US Home Foreclosures are Comparable to the Great Depression

with those of the Great Depression:

Foreclosure rates of the late 2000s are often compared with those of the Great Depression, which took place through the first half of the 1930s. However, there were no public or private agencies keeping track of foreclosure rates at that time. Indeed, the government still does not keep an official statistic on the number of homes in foreclosure or repossessed by banks and lenders.

But the Chronicle provides estimates of foreclosures during the 1930s:

A 2008 article by David C. Wheelock, an economist at the

Federal Reserve Bank of St. Louis, cited annual reports issued by the

Federal Home Loan Bank Board during the 1930s. These reports reveal that

the foreclosure rate exceeded 1 percent from 1931

until 1935. At the worst point in the Depression-era economic crisis, in

1933, about 1,000 home loans were being placed in foreclosure by banks

every day.

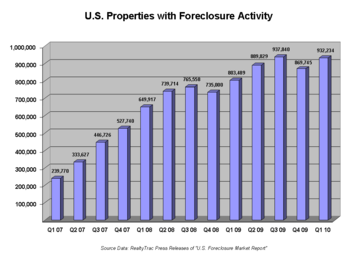

How does that compare to the last 5 years?

RealtyTrac notes (via North Carolina State University) that:

From January 2007 to December 2011 there were more than four million completed foreclosures and more than 8.2 million foreclosure starts ….

CoreLogic reported a year ago:

Approximately 1.4 million homes, or 3.4 percent

of all homes with a mortgage, were in the national foreclosure

inventory as of May 2012 compared to 1.5 million, or 3.5 percent, in May

2011 and 1.4 million, or 3.4 percent, in April 2012. The foreclosure

inventory is the share of all mortgaged homes in some stage of the

foreclosure process.

Given that there are currently around 316 million

Americans – more than twice the number during the Great Depression –

such high foreclosure rates mean that there may well be as many people

suffering foreclosure than during the Great Depression

Already some 5 million homes have been

lost to foreclosure; estimates of future foreclosures range widely.

Some who have followed the

mortgage mess since the housing market began to crack in 2006, figures

foreclosures will strike another three million homes in the next three or four years.