Matthew Yglesias's Blog, page 2432

February 3, 2011

The Violent Turn in Egypt

Two things to consider as pro-regime thugs beat Egyptian protestors. One is Daniel Davies' point about arseholes as a strategic resource. The other, related issue, is that when a dictatorship seems to be on the verge of toppling, there's a real divergence of interests between the people at the tippy-top of the hierarchy and the much larger train of individuals more loosely associated with the regime.

In this case, for example, Hosni Mubarak clearly has the option at any point of fleeing the country and living out the rest of his life in a comfortable and prosperous exile. And there's some number of other key leaders for whom that's also the case. Beyond exile, given the long duration of Mubarak's rule any possible post-Mubarak regime will need to continue employing some large number of incumbent civilian and military officials merely because the opposition lacks the requisite expertise. But as you further down the chain, these options tend to disappear. In any functioning authoritarian regime, some large minority of the population will see itself as benefitting from the dictatorship. And unlike Mubarak himself, most of these people have nowhere to go. They don't have Swiss bank accounts and the option of moving the Monaco.

Carter and Israel

Adventures in :

More than four years after its publication, five disgruntled readers have filed a class-action lawsuit against President Jimmy Carter and his publisher, Simon & Schuster, alleging that his 2006 book "Palestine Peace Not Apartheid" contained "numerous false and knowingly misleading statements intended to promote the author's agenda of anti-Israel propaganda and to deceive the reading public instead of presenting accurate information as advertised."

The odd thing about the anti-Carter animus among Israeli nationalists is that the signature legacy of the Carter administration is the peace agreement between Israel and Egypt. And as you may have noted with recent Israeli freakouts about Hosni Mubarak's possible fall from power, the treaty in question is the cornerstone of Israel's regional policy. That doesn't mean people need to like Carter's books, but it should certainly lead people to think harder before ascribing anti-Israel motives to the architect of a key element of Israel's current national security.

February 2, 2011

Endgame

All the kids in the neighborhood:

— Iceland, where recalculation is real.

— GOP contenders ranked by sanity and Mormonism. John Thune looks like a winner.

— Repealing the Clean Air Act is not so popular.

— Mubarak's last push.

— Amazing photo from Egypt.

Diplo remix of Sleigh Bells, "Tell 'Em".

Everything Is a Remix

Watch, enjoy:

Everything is a Remix Part 2 from Kirby Ferguson on Vimeo.

The Star Wars stuff is particularly striking in my view.

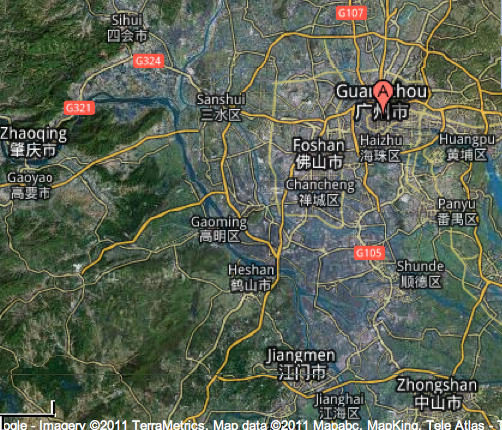

China Eying Pearl River Mega-City

The new mega-city will cover a large part of China's manufacturing heartland, stretching from Guangzhou to Shenzhen and including Foshan, Dongguan, Zhongshan, Zhuhai, Jiangmen, Huizhou and Zhaoqing. Together, they account for nearly a tenth of the Chinese economy. Over the next six years, around 150 major infrastructure projects will mesh the transport, energy, water and telecommunications networks of the nine cities together, at a cost of some 2 trillion yuan (£190 billion). An express rail line will also connect the hub with nearby Hong Kong

As Ryan Avent points out, it's not even that crazy:

The region is already quite densely populated, as you can see above, and the metro areas within the new city limits currently bleed into each other. Neither is the area of the new city that outrageous. It's about 120 miles from Zhaoqing to Huizhou, not much more than the distance from Malibu to the eastern side of the Moreno Valley, between which spans the Greater Los Angeles metropolitan area (home to about 17m people).

What the Chinese effort actually seems to entail is a significant improvement in transportation around the region, harmonised local policies, and a rationalised metropolitan system of governance. And America could learn something from this. The New York metropolitan area (about half the size and population of the above mega city) stretches across four states. If the jurisdictions that make up the New York area were better able to coordinate, they city might not find itself cancelling critical infrastructure projects to close short-term budget gaps.

Indeed, check out a rough satellite view of the area and you'll see that envisioning the Pearl River Delta as a mega-city seems fairly reasonable:

I would say the key merit of this plan isn't just the possibility for more coherent regional planning (it might work out well, or the planning might be out of touch and inept) so much as it is the deliberate desire to keep filling in China's most prosperous, highest-productivity area. And it's quite reasonable to expect people to continue flowing away from the poor countryside to opportunity in richer areas, and specifically this area which is quite prosperous by Chinese standards. Rich, productive urban areas are, after all, where the best opportunities lie and it's sensible for the Chinese to be planning for the infrastructure needs of a future in which more people flock to them.

The tragedy is that we've largely stopped doing this in the United States. Of course people still flock to the Boston-Washington corridor, the Bay Area, etc. But we don't adopt the kind of infrastructure and zoning policies that would facilitate those areas becoming substantial denser. Consequently, instead of having the fastest net population growth in the richest metropolitan areas (or states) we have people flocking to Houston and Phoenix in search of cheap housing.

The Trouble With "Jobs"

Coming and going on vacation through DCA over the past week, I had occasion to see a bunch of ads about the 9.6 million jobs in the oil and natural gas industry. Here's a representative sample:

This is, in fact, a good illustration of why progressive reform is hard. Dirty energy doesn't just have a lot of money behind it, there are tons and tons of people working in the field and they don't want to lose their jobs. And the same is true of health insurance, banking, and any other sector you might want to take on.

But as an argument on the merits, it's a huge fallacy. Suppose someone invented a Magical Energy Device tomorrow, a cube that costs about $1,000 to build and provides enough energy to power a city the size of Philadelphia. Even better, the cube has no operating expenses and causes no pollution. What should we do? Well, obviously, we should start building MEDs! A lot of them. We'd need somewhere between 300-400 of them to power the whole country, and we'd want more than that since with this new source of basically free, zero-pollution electricity we'd want to pursue electrification of our automobile fleet very aggressively. This technological breakthrough would be an enormous step forward for mankind. And not because of the jobs that would be created in the MED-manufacturing sector. Even if all the MEDs were built in China, America would benefit, and even if all the MEDs were made in the USA the benefits would be modest since the total size of the global market for MEDs would be pretty modest in dollar terms.

The MED would be a boon to humanity, in other words, just because an unlimited supply of cheap pollution-free energy would be a great thing to have. And yet, just like all forms of dramatic technological progress it would, in fact, disrupt a lot of people's careers.

Business and Growth

A friend emailed me to complain about ANC 6B's concern that more bars and restaurants in Barracks Row will turn the area into "the next Adams-Morgan." As he points out, you could just as easily call it "the next Bethesda." They've got lots of restaurants and they brag about it. It's nice. And I agree—entertainment, broadly construed, is a lot of what modern cities are about and it's not all Adams-Morgan.

But I think the whole question of urban liquor licenses is an excellent parable about the insane "pro business" discourse we've recently been afflicted with here in Washington. The success of businesses, of for-profit firms, is crucial to economic growth and prosperity. But this is overwhelmingly a question of businesses that don't currently exist. If you call up a bunch of incumbent businessmen and ask them what they want, then any relationship between their pro-business agenda and a growth agenda is going to be pretty coincidental. For example, whatever the merits of restrictive liquor licensing policies, they're clearly bad for the growth of new businesses in the bar and restaurant sector. But they're just fine for many incumbent bar and restaurant owners, particularly the less aggressive and less skilled ones.

If you're concerned about growth you need to be concerned about the ability of people to found new firms, and about the ability of small firms to grow rapidly. Talking to executives at today's large firms tells you basically nothing about this. You just chatting to a bunch of comfortable rich guys who want to pay lower personal income taxes and to get some firm-specific regulatory favors.

China's US Dollar Holdings

Here's a striking fact from Eichengreen's Exorbitant Privilege: "Today, in contrast, Chinese holdings of U.S. government and agency securities exceed $1,000 per resident."

That dramatizes the under-comprehended fact that China's exchange rate policy is a huge ripoff for the bulk of the Chinese population. At market exchange rates, China's per capita GDP is under $5,000 per head. Disbursing that horde of dollar-denominated financial assets to the population so that people could obtain additional foreign-made goods would be a boon to Chinese people's welfare. But it would be bad for the owners of politically influential export factories, so it doesn't happen.

Superman's Immigration Status

Kay Steiger reflects on a British actor playing Superman and fighting for truth, justice, and the American way:

The reaction among some comic fans has been aghast, especially since Superman is generally considered the quintessentially American superhero (that is, considered that way generally by white, male comic book characters who look pretty demographically similar to Superman himself). In fact, if you have some time, you should read this award-winning student paper (PDF) on how comic books in the stretch between the Great Depression and the Cold War change to adapt to American ideals that are popular at the time.

But it's important to remember that Superman, while very representative of Americans in certain ways, might be even more representative than you might think: After all, Superman was an illegal immigrant — one of the 9.3 million estimated to be living in the United States today. These days, he wouldn't even qualify for in-state tuition.

As those of us who recall Action Comics Annual #3 know, this is wrong. When a strange set of circumstances led to Superman becoming a candidate for president his immigration status was litigated with the Supreme Court determining that since he was transported to the planet earth in a kind of artificial womb, he's actually a natural born citizen of the United States of America.

President Superman went on to eliminate the national debt by teaming up with Aquaman to unearth a buried stockpile of gold,* and to pursue an Obama-esque agenda of ridding the world of nuclear weapons. Some may say that because this was merely an alternate timeline, my observation is invalid. But the facts of Superman's birth are the same in the "canonical" universe as in this branch of time, and the case of Uatu v. Lewis (1993, supra) firmly established that counterfactual legal precedents are binding on lower courts until explicitly overruled by the Supreme Court.

Monetary Expansion Boots Employment

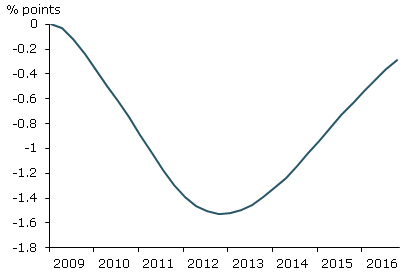

Hot new macroeconomic estimates from Hess Chung, Jean-Philippe Laforte, David Reifschneider, and John C. Williams investigate the impact of the Federal Reserve's asset purchasing program:

An analysis shows that the Federal Reserve's large-scale asset purchases have been effective at reducing the economic costs of the zero lower bound on interest rates. Model simulations indicate that, by 2012, the past and projected expansion of the Fed's securities holdings since late 2008 will lower the unemployment rate by 1½ percentage points relative to what it would have been absent the purchases. The asset purchases also have probably prevented the U.S. economy from falling into deflation.

The basic shape should come as no surprise. Monetary expansion raises aggregate demand. That means more employment and more inflation. If the economy is already close to full employment, extra demand mostly means more inflation. But if the economy is far from full employment, then you mostly get more employment and more output.

Relatedly, the Hamilton Project is offering $25,000 as a prize to whoever comes up with the best job creating idea. I'm not long-winded enough to stretch this out into a 5,000 word essay, but it seems to me that if monetary expansion leads to job creation in a depressed economy and the economy is still depressed, then we ought to have more monetary expansion.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers