I’m Prestigious! Getting Citi Prestige and First Impressions of the Card

Also see:

Citi Prestige: No Luck Getting a $350 Annual Fee In-Branch, and Why to Apply ASAP

Yes! Instantly Approved for Citi Prestige!

I got my Citi Prestige card this week and wanted to share the experience. Because it was an experience getting this card.

And I can’t wait to dig in to to all the perks this card has to offer!

Here are my first impressions and things I noticed right away.

The 2-package process

Early in the day, I got an envelope delivered from UPS.

Oh good, I thought, it’s here.

Um, thanks?

There was literally 1 page in the package. No card.

An “account approval notice.” Thanks, Citi. I already knew that from when I was approved online, and from the subsequent email you sent right after. But it’s nice that you spent money on a UPS express delivery service to send me another letter about it.

Soon after, a FedEx box came, too.

Round 2

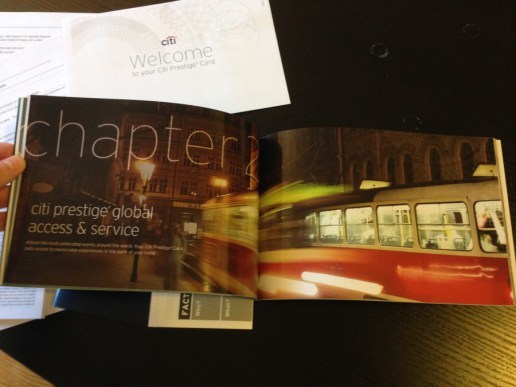

And it was quite a process to dig out the thin little plastic card inside of it.

Inside the box was another box.

A beautiful matte box with the Prestige emblem

Granted, it was a sturdy matte-textured box, with a flap to open it.

Beautiful marketing materials

Once you flip it open, you get to another box.

A box in a box in a box

Within that box was a plethora of paper: benefits guide, T&Cs, more T&Cs, rate information, oh, and in an envelope, the card.

Nice package of welcome/introductory guides

Very thorough guide to the perks of the card

As I flipped through the guide, I kept thinking, wow, how neat.

Did you know, for example, the $500 trip and baggage delay benefit starts after only 3 hours? And that flights purchased with Citi ThankYou points are specifically included?

(I want to do a whole post series on this soon.)

The whole package contents

All-in-all, lots of paper and packaging for one little ol’ card.

You’d think that for all the effort they put into the packaging, they could’ve sprung for a heavier card made of stronger materials, like the Chase Sapphire Preferred (which “just” comes in an envelope).

I kinda don’t want to keep all this hullabaloo and clutter, but another part of me doesn’t have the heart to immediately discard of it. I’ll at least keep the benefits guide and the T&Cs, just to have in my file cabinet.

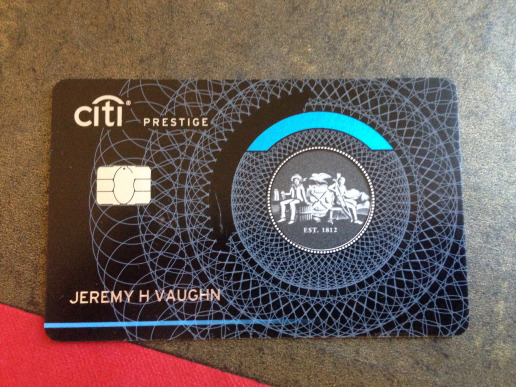

The Citi Prestige card!

Now I can finally be one of the cool kids and post a pic of my new Citi Prestige card.

It’s the new design with the stripe on the back of the card, and it comes with a chip-and-siggy embedded into the front.

Your ticket to Admirals Clubs

On the back, you’ll find your name and card number, as well as what the folks at the Admirals Club will be looking for when you go for a visit.

Your lounge access is denoted here. Note this benefit is only for the primary cardholder. If you add an authorized user, they’ll have to be with you to get into the lounge.

Your Priority Pass membership card will show up a few days after – there’s nothing you have to do to make it happen. It will arrive automatically.

The website

I activated the card, then made sure to set it up on my Citi account online.

Couldn’t sign in right away

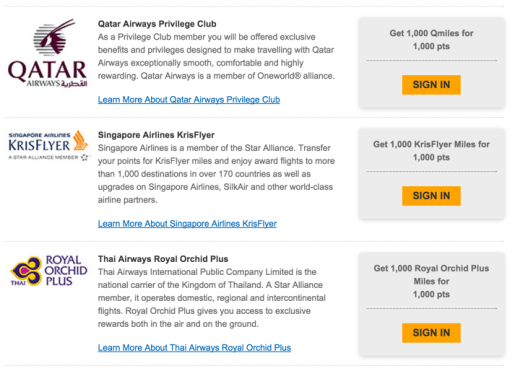

I headed over to ThankYou.com to explore the new points system.

I could see all the transfer partners, but when I pressed “Sign In,” I got an error message:

No bueno

Which was fine, I didn’t expect it to really sync up moments after adding it to my online account.

But the next day, it did show up. So if you notice that, it’s nothing to worry about.

I had a great time going through the seemingly never-ending perks and benefits on the card.

Cit Smart Savings is a cool new perk, too

Including Citi Smart Savings, which seems embryonic right now, but intended to directly compete with AMEX Offers.

Save up to $1,200 a year ($300 per claim) with Citi Price Rewind

And don’t underestimate Citi Price Rewind, especially with the holidays coming up.

They’ll track the items you pay for with your Citi card for 60 days. If the price drops, you’ll get a credit up to $300 per item and $1,200 per year.

This is super handy for appliances, electronics, and anything else you think will go on sale in the next couple of months. Which, during this time of year, is absolutely everything.

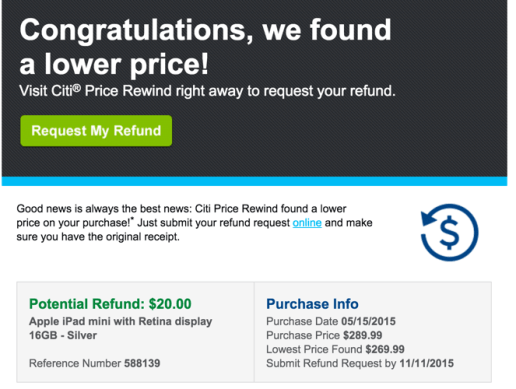

Citi saved me $20 on a purchase this year

Note this benefit is per card, so you could theoretically get a ton of value out of this.

I got $20 back from an iPad purchase earlier this year. Citi did it all for me, and credited my account within a month.

What now?

I need to use the $250 annual airline credit like, now. I’m thinking of booking a trip to the French Caribbean for next year.

Amazing

Tickets to Martinique are ~$300 round-trip right on Norwegian. But only $50 for me after getting $250 back! (Or, I just buy American Airlines gift cards.)

And, because of the timing on this, I can turn around and get another $250 next month. That’s why I said to apply ASAP or wait until next year.

And you bet your tookus I’ll be using my 4th night free benefit! (Be sure to look on the Carlson Wagonlit website to see which hotels you can book with the 4th night free.)

With this card in particular, I’m swapping out the AMEX Platinum for it (what a weird sentence that is).

I’m hyper-focused on value. Getting the most out of it.

So much so I’ve created a new page, Citi Prestige by the Numbers, to document exactly how much value I get from this card.

I’ll update it every time I use the card, and I’ve added it to the home screen under the “Credit Cards” tab. So keep an eye there to see how much I save (and how much you can potentially save).

If anything, I’ll save $500 this month and next with the $250 annual airline credits alone. After that, I’ll have recouped the annual fee and will be into pure savings mode. Can’t wait!

If you’re interested in this card, thank you for applying through my links!

Bottom line

Receiving this card felt like a special experience, so I wanted to share it with you guys.

It’s a beautiful card, very well put-together, and Citi’s attention to detail really shines.

The list of perks is dizzying, but I’m excited about unraveling them one-by-one and documenting the savings as I go along.

The only thing I’d change is: I wish the 3X category was for all travel and not just airfare and hotels.

It’ll be a nice complement to my Chase cards, though, and I’m now firmly in a Chase/Citi combo with my credit cards for regular spending. I’ll keep my AMEX cards – for now- for AMEX Offers and to maximize the perks until the annual fees are due, but after that, sayonara sucker. Unless they really step their game up in a big way, and soon.

Let me know your thoughts about Citi Prestige, and if you have any questions, ask away – I’ll do my best to dig up answers!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!