Support for Indie Authors discussion

Ebook Publishing

>

I've Published Online and Received a Federal Form 1099-MISC for Royalties. Now what?

date newest »

newest »

newest »

newest »

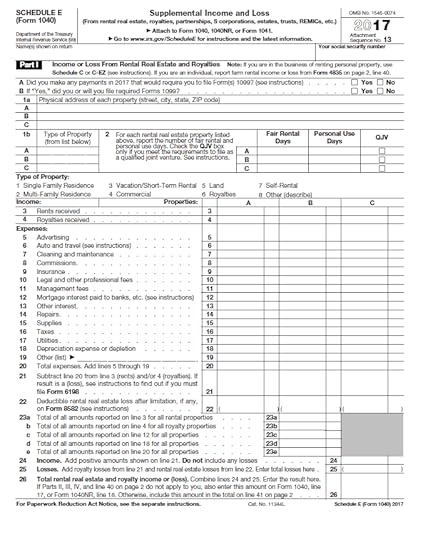

You need to do a 1040 Schedule E at a minimum. I hired an accountant 4 years ago and never looked back.

You need to do a 1040 Schedule E at a minimum. I hired an accountant 4 years ago and never looked back.

Martin wrote: "You need to do a 1040 Schedule E at a minimum. I hired an accountant 4 years ago and never looked back."

Martin wrote: "You need to do a 1040 Schedule E at a minimum. I hired an accountant 4 years ago and never looked back."Thank you for responding, Martine. My amount only $180. Do you still think it's worth hiring an accountant or trying to do it myself?

Do it your self if it's only $180. It's still in schedule E. Computer Tax software has Royalties as an input. You might want to start tracking writing expenses. Mileage to writers groups and events, computers, books even the coffee you buy at a writers group. I use Quickbooks now to keep the accountants happy.

Do it your self if it's only $180. It's still in schedule E. Computer Tax software has Royalties as an input. You might want to start tracking writing expenses. Mileage to writers groups and events, computers, books even the coffee you buy at a writers group. I use Quickbooks now to keep the accountants happy.

Martin wrote: "Do it your self if it's only $180. It's still in schedule E. Computer Tax software has Royalties as an input. You might want to start tracking writing expenses. Mileage to writers groups and events..."

Martin wrote: "Do it your self if it's only $180. It's still in schedule E. Computer Tax software has Royalties as an input. You might want to start tracking writing expenses. Mileage to writers groups and events..."Thank you, Martin... as you stated there are related expenses to writing that should be offset against the royalty income.

I actually have a tax person that I take everything to every year. All my forms, invoices, books I have on stock, and more. She does it in about an hour and if something’s wrong she can spot it in seconds.

I actually have a tax person that I take everything to every year. All my forms, invoices, books I have on stock, and more. She does it in about an hour and if something’s wrong she can spot it in seconds.

I do my own taxes. What I read on royalties from books is, if you're still actively writing, you would put it under Schedule C, like other self-employed income. You only put it under royalties if you've gone inactive.

I do my own taxes. What I read on royalties from books is, if you're still actively writing, you would put it under Schedule C, like other self-employed income. You only put it under royalties if you've gone inactive.I'd post a link, but that's against site policy. I'd suggest doing a little googling or taking a few minutes at least to talk to an advisor. Neither schedule is too hard, particularly if you're using software to assist.

If others have heard differently, especially from tax experts, I'd definitely like to know.

Aaron wrote: "I do my own taxes. What I read on royalties from books is, if you're still actively writing, you would put it under Schedule C, like other self-employed income. You only put it under royalties if y..."

Aaron wrote: "I do my own taxes. What I read on royalties from books is, if you're still actively writing, you would put it under Schedule C, like other self-employed income. You only put it under royalties if y..."Thank you, Aaron.

I wanted to double-check my sources. If you look at the Instructions for Schedule E, Line 4, it says: "If you are in business as a self-employed writer, inventor, artist, etc., report your royalty income and expenses on Schedule C or C-EZ, not on Schedule E."

I wanted to double-check my sources. If you look at the Instructions for Schedule E, Line 4, it says: "If you are in business as a self-employed writer, inventor, artist, etc., report your royalty income and expenses on Schedule C or C-EZ, not on Schedule E."That's direct from the IRS.

Again, my understanding is once you've stopped working at it as a job, either because you've retired, moved on, given up, or for whatever other reason, then it goes on Schedule E. The royalties on E are for "passive" things.

@Shanna: Amazon should send you a 1099, usually around the end of January. If you didn't get one for last year, follow up with them.

I am a full-time author. I admit I have an accountant do my taxes. My 1099 royalties all go in Schedule E.

I am a full-time author. I admit I have an accountant do my taxes. My 1099 royalties all go in Schedule E.YMMV...

Martin wrote: "I am a full-time author. I admit I have an accountant do my taxes. My 1099 royalties all go in Schedule E.

Martin wrote: "I am a full-time author. I admit I have an accountant do my taxes. My 1099 royalties all go in Schedule E.YMMV..."

Thank you, Martin. Hugs

Shanna wrote: "Does anyone use Turbo Tax? And if you are KDP, do they send you a 1099 or will I need to print one?"

Shanna wrote: "Does anyone use Turbo Tax? And if you are KDP, do they send you a 1099 or will I need to print one?"I used Turbo Tax this year because I got tired of paying a CPA when I was doing most of the work anyway. My taxes include a schedule C because I also do other writing for a living - not just my novel on KDP - and I keep track all year of any writing expenses. It is way easy.

Schedule C 1040 profit and loss from the business of writing. Imagine all the expenses that went into writing your book, for example: travel, computer, Internet, books, utilities etc etc etc All expenses necessary to producing your book. Report the amount from the 1099 as income and the deduct all the expenses. The figure you get (loss or net income) goes on 1040 page 1, where it says profit or loss from business.

Schedule C 1040 profit and loss from the business of writing. Imagine all the expenses that went into writing your book, for example: travel, computer, Internet, books, utilities etc etc etc All expenses necessary to producing your book. Report the amount from the 1099 as income and the deduct all the expenses. The figure you get (loss or net income) goes on 1040 page 1, where it says profit or loss from business.

Peter wrote: "Schedule C 1040 profit and loss from the business of writing. Imagine all the expenses that went into writing your book, for example: travel, computer, Internet, books, utilities etc etc etc All ex..."

Peter wrote: "Schedule C 1040 profit and loss from the business of writing. Imagine all the expenses that went into writing your book, for example: travel, computer, Internet, books, utilities etc etc etc All ex..."Thank you, Peter. Hugs

Peter wrote: "Schedule C 1040 profit and loss from the business of writing. Imagine all the expenses that went into writing your book, for example: travel, computer, Internet, books, utilities etc etc etc All ex..."

Peter wrote: "Schedule C 1040 profit and loss from the business of writing. Imagine all the expenses that went into writing your book, for example: travel, computer, Internet, books, utilities etc etc etc All ex..."Electricity would fall under deductions but it's not quite that easy to claim such a thing. The IRS has very specific rules as to deductions on a 1099. For e.g. if you are sitting at your desk in your bedroom, you can't write off anything bc IRS rules specifically demand that you have a dedicated room for any work you perform in which you will itemize deductions. So obviously, if you live a studio apartment and/or rent a room out of someone's home, the IRS will come a knockin' with an audit. Just sayin'.

I honestly gave mine to a tax accountant and had her take care of it. I did not want to mess up and do something wrong.

I honestly gave mine to a tax accountant and had her take care of it. I did not want to mess up and do something wrong.

I am not an author, I am a Tax Analyst.

I am not an author, I am a Tax Analyst. The 1099-MISC

Box 2 Royalties

Are actually reported on a schedule C Profit or Loss from Business.

I'm sorry if I sound like a nitwit, but, this is my first encounter with royalty income and I don't know what to do. I'm nervous and sick to my stomach as to how to report this properly. I would greatly appreciate any advice anyone has to offer here or in a message. Thank you. Hugs