Bullish Sentiment Breaking Out

It’s important to keep your finger on the pulse of investor sentiment. Knowing the mood du jour helps us know which direction the herd is leaning. And we can make moves accordingly.

Two sentiment indicators that I regularly monitor are 1) the Consumer Discretionary-to-Staples (XLY: XLP) ratio, and 2) the Small-Cap-to-Large-Cap (IWM: DIA) ratio.

The former shows when investors are bidding up consumer discretionary stocks faster than consumer staples stocks. When this is the current mood among investors, the ratio rises and indicates increased optimism and risk-taking.

Likewise, the latter ratio measures investors’ preference for small-cap stocks relative to large-caps. Typically, when investors are optimistic and willing to assume increased risk, they invest in small-cap stocks, causing the ratio to increase along with the bullish sentiment.

Currently, it appears that both ratios are breaking out to the upside, indicating that bullish sentiment is quickly increasing. Take a look…

Here’s the Consumer Discretionary-to-Staples (XLY: XLP) ratio:

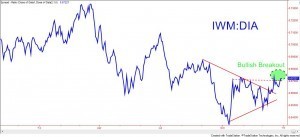

And here’s the Small-Cap-to-Large-Cap (IWM: DIA) ratio:

So both ratios are now beginning to indicate that investors are growing increasingly bullish.

This, of course, is a positive sign that the current broad market bull-run may have legs for a while longer into the New Year. But it’s also important to realize that these breakouts are in an early stage and may be prone to pullbacks in the near future.

I’ll continue to keep an eye on these developments.

I have a specific trade in mind that I’ll likely be recommending to Cycle 9 Alert subscribers in the next week or two. Click here to gain access to real-time trade alerts.

Adam