Gox Goes Belly-up After Losing A Billion Dollars Without Noticing; Blames Fault In Corporate Bookkeeping Protocols

Cryptocurrency: So it’s more or less official: MtGox, once the world’s largest bitcoin exchange, has died and taken all its holdings with it to the grave. This follows a long string of evasive statements, silence, and strange behavior from the exchange, particularly including bad customer service. The net is full of horror stories of people having lost their money, and claims of a “hack against the vault” are not credible in the slightest – here’s why.

In a chaotic situation like this, it’s hard to know exactly what is true. Here are the claims that seem reasonably factish:

The vault of Gox is empty, instead of containing 744,000 bitcoin

Gox has halted all trading, deleted all previous communication, and is serving a blank web page

The blank web page holds an invisible comment hinting at an acquisition

There are claims that the loss of 744,000 bitcoin was due to a years-running hack that gradually emptied the vault

Claims that the loss is due to a “hack” appear not credible

Previous large “hacks” in the bitcoin ecosystem have been widely believed to be outright scams, but haven’t met the evidence bar for a criminal trial

In persistent rumors of insolvency, “MT Gox” has been pronounced “Empty Gox” for some time in mockery. As it turns out, it’s more true than expected. News this morning says that 744,000 bitcoins are missing from its “cold storage”, its vault. What appears to be a consultant’s crisis report and findings doesn’t list a cold storage wallet at all among assets, indicating the exchange’s vault is empty.

How much is 744,000 bitcoin? In technical terms, it’s a shitload of money. Using the peak exchange rate from two months ago, it’s a hairsbreadth shy of one billion US dollars, with a B.

So the question is; how can you not notice one billion dollars gradually disappearing from your company over several years, as has been claimed to be the case?

The answer is simple: you can’t. It’s practically against the laws of physics to not notice this. You can’t close the ledgers on a fiscal year without every cent accounted for. There would be a faint theoretical possibility it could have taken place entirely within a fiscal year, but even that is improbable to the level of the moon being made of cheese.

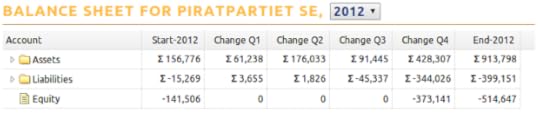

Any CEO of a company this size has screens in their office showing real-time key numbers, specifically including financial flows and balances. Frak, I’ve been running a non-profit organization that made it to the European Parliament, and I had a real-time view of every single cent of the organization’s assets, using our homebuilt software Swarmops.

Balance sheet, motherfucker. Do you speak it?

So an obvious conclusion is that the claims of a long-running hack emptying the vault are false. It’s not just possible to not notice one billion dollars disappearing. It’s not possible to miss one single dollar disappearing with normal bookkeeping methods.

Live updates to the situation below, as I get them. Timestamps are European.

Feb 26 00:13 - Andreas Antonopoulos (one of the key bitcoin developers) points out, in a rather technical post, that it is impossible for funds to “leak” from cold storage. The very definition of cold storage means it doesn’t leak. Either there was no leak, or there was no cold storage.

Feb 25 23:53 - Mark Karpeles, CEO of Empty Gox, has confirmed the authenticity of the leaked document, though he points out that it’s a draft with suggested options.

Feb 25 23:39 - This story has reached beyond tech and financial media; it’s being covered in mainstream oldmedia up to and including the evening TV news.

Feb 25 18:06 - Mark Karpeles has recently bought the domain gox.com, according to the people who brokered it, which lends further credibility to the leaked crisis recommendations document which suggested just that – a rebranding to “Gox”.

Feb 25 17:20 - The exchange rate seems to already recover from the loss of Empty Gox from the ecosystem; the exchange rate at Bitstamp is already back at $550, having bottomed out at $400. However, as with anything bitcoin, this is too early to call.

Feb 25 17:14 - Empty Gox has added a nonsense statement on their previously-empty web page: “In the event of recent news reports and the potential repercussions on MtGox’s operations and the market, a decision was taken to close all transactions for the time being in order to protect the site and our users. We will be closely monitoring the situation and will react accordingly.”

Feb 25 16:42 - The claim of a years-long-running hack against the vault comes from the leaked strategy document: “At this point 744,408 BTC are missing due to malleability-related theft which went unnoticed for several years”, in bold. At this point, there is nothing that contradicts its being genuine; to the contrary, the timetable of the report agrees with events unfolding today.

“I wonder how much money Hitler had with Mt Gox. Expect to see a video soon.” — Martijn Meijering

Now, as far as we know, all of these are unconfirmed claims, with the exception of Empty Gox going essentially offline. In their trailblazing PR strategy that will surely rewrite the handbook of corporate communications, they master the situation by not communicating a single shred at all.

There are hopeful rumors that a competent management will buy Empty Gox. I have to shatter your hopes here – that concept is a contradiction in terms. Nobody competent is going to take on one billion USD in debt for this brand. Look at other startups; which ones of them sell for $1B or more?

DISCLOSURE

Yeah, I’m one of those who lost coins stuck at Gox. About 160 of them. As soon as I saw the writing on the wall, before the many but after the savvy, I started trying moving coins home… but most of the withdrawals failed, and could be retried only after a week. After a couple of weeks of withdraw/retry cycles, withdrawals didn’t exist anymore.

May Empty Gox burn in hell. Long live Bitcoin.

Oh, and as for the title, “blames fault in corporate bookkeeping protocols”? That’s well-deserved mockery of when Empty Gox tried to blame the bitcoin protocol for having to halt withdrawals due to “transaction malleability”, as I’ve written about before. It’s not anywhere near the level of mockery they deserve for cratering a community and clientele like this, but I do what I can. I’ve got a ton of frustration to take out on them, and I’m not done yet.

Rick Falkvinge's Blog

- Rick Falkvinge's profile

- 17 followers