Swapping AMEX for Citi: Bye Platinum, Hello Prestige? And Bye, EveryDay Preferred, Hello ThankYou Premier?

Also see:

Dear Amex: DIAF!

American Express Vs. Chase: Why Chase Is Winning

Booking Barcelona: $747 Round-trip in AA Business Class

Citi Offers to Compete With AMEX Offers “Soon”

And, bye EveryDay Preferred, hello ThankYou Premier?

Recently, I’ve seriously been pondering why it is I hang on to my AMEX cards.

I’ve had at least 2 since 2012, and haven’t accumulated enough points to actually do much.

Membership Rewards… meh.

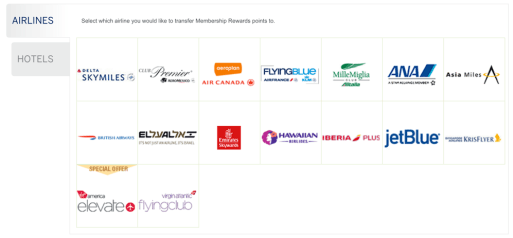

I’ve always thought there might come a day when I’d finally transfer some AMEX Membership Rewards points for an award booking on ANA or Aeroplan.

Are any of these useful… or nah?

In particular, you can fly to Western Europe for 45K miles each way in business with Aeroplan, or 90K miles round-trip (until December 14th, 2015).

That’s changing in about a month. On December 15th, 2015, the price will increase to 110K miles round-trip for a partner award flight in business class.

There aren’t too many other sweet spots that rival other Star Alliance carriers.

Fine, what about ANA? The biggest upside is you can string along a trip with lots of stopovers.

I haven’t exactly been following closely because they change their award chart and routing rules so frequently.

But redeeming miles is always about the best deal you can get at the time of booking.

Again, I’ve always been curious about ANA and Aeroplan, but I’ve never had 110K (or close to there) to actually book an award. So, meh.

Look at this little collection of uselessness

And the hotel transfer partners? SPG, nope (bad ratio of 3:1). Hilton, nope (a waste when you could transfer to an airline partner instead). The best one is actually Choice Privileges!

But because I have Chase Ultimate Rewards, I can access Hyatt and I already have plenty of Hilton and IHG points, so…

And, Citi Prestige encourages paid stays, which I’ll get to in a bit.

Why keep the Platinum Card?

The AMEX Platinum Card is almost legendary for its long list of perks. You get:

Starwood Gold elite status

Hilton Gold elite status

Lots of car rental status

$200 airline credit on an airline of your choice (most large domestic carriers are on the list. American, Delta, United, Southwest, etc.)

Access to Fine Hotels & Resorts for late check-out, spa and dining credits, and possible upgrades

FREE CENTURION LOUNGE ACCESS

Lots of other ancillary benefits

The 2 perks I’m most interested in are the $200 airline credit and Centurion Lounge access.

I’ll do a proper post about this, but I’m closing next month on a house in Dallas. I’m not sure what that means yet (I’ll work out those thoughts in the post), but it seems the biggest perk – for me to keep or lose – would be the Centurion Lounge access.

Here’s my completely gratuitous review of the Centurion Lounge @ DFW.

Ah, craft cocktails at the Centurion Lounge, how I’ll miss you. Ah, huge crowds and the fight for a seat, how I won’t

The $200 airline credit is great, too.

I’ve been known to buy $50 American Airlines gift cards and/or buy lots of beers and liquor whilst sitting in coach. And this is nice, no doubt.

But…

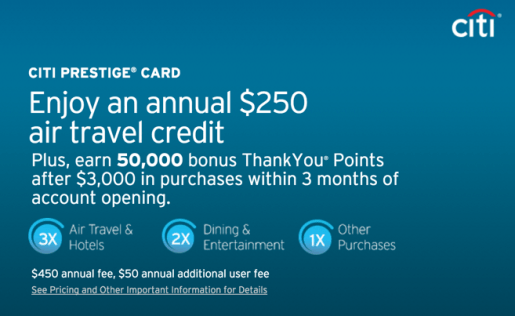

Why get Citi Prestige?

Citi Prestige, you alluring little thing.

This card comes with its own laundry list of perks that make it worth its ilk.

The face of intrigue

The biggest perks I can see are:

$250 airline credit to use on ANY airline for ANYTHING including airfare

Points-earning of more than 1X! Take that, AMEX Plat!

Admirals Club access when flying on American

Priority Pass access for you and 2 guests or immediate family – for no extra charge (AMEX’s version charges $27 per guest)

The 3 free rounds of golf benefit (not for me, but definitely for some! Golf is expensive!)

4th night free on pretty much any hotel stay AND you get to earn points, have elite status recognized, and stack discounts

Now, I already get my lounge access to Admirals Club for free thanks to Business Extra, so this is a moot point for me. Although it would be nice to use the Business Extra points for award flights instead.

And I’d definitely use the Priority Pass access.

The biggest perks for me would be the 4th night free on hotel stays and the $250 airline credit.

Also, you actually earn points that mean something. You can redeem for miles-earning flights on American, and each point is worth 1.6 cents each. And:

You’ll earn 3X Citi ThankYou points on airfare and hotels

And 2X Citi ThankYou points on dining

That’s essentially a 5% discount or 3% discount on American (1.6 x 3X points is 4.8 cents for airfare and hotels, and 1.6 x 2X points is 3.2% from dining).

Plus, Citi ThankYou points transfer to FlyingBlue and Singapore Airlines, which duplicates AMEX Membership Rewards (and the Virgin duo of Atlantic and America). Those are the biggest upsides, IMO. I really wish they’d add a meaningful domestic carrier, but that’s another post, too…

EveryDay Preferred Vs. ThankYou Premier

When AMEX came out with the EveryDay Preferred card, they accidentally created the best Membership Rewards-earning card, which is kinda tragically hilarious.

It earns

3X AMEX Membership Rewards points at US grocery stores, up to $6,000 per calendar year, then 1X

2X AMEX Membership Rewards points at US gas stations, unlimited

1X AMEX Membership Rewards point everywhere else

But the kicker is that after 30 transactions in a month, you earn 50% more points, so 4.5X on groceries, 3X on gas, and 1.5X everywhere else.

I like that last bit: 1.5X everywhere else.

It’s almost not enough though. Too little, too late.

Combined with some not-so-great transfer partners, you really have to cherry-pick your award redemptions.

Delta still offers some great prices for awards on Virgin Australia and Korean Air

Singapore is great, but as mentioned, duplicated with Chase UR and Citi TY

Aeroplan and ANA for specific uses

The others can DIAF, especially since British Airways announced the devaluation of short-haul flights and AMEX sliced the ratio to 800 BA points per 1,000 AMEX points.

(Although Iberia Plus might be a saving grace. But I have their points via Chase UR and I can get to Australia or Asia with American miles.)

But for the $95 annual fee, Citi ThankYou Premier takes it on.

You get:

3X Citi ThankYou points on ALL travel, not just airfare and hotels

2X Citi ThankYou points on dining

Man, I wish Citi would switch up the categories on the card. But whatever, I can use my Chase Ink Plus card for gas. The only category I’m losing out on is grocery stores, but it’s not a huge loss. So many other cards earn points at grocery stores.

Bottom line

Both AMEX and Citi have a card with a $450 annual fee, and a card with a $95 annual fee.

Blow for blow, I think the Citi cards take on the AMEX cards well.

And after my devastating recent interaction with AMEX that cost me hundreds of dollars, combined with several other “bad taste” encounters before, I’m thinking of dumping the AMEX Platinum Card, and downgrading my EveryDay Preferred to its no annual fee version just to keep access to AMEX Offers (although Citi is supposed to release Citi Offers for You… soon).

My biggest loss from dumping the AMEX Platinum Card will be the Centurion Lounge access, especially as I consider basing myself at DFW.

But on all other points, the Citi cards handily overtake the AMEX cards point by point… literally.

Competition is a healthy thing, and I’m glad Citi is taking AMEX on. I’ve always said, when banks compete, you win.

I think I’m going to bite the bullet and sign up for the Citi Prestige card. (And if you are to, thank you for using my links to apply!) I’m looking forward to exploring a new points program.

As for the EveryDay Preferred, it’s too little too late. And I’m feeling both underwhelmed with AMEX Membership Rewards and interested in Citi ThankYou points. It’s a perfect storm for a little switcharoo.

What do you guys think?

AMEX Platinum Card or Citi Prestige?

AMEX EveryDay Preferred or Citi ThankYou Premier?

AMEX Membership Rewards or Citi ThankYou points?

All opinions valid, would love to hear your take on it!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update!