use the famous Whitney Houston song “I Will Always Love You,” your base password might be “IWALY.” Recalling the password is just a matter of singing yourself the song.

To add specificity, choose a consistent way to make the site’s name an acronym or a description, separated by a number that’s meaningful to you. For added security, and a precaution adopted by more and more secure websites these days, you can wrap your base password and vendor code with a special character as well. For example, your password to Facebook might be: #IWALY10FA#.

Create Your Own Language

Another way to generate unique passwords is to create your own “language” — that you yourself make up — and then write new passwords in that code. “S” becomes “$” for example, or a backwards “E” looks a lot like “3”. Just a few simple character swaps outs, or even misspelling a word on purpose – can throw a thief off.

Use a Password Checker

Still not sure if your password is safe? Use a password checker that evaluates your password’s strength automatically. Try Microsoft’s secure password checker.

Safely choosing and keeping track of passwords and PINs is a modern-day inconvenience that many of us wish we didn’t have to deal with. But with a few simple improvements to your online and mobile security, you can stay one step ahead of the hacker-pack.

Photo Courtesy of Flicker/redspotted/272104/

January 22, 2013

3 Steps to a Better Credit Score

A recent survey reveals that many Americans lack important knowledge on maintaining their credit.

A recent survey reveals that many Americans lack important knowledge on maintaining their credit.

FreeCreditScore.com found that more than a quarter of respondents, 28%, never check their credit score because they don’t find it “necessary.” Troubling findings considering just how important credit is in some of life’s major financial decisions: buying a house, paying for college or purchasing a car.

It’s not all bad news, however. According to the same survey, 83% of Americans do know their credit scores. In addition, 65% indicated that they consider their credit score when engaging in activities that could affect it, and 42% said they’d like to improve their credit scores — they just don’t know how.

Don’t go into the new year with an old attitude about your credit. Here are a few key factoids about credit scores, along with tips to begin improving your credit today.

Also See: #AskFarnoosh – All Things Credit!

Understand Your Score

Your credit score signifies to lenders how credit-worthy you are and is a primary deciding factor in whether you get approved for everything from an apartment lease, car loan to cell phone contract. And the quality of your score, whether it’s high or low, also determines if your eligible for deals and interest rates that will save you money in the long run. FICO scores range from 300 to 850 with a score of 740 or higher making you eligible for the lowest interest rates. Start on your path towards better credit by first obtaining a free credit report from AnnualCreditReport.com, where you can receive a report once a year from each of the three major credit reporting firms. Unfortunately they won’t provide you with the all-important score. For that, head over to myFico.com, where for $20, you can get your FICO score, which is the score most lenders use to review loan applicants.

Dispute Errors On Your Report

It’s been estimated that nearly 25% of credit reports contain errors serious enough to cause a denial of credit. For that reason it’s especially important to go over yours with a fine-tooth comb. It should reflect your credi history, current accounts, inquiries and any accounts you have in collections, if that’s the case. You’ll want to dispute and correct any inaccurate information on your credit report, especially account balances and items older than seven years. The reports available through AnnualCreditReport.com all have user-friendly features that allow you to single out items on your report and dispute them electronically. You can also do it the old-fashioned way by writing to your creditors and, for that, The Federal Trade Commission has a handy guide to writing a dispute letter.

Manage Your Credit Wisely

Your credit score is a tricky formula made up of your payment history (35%,) amounts owed (30%,) length of credit history (15%,) new credit (10%) and types of credit used (10%.) In rebuilding your credit, FICO spokesman Anthony Sprauve says, “The three most important things are to do are: First, pay all bills on time every time. Then, keep revolving credit balances low and, finally, only open new credit when you need it.” He says do this and you will start to see improvements within six months. Meanwhile, keep track of your credit. Credit Sesame, Credit Karma and Credit.com all offer credit-monitoring services to users.

5 Ways Money Makes You Happy

Your paycheck has more power than meets the eye. While it can help us to afford life’s necessities, it’s also a key source of happiness. In fact, studies show that how much you earn, how you earn it and how you spend your hard-earned dollars can make you happy. Read more here.

As always, we want to hear from you. How does your money make you happy? Connect with me on Twitter @Farnoosh and use the hashtag #finfit.

January 21, 2013

Interest Rates Fall, But For How Long?

Last week ended with rates falling in many areas, most notably for used cars loans and variable-rate credit cards. Also of note: mortgage rates fell considerably, continuing a steady downward trend that began in 2008.

Last week ended with rates falling in many areas, most notably for used cars loans and variable-rate credit cards. Also of note: mortgage rates fell considerably, continuing a steady downward trend that began in 2008.

But how low can they go? There’s no telling, exactly. Federal Reserve Chairman Ben Bernanke said in the past that the Fed will continue efforts to drive interest rates down through 2013 but, according to reports, several member of the agency’s policy-making committee have expressed interest in ending their program of purchasing of treasury and mortgage-backed before the end of the year. That could mean a slowdown to the housing recovery and, more immediately, an end to great rates for consumers.

Here’s a look at where rates stand today, if you’re in the market for a new car, home or credit card.

Auto Loan Rates

Rates for 48-month new-car (4.07%) and 60-month new-car (4.15%) loans were unchanged last week. Used-car rates saw significant movement, however. The average rate for a 36-month used-car loan fell to 4.77% from 4.84% just a week before.

Credit Card Rates

The average APR for fixed-rate credit cards fell a 0.69 percentage points to 13.33%. On the other hand, the average APR for variable-rate credit cards rose almost equally, from 14.59% to 15.13%, a total of 0.54 percentage points.

National Mortgage Rates

Average rates on 30-year fixed-rate mortgages fell 0.07 percentage points to 3.6% last week. Fifteen-year fixed-rate mortgage fell, as well, to 2.89% and rates for 30-year jumbo mortgages to 4.04%.

CD Rates

Finally, for those looking to save for a rainy day, the average yield of a five-year CD ticked down to 0.88%. The average five-year jumbo yield followed the trend, falling just 2 basis points to 0.89%. When it comes to short-term CDs, rates were unchanged from the week prior: one-year CD yields are at 0.27% and a one-year jumbo CD yields 0.3%.

This week’s roundup comes from data reported last week, ending with Thursday, Jan. 17, 2013 and reflecting activity from Jan. 10-17, 2013.

Photo Courtesy,Victor1558

January 19, 2013

LA’s Best Place to Catch a Buzz

In 2007, Matt Berman was just another burnt out branding executive whose corporate successes brought increasingly diminishing returns. With each pay increase, Berman felt less and less fulfilled. “It was clear I was doing a better job of selling myself than performing. I did not really think I had it in me to continue to succeed in the corporate world. My back was up against a wall,” he said.

And so what do you do when you crave change? Well, for starters, you can shave your head. In 2008, Berman did just that. He left his cushy corner office behind and did what felt right: attend barber shop school, a long-time dream. By 2009, Mohawk Matt – along his new renegade barbershop – was born.

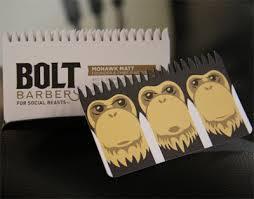

Today Bolt Barbers located on 460 S. Spring St., likes to be known for breaking all the traditional rules in the “salon” biz. Berman insists that his downtown flagship store is LA’s first real barbershop in over 50 years and playfully dismisses competition like Rudy’s and Floyd’s as “salons that employ cosmetologists.” In the Bolt Barbers vernacular, words like salon and cosmetologist come with an implication of social stigma not unlike cooties or grossy pants.

Bolt Barbers has a distinct speakeasy kind of feel offering a range of services – from beard trims ($10-$12) to shoe shines ($7) to teeth whitening ($50) – all targeted exclusively and unapologetically at “dudes.” (Dudes aged 7-70, to be precise.)

Bolt Barbers has a distinct speakeasy kind of feel offering a range of services – from beard trims ($10-$12) to shoe shines ($7) to teeth whitening ($50) – all targeted exclusively and unapologetically at “dudes.” (Dudes aged 7-70, to be precise.)

Going rogue in a saturated market amid the worst economic conditions since the Great Depression may seem like the desperate act of a desperate man. But Berman understood that even in a bad economy, dudes need a good haircut. And for the price of a shear ($25), Bolt Barbers offered its clientele something even more important: a supportive community and a sanctuary from the harsh economic storm.

Location also played a huge role in Berman’s strategy. The redevelopment of downtown Los Angeles and its growing community of artists and young professionals complimented his emphasis on “return on community” over “return on investment.” “I thought it was a very opportune time, actually,” says Berman. “Low rents and the micro environment in downtown was growing despite the global economic recession.”

There is an undeniable sense of rebellion that pervades the Bolt mystique. The three monkeys logo represents the company’s mischievous set of core values: see no evil, hear no evil, speak no evil. Bolt’s “People Hate Us on Yelp” campaign along with a teasing and, at times, antagonistic rejection of anything that so much as resembles Steel Magnolias are just two examples of Berman’s unique anti-branding strategy.

There is an undeniable sense of rebellion that pervades the Bolt mystique. The three monkeys logo represents the company’s mischievous set of core values: see no evil, hear no evil, speak no evil. Bolt’s “People Hate Us on Yelp” campaign along with a teasing and, at times, antagonistic rejection of anything that so much as resembles Steel Magnolias are just two examples of Berman’s unique anti-branding strategy.

But Berman must be doing something right. Bolt Barbers has been a huge success…even on Yelp! Their second location, Bolt Barbers’ Monkey House, recently opened in West Hollywood. A vintage mobile barbershop called Bolt Barbers On Safari is available for events and parties, while a fourth location in Las Vegas is currently under construction.

I guess it’s not shocking that the barber who offers free beer with a shear usually wins.

January 18, 2013

What’s Your Money Personality?

“I’d always had an interest in personality,” says career coach Ray Linder. But, despite that interest, he says never made the connection between personality and personal finance until one day while counseling friends.

“They were a couple and the husband was just unmovable,” he says. “The idea of putting money into long-term investments was horrifying to him because he was so ultraconservative.” Linder says he was driving home after the failed session when a lightbulb went off. “His approach to finances and his general personality were so closely aligned that I knew there was a connection that needed to be explored.”

After extensive research, Linder wrote ”What Will I Do With My Money?,” a book examining personality types and how they impact our behavior, especially the decisions we make (or don’t) with our money. Based on established psychology theory, he reduced the 16 known personality types into four larger categories: protectors, planners, pleasers and players. I spoke recently with Linder to discuss his book, the pros and cons of each category and what each of us can do to maximize the positive attributes of our personalities and avoid the negative.

Protectors

“The natural approach of a protector is to be careful, cautious and conservative,” says Linder. “They want stability and security and generally don’t like debt.” He describes protectors are the “frugal” type who lean heavily on experience and tend to return to what’s familiar. Because protectors are typically very organized, Linder says if they fall into situations where there’s uncertainty, they often have a hard time making decisions. His advice: If you think you’re a saver, it would benefit you to embrace financial products that fit your personality. Look into bonds, savings accounts and blue chip stocks. “But beware that your desire for security means that you could miss out on the payoffs that come with risk,” he warns. “Work with your personality by setting aside ‘risk’ money, funds you can play with without any anxiety.”

Planners

“Planners or, as I think of them, professors, are the thinkers of the bunch,” he says. According to Linder, planners like theory and abstraction so they spend their financial energies mostly thinking about the future and strategizing. “You’ll find lot of portfolio managers in this group because these are people who are naturals at taking in data and creating forecasts. The planner delights in beating the market and wants to be confident in making decisions,” says Linder. He advises, as such, to avoid overanalyzing. “A big challenge for this group is failure to launch because there’s always one more thing to consider. Again, you have to work with your personality, adjusting for this. As a planner, build into your projections and models a deadline by which you should start – easy to do if there’s a point by which your returns diminish.”

Pleasers

By virtue of their personality, pleasers are the least interested in money, according to Linder. “They’re highly relational by nature and care more about people. Pleasers tend to want to build a life that reflects who they are and their relationship to others,” he says – even when it comes to their money. Because pleasers are caring, they often use their money as a way of caring for themselves and others. Linder says a good example of this is the parent who will maintain high expenses for a large home just in case their kids ever have to return, or an overly generous friend. He says the best advice for a pleaser is to remember that being logical with their money (saving, investing and budgeting) will lead to better relationships, ultimately. “It may seem like you’re sacrificing connection in the short-term but making sound decisions will positon you better in the long-term,” he says.

Players

Then there are the “players,” those who seem to use money as they please, letting the chips fall where they may – so to speak. “Most might call players impulsive but they’re really just very oriented in the present,” says Linder. In fact, because they tend to have great skill in reading situations and responding accordingly, Linder found that players don’t actually need the planning qualities many of us depend on to get along. “They’re more comfortable with risk because they don’t see it as that. They have a belief and optimism that they can make any situation work and often can,” he says. Still, even players need to practice some restraint and Linder suggesting, in making financial plans, that they embrace tactile tools and strategiess. “They benefit from using cash, instead of a card,” he says. If you’re a player, don’t budget and plan too far into the future, but in weekly increments to avoid getting disconnected from your goals.

Finally, Linder says that no one money type is bad or good, right or wrong. “I encourage people to be comfortable with who they are because there’s something to be learned from each approach,” he says. “You’ll be most comfortable and make the best decisions when you’re playing on your instincts, but try to temper that with checks and balances. It’s when we overdue aspects of our personality that we get in the most trouble.”

Photo Courtesy, Tax Credits.

January 17, 2013

Why Clutter Costs You

Just how many hundreds of unnecessary emails do you have sitting in your inbox? What about that pile of mail you stash away and forget to review until who knows when? All this excess can make you misplace bills or tax information, and, as a result, suffer from late fees and accrued interest. How to stop all the clutter madness? Read more here.

And, as always, we want to hear from you. How much is your clutter costing you? Connect with me on Twitter @Farnoosh and use the hashtag #FinFit.

Fat Loss Foods: 7 For Under $5

If your New Year’s weight loss resolutions have waned, here’s some food for thought: a few simple and inexpensive swap-outs on your grocery list could usher in a whole new era of fat burning.

If your New Year’s weight loss resolutions have waned, here’s some food for thought: a few simple and inexpensive swap-outs on your grocery list could usher in a whole new era of fat burning.

“Eating a healthy diet is NOT the same as eating a diet for fat loss. Many of [us] already have a healthy diet but are not seeing the results [we] want…In a nutshell, you have to increase protein, vegetables and essential fats, while cutting out quick-burning carbs and sugars, and still maintaining a calorie deficit,” says Julie Longmuir, Tier 3+ certified trainer & nutritionist from Equinox Gyms. Lean protein is a key to fat loss she says, and that’s why eating certain foods — and cutting out others — will help you achieve your goals in a shorter period of time.

Why is protein so important? For starters, it’s more difficult for your body to break down than carbs or fats, making your metabolism work harder. It also has a satiety effect: one small serving keeps you going until your next meal or snack, which means an easier time keeping your appetite and food cravings under control. As well, protein is used for building and maintaining muscle tissue — the amount of muscle you have on your body determines your metabolism. And finally, because you need protein to fuel and repair your muscles’ recovery, a small serving of protein after a tough workout can help you recover faster, get stronger, and therefore burn more calories at rest.

Including after a work-out, Longmuir recommends eating protein at every eating opportunity, including snacks. That’s no less than six servings of lean protein per day. Here 7 foods that fit the bill, and cost less than $5 for a 3-6 serving package:

Plain Greek Yogurt (2%)

This weight-loss powerhouse is super high in protein, probiotics, and low in sugar — unlike almost every other kind of yogurt. No wonder sales have doubled in the last 5 years. Skip the 0% — it’s not as tasty and therefore harder to enjoy by itself. If you’re looking for a little extra “something” in your yogurt — instead of honey try fresh fruit with lots of tart juice like blueberries or pomegranate seeds. A 17.6 ounce container is roughly $4.69.

Boiled Eggs

For about 25-95 cents per serving, boiled eggs are incredibly economical and satisfying additions to salads, breakfast, or even eaten alone as a snack. A dozen can cost as low as $2.99. I like to boil a dozen over the weekend and then eat them all week.

Almond Milk

Low-fat milk is a healthy choice with 10 grams of protein per serving, however, cow’s milk contains just enough natural sugar that, if it’s a diet staple, could interfere with your fat loss goals. Fortified almond milk on the other hand, contains all the protein and calcium of cow’s milk, with MORE nutrients and LESS carbohydrates and calories — the unsweetened variety has just 40 calories per serving which is less than half the calories of low-fat cow’s milk. Rather than drink it plain, I like to use almond milk as the base for protein shakes, which makes it even more creamy, flavorful and delicious. Best of all, it’s often cheaper than milk, or at least it is at my grocery store. You can get a 32 oz carton for just $2.69 or $3.19 for a half gallon –or about 80 cents less than a half gallon of cow’s milk.

Low-fat Cottage Cheese

Cottage Chesese, like yogurt, is a weight loss go-to. And though the low-fat (2%) version is best for your weight loss goals overall, Longmuir says that if you don’t like the taste of cottage cheese, go ahead and try the higher-fat varieties — I like 4% and the added fat is negligible if it gets me eating this protein-rich food more consistently. When prioritizing nutrients, the right kinds of fats can often times be a better choice over carbohydrates if you’re trying to maintain ketosis in the body, (a biochemical process that occurs during the fat-burning state). You can buy 16 ounces for about $3.79.

Hummus

Hummus wasn’t always my favorite snack, but over the years this chick-pea spread has become so ubiquitous in my diet, I admit I’m not sure how I ever snacked before! High in protein and good fats, hummus helps keep hunger at bay at any hour. It’s delicious on cut up veggies like peppers, cucumber and cherry tomatoes, and I even like to scoop it on grilled chicken. You can get a 17 oz tub for $4.99. My favorite is Sabra’s original — the creamiest!

Canned Tuna

Fish is one of Longmuir’s favorite fat loss foods because it’s a heart-healthy, lean protein with all the right kinds of fats. The only downside to eating fish is that it can be expensive. But even Dr. Oz says canned fish like tuna and salmon is just as healthy for you, and it’s budget-friendly, too. Just make sure to get the low-sodium variety packed in water to help support your fat loss goals — you can buy one 7 oz can for 3.99 each, which offers about 2-3 servings.

Edamame

Edamame is a versatile legume and great for adding protein to salads, puréed into soups and pestos, made into hummus, dried and salted for snacking or even eaten green and raw as an appetizer. You can get a 12 oz bag of shelled raw beans for $3.39.

Eating well in the New Year is easy when you have an arsenal of lean, high-protein options to add to meals and to eat as snacks. Finally, please note prices may vary in your area: I calculated these prices using online supermarket FreshDirect.com.

Photo Courtesy of pixabay.com/en/food-cartoon-soft-eggs-egg-32867

January 16, 2013

Tax Tips: Deducting Your Home Office

[image error]The more than 13 million Americans working from home have reason to rejoice this year. Deducting their business expenses just got a whole lot easier.

Despite the growing trend of working from home, few actually deduct their home office with just over 3 million taxpayers claiming the home-office deduction in 2010, according to the IRS. To remedy that, the IRS announced Tuesday new measures that will go into effect next tax year to streamline the process of deducting the cost of a home office. Those of us who telecommute, or simply use our homes as our primary place of business, will be allowed to deduct $5 per square foot of work space – up to 300 square feet for as much as $1,500 in deductions.

The IRS expects taxpayers to save more than 1.6 million hours per year in time devoted to tax preparation with the new method, siad SBA Administrator Karen G. Mills on the White House blog. “Today, more than half of all working Americans own or work for a small business,” she wrote. “An estimated 52 percent of small businesses are home-based, and many of these small businesses have home office space that would qualify for the deduction.”

In the meantime, tax season is upon us and if you’re looking to claim your home office you’ll need to know what to do. The IRS has a 28-page guide but, to get you started, here are a few tips and resources to make the process just a little easier.

Determine Eligibility

Just because you work from home on occasion doesn’t mean you can deduct having a home office. You have to meet the IRS’ set of requirements. Pursue the deduction if you use part of your home exclusively and regularly as your principal place of business, or as a place to meet or deal with patients, clients or customers in the normal course of your business. One exception: for storage, rental or daycare-facility use, you’re only required to use the property regularly, not exclusively.

Calculate Indirect Expenses

If you meet those qualifications, you’ll need the IRS’ form 8829 to calculate your indirect expenses – costs including: mortgage interest, real estate taxes, homeowners insurance, water, heat, electricity and waste removal. And until the new calculations take effect, the amount you can deduct for your home office is based on the percentage of your home used for the business. So measure the square footage devoted to your home office to its percentage of your home’s total size. For example, if your home is 1,200 square feet and your office 300 square feet, by just dividing 300/1,200 you’ll see that you use 25% of your home for work, can deduct 25% of those indirect expenses.

Consult a Tax Expert

Finally, the IRS is making changes to the home-office tax deduction because, to be honest, it’s a little complicated. It can be hard for many taxpayers to determine, first, if they qualify and then how much is appropriate to deduct. If you’re unsure, don’t just skip the deduction and miss out on a great tax savings. Consult a profession, a personal accountant that has experience with freelancers, small businesses and other other that work from home. Doing so could help you avoid an audit and save you the headache of figuring it all out yourself.

Photo Courtesy, DavidMartynHunt.

January 15, 2013

Live! With Kelly & Michael

Stopped by the set of Live with Kelly & Michael last week to dispense some of my favorite savings tips to help you earn and save more in the New Year. In case you missed it, check out the video below.