Is It Hard to Create Inflation Expectations?

Paul Krugman says he "very much agree[s] with the notion that central banks can gain traction, even in a liquidity trap, if they can credibly promise future inflation — that was the whole moral of my 1998 paper."

That paper is the lynchpin of my understanding of this issue as well, but Krugman seems very skeptical in practice that monetary action will deliver the goods:

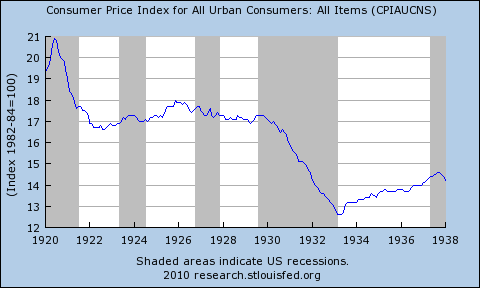

But in the 30s, we were mainly talking about ending expectations of deflation, or at most creating expectations of a rise in the price level to where it was before the Depression; remember that even in 1938, prices were well below 1929 levels:

That's very different from trying to create expectations of inflation looking forward with no actual deflation in our past.

It's certainly different. But is it "very" different? It doesn't seem all that different to me. Suppose the official Fed statement after the next meeting involves some QE and gives as the reason for it "the inflation rate is too low, we believe this round of QE will produce extra inflation and if it doesn't we're going to do more QE." That would certainly lead me to expect more inflation.

It seems to me that the problem we face is much more that the median member of the FOMC is unlikely to agree to such a strong statement than that a strong statement wouldn't work.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers