More on this book

Kindle Notes & Highlights

by

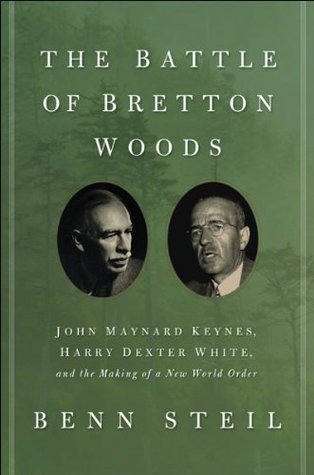

Benn Steil

Started reading

August 10, 2017

It

was this dynamic of ceaseless change...

This highlight has been truncated due to consecutive passage length restrictions.

stability that was held to underlie the prewa...

This highlight has been truncated due to consecutive passage length restrictions.

he assumption that the capital exports benefit both the country and the world at large is not unassailable,” was typical of his sober conclusions.

S]ome measure of intelligent control of the volume and direction of foreign investments is desirable….

The ramifications of exporting a large portion of a country’s savings are too complex, and the consequences too important to permit the continuance of capital exports without making some attempt at evaluating ...

This highlight has been truncated due to consecutive passage length restrictions.

am also learning Russian in the hope that I may get a fellowship which would enable me to spend a year chiefly in Russia. There I should like to study intensively the technique of planning at the Institute of Economic Investigation of Gosplan.

White telegraphed his acceptance two days later—“

“Selection of a Monetary Standard for the US,” clearly

suggests that its author had no intention of getting sidetracked with

f...

This highlight has been truncated due to consecutive passage length restrictions.

is...

This highlight has been truncated due to consecutive passage length restrictions.

He now wanted to make, not just shape, policy at the highest level, and he was not about to let the opportunity afforded ...

This highlight has been truncated due to consecutive passage length restrictions.

The stabilizing influence exerted by the interdependence of nations is not likely in the future, however, to be so

great as it has been in the past.

White concluded that any new monetary standard would have to have “promotion of trade and finance” as a key criterion, but that it

would also have to allow “sovereignty in shaping domestic policies.”

Under the gold standard, exchange rates were fixed, so that the balance of payments had to adjust through domestic deflation.

White therefore wanted to rewrite the rules of the American monetary system

to give a revamped Federal Reserve far more discretionary powers than the gold standard could accommodate, and then convince the rest of the world to help make such a new system stick internationally.

the world signed on much later only when it became clear that the system served to boost both local and global commerce.

But

1934, the world was mired in depression. U.S. gross domestic product was 28 percent lower than it had been at the start of the decade.17 Trade had plummeted 29 perc...

This highlight has been truncated due to consecutive passage length restrictions.

White argued that U.S...

This highlight has been truncated due to consecutive passage length restrictions.

recovery demanded trade expansion opportunities for American business, and that such expansion in turn required a new model for international monetary stabilization. This was to be White’s bedrock position as his re...

This highlight has been truncated due to consecutive passage length restrictions.

Such imperialism, he charges, “urges the U.S. to make [the] most of our financial domination and military strength and become the most powerful nation in the world.”

As White pursued U.S. global financial domination with a zeal not witnessed before or since in the Treasury,

it is more than curious that he should here express objection to using such domination to “become the most powerful nation in the world.”...

This highlight has been truncated due to consecutive passage length restrictions.

States to share power? The essay is clear. Ha...

This highlight has been truncated due to consecutive passage length restrictions.

His attack on an unidentified “Catholic hierarchy”