State of the Game: Is MS Worth It Any More, Cashback, Chase, and More

Also see:

State of the Game: What I’m Looking Forward To (MS, Points/Miles, & Status)

If you want a laugh, check out my previous “State of the Game” post. In it, I talk about looking forward to REDbird, loving Club Carlson, and wondering how Evolve Money would play out.

And now, REDbird is so, so over, I declared Club Carlson dead to me, and haven’t messed with Evolve Money since they started charging a 3% fee on credit card bill payments.

I also lamented the loss of Vanilla Reloads and Amazon Payments, and was just switching from Bluebird to Serve.

Manufactured spending

Dude. MS is DONE. Right? What is left?

I read on the FlyerTalk forums about people MSing $20K-$50K a month… HOW?!

People aren’t talking about what they’re doing. And I don’t know how to do it either.

The only ace in my little MS hole is buying PayPal My Cash card at CVS to pay rent on RadPad.

RadPad with PayPal debit card… S’all I got

I hear people still MS with Bluebird. But there are no Walmarts here in New York, so I can’t mess with that. I don’t even have a Bluebird card any more anyway.

We kinda thought for a second that Evolve would be a good way to liquidate PayPal My Cash cards by using the PayPal Business Debit MasterCard, but nope. They charge a 3% fee on that, too.

So I don’t know what the next thing is or what people are doing… is MS even worth it any more?

Cashback bonanza

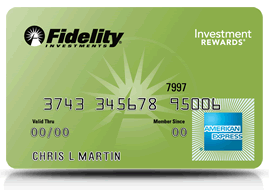

Ever since getting FIREd up, I’m loving the Fidelity Amex more and more each day.

I’m also thinking about getting the Discover It card and taking advantage of double cash back on the first 12 months… including quarterly category bonuses, portal shopping, and regular spend.

I might Discover… It.

Frequent Miler had a post about it that put me over the edge. But, I’m going to take his advice and get it in late July to get the best categories repeated next year at this time. I haven’t had a nice app-o-rama in a while anyway.

Tsk, tsk about Chase

Speaking of app-o-ramas, it looks like Chase is going the way of the dodo.

Chase Bank, extinct since June 2015

I wonder if other banks will start following suit.

If it becomes more difficult to open new cards, and if manufactured spending is difficult, what is left?

Man, the recession was great for the points and miles hobby. Airlines and hotels were throwing points out like candy. And now that flights are full and hotels are doing fine, they don’t need to have great loyalty programs or incentive spend.

The hobby will march forward, but to where? And when?

Until the “next thing” pops up, I’m gonna stick to loading up my Roth IRA for free.

Thank you for being a friend

I have plenty of AA miles and a nice Ultimate Rewards balance. Until I get another travel goal in mind, I’m going to focus on my FIRE (financial independence, retire early).

Airline status

Remember when I said I was going to do the AA Platinum Challenge again this year? I… didn’t.

While the extrAA miles are nice (and I do think AA is still the best airline program, for now anyway), I simply don’t have that many paid flights these days.

I consider myself a free agent when it comes to AAirlines. I’ll fly whAAtever gets me there the cheapest when I pay, and whAAtever I have the most points with when I redeem. Easy as that. (K, I’ll stop with the AA thing now.)

I’m still waiting on the other shoe to drop with American anyway. 2016 is gonna be a bloodbath a la United, Hilton, and Club Carlson, I think.

Hotel status

Speaking of other shoes to drop, I’m looking at you, Hyatt.

American needs a hotel partner like United has Marriott and Delta has Starwood, and Hyatt or IHG look like the best options right now (or Hilton since both have credit cards issued by Citi… hmm?).

American and Hyatt sittin’ i a tree…

I love Hyatt, but I suspect they’ll devalue soon too.

In fact, I expect IHG to do something shitty in 2016 (though I recently got an IHG card), and for SPG to make some changes (not that I ever liked Starpoints, anyway).

Until the next recession, of course. Then they’ll all be printing points and miles like crazy again.

But now that I’m done trying to like Club Carlson, I really want to like Hyatt. It’s a trepidatious loyalty. Because I keep expecting them to do something crazy.

Bottom line

It’s a barren, battered landscape out there right now.

Mars? Nah, that’s just the points and miles wasteland right now

In lieu of everything, I’m going to down, focus on my FIRE, and get some cashback while I drain my current balances. Points accounts are NOT savings accounts (but they can be insurance). Earn and burn, baby!

So talk to me.

Tell me about:

Your predictions

How you liquidate PayPal My Cash cards (or if you use RadPad)

MS if you care to share

How you see things playing out in points and miles land

Or, if you want, come tell me in person at the points and miles Meetup tonight.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! Thank you for using my link when considering a new credit card on creditcards.com