The Reagan Precedent

This is a bit of an aside in a column that's primarily about legislative strategy, but I think Mark Schmitt is expressing a widespread tendency to take an undue level of comfort from the precedent of Ronald Reagan's first term:

Many of the White House's political troubles can be entirely explained by the economy, of course, since they are exactly comparable to Ronald Reagan's unpopularity with similar levels of unemployment in 1982. But when the economy recovers, as it will, and his presidency regains its footing, Obama — and we — will need a whole new theory about how to make government work without losing the bigger vision.

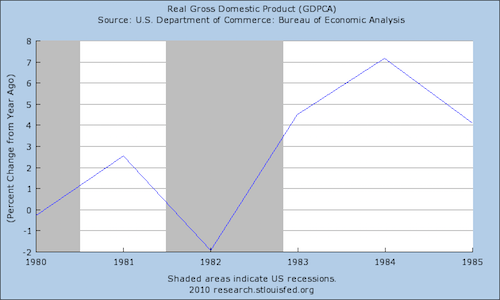

Check out the level of GDP growth associated with the "morning in America" recovery:

By contrast, the CBO is projecting (PDF) 2.1 percent real GDP growth for 2011. Now it's true that CBO's estimate is on the pessimistic side. We might well do better than that. But the point I would make is that there's nothing inevitable about a robust catch-up recovery. We entered the early 80s recession with high inflation and very high nominal interest rates. When Paul Volcker was satisfied that inflation was whipped, he implemented sharp reductions in nominal interest rates and growth came roaring back. But ever since nominal rates hit zero, the Fed's been stumbling around, real rates are still pretty high, and nobody seems to have any politically feasible ideas about how to do better.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers