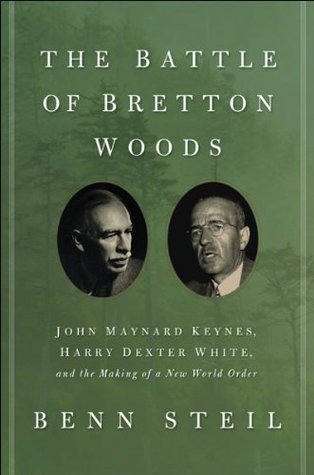

More on this book

Kindle Notes & Highlights

by

Benn Steil

Started reading

August 10, 2017

where representatives of forty-four nations gathered in

July 1944,

to design a global monetary system, to be managed by an i...

This highlight has been truncated due to consecutive passage length restrictions.

The classical gold standard of the late nineteenth century, the organically formed foundation...

This highlight has been truncated due to consecutive passage length restrictions.

globalization, had collapsed during the previous world war, with efforts to revive it in the 1920s proving...

This highlight has been truncated due to consecutive passage length restrictions.

White, working in parallel and in frictional collaboration with his British counterpart, the revolutionary economist John Maynard Keynes, set out to create the economic foundations for a durable postwar global peace, one that would allow governments more power over markets, but fewer prerogatives to manipulate them for trade gains.

To be sure, there were major flaws in the monetary framework that emerged from Bretton Woods, which contributed directly to its final collapse in 1971.

On the eve of the First World War the ratio of British debt

to gross domestic product was a mere 29 percent; by the end of the Second World War it had soared to 240 percent.

A nation that had in the 1920s controlled a quarter of the earth’s territory and population was, in Keynes’s word...

This highlight has been truncated due to consecutive passage length restrictions.

Faustian bargain Britain struck with the United States in order to survive the war would become an essential ele...

This highlight has been truncated due to consecutive passage length restrictions.

Ce...

This highlight has been truncated due to consecutive passage length restrictions.

to that drama were the antipodal characters of Keynes and White: the facund, servant-reared scion of Cambridge academics, and the brash, dogged technocrat raised in workin...

This highlight has been truncated due to consecutive passage length restrictions.

Keynes excelled,” observed Treasury colleague Paul Bareau.5 Keynes struggled both mentally and physically to adapt to the strange

never ratified

is fitting that even while

the war for liberation is at its peak, the representatives of free men should gather to take counsel with one another respecting the shape of the future which we are to win,” the president said.

Commerce is the lifeblood of a free society. We

Economic diseases are highly communicable.

follows, therefore, that the economic health of every country is a proper matter of concern to all its neighbors, near and distant.

Morgenthau told the assembled that “competitive depreciation of currency” and “devices to hamper and limit the free movements of goods” had become the “economic weapons” with which “the Fascist dictators” of Europe had initiated the bloodshed.

“Economic aggression,” he said, “can have no other offspring than war. It is dangerous as it is futile.”

Wh...

This highlight has been truncated due to consecutive passage length restrictions.

Keynes would have shared Morgenthau’s sentiments on the disastrous political progeny of bad economics, the most substantive p...

This highlight has been truncated due to consecutive passage length restrictions.

unnerved him—cutting straight to the heart of British angst over America’s blueprint for the immediate postwar eco...

This highlight has been truncated due to consecutive passage length restrictions.

Article VII spelled out what the Americans called the British “consideration” for the aid: a commitment by the British “to the elimination of all forms of discriminatory treatment in international

commerce, and to the reduction of tariffs and other trade barriers.”

Keynes knew that Article VII was, in reality, code for an end to “Imperial preference,” by which Britain secured privileged trade access to the markets of its colonies and dominions.

Being left to the mercy of an all-powerful United States was intolerable, particularly as the U.S. government had been determined to show its people that American boys had not been sacrificed to perpetuate the moral abomination of empire.

The British had been anxious to see themselves as partners with the Americans in creating the ground rules for the postwar order, yet at every step to Bretton Woods the Americans had reminded them, in as brutal a manner as necessary, that there was no room in the new order for the remnants of British imperial glory.

The youngest of seven children, Harry was born on October 29, 1892, four months after his father, Jacob, had become an American citizen. Jacob and his wife Sarah had come to the United States in 1885, part of the immigration wave of Lithuanian Jews escaping tsarist pogroms.

Jacob anglicized the family name to White in 1897.3

1917, when Congress passed President Woodrow Wilson’s declaration of war on Imperial Germany.

Now twenty-five, Harry did not wait to be drafted, enlisting in the

U.S. Army six day...

This highlight has been truncated due to consecutive passage length restrictions.

His new wife was a twenty-two-year-old Ukrainian-born student named Anne Terry, who would eventually go on to become a successful author of children’s books.

In October 1924, White graduated Phi Beta Kappa “with great distinction” in economics. He received his master’s the following June. A professor later described him as “aggressive and

brilliant,” set on pursuing a PhD at Harvard and a subsequent academic career.

White headed back across the country in 1925 to start his PhD studies at Harvard.

The French International Accounts 1880–1913.

The research marked the beginning of White’s fascination with policy questions surrounding the relationship between the workings of the international monetary system and the performance of the real economy.

The years 1880–1913 constitute the great era of laissez-faire in world economic history—the reign of the classical gold standard, in which governments around the globe had allowed an unprecedented degree of economic activity within and between their nations to be regulated by the market-driven

driven transfer of gold

claims across borders (the physical stuff itself just shifted around in central bank vaults). The ...

This highlight has been truncated due to consecutive passage length restrictions.

saw the world mired in the Great Depression, with the gold standard in tatters, trade decimated, and unemployment...

This highlight has been truncated due to consecutive passage length restrictions.

“the Golden Age of Security,”

the three decades prior to the Great War.10

He admired the economic machine, but was looking

for the dials government might fiddle with to make it run better.

showing how this remarkable watch-like system continuously regenerated equilibrium.