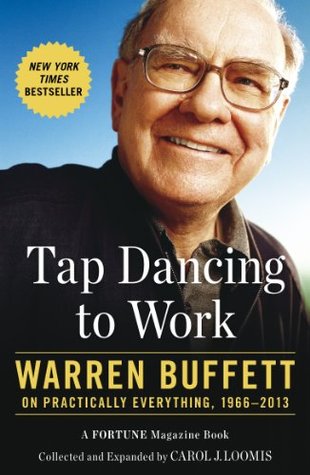

More on this book

Community

Kindle Notes & Highlights

Started reading

September 29, 2017

When Feeney was dropped from the Forbes 400 in 1997, the magazine explained his departure in words not often hauled out for use: “Gave bulk of holdings to charity.”

Ted Turner repeated the oft-told tale of how he had made a spur-of-the-moment decision to give $1 billion to the United Nations.

The asset I most value, aside from health, is interesting, diverse, and long-standing friends.

The concise, 129-page treatise expounds Sokol’s six laws: operational excellence, integrity, customer commitment, employee commitment, financial strength, and environmental respect. Yes, they are management bromides, but Sokol drives them so hard and so consistently into every organization he touches—ruthlessly if need be—that time and again they get him the kind of results even a Warren Buffett could like.

In short, says, Edward Bell, an executive at Ogilvy & Mather in Shanghai who has studied the twentysomething Chinese in depth, “this is a generation that has to sprint just to stay even. I call it Generation Stress.”

That pointed to the lack of trust that exists in the charitable sector in China.

From our definition there flows an important corollary: The riskiness of an investment is not measured by beta (a Wall Street term encompassing volatility and often used in measuring risk) but rather by the probability—the reasoned probability—of that investment causing its owner a loss of purchasing power over his contemplated holding period.