Inflation and Stock Prices

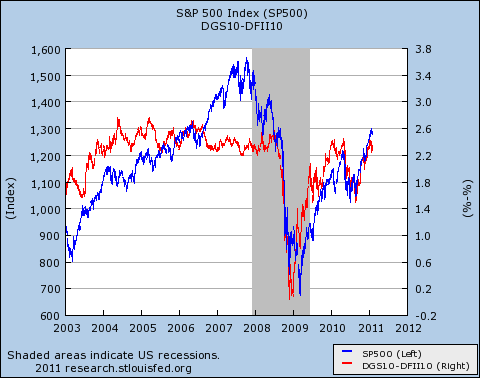

Paul Krugman and Scott Sumner tout a new David Glassner paper showing a tight post-crash correlation between inflation expectations and the S&P 500 which they think illustrates the case that a demand shortfall is at the root of our economic problems:

Kevin Drum likes the conclusion but says "Sadly, neither Glasner, Sumner, nor Krugman explain in terms someone like me can understand why this correlation implies that aggregate demand is what's behind our economic woes." Let me take a stab at it.

If low aggregate demand is at the root of our problems, then we should be able to solve our problem through helicopter drops. Mail envelops full of dollar bills to each American household, and spending will increase. The increased spending will induce firms to increase the pace of activity, which will lead to more hiring, more real output, and a virtuous circle of higher incomes and higher demand. But Matt, you say, if it's really possible to boost growth just by printing money and mailing it to people, why don't governments do this all the time? Won't that just lead to ruinous inflation?

The answer is that, yes, most of the time printing money and mailing it to people would merely lead to inflation and not do anything to boost real output. To get more real output you need more workers, or more productive workers, or better regulations, or something. You can't just have more spending.

Back to Glasner. He uses the TIPS spread as a proxy for expectations of future inflation, and the S&P 500 as a proxy for expectations of future real economic activity. And he finds that, in general, there's no correlation between the two. Which is exactly what you would expect to find in a scenario where you can't boost growth just by printing money. But then comes the crash of 2008, the 2009 recovery recovery, the mini-crash of 2010, and the renewed recovery an extended period of time when inflation expectations and real growth expectations are tightly correlated. That means that the very same swings in nominal spending that push inflation up or down are also—and simultaneously—pushing real output up and down. That indicates that any measures we take to increase nominal spending, up to and including mailing envelops of newly printed dollars to random households, will mobilize idle resources and increase real economic output.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers