Farnoosh Torabi's Blog, page 47

February 12, 2013

Save $1,500 in a Year

Even the most budget-minded folks can forget that the little things really do add up. Small, overlooked costs can turn into hundreds or thousands of dollars down the drain. To help, here are five simple ways to save more than $1,500 in a year. Read more here.

What’s your big savings tip for 2013? Connect with me on Twitter @Farnoosh, using the #FinFit hashtag.

February 11, 2013

Flex Work Schedule Boosts Romance

This Valentine’s Day the best gift you can give your significant other could be a change in your work schedule. According to a recent survey by FlexJobs.com, work flexibility can improve your personal relationships – romantic and otherwise.

Also See: 3 Work-From-Home Alternatives

The job-search site surveyed more than 1,000 people and found most believed that improved flexibility in their schedules – through telecommuting, freelance or part-time work – would have a positive impact on their relationships. An overwhelming 91% said that job flexibility would free up time for family and friends. When it comes specifically to matters of the heart, 82% said that it would help them be a more attentive partner, with 47% even reporting that they would spend more time dating or having date nights. Interestingly enough, 41% said that having a flexible job would also improve their sex lives.

Also See: 3 Ways To Find Work-From-Home Jobs

These results may not be too surprising considering long work schedules often lead to increased stress, but the research suggests it’s really what couples do when their together that leads to better relationship outcomes.

A study conducted by the University of Virginia for the The National Marriage Project sought to examine the value of “date nights” in relationships. It looked at 1,600 married couples, focused on how much quality time they spend together, and found that their reports of couple time were associated with higher relationship quality. More specifically, husbands and wives who engaged in couple time with their mates at least once a week were approximately 3.5 times more likely to report being “very happy” in their marriages than those who enjoyed less quality time together. According to the report, couples used this valuable time to decompress, communicate and reconnect.

FlexJobs CEO Sara Sutton Fell says the best approach to find a telecommuting job search is target niche agencies and job search sites that specialize in telecommuting, freelance and part-time opportunities. When searching online, she says avoid scam postings with precise search terms including “remote,” “telecommute” and “telework.”

Photo Courtesy, Jenisse Decker.

February 10, 2013

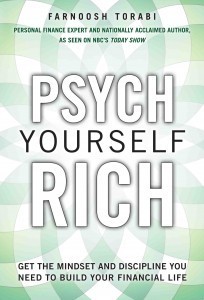

$9.99 eBook Deal: Psych Yourself Rich

For a limited time this week, FTPress.com is selling the e-book version of my latest release, Psych Yourself Rich, for $9.99, a 60% discount. And remember, to get the first chapter for free, just sign up for my newsletter.

For a limited time this week, FTPress.com is selling the e-book version of my latest release, Psych Yourself Rich, for $9.99, a 60% discount. And remember, to get the first chapter for free, just sign up for my newsletter.

Happy reading!

February 8, 2013

3 “Work From Home” Alternatives

[image error]Working from home is becoming a popular option for more and more professionals but sometimes your living room isn’t the ideal place to work. Luckily, if you’re in need of something more official and productive, a home office away from home, there are new alternatives.

Also See: 3 Ways To Find Work-From-Home Jobs

An estimated 13.4 million people work from home at least some of the time, according to the U.S. Census Bureau. I’m one of them, as a journalist, filing many of my stories and conducting interviews from my apartment. It can be a great, flexible way to work but it has its challenges. Those that work from home know that it can be isolating and ripe with distraction. In fact, a recent survey counts family interruptions, household noise and television as top work-from-home distractions. You make think venturing out to a coffee shop is better but with unreliable internet, loud machinery and big crowds, if often isn’t.

For the many reasons you may want to work elsewhere, here are a few wallet-friendly alternatives to working from home.

Establish A Virtual Office

You can sometimes lose your appeal as a professional when you work from home. Give yourself some corporate cache by first separating the personal from the professional. Establish a virtual office. You can first set up a second line using Google Voice. Google’s service will allow you to pick your own number, establish a voicemail and forward you calls from your Voice line free of charge. Second, you probably don’t want to share your personal address for professional correspondence. Do it the old-fashioned way by setting up a post office box. Fees vary but start as low as $14 for six months.

Set Up Shop

Business centers around the country offer more advanced virtual-office services, but in a package. Companies including Regus and Davinci Virtual Office Solutions manage mail and calls for their clients with the help of their live receptionists at locations around the country. Prices range from $50 to $130. Need temporary space? Regus, for example, also has offices, meeting spaces and lounges that you can rent for just a few hours, days, up to months. Perhaps you don’t want the full commitment of renting and maintaining a space to work. Well, for a $30/month membership fee, you can visit one of their 1,500 lounges to work. The spaces sport fully-stocked kitchens, free Wi-Fi, support services and an administrative team to help you with your business.

Find Co-workers

Finally, studies show people report being more productive in the company of co-workers. To capitalize that finding and the growing number of independent workers, website Deskwanted.com launched in 2010 as a listing service for collaborative workspaces. Unlike business centers, the coworking locations available through Deskwanted are more open, for those who enjoy the social component of the workplace. The cost to co-work is fairly inexpensive and you can pick your own terms: duration, space. etc. One Brooklyn office, for example offers dedicated desk space for as little as $10 a day and $350 per month.

Photo Courtesy, DavidMartynHunt.

Two Cooks, One Kitchen, a Recipe for Success

April and Rich on a culinary adventure through Ireland.

“Most people thought we were pretty crazy,” says April Christiansen of her bold decision to launch a catering business with husband Rich Christiansen. “But we actually have a lot of fun together.”

And fun isn’t something they take for granted these days. Up until recently, times had been financially challenging for the southern California couple, who loved to spend every spare dime pursuing their passion of catering parties for close friends and family (at no charge). Rich, head chef at Fabrocini’s in Beverly Glen, and April, a former bartender, were famous for going all out, delivering professional-level quality, free of charge.

But all that took a back seat in 2011 when April’s wages and hours got slashed at the architectural signage company where she worked as a sales and marketing assistant. “We were making ends meet. But just barely,” she says. “We could pay our bills and not much else.”

April began to seek additional sources of income and after a few failed attempts, realized the solution wasn’t far from home. Why not profit from our passion? she thought. And so, Two Cooks in Your Kitchen – the site and the business — went live within weeks. It was a bold move that proved pretty successful. It just took having some confidence and believing your talents have value beyond just kind words and thank yous from friends. The Christiansens, in fact, found that their friends and family were more than willing to pay generously for services they once enjoyed for free. With that new found confidence, they marketed themselves online via Yelp and Facebook as personal chefs-for-hire and used April’s graphic design expertise to create postcards and business cards to further promote their new side venture.

April began to seek additional sources of income and after a few failed attempts, realized the solution wasn’t far from home. Why not profit from our passion? she thought. And so, Two Cooks in Your Kitchen – the site and the business — went live within weeks. It was a bold move that proved pretty successful. It just took having some confidence and believing your talents have value beyond just kind words and thank yous from friends. The Christiansens, in fact, found that their friends and family were more than willing to pay generously for services they once enjoyed for free. With that new found confidence, they marketed themselves online via Yelp and Facebook as personal chefs-for-hire and used April’s graphic design expertise to create postcards and business cards to further promote their new side venture.

That’s right. They still have day jobs. April has since been promoted to a commission-based sales position that gives her the flexibility to work on expanding the family business. The dynamic cooking duo’s overarching goal is to play host for a change by acquiring their own space near Studio City. ”We hope to transform Two Cooks in Your Kitchen into Two Cooks in a Kitchen,” says April. The details of their business plan — which may include event planning services and cooking classes — are still in the works.

February 7, 2013

Which Rewards Card is Right For You?

With credit card offers coming nearly daily in the mail and a bombardment of TV commercials and online ads touting the mega-rewards of this card or that card, it’s enough to make your head spin. How can you figure out what the best reward card is for you?

It depends on how you spend your money, says Odysseas Papadimitriou from Card

Hub.com. As reported on CBS’s MoneyWatch, she says:

“To be truly effective, a rewards card must complement the cardholder’s spending habits… That means the best credit card for people who want rewards is likely to vary from person to person.”

Best to get familiar with your budget, experts say, which means understanding how much you regularly spend in different categories such as your monthly grocery bill, travel, and gas. Utilize your online banking options for this or even outside tools like Mint.com, which can help keep track of your weekly or monthly expenditures. Then try NextAdvisor’s cash-back calculator, which gives you a better picture of how much any given rewards card will pay out and more importantly, can help you determine if your expected rewards will more than cover the card’s annual fee.

So whether you already earn rewards with a credit card, are in the market for one, or perhaps the thought of choosing one is simply exhausting — here’s a review of some of the best rewards cards out there and the types of spending habits they’d be best suited for:

If you want to keep it simple…

Capital One Cash is one favorite among experts for the reason that it’s easy to understand, and it comes with minimal fees. You get 1% cash back on every purchase along with a 50% bonus at the end of the year (effectively a 1.5 percent cash back on every dollar you spend) with no annual fee, and you pay zero interest in the first year. After that 12-month period, you’ll pay between 12.9 percent and 20.9 percent for any balances.

If you spend a lot at the grocery store…

The Blue Cash Preferred from American Express is another front-runner, as this card offers the best rewards on the market for everyday purchases including 6 percent cash back at supermarkets; 3 percent at gas stations and 1 percent everywhere else. This card charges an annual fee of $75, but it promises a $150 bonus for new cardholders (which essentially pays the annual fee for the first two years).

If you’re a commuter and burn tons of gas…

PenFed Platinum Rewards provides the absolute best gas rewards, with 5 points per dollar spent on gasoline at any station. There’s no annual fee, and there’s a $250 sign-up bonus of $250. The catch: you have to join the Pentagon Federal Credit Union, which costs a one-time fee of $15.

If you’re about to make a big purchase…

Chase Sapphire Preferred is noteworthy for its generous bonus for cardholders who charge at least $3,000 during the first three months. The reward is 40,000 bonus points, which are worth $500 in travel accommodations, or $400 in cash. Not bad! This card is also good for travelers as these points can be transferred to any airline’s frequent flier program. Plus, you get two points for each dollar spent on travel and dining, with a once-a-year, 7 percent “dividend” bonus. The catch: there’s an annual fee of $95, but it’s waived for the first year.

If you’re a Costco junkie…

Costco’s True Earnings card from American Express is a great option for Costco shoppers. It’s the only credit card you can use when shopping at Costco and there’s no fee for members. It gives you an annual reward check that amounts to 3 percent of your spending on gas and restaurants, 2 percent on travel, and 1 percent at Costco (and everywhere else).

If you like to travel…

Capital One’s Venture and Venture One are great choices for those who like to travel, but don’t want to be locked in to one particular airline or hotel chain. The Venture card charges a $59 annual fee, but provides two points per dollar spent anywhere. Similarly, the Venture One card provides 1.25 points per dollar, without the annual fee (otherwise the cards are identical). While these are called “points,” each point is worth a penny and to claim travel rewards, the charge will simply be subtracted from your bill. Which one is right for you? Consider whether you’ll spend at least $10,000 a year on the card (this much usage will earn you $200 in rewards on Venture, vs. $125 with Venture One). If yes, the more generous reward card will more than make up for the annual fee — otherwise, go for the no-fee card.

If you LOVE to travel (or must)…

If your relationship to jet-setting is less casual and more of a way of life a la Ryan Bingham from “Up in the Air”– then you’re the perfect candidate for a travel-specific rewards card. Many charge an annual fee, but frequent travelers swear they’re worth the cost. Not only can you earn extra miles for pleasure trips on your most frequently-used airlines, rewards cards can provide first-class upgrades and other perks, which can be even more valuable than earning airfare.

Case in point: Delta’s American Express Reserve credit card. Though expensive — a whopping $450 annually — benefits like a free checked bag on each flight (a savings of $50 per roundtrip), one free first-class companion ticket every year, and access to Delta’s airport lounges (regularly-priced at $450, so the annual fee pays for itself with this one perk alone) are enough to win over frequent travelers. If you’re interested in a charge card — where you pay your balance down every month instead of carrying a balance — than the American Express Platinum Card, priced similarly, has even more perks including a 24/7 travel concierge, Priority Pass access to over 600 VIP airport lounges around the world, and upgrades at partner hotels. To compare the two cards, see this article on NerdWallet.com.

If you’re an airline or hotel loyalist…

However, if you fly primarily on a specific airline like American, United or Southwest, or only ever stay in hotel chains like the Starwood or Hilton – all offer their own attractive reward cards that will rival the perks offered by Delta and American Express. Each are very competitive and company-specific, so check out individual vendors for details.

If you’re going to transfer a balance…

Experts seem to agree that for those who will be carrying a balance, and/or want to transferr their current balance, the Chase Slate card is one of the best options as it offers free balance transfers, while most other credit card companies charge 3% to 5%. You also get zero percent interest on transferred balances for 15 months.

If you’re young or have poor credit…

Credit card options for the young and credit-challenged are far less appealing than for those with excellent credit. But your best bet are the BankAmericard for Students which offers no annual fee and 0% APR for the first 15 months or the Journey Student Rewards from Capital One, which pays 1.25% cash back on every purchase, as long as you pay your bill on time. This is one of the few cards great for students studying abroad, as it doesn’t charge foreign transaction fees.

If your credit isn’t great, try the Capital One Platium MasterCard, which has a high APR (24.9%) but a low, annual fee ($19) which makes it a good option for those with average to so-so credit, as long as you’re able to pay the balance each month. Of course, if you have truly terrible credit, the only way to go is a secured card. Try the Capital One Secured MasterCard –the annual fee is relatively low ($29) and the security deposit is modest.

Photo courtesy of: fotopedia.com/flickr-3274955487

February 6, 2013

Preparing Taxes? How to Keep Your Cool

Who actually enjoys filing their taxes? I suppose if you’re expecting a fat refund, you may be eager to get a jump on the paperwork. But, in general, it’s not exactly our favorite pastime. To ease the burden, I’ve partnered with Office Depot – a one-stop shop for all your tax preparation needs – to provide some essential tips on ways to prepare and file your taxes smoothly this year.

Who actually enjoys filing their taxes? I suppose if you’re expecting a fat refund, you may be eager to get a jump on the paperwork. But, in general, it’s not exactly our favorite pastime. To ease the burden, I’ve partnered with Office Depot – a one-stop shop for all your tax preparation needs – to provide some essential tips on ways to prepare and file your taxes smoothly this year.

Don’t Go It Alone. It’s easy to make mistakes when filing your taxes solo. Invest in some assistance to not only ensure you make no errors, but also to maximize on all the tax credits and deductions you may forgot to claim on your own. You can find a wide array of tax software like Intuit’s Turbo Tax, where you can compile and file your taxes online with the click of your finger. For consumers who would rather stay offline, Office Depot also has all the tax forms you need to successfully file the more traditional way.

Take Smart Steps Now to Make Life Easier in 2014. Start preparing for next year, now. Small business owners, for example, can stay ahead of tax season by utilizing Intuit’s QuickBooks, a critical tool to help them run their business and prepare their taxes. You can also automate as many of your financial responsibilities as possible for easier tracking.

Clear the Clutter. When in doubt about what to keep and what to toss, I stick to the 1-3-6 rule. Monthly statements from your bank, insurance company, utility company, keep for one year until you get the annual statement and you can shred all the monthly statements. Tax paperwork, keep for 3 years since that’s typically the time frame the IRS uses to audit returns. If you know that you’ve underreported income in the past, you definitely want to keep your IRS paperwork for 6 years, as the IRS has more time to audit for filers who underreport income. Use colorful folders to help organize these statements. Office Depot has great organization tools that also add a little fun to a traditionally boring task, like See Jane Work products. They will help to add a stylish twist to your space!

Don’t Toss, Shred. A shredder is a must-have for any home office, especially around tax season when you’re filtering through all your paperwork and deciding what stays and what goes. A mistake many households still make is failing to shred documents with sensitive information such as their credit card information, social security number, address, etc.

For more info on all these helpful products and services check out OfficeDepot.com/tax.

Preventing Frozen Pipes

This past Groundhog Day, Punxsutawney Phil predicted an early Spring. But not so fast! Meteorologists still expect the remaining days of this Winter to be marked with record-cold weather across the country, and with those temperatures comes a major threat to your home: frozen pipes.

This past Groundhog Day, Punxsutawney Phil predicted an early Spring. But not so fast! Meteorologists still expect the remaining days of this Winter to be marked with record-cold weather across the country, and with those temperatures comes a major threat to your home: frozen pipes.

Your home’s pipes are filled with pressurized water and like any other water, it can freeze at 32 degrees Fahrenheit. That ice expands and what you get if it expands beyond the strength of your pipes are cracks, leaks and sometimes a flood.

Also See: 3 Ways To Save On Your Heating Bill

When a pipe bursts it can quickly fill your home with water and ruin flooring, carpeting, drywall, cabinetry, furniture, draperies, electronics and family heirlooms – not to mention the damage associated with mold. According to the Insurance Information Network of California, a standard damage claim of $50,000 from a broken pipe is fairly common. Frozen and broken water pipes are second only to hurricanes and as the costliest home disaster in the United States – both in terms of the number of homes damaged and their cost to individual homeowners, according to the IINC.

Before this winter is over, especially if you plan to travel away from home, here are a few tips to protect your pipes.

Keep Your Home Warm

It probably goes without saying but the best line of defense against a frozen pipe is a warm home. That’s easy to do when your at home but when your away at work keep the thermostat set at least 55 degrees . If you plan to be away for a stretch of time during cold months, have someone regularly visit to run water and make sure the home is staying warm enough to prevent freezing.

Consider Your Home’s Age

Modern home construction is designed to protect the plumbing from freezing, says Richard Beard, associate professor at the Utah State University School of Applied Sciences. “This is done by a combination of the central heating of the home, insulation characteristics of the home’s exterior walls, and the locations selected and protection provided for the pressurized water pipes within the home,” says Beard. If a you have an older home or an addition/modification made to your home’s original plumbing system, your plumbing may be more susceptible to freezing temperatures and damage.

Prep Your Pipes

The goal is to keep your pipes’ temperature above freezing. IINC has handy tips that start with shutting off your home’s water supply if you plan to be away for some time. After shutting it off, run your faucets (indoor and outdoor) to drain any water from pipes that could potentially freeze. You can also insulate all exposed pipes located in your basement, under your home, on outside walls or in attics with electric heating cables available for as little as $35 from Wal-Mart, Ace Hardware and Home Depot.

Drip Your Faucet

Finally, Beard says the old trick of dripping your faucets does, in fact, work. It is not the preferred method, he says. It’ll add cost to your water bill and it’s the most “water-wise” option but can be effective if there’s no other way to keep your pipes warm. Beard says remember to let the water drip from both the hot and cold water faucets. Again, the water flow must be sufficient to prevent freezing because if the temperature is low enough, even flowing water will freeze.

Photo Courtesy, BryanAlexander.

February 5, 2013

Secrets to Earning More in 2013

If you’re determined to land a new job or score a promotion this year, you’re in luck. Workplace experts predict 2013 offers the best chance for career enhancement in more than five years, especially if you’ve got skills. But no matter what your occupation, it’s possible to boost your paycheck in 2013 with these new “secrets” from researchers at Money magazine. Read more here.

What’s your best job search tip for 2013? Connect with me on Twitter @Farnoosh and use the hashtag #finfit.

February 4, 2013

Best Things to Buy in February

[image error]February may be the shortest month of the year, but it hardly falls short when it comes to shopping deals. Whether you’re looking for discounts on clothing, accessories or electronics, offline or in stores, February is when it’s at.

In fact, in a survey of nearly 585,000 clothing, accessories and shoe markdowns from over 150 online retailers, fashion site Shop It To Me found that average online sales reach 47% during February 2012 – better than the 43% yearly average. For women, markdowns during the month averaged 49% and, for men, they weren’t quite as steep but still the best of the year - at just 43%.

Researchers say the second month has the deepest discounts helped largely by steep Presidents’ Day sales. “Retailers are eager to clear out winter merchandise, so they can start selling spring items,” says Shop It To Me CEO Charlie Graham. “That’s why there are so many clearance events during February and why Presidents’ Day ushers in a host of great sales.”

Researchers at Dealnews.com agree. Here are some of the best things to buy in February.

Winter Coats

Now’s the best time to buy a new coat if you haven’t already. Prepare for next winter or the remaining cold days of this one with gear from companies like Columbia Sportswear and The North Face. Last year’s mild weather led to steep deals on outerwear and, in its list of best things to buy in February, Deal News predicts similar sales this time around, with some coats marked up to 85% off.

Romantic Gifts

Of course, with Valentine’s Day around the corner you won’t see romantic gifts with rock-bottom prices, but after the holiday, sales on chocolate, lingerie, jewerly and other popular V-day gifts boast discounts of up to 50% off. DealNews suggests looking for coupons at lingerie stores like Victoria’s Secret and jewelry sites like Netaya, ICE.com, Limoges Jewelry, and Ross-Simons.

Presidents’ Day Deals

By far, the best sales of the month come around Presidents’ Day weekend. This year, the holiday falls on Monday, Feb. 18, but in the days leading up to it, you can expect as much as 80% off mostly apparel, as well as tools, bedding, and furniture. Experts at DealNews say that the best prices will come in the form of deeper discounts on existing sales – mostly at department stores, online and off.

New Electronics

Finally, January and February are the best two months to purchase a big-screen HDTV, according to DealNews. Prices on 55″ and 60″ 1080p LCD HDTV’s, in particular, are at their lowest in 12 months. And with new electronics already hitting shelves, expect retailers will make room by discounting older inventory. Throughout February, look for discounts on 2012 models on all types of electronics, including small gadgets and audio equipment.