Speculators and Instability

MarcK asked in the requests thread about commodity speculators: "I would like to hear more about the commodities market and how banks like Goldman have been manipulating the prices. No one seems to focus on these speculators when the price of oil and even copper goes up for no good reason."

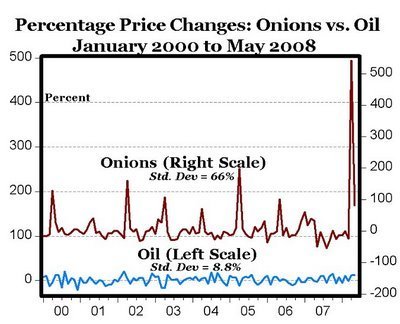

I think speculators get a bad rap and speculation is a stabilizing impact on commodity prices. The easiest illustration of this comes from the price of onions. Onion futures trading was banned in 1958 at the behest of then-congressman (later president) Gerald Ford who felt speculators were engaged in price manipulation. The result is that onions are one of the most unstable commodities out there:

In general, commodities speculation is a good thing. For any given commodity at any given time, there's always someone who wishes the price were either higher or lower and that person tends to complain about speculators. But if you constantly had to pay the spot price for everything, prices would be more unstable and ordinary households and firms would need to spend more time stockpiling goods to hedge against price fluctuations. The world of derivatives is a convenient playground for Wall Street firms interested in designing products whose purpose is regulatory arbitrage and this is a bad thing. But the problem there is with the regulatory arbitrage, not the speculation.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers