Violent Volatility in the SP500

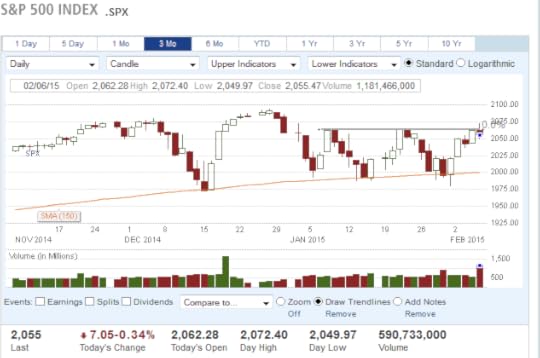

SP500 3-Mnth Chart with simple technical indicators

Headlines on market news sites scream: “The market is up 3% for the week!” And, “The losses of January erased!” Yes, it is up 3% for the week…but hasn’t changed much at all since the beginning of the year as you may see in the picture above. It was only five weeks ago that I’d thought we may be in for some volatility. We’ve seen 3% moves every week since then. Shouldn’t the market headlines be “Market volatility of 3% every week?”

As for the past week’s action, sure, we bounced off a short-term trend line and near a psychological level for the SP500, but we are not seeing new highs in the market. This past Friday saw such an attempt with a sell-off (at the end of the chart above) at almost twice normal trading volume – which, at the top of this past five-week channel, technicians will tell you, is an indication that we may be seeing another turnaround. Besides, this action ensued despite a very strong US jobs and wage growth number with significant upward revisions for past months.

What may we expect ahead? Market “experts” claim that FED comments and another jobs number is expected the next week…and the situation with Greece is nearing a decision juncture soon (before the end of this month) with strong implications for Europe and the US markets. Retail sales numbers are also anticipated, with a slight reduction in January relative to the December holiday month. None of these are necessarily good news; the FED raising rates mid-2015 is once again in play given the strong jobs and wages number, and Greece defaulting or exiting the European union, given a new government set against prior compromises for bailout loans extended, is a higher probability. What may be certain is that uncertainty awaits…

Some say that the market will break out of this channel and head on upward…but I think we may see more volatility ahead, and am long the VIX again with a small position.