Are Reinhart and Rogoff Right Anyway?

By James Kwak

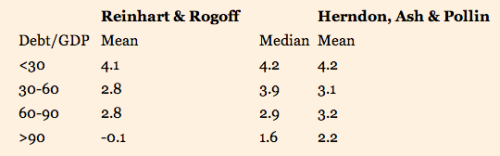

One more thought: In their response, Reinhart and Rogoff make much of the fact that Herndon et al. end up with apparently similar results, at least to the medians reported in the original paper:

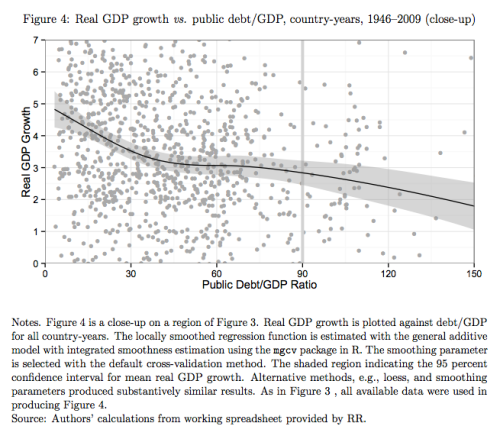

So the relationship between debt and GDP growth seems to be somewhat downward-sloping. But look at this, from Herndon et al.:

Yes, we still have that downward slope. But two things:

1. There’s no cliff at 90 percent, which was the central finding of the original paper. This is the second sentence of that paper:

“Our main result is that whereas the link between growth and debt seems relatively weak at ‘normal’ debt levels, median growth rates for countries with public debt over roughly 90 percent of GDP are about one percent lower than otherwise; average (mean) growth rates are several percent lower.”

2. Aren’t we only supposed to be interested in empirical results that are significant? What the figure from Herndon et al. says, in their words, is this:

“Between public debt/GDP ratios of 38 percent and 117 percent, we cannot reject a null hypothesis that average real GDP growth is 3 percent.”

I find it hard to agree with Reinhart and Rogoff when they say, “We do not, however, believe this regrettable slip affects in any significant way the central message of the paper.”

Simon Johnson's Blog

- Simon Johnson's profile

- 78 followers