Fed Tilting Stronger Toward Disinflation

Given that for the past three years the country has consistently experienced an unusually high level of unemployment, and unusually low rate of inflation, and unusually low level of aggregate demand it seems to me that the Federal Reserve should alter its policies to be less worried about inflation and more concerned that low AD is leading to low output and high unemployment. Certainly given that we're looking at a changeover in members of the Fed's Open Market Committee one would hope for new FOMC members who are skeptical of the status quo and eager to see more growth and more demand. Instead, Sewell Chan reports that we're getting the reverse:

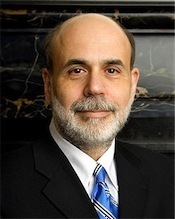

One is an economist who fears that the Fed's easy-money policies could lead to manias like the housing bubble that burst in 2007. Another is a Texas Democrat who served in the Clinton White House, but is wary of the Fed's aggressive efforts to combat unemployment. A third is a precocious economist who graduated from Princeton at 19. And the fourth is the only one who agreed wholeheartedly with the Fed's chairman, Ben S. Bernanke, that the economy was at risk of falling into a dangerous cycle of deflation last summer and that an additional monetary boost was needed.

Peter Diamond, meanwhile, remains in limbo.

As I've said many times, I think Barack Obama's administration has made many fewer errors than most of its critics on the left and the right believe. But part of what that means is that some of the errors it has made have been much more serious than is conventionally recognized. Failure to appreciate the importance of the Federal Reserve and the need to get good people confirmed in a reliable manner is very high on the list of errors.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers