The Fuzzification of Candlesticks

Having difficulty predicting the ups and downs of the stock market? Have you considered the fuzzification of candlesticks? Authors Partha Roy, Sanjay Sharma and M.K. Kowar (at the Bhilai Institute of Technology, Durg, India) have – and present their approach in the International Journal of Hybrid Information Technology, Vol. 5, No. 3, July, 2012.

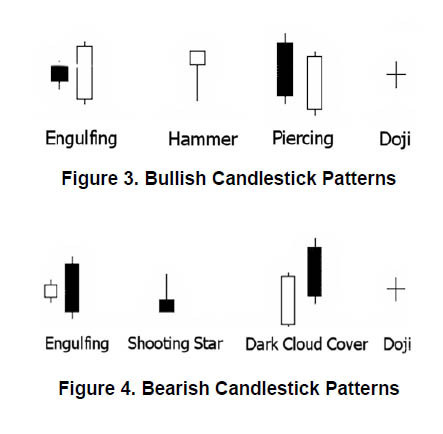

The team’s fuzzification technique, which looks at the bullish and bearish aspects of both black and white fuzzified candlesticks is described on page 4 [of the pdf] of their paper ‘Fuzzy Candlestick Approach to Trade S&P CNX NIFTY 50 Index using Engulfing Patterns’

“Human brain creates rules through experience and uses it at appropriate instances, similarly for our system, at every phase we develop Fuzzy-Rules. The accumulated Fuzzy-Rules from every phase would become the Fuzzy Rule-base. This Fuzzy-Rule-base guides the system and helps to decide the course of action whether to buy or sell.”

The team go on to explain that there is room for further work, possibly including, but not limited to, defuzzification of trend values towards crispness.

Marc Abrahams's Blog

- Marc Abrahams's profile

- 14 followers