Tax Evasion: Why Not Follow the Irish Model?

Europeans - and now Americans too - are all griping about Ireland, how it is a tax haven for big corporations seeking to shield their profits from fiscal authorities. Only a 12% levy! Neat, cool.

The latest "scandal" (if you will) is the Johnson Controls and Tyco deal: here we have a big American corporation divesting itself of its American nationality and happily becoming Irish...to avoid taxes of course. And needless to say, Johnson Controls is only the latest one joining the jolly band of tax evaders that include just about everyone in Fortune 500, from Microsoft to Coca-Cola, from Google to Amazon and Facebook.

Europeans are no less unhappy - ever since the Great Recession started, they haven't been able to bring Ireland to heel. No fiscal union here! Ireland got € billions of bailout money but it never agreed to (really) align its rates with the European Union. Not a bit. The Irish are Irish and don't care about the rest of Europe. They also know

I have a simple solution. It's based on the true and tried strategy of "if you can't beat 'em, join 'em".

Why doesn't every country in the EU align itself on the Irish tax rates? And the US too? Of course, the Irish might suddenly find that they're not a tax haven anymore - but so what? The more, the merrier. Everybody pays 12% (instead of 23% and more).

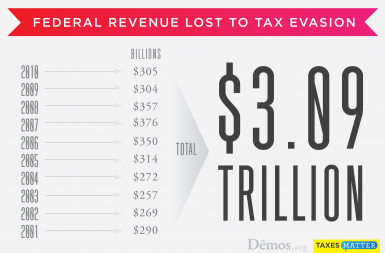

Ah, I can hear the objections, treasuries would go dry, budgets would collapse, states would go broke. Would they now? Are you sure? What about all the money that would be recovered from tax evasion? Billions and billions. In the UK alone, it is estimated that some £35 billions have been lost to the state through people not paying as much as they should. And the situation in the US is ten times as bad:

Now if tax rates were reasonable, the way they are in Ireland, people would start paying taxes, corporations would stop playing fiscal games (like the "tax inversion" one).

Why not try this simple recipe? But politicians, I'm afraid, hate innovation and

don't have that kind of courage...

Related articles [image error] John Kay on tax: so right, and so wrong [image error] Corporate tax initiative in Oregon: Letters to the Editor [image error] IRS Reveals That Microsoft Effectively Stole Tens of Billions of Dollars of Public Money Using a Network of Tax Havens [image error] Trade secrets: Coca-Cola's hidden formula for avoiding taxes

Published on January 28, 2016 12:33

No comments have been added yet.