More on this book

Kindle Notes & Highlights

by

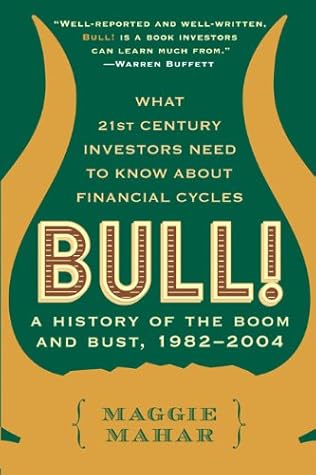

Maggie Mahar

Read between

November 13 - November 16, 2020

BUFFETT TAP-DANCES (1973–74)

ONLY “OLD FOGIES” BUY STOCKS (1975–82)

From his perch at Merrill Lynch, Bob Farrell watched investors gradually give up. “A downturn normally has two stages, and investor sentiment goes through two fairly predictable phases,” said Farrell. “First there’s the guillotine stage—the sharp decline. That creates fear. That’s what happened in 1974. Then, the second stage goes more slowly—there’s the feeling of being sandpapered to death. The investor is whipsawed by a choppy market, and then worn down gradually. In place of fear come feelings of apathy, lack of interest, and finally, hopelessness. That is what happened for the rest of the

...more

Shrewd investors

European Australian and Far East Index (EAFE)

the fall of 1980.25

From 1970 to 1975,

A “New Era”

Methodist University’s business school. “‘The old rules no longer apply.’”

In 1980, the bear, always sadistic, allowed investors a glimmer of hope.

2004 began with a question: Is the bear dead or is he just hibernating?

For Wall Street, 2003 had been a spectacular year: in just 12 months the Dow gained 25 percent while the S&P climbed 26 percent.

N...

This highlight has been truncated due to consecutive passage length restrictions.

stunned inv...

This highlight has been truncated due to consecutive passage length restrictions.

Some of the most widely held stocks made the ...

This highlight has been truncated due to consecutive passage length restrictions.

In January of 2004, Karen Gibbs, host of the Public Broadcasting System’s Wall $treet Week with Fortune, ticked off the winners: “Lucent Technology up a whopping 125 percent; Time Warner, better by 37 percent; Cisco Systems, up 85 percent; Intel, over 106 percent higher; Microsoft better by 6 percent;…General Ele...

This highlight has been truncated due to consecutive passage length restrictions.

But this did not mean that investors had recovered al...

This highlight has been truncated due to consecutive passage length restrictions.

Taking a look at how those same stocks had performed since March 1, 2000, when the bear market started, she found “Lucent, still down 91 percent—it would almost have to double its price just to break even; Time Warner, still off 67 percent; Cisco, down 59 percent; and Intel, that semiconductor blue-chip bellwether, off 43 percent; Microsoft still down 39 percent; and SBC Communications off 35 percent; General Electric, down 27 percent; Big Blue (IBM), off 6 percent.”1

rewarding investors

positive r...

This highlight has been truncated due to consecutive passage length restrictions.

Still, after three years of brutal losses, investors were more than grateful for a year of double-digit gains, and early...

This highlight has been truncated due to consecutive passage length restrictions.

Indeed, bullish sentiment was so strong that in the first month of the year, investors poured more than $40 billion into equity funds—the highest monthly inflow the m...

This highlight has been truncated due to consecutive passage length restrictions.

Gail Dudack

“scary” heights.

“The American Association of Individual Investors reports that bullish sentiment stands at 69.5 percent of those surveyed—with only 13....

This highlight has been truncated due to consecutive passage length restrictions.

Dudack warned SunGard’s institutional clients at the beginning of 2004. “The last time the spread between bulls and bears exceeded 40 percent,” she added, “was in January of 2000”...

This highlight has been truncated due to consecutive passage length restrictions.

Had investors already forgotten what the market’s meltdown had taught them about risk? Not really, but everyone wanted to believe. They could only hope that the headline that appeared on the right-hand corner of Barron’s December 2, 2...

This highlight has been truncated due to consecutive passage length restrictions.

ANOTHER BUBBLE?

Yet, even while 401(k) investors flocked back into the market, some of the financial world’s most experienced investors shook their heads.

“Bill Gross

Templeton is very bearish and talking about real estate falling 90 percent. Soros doesn’t

Warren Buffett made his views clear in his March 2004 letter to Berkshire Hathaway’s shareholders: “Despite three years of falling prices, which have significantly improved the attractiveness of common stock...

This highlight has been truncated due to consecutive passage length restrictions.

Buffett was sitting, none too happily, on some $31 billion in cash. “Our capital is underutilized now, but that will happen periodically,” Buffett wrote. “It’s a painful condition to be in—but not as painful...

This highlight has been truncated due to consecutive passage length restrictions.

That same month Morningstar revealed that some of the mutual fund industry’s most respected managers shared Buffett’s misgivings. “Lege...

This highlight has been truncated due to consecutive passage length restrictions.

Gregg ...

This highlight has been truncated due to consecutive passage length restrictions.

“In fact, it’s remarkable how many top-flight managers have more than 20 perc...

This highlight has been truncated due to consecutive passage length restrictions.

First E...

This highlight has been truncated due to consecutive passage length restrictions.

Jean-Marie Ev...

This highlight has been truncated due to consecutive passage length restrictions.

“When several of the very best managers all say they are having an extremely difficult time finding anything to buy at prices that ma...

This highlight has been truncated due to consecutive passage length restrictions.

To value investors like Eveillard, the signs of a bub...

This highlight has been truncated due to consecutive passage length restrictions.

Historically, the average stock on the S&P 500 has fetched 18 or 19 times the prior year’s earnings while paying dividends of 4 percent. But by the spring of 2004, the S&P was trading at close to 29 times 2...

This highlight has been truncated due to consecutive passage length restrictions.

Of course, in the year ahead, analysts expected earn...

This highlight has been truncated due to consecutive passage length restrictions.

price/earning...

This highlight has been truncated due to consecutive passage length restrictions.

2...

This highlight has been truncated due to consecutive passage length restrictions.

2004

This highlight has been truncated due to consecutive passage length restrictions.

S&...

This highlight has been truncated due to consecutive passage length restrictions.

18 ...

This highlight has been truncated due to consecutive passage length restrictions.

Normally, investors pay only about 14 times the current year’s estimated operating profits; still, a price/earnings ratio of 18 did not loo...

This highlight has been truncated due to consecutive passage length restrictions.

Rob Arnott, editor of the Financial Analysts Journal and chairman of Research Affiliates.

“There are two big items inflating earnings,” Arnott observed in April of 2004. “First, most companies still didn’t subtract the cost of the options from their profits. Secondly, many make unrealistic assumptions about how much their pension funds are likely to earn—and those hoped-for gains then show up as profits on their income statements.”