Never Let 'Em See Your Card

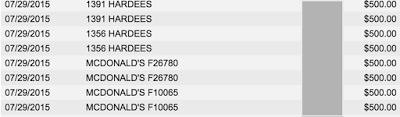

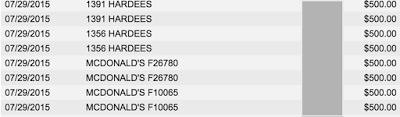

Earlier this month, I wrote about my credit card being stolen. The thief charged $500 twice at a series of fast food restaurants, totaling more than $5,500. Here were a few of the charges:

Everyone was so supportive in the comments, but it seems that a few people didn't realize when your credit card is stolen, the bank covers it. As much a pain in the butt getting your card stolen is, it isn't nearly as painful as actually being forced to pay for $5,500 worth of someone else's Big Macs.

When your card is stolen, you hope for a warning call from your bank. Some banks just cancel the card and let you learn from your cashier when you try to pay for groceries.

Then the real work begins. You have to go to the bank and dispute every charge on a computer screen. You could have printed it out and handed it over, but usually they conveniently wipe out your online statement as if you never had a credit card at all.

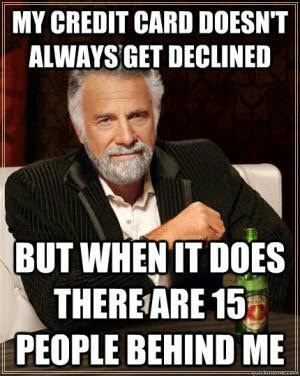

If the stolen card was a credit card, the bank has 30 days to "provisionally" take it off of your credit card. They can still investigate after that, but it becomes permanent if they haven't found after 90 days that YOU were the one who bought all those Big Macs.

Having a $5,500 balance on your credit card sucks, but it isn't the end of the world. However, as the bank employee pointed out, if it's debit, $5,500 is gone from your bank account for a full ten days. That's the amount of time they have to put the money back "provisionally" if your debit card is stolen.

Fortunately, we've always followed fraud experts' advice to use our credit cards for all our purchases and pay the balance off every payday. But I'm now afraid to shop online, since I'm pretty sure it was stolen from Shutterfly as part of a widespread security breach. (And neither I nor the fraud investigators know why anyone would want $1,000 worth of McDonald's food!)

Have you ever had a credit card stolen?

Everyone was so supportive in the comments, but it seems that a few people didn't realize when your credit card is stolen, the bank covers it. As much a pain in the butt getting your card stolen is, it isn't nearly as painful as actually being forced to pay for $5,500 worth of someone else's Big Macs.

When your card is stolen, you hope for a warning call from your bank. Some banks just cancel the card and let you learn from your cashier when you try to pay for groceries.

Then the real work begins. You have to go to the bank and dispute every charge on a computer screen. You could have printed it out and handed it over, but usually they conveniently wipe out your online statement as if you never had a credit card at all.

If the stolen card was a credit card, the bank has 30 days to "provisionally" take it off of your credit card. They can still investigate after that, but it becomes permanent if they haven't found after 90 days that YOU were the one who bought all those Big Macs.

Having a $5,500 balance on your credit card sucks, but it isn't the end of the world. However, as the bank employee pointed out, if it's debit, $5,500 is gone from your bank account for a full ten days. That's the amount of time they have to put the money back "provisionally" if your debit card is stolen.

Fortunately, we've always followed fraud experts' advice to use our credit cards for all our purchases and pay the balance off every payday. But I'm now afraid to shop online, since I'm pretty sure it was stolen from Shutterfly as part of a widespread security breach. (And neither I nor the fraud investigators know why anyone would want $1,000 worth of McDonald's food!)

Have you ever had a credit card stolen?

Published on August 31, 2015 05:34

No comments have been added yet.