Farnoosh Torabi's Blog, page 53

December 10, 2012

Today: Green Monday Deals

[image error]Swung by TODAY this morning to give a breakdown of some of today’s best GREEN MONDAY deals. (By the way Green Monday does NOT stand for anything eco-friendly, as I presumed. It is actually referring to the more than $1 billion in sales online retailers expect to earn today, as it is the busiest online shopping day in December).

Visit NBCNews.com for breaking news, world news, and news about the economy

December 7, 2012

Top Job-Search Terms of 2012

Are you looking for a job? Then it might help to know what other job seekers are looking for. I sat down with the team at ABC to discuss Yahoo!’s top job-search terms of 2012. A few might surprise you.

December 6, 2012

5 Signs You Have a Shopping Addiction

[image error]Some people despise shopping, and for others it’s a way of life… to the point of spending more than they can afford, over and over again, even putting themselves and their families into debt because of it. But at what point does a penchant for shopping become an addiction?

Donald Black, a professor of psychiatry at the University of Iowa College of Medicine, describes compulsive shopping and spending on WebMD as “inappropriate [and] excessive…. Like other addictions, it basically has to do with impulsiveness and lack of control… In America, shopping is embedded in our culture; so often, the impulsiveness comes out as excessive shopping.”

No one knows exactly what causes it, but new evidence suggests that some people – perhaps even 10%-15% of the population, already have a genetic predisposition towards addictive behavior such as shopping, alcoholism, drug abuse, or gambling. That means that for certain people, their relationship to spending could become a serious addiction. Here are some signs indicating a problem and how to get help:

Nothing Else Gives You the Same Thrill

The feelings associated with purchasing something new can trigger endorphins and dopamine, so you feel good — SO good in fact, that without a healthy dose of self-control, most of us would literally “shop till we drop.” But for those struggling with a shopping addiction, the “high” they get from the behavior prompts them to seek this dopamine “fix” in the face of financial consequences; it’s the lack of impulse control that keeps them spending while others would show restraint. In fact, shopping addicts forced to stop engaging in their behavior can even experience withdrawal symptoms, much like any drug addict would. Take note: if nothing else in life makes you feel as good as shopping does (not sex, not food, and not spending time with loved ones) than it may be time to examine your problem further.

You’re Fighting with Friends & Family

Sure, an unexpected shopping spree or two is bound to trigger the occasional argument amongst financial partners, but if you’re in a constant state of conflict with your loved ones over your chronic shopping habit, this could be a sign you’re in over your head. Ruth Engs, EdD, a professor of applied health science at Indiana University says, “It’s more than two or three months of the year, and more than a once-a-year Christmas spree.” In addition, someone spending an excessive amount of time outside the home at the shopping mall, for example, is likely to be emotionally and physically isolating themselves from others. Your relationships could be suffering as a result and your excessive spending could lead to a break up or divorce, especially when deception or debt is involved. Speaking of deception…

You Lie About What You Buy

There are strong commonalities among shopaholics and other addicts and one is a tendency to lie about, or keep behaviors secret. While alcoholics often hide their alcohol, shopping addicts may hide purchases so friends, family or significant others won’t criticize their decisions, or inquire about their finances. If you have a problematic relationship with spending, you might continue to shop regardless of means, opening secret credit card accounts, hiding bank statements, and accumulating debt that only you know about. You may deny problems stemming from your behavior, even if others around you can clearly see its negative effect. As a result, shame and guilt ensue that can wreck havoc on relationships and on your personal life.

You Immediately Lose Interest In the Purchase

Shopaholics describe the state of thrill or excitement they experience the “rush” that accompanies buying something new, but then report losing interest in the item within minutes, hours, or days after making a purchase. It’s common for those with a shopping addiction to amass large quantities of clothes they never wear, beauty products they never use, and a slew of household knick-knacks and acquired “stuff” — more than one could ever need. In extreme cases, hoarding becomes an issue. In the end, the “stuff” itself means very little – it’s the act of acquiring it that’s the obsession.

You’re In Debt Because of Shopping

One of the best ways to know if it’s time to turn in the credit cards and seek help, is if your shopping habit has escalated to the point where you’re in debt beyond your means to repay it. People with a shopping habit often have significant credit card debt, because in the moment, throwing down the plastic is a quick-fix to the “I want that” (but can’t afford it) problem. It’s not uncommon for those with a shopping addiction to accrue $10, 20 –even $30,000 or more in debt — digging themselves further and further into the red.

What You Can Do About It

Treating a compulsive shopping habit often requires a multifaceted approach, but like with any addiction, admitting you have a problem is half the battle. Recognize your spending for what it is, and get rid of all checkbooks, credit cards, and other resources that fuel your behavior. If you’re going to a store, bring a friend: if you’re with someone, you’re less likely to overspend since most addicted shoppers engage in problematic behavior alone. Also, find new past-times: take pleasure in other activities that replace your unhealthy hobby with something engaging, like exercise, the arts, or volunteerism.

And finally, know that there are counseling groups and therapists out there that specialize in shopping addictions – cognitive-behavior treatment programs exist and best of all, there’s hope in the form of medication, which can help treat the underlying issues of depression and impulse control. Don’t let a passion for spending money — on yourself or others this season — get the best of you.

How to Find the Perfect Bra

It’s typically the first and most important garment we put on, but rarely a thoughtful purchase. In fact, one in three women never try on a bra before buying it. Big mistake! I tapped Kimberly Caldwell of Linda’s Bra Salon in Manhattan to find out how to buy and care for this wardrobe basic. Read more here.

As always, we want to hear from you. What are some of your best lingerie tips? Connect with me on Twitter @Farnoosh, and use the hashtag #finFit.

December 5, 2012

Holiday Internet Scams: How to Stay Safe

[image error]Dr. Seuss shared how the Grinch stole Christmas, but that green monster isn’t the only sly culprit lurking around the holidays. Every year, online scammers invent new ways to spoil the season and burn a hole in our wallets.

All signs point to this holiday season being especially ripe for fraud. Following Black Friday, spending is higher than it’s been in years. According to accounting firm Accenture, customers will spend an average $582 this year, with nearly a quarter maxing out at $750. Here’s the thing: more than half of those consumers will be doing their shopping online, a space swarming with scammers.

To help you shop and surf the web safely, various companies have issued warnings of holiday scams. Here are a couple popular scams and how to play it safe online this year.

“Work From Home” Scams

In an effort to earn a little holiday shopping money, many fall for “work at home” and “mystery shopper” scams every year, according to a warning from MoneyGram. How it works: After you agree to the work, you’ll usually be asked to wire or transfer money to the scammer for a “start-up kit.” Once the money’s received, the scammer and opportunity are – poof – gone. Instead, earn extra cash with a seasonal job. Retailers are still hiring in record numbers to meet the holiday rush and will probably continue into the new year with a deluge of return gifts to process. Also online gig sites such as Fiverr, Elance and Tutor.com offer legitimate ways to earn cash from home and check out Farnoosh’s other strange but true ways to earn income.

Fake Charities

The holiday season is a time when we become more generous, especially with the deadline to make charitable contributions just around the corner. Scammers expect you’ll have your guard down. Experts at McAfee, the anti-malware company, say to be on guard for emails advertising charities. These messages and others are often “phishing” scams used to get you to a bogus website where you’re asked to enter your personal and financial information. You can guess what happens next.

Always verify a charity before making a contribution. A legitimate charity or non-profit will be registered as a 501 (c) with the IRS and can be found by searching GuideStar, Charity Navigator or the IRS’ database.

Also, even if the email you receive appears to be from a reputable charity, avoid clicking on any links embedded in the message. Stay safe by typing in the charity’s web site directly into your browser. Then, donate through there.

FTC’s Advice

Finally, the Federal Trade Commission has prepared a useful guide to online holiday shopping to avoid pitfalls. First, always look for the secure checkout when paying online. Before entering your credit card information anywhere, look at your browser’s address bar. If the website’s address begins with “https” (the “s” stands for secure,) you’re in the clear. If not, it’s better you shop in person rather than take the chance. In the flurry of spending keep an eye on your bank and credit card accounts, too. Hold onto receipts and monitor your statements for unauthorized transactions.

Photo Courtesy, dave416.

December 4, 2012

4 Ways to Shine on LinkedIn

[image error]At this point in the digital age, we should all be aware that there are certain things best kept away from social media. Questionable content could hurt you professionally, but what kind of content will help you stand out in a positive way?

Whether you know it or not, recruiters, colleagues, supervisors and your contemporaries are Googling, Facebooking and Tweeting to find you. In fact, according to a recent survey by social media monitoring service Reppler, more than 90% of recruiters use social media outlets to screen candidates. Nearly 70% have actually hired candidates based on their social media presence and, by far, the most popular service among recruiters is (you guessed it) LinkedIn.

To help you shine online, here are four tips to upgrade your LinkedIn profile.

Show, Don’t Tell

LinkedIn released its annual list of the 10 most overused profile keywords this morning. They are – from least to most overused:

problem solving

analytical

responsible

innovative

track record

extensive experience

motivated

effective

organizational

creative

Of course, there’s nothing wrong with these terms, but with millions of profiles claiming to be “creative” your could get lost in the sauce. “Set yourself apart by describing and linking to projects you’ve worked on that truly were different, unique and compelling,” says Linkedin’s Career Expert Nicole Williams. “Pointing to concrete examples of the creative work you’ve done is more convincing than simply stating you are a ‘creative’ professional.”

Also See: Legal Risks of Social Media, How To Play It Safe

Trick Out Your Profile

Your LinkedIn profile isn’t just a resume; you can provide so much more than just a work history, skills and awards. You can – and should – take advantage of its other digital features to enhance your presence. For example, you can request that individuals in your professional network endorse your expertise, presenting a pretty convincing case that you know your stuff. Focus first on listing in-demand, industry-specific goals (perhaps you’ve been trained in new technology or have studied a specific concept in your field.)

Make Heads Turn

Your photo is the ultimate draw and typically the first feature most will see (besides your name). In fact, “People with photos are seven times more likely to have their profiles viewed,” according to Williams. “Having a more polished image will not only make you visible, but it also lets employers know that you are serious about representing their company in the most professional way.” You may want to consider paying for a professional headshot, but no matter what just make sure to post a picture that reflects the standards of your industry.

Match Your Profile To the Job You Want

In all, the researchers at Reppler found that the number one “it” factor employers seek when searching social media profiles is that a candidate presents a “positive impression of their personality and organizational fit.” To be certain you’re exuding hireability and professionalism, Williams suggest you do a search of leading professionals in your industry. Model your profile on theirs, making sure to highlight your unique character.

Photo Courtesy, LinkedIn.

Buy This Not That: Dining Out

Everyone loves to eat out, but it doesn’t have to be expensive. In my latest video for Yahoo! Finance, I explain what to buy and what to skip to keep both you and your wallet full. Read more here.

We want to hear from you. How do you save money when dining out? Connect with me on Twitter @Farnoosh and use the hashtag #finfit.

December 3, 2012

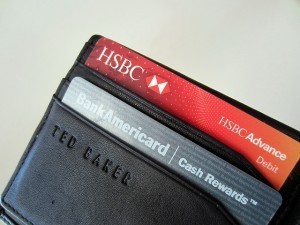

Credit Cards: 3 Tips For Smart Holiday Spending

If tradition holds, most of us will be pulling out the plastic – way more than cash -this holiday season. Shoppers have already spent an average $423 each, according to the National Retail Federation and credit card purchases are up nearly 7% this year, according to First Data, a firm that analyzes consumer data. And with consumer confidence at its highest level since the 2008 recession, credit card spending is likely to soar even higher.

Before charging it, here’s how to use your card effectively – and responsibly.

Cash in On Rewards

If you’re going to use your card, why not get something back? Credit card rewards are a great way to maximize your holiday spending and, to help you out, consumer site FatWallet.com has a list of the best cards for holiday shopping (in case you are in the market). For example, the Chase Freedom and Discover Cash Back Bonus cards offer 5% back on purchases- and with Chase, you get an additional 3-10% back when shopping with their retail partners. You can also save on holiday travel costs with rewards cards that offer airline miles. The best one is Capital One’s Venture Rewards card, which offers two airline miles for every dollar spent. With a $1,000 holiday budget, that’s enough to get you a round-trip ride from New York to Orlando – at no additional cost.

The 30% Rule

Beware of running up balances you can’t pay off quickly. A rule of thumb: don’t charge more than 30% of your limit. That not only keeps your balances manageable, it helps to keep your credit score in good standing. For example, if you have two cards with a combined limit of $2,000, don’t change more than $600. One of the things your FICO score measures is “credit utilization,” or the amount of available credit you’ve used, to determine your creditworthiness. Those with the highest credit scores in this country are less than 10% utilized on cards.

Compare Before You Buy

Be sure you’re getting the best prices with comparison tools including; PriceGrabber.com, Red Laser and Shop Savvy. Also, take advantage of your store credit to save. JC Penny’s in-store card, for example, boasts 20% off apparel, shoes, handbags, and jewelry. That potential savings should be a factor in considering where to shop.

Photo Courtesy, 401(K) 2012.

Who Do You Tip And How Much

New York News | NYC Breaking News

Tipping and bonuses can make the holiday season an expensive time of the year. I sat down with the team at Fox5′s Good Day New York to talk tipping etiquette, how much and who you should pay.

November 30, 2012

AskFarnoosh: File Taxes Jointly or Separately?

[image error]This week , Nadine tweets: I got married in July. Should we file taxes together or separately for 2012?

I gave the following answer in my column Yahoo!Finance. For more, check out the full AskFarnoosh article, which also includes answers to one Facebook fans’s student loan questions:

As a married couple, there are myriad financial decisions to make over the next several years as husband and wife, but the one that creeps up on you the quickest is often regarding good old Uncle Sam. How to file your taxes? You have two choices: Married Filing Jointly (MFJ) or Married Filing Separately (MFS).

There are a number of considerations to make before designating your status (more on that in a second), though it’s clear that the IRS plays favorites and prefers couples to file jointly. File separately and you may lose the ability to claim key tax benefits such as the student-loan-interest deduction and the earned-income credit. You’re also left with a lower income phase-out range for deductions. What’s more – you both need to choose the same method of recording deductions – standard or itemized. In short, this filing status tends to result in the bigger tax bill and it’s why many accountants advise their clients to file jointly.

That said, there are a few notable advantages to filing separately, which may appeal to you and your spouse. For example, if one of you greatly depends on itemized deductions to lower your taxable income, filing jointly may require reporting a much larger, combined adjusted gross income, which may reduce your chances of being able to itemize some major deductions. Popular itemized write-offs that are limited by AGI, for example, include medical expenses (which must total 7.5% of AGI before the deduction kicks in for 2012), personal casualty losses from theft, accidents or destruction (must total 10% of AGI), and other miscellaneous itemized deductions ranging from accounting fees to unreimbursed business expenses related to work, which must total over 2% of AGI before taking effect.

Another reason you may want to file separately is to offset potential financial risks or tax liabilities. Does your spouse or his tax preparer take certain liberties you’re not comfortable with? In that case, you may want to file separately for peace of mind that if an audit does crop up down the road, you won’t be on the hook, too. This probably isn’t something on too many newlyweds’ minds, but it’s unfortunately a price some couples pay for filing jointly. “Separating the liability from your spouse could prove to be a good and smart thing versus everyone going down with the ship,” says Joshua Jenson, a CPA in Edmond, Okla.

Finally, the state you live in may simply dictate what’s best. If you live in one of the nine so-called community property states (Arizona, California, Louisiana, New Mexico, Nevada, Idaho, Texas, Washington and Wisconsin), you may find it more convenient to file jointly, since your state requires you to go halfsies on most – if not all – income and deductions earned while married. If you file separately, there may be some added steps, such as reporting half your spouse’s income, in addition to yours.

Photo Credit: Tax Credits on Flickr