Matthew Yglesias's Blog, page 2366

April 3, 2011

What Hath God Wrought?

Daniel Walker Howe's What Hath God Wrought: The Transformation of America, 1815-1848 covering American history from roughly 1812-1848 is just a tremendous book. I recommend it unreservedly to any nonfiction readers out there. This is a period in the United States that most of us (certainly myself included) don't know much about because "nothing happened." except, as Howe makes clear, tons of stuff happened. For one thing, the country expanded massively in size to include Florida, Texas, and the Pacific Coast. Mass democracy came into being paired with mass communication and mass literacy. The country was tied together by these factors into a meaningful national unit even while controversy over war with Mexico and what to do with its spoils began to split it apart.

As a side observation, I'll note it's interesting that there's a surprising amount of partisanship among contemporary historians in their treatments of this period even though obviously the Second Party System was very different from ours. Sean Wilentz's The Rise of American Democracy: Jefferson to Lincoln is very much a pro-Democrat book while Howe is much more of a Whig. My own inclinations, I suppose, are closer go Howe's in this regard. But it's a bit of an odd way to look a things.

But the incredible strength of Howe's book is his ability to weave the myriad non-political elements of the history into the narrative. You get the establishment of doomed utopian religious communities, but also the non-doomed establishment of Mormonism. Technologic change via the rise of the railroad and the telegraph. Economic transformation driven by canal-building and more modern finance. Military strategy in Mexico. Social change as the understanding of race relations, slavery, and the status of Christianity in America is redefined. It's something close to a genuinely comprehensive history of the period. Check it out.

Progress-Related Job Losses

A.G. Sulzberger reports on Illinois' abolition of the death penalty and finds that change is rarely Pareto optimal:

>The day after the death penalty was abolished in Illinois in early March, Wendi Liss received a call from one of her clients

, who was facing trial for murder and the prospect of being executed if found guilty.He was calling not to celebrate, but to express concern for her career.

"He said, 'I know this is what you guys wanted and I know this is good for us, but I don't want you to be out of a job,'" recounted Ms. Liss, one of dozens of employees at the Office of the State Appellate Defender who specialize in death penalty cases.

Change for the better, I'd say.

The Best April Fool's Post

Now that the day is well behind us, I feel comfortable in saying that Amanda Marcott wins:

Sure, I make it sound like the 90s, especially the late 90s, were the greatest, most perfect time in history. And it was! But there were naysayers. I had one friend who fashioned herself all arty, and she'd complain to me all the time about the death of college radio. Even though they had college radio on at night on 91.7 all through the late 90s, she kept bellyaching about the end of K-NACK, which was supposed to be this great indie/punk station, and it was shut down in the mid-90s. Like I said to her at the time, there wasn't any more need for college radio anymore. After all, K-NACK ended because they got bought out by the alternative rock station, 101X. Alternative rock meant you didn't need some stupid college radio stations to have anything on the air besides insipid pop music. Alternative music was mainstream, baby! After all, weren't even the frat daddies and the party girls listening to alternative rock? Alt rock had won, and there wasn't a need for any kind of underground or indie music any more.

As further food for thought, here's Local H's "High Fiving MF".

April 2, 2011

Meet The Half-Siblings

Lots of kids growing up with half-siblings:

The data included information about individual men in each household, describing what demographers call "relationship churning." Dorius found multiple fathers is common — 28 percent of all U.S. women with two or more children have children by more than one man — and it is frequently tied to marriage and divorce rather than just single parenthood.

"We tend to think of women with multiple partner fertility as being only poor single women with little education and money, but in fact at some point, most were married and working, and going to school and doing all the things you're supposed to do to live the American Dream," Dorius says in a statement.

Unlike the author of this piece, I guess I had no strong prior views about this situation. My father's two siblings were the offspring of an earlier marriage of my grandmother's, so nothing about this idea seems especially unusual or troubling to me. But here's another piece on the study in The Daily that seems wildly alarmist and quotes Dorius saying that "juggling all the different needs and demands of fathers in at least two households, four or more pairs of grandparents, and two or more children creates a huge set of chronic stressors that families have to deal with for decades."

Commerce Cabinet Crisis XVII: Alexander Trowbridge

It's been pointed out to me that I've fallen down on the job of the Commerce Cabinet Crisis series, which hereby resumes with Alexander Trowbridge. Born in 1929 into a model WASP family in New Jersey, Alexander Trowbdridge attended Philips Andover and then Princeton, graduating in 1951. He interned at the United Nations and served as an officer in the Korean War. After that he became a somewhat obscure oil company executive and was serving as president of Esso Standard Puerto Rico in 1965 when "President Johnson's talent scout, the chairman of the Civil Service Commission, … pulled Mr. Trowbridge's name from a file of 20,000 potential appointees and asked whether he was interested in working in Washington." He took a job as Assistant Secretary of Commerce and then got bumped up into the big chair when John Connor stepped down.

As Secretary he had part of the Great Society brief and was supposed to work on overseeing programs to help create jobs for poor inner-city communities. He left the position in 1968 after a relatively brief tenure, having obtained the lofty status of youngest-ever commerce secretary. He went back into the business world, again working for Connor, this time at Allied Chemical Corp where he was instrumental in resolving litigation around some toxic waste dumping the firm had been engaged in before his time. After getting passed over for the chairmanship, he got back involved in Washington life. He served on the Greenspan Commission on Social Security where he pushed for keeping the program's basic structure in place, and he spent the 1980s as President of the National Association of Manufacturers. After about ten years at NAM he stepped down to found a consulting firm and served on some corporate boards as well as George HW Bush's base realignment and closure commission.

Finite Television

I'm glad to hear the news that Mad Men will last seven seasons not because of any affection for the number seven, but simply because I like the idea of attaching a finite number to the show well in advance. I think the big thing holding television back as an art form is the medium's habitual inability to do this kind of thing. Proper plotting requires you to know more or less where you're going to end, and that's something the conventional TV business model doesn't allow for.

Meet The Corporate Democrats

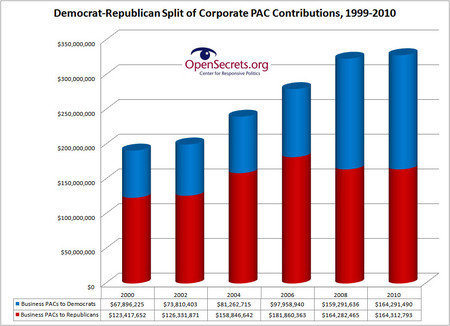

Via Nick Baumann, some empirical support for what I've been saying ever since Scott Walker's union-busting exploded onto the scene—crushing organized labor won't kill the Democratic Party's financial prospects, it'll just make it more dependent than ever on corporate money which is very much available to Democrats:

That's not by any means to assert that one should just be sanguine about this, it's just to clarify what exactly the stakes are. In strict partisan terms, they're relatively low. If union money goes away, Democrats can and will shift in order to get the cash they need. But in exchange, they'll be making policy concessions of various kinds. To offer an example, in the Affordable Care Act debate the Obama administration steered clear of any initiatives that would stick it to the pharmaceutical industry and drug companies were happy to offer support for a measure that would give more people health insurance and thus the ability to buy prescription drugs. But if both parties are utterly in hock to corporate interests of one flavor or another, then nothing that damages the interests of rich businessmen as a class will be able to pass.

Are Farm Subsidies Progressive?

In short: No, they're not, largely because the largest subsidies go to the biggest, richest farmers. But even if they didn't, Sallie James observes that farmers in general are richer than most people:

Farmers are wealthier (second graph from the bottom) and earn higher incomes (fourth graph from the bottom) than the average U.S. household. Their average debt-to-asset ratio is about 12 percent (third graph from the bottom), very low relative to the average U.S. household. Those should be the relevant data for any progressivity test.

America's agricultural sector is very productive. And that's an excellent thing and a real source of strength for the country. But it means that American farmers, though few in number, are pretty well off. They don't need subsidies. But though few in number, they're many in congressional representation.

Life in 1984

Jonathan Bernstein notes how far women have come in politics since Geraldine Ferraro's stint as a VP candidate:

There were two women in the Senate, matching the then all-time high. Both were Republicans. Over the three election cycles leading up to 1984, the Democrats nominated a grand total of four women for the U.S. Senate. Currently, 17 women serve in the Senate (12 Democrats).

Governors? There was one woman out of 50 in 1984, a Democrat who had just taken office that year. In the previous three election cycles, the Democrats had nominated a total of three women for governor (and the GOP hadn't nominated one since 1974). Currently, there are six women servings as governors, down from a high point of nine.

In the House, Ferraro was Secretary of the House Democratic Caucus — the only woman in a leadership role in either party, and one that Democrats had traditionally held by a woman, at least sometimes, since the 1940s; no woman from either party had ever held any other party leadership position in Congress. Nor were any women chairs of a House committee. Nada. Things, of course, are different now (especially for the Democrats).

In 1984, there had been one female Supreme Court Justice ever; there are three now. There had never been a woman at the top of any of the big four cabinet departments (State, Defense, Justice, Treasury).

It's a huge mistake to understate the gender inequities that exist in 2011. But I think it's also a huge mistake to underrate the enormous and fairly steady amount of progress that's been made. The feminist movement over the past forty years is a huge progressive success story in a way that often gets unduly discounted when people talk about the past couple of generations of political life.

The Accidental Recession

Brad DeLong on what makes this recession different:

As soon as the Fed had achieved its inflation-fighting goal, however, it would end the liquidity squeeze. Asset prices and incomes would return to normal. And all the lines of business that had been profitable before the downturn would become profitable once again. From an entrepreneurial standpoint, therefore, recovery was a straightforward matter: simply pick up where you left off and do what you used to do.

After the most recent US downturn, however (and to a lesser extent after its two predecessors), things have been different. The downturn was not caused by a liquidity squeeze, so the Fed cannot wave its wand and return asset prices to their pre-recession configuration. And that means that the entrepreneurial problems of are much more complex, for recovery is not a matter of reviving what used to be profitable to produce, but rather of figuring out what will be profitable to produce in the future.

I wonder if this can't be reformulated into more of an expectations framework. During the recession associated with the Volcker Disinflation, everyone understood the recession to have been induced by deliberate Federal Reserve policy. Then a time comes when the Open Market Committee decides that enough disinflating has happened and it wants to start boosting growth. So the Fed waves its wand, and expectations coordinate very rapidly around expectations of growth and those expectations are largely self-fulfilling. But when the economy stumbles into a recession by accident, things look different. And they especially look different because policymakers most certainly don't immediately rush out in front of the cameras to say "holy shit, we fucked this up, sorry guys, we're going to fix it." Instead they emphasize an exculpatory narrative. They don't say "this happened but we didn't intend for it to happen," they say "this happened for reasons beyond our control." That's good for helping Ben Bernanke get named person of the year but bad for the Fed's ability to re-coordinate expectations around growth.

Now consider the situation of the 1930s. The economy falls into Depression in 1929 and things get worse and worse. But then FDR takes office in 1933, loudly proclaiming that the policies are in fact the fault of the incumbent policymakers. But now "[t]he money changers have fled from their high seats in the temple of our civilization," the bums have been kicked out, happy days are here again, "the only thing we have to fear is fear itself," and dramatic new monetary policy initiatives are being undertaken to restore growth. So suddenly the magic wand works and output begins moving back toward its potential.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers