What A Difference A Year Makes

It occurred

to me I really should do a wrap-up post for the blog since it doesn’t look like

I’ll be posting here much anymore. I think I simply hit that wall that many

bloggers who’ve blogged for a few years hit. Been there, done that, time to

move on to something new. Not without regret, of course. It’s been a great

place to work out and share the first steps of my self-publishing journey, as

well as a great place to share data and put forward marketing theories. Had I

known earlier self-publishing could involve so many lovely spreadsheets and

data analyses, I would have jumped in far sooner!

In that

spirit, I thought it appropriate for this post to cover three topics:

Amazon Select Then And Now – One Book’s Journey

Steel Magnolia Press – One Year Later

The Latest On The Pop List Watch – Math-Free

Version!

AMAZON

SELECT THEN AND NOW – ONE BOOK’S JOURNEY

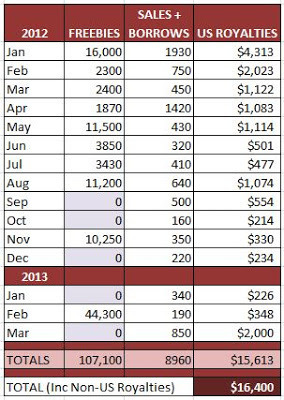

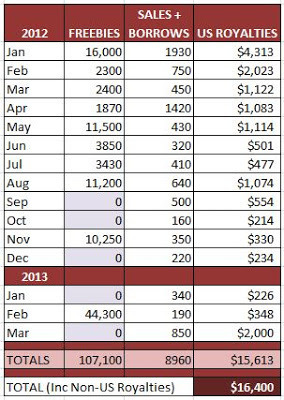

I first

enrolled SECTOR C in Select on January 6, 2012. Since then, it’s gone free 10

times. It’s always lucked out and had fairly good runs, and was one of the

books that saw immediate success in the Golden Age of Amazon Algos, when free

book downloads were counted as real sales. It hit #1 on the SF poplists a few

times and made a couple of appearances (with its old cover) on the Amazon splashpage for ebooks.

When authors

ask whether or not frequent free eventually reaches saturation, I point to

SECTOR C. In a string of 8 months where SC went free each month, it still had a

decent showing of 11,000+ downloads in the 8th month. And, after

being downloaded about 63,000 times in the 9 free runs prior, it still managed its

best run yet on its 10th time out.

Granted, it

had a little help via a BookBub ad on Day 1 followed by a late rally on Day 4

from a FKBT mention, which resulted in over 44,000 downloads. It hit #1 Free in the

store late in the day on its first day free and then again on the afternoon of

its second free day.

But what of

the post-free sales bounce? In January 2012, SC had 16,000 free downloads, then

went on to sell 1930 copies, netting over $4300. Bless those old algorithms!

After its

late February 2013 run with 44,300 downloads, it’s had over 750 sales+borrows,

with an anticipated 30-day total of 850 sales, with a net of about $2000.

Almost 3 times the number given away this year resulted in less than half the

number of sales and royalties from January last year. Still, it sextupled what

had been its monthly sales average for the 5 months prior, so I still count

what was probably its last free run for a while a grand slam.

In all,

SECTOR C (pubbed Sept 1, 2011) has earned about $17,000 over its lifetime. Not a groundbreaking figure,

but one I’m still pretty pleased with.

Does Select

Free still “work”? (Weren't we asking that same question back in August?) For many of the titles in the Steel Magnolia Press

inventory, the answer is YES, with caveats. Those caveats are common sense. Freebook

site mentions, of course, play a huge part. But we have titles that can still hit

high in the Top 100 without a major site mention, even competing against titles

with BookBub, POI and ENT backing. That’s due in large part to one or more of

the following:

being

penned by a name author

being a boxed

set with a higher perceived value to begin with

being in

a highly popular genre

Shorter

works, titles without a high review rating, and/or titles that don’t get an

advertising push don’t do well. No surprises there. For those books, we have to

figure other strategies to get them noticed.

STEEL

MAGNOLIA PRESS – ONE YEAR LATER

On January 1,

2012, Steel Magnolia Press had my 2 novels and short essay collection and 3 of Jennifer

Blake’s novellas in its inventory, and had been in business for about 6 weeks.

Today, Steel

Magnolia has 50 titles by 4 authors published, with 49 of those titles in

Amazon Select. SMP also has an honorary bestselling Magnolia with 2 titles in

(though her sales are not included in our overall totals). We’ll be publishing

another backlist novel from Jennifer Blake, Sweet

Piracy, at the end of March, then a brand new book in Jennifer’s Italian

Billionaires Collection will release in early May. In June, we’ll put out 2

more box sets, then follow those this summer with 12 backlist novels as we give

the box sets a rest. On top of that, we have a handful of Blake’s backlist

novellas waiting to be formatted, and new titles to come soon(ish) from Tamelia

Tumlin and me. By the end of 2013, we’ll have close to 80 titles available once

we bundle some more of them up in time for Christmas giving.

But having a

large inventory and selling them are two different things. Now, we could go

with the KKR-DWS approach of pricing high, publishing to all platforms and then

ignoring the books as we move on to publishing the next. Instead, we

concentrate our marketing on Amazon, use the tools available there, advertise

strategically, and price competitively and aggressively to gain the visibility

that leads to more sales. Using this approach on mainly backlist titles has

worked well for us as we’ve grown Steel Magnolia to its current 50 titles, the

majority of which are novels and box sets.

When reading our sales figures, keep in mind

that we did not start publishing out Jennifer’s backlist novels until last July, and

then it was only 4-6 books per month from July-October. October also saw the

release of a brand new book by Jennifer, The Tuscan’s Revenge Wedding, which

hit #1 Free in the Amazon store with 37,000 downloads, jumped to #91 Paid overall, then went on to sell

25,000+ copies. In November, we bundled

the existing books into virtual boxed sets and released 8 of those. We published nothing

new in December, and then published two more box sets in January, with no new

titles being published in February and March.

One of the

box sets, the Louisiana Plantation Collection hit #14 Paid in Amazon in

December, stayed in the Top 100 through January, hopscotched in and out of the

Top 100 through February and finally fell out in March after selling well over

65,000 copies. As I write this, it’s at #198.

In all, over

the past year, Steel Magnolia has had 10 separate titles in the overall Top 100

Paid bestseller list in the Amazon.com store, and several more ranked under

#1000.

Sales

Figures For Steel Magnolia Press, January 2012 – Feb/March, 2013

195,347 - Total

# of Books Sold (through March 22, 2013)

724,456 - Total

# of Books Given Away (through March 22, 2013)

$163,660 - Total

Royalties (through Feb 28, 2013)

96,581 of those sales have happened since January

1, 2013. I think, maybe, we’re finally getting the hang of this indie publishing thing ;o).

POP LIST

WATCH

Having been

among the first (maybe The First) to point out how Amazon uses the popularity

lists as tools in its internal marketing and recommendation engines -- and

changes those algos to better reflect the browsing and buying choices of its

readers and to better influence whatever buying choices it wants its customers

to be making -- I figured I should end by throwing out a couple of things for the

new Data Avengers among you to mull over.

First, the

UK is still using algorithms that are quite favorable to indies who run free,

whether via Select or price matching. Spoil of War was recently price-matched

to free in the UK for a couple of weeks, during which time it had 2077

downloads. When it came off free (by my choice, I no longer wanted it

price-matched so was actively trying to get Amazon to re-price the book to

paid), it was quite nicely ranked in the poplists:

#1 Arthurian

Fantasy

#1

Historical Fantasy

#5

Historical Fiction

#5 Fantasy

Those

rankings were true to the algorithms of the Golden Age of early 2012 that we

all knew and loved on the .com store. Sales

at the UK-equivalent of $3.78 began promisingly enough: 28 the first day after

it came off free, followed by 25 sales the next day. Followed by 4 sales the

next. Sigh. Amazon, in its infinite wisdom, had seen fit to re-price the book

to free again. Since it’s full price elsewhere, it could only be price-matching

some cached version of iTunes, or price-matching the US store.

Still,

enough of a glimpse to know the UK remains firmly entrenched in the Golden Age

algos. For now.

But here’s

the kicker on the .com site and the tease for all you data watchers. The higher

(better) SECTOR C climbed the poplists and the KOLL lists, the worse its sales

seemed to get, on average. Yes, even before that 30-Day Cliff that still looms ahead for SECTOR C. Yesterday was its best placement on those lists since being

free – but yesterday was its worst sales day yet.

Your

mission, should you decide to accept it, is to figure out why.

Peace out.

to me I really should do a wrap-up post for the blog since it doesn’t look like

I’ll be posting here much anymore. I think I simply hit that wall that many

bloggers who’ve blogged for a few years hit. Been there, done that, time to

move on to something new. Not without regret, of course. It’s been a great

place to work out and share the first steps of my self-publishing journey, as

well as a great place to share data and put forward marketing theories. Had I

known earlier self-publishing could involve so many lovely spreadsheets and

data analyses, I would have jumped in far sooner!

In that

spirit, I thought it appropriate for this post to cover three topics:

Amazon Select Then And Now – One Book’s Journey

Steel Magnolia Press – One Year Later

The Latest On The Pop List Watch – Math-Free

Version!

AMAZON

SELECT THEN AND NOW – ONE BOOK’S JOURNEY

I first

enrolled SECTOR C in Select on January 6, 2012. Since then, it’s gone free 10

times. It’s always lucked out and had fairly good runs, and was one of the

books that saw immediate success in the Golden Age of Amazon Algos, when free

book downloads were counted as real sales. It hit #1 on the SF poplists a few

times and made a couple of appearances (with its old cover) on the Amazon splashpage for ebooks.

When authors

ask whether or not frequent free eventually reaches saturation, I point to

SECTOR C. In a string of 8 months where SC went free each month, it still had a

decent showing of 11,000+ downloads in the 8th month. And, after

being downloaded about 63,000 times in the 9 free runs prior, it still managed its

best run yet on its 10th time out.

Granted, it

had a little help via a BookBub ad on Day 1 followed by a late rally on Day 4

from a FKBT mention, which resulted in over 44,000 downloads. It hit #1 Free in the

store late in the day on its first day free and then again on the afternoon of

its second free day.

But what of

the post-free sales bounce? In January 2012, SC had 16,000 free downloads, then

went on to sell 1930 copies, netting over $4300. Bless those old algorithms!

After its

late February 2013 run with 44,300 downloads, it’s had over 750 sales+borrows,

with an anticipated 30-day total of 850 sales, with a net of about $2000.

Almost 3 times the number given away this year resulted in less than half the

number of sales and royalties from January last year. Still, it sextupled what

had been its monthly sales average for the 5 months prior, so I still count

what was probably its last free run for a while a grand slam.

In all,

SECTOR C (pubbed Sept 1, 2011) has earned about $17,000 over its lifetime. Not a groundbreaking figure,

but one I’m still pretty pleased with.

Does Select

Free still “work”? (Weren't we asking that same question back in August?) For many of the titles in the Steel Magnolia Press

inventory, the answer is YES, with caveats. Those caveats are common sense. Freebook

site mentions, of course, play a huge part. But we have titles that can still hit

high in the Top 100 without a major site mention, even competing against titles

with BookBub, POI and ENT backing. That’s due in large part to one or more of

the following:

being

penned by a name author

being a boxed

set with a higher perceived value to begin with

being in

a highly popular genre

Shorter

works, titles without a high review rating, and/or titles that don’t get an

advertising push don’t do well. No surprises there. For those books, we have to

figure other strategies to get them noticed.

STEEL

MAGNOLIA PRESS – ONE YEAR LATER

On January 1,

2012, Steel Magnolia Press had my 2 novels and short essay collection and 3 of Jennifer

Blake’s novellas in its inventory, and had been in business for about 6 weeks.

Today, Steel

Magnolia has 50 titles by 4 authors published, with 49 of those titles in

Amazon Select. SMP also has an honorary bestselling Magnolia with 2 titles in

(though her sales are not included in our overall totals). We’ll be publishing

another backlist novel from Jennifer Blake, Sweet

Piracy, at the end of March, then a brand new book in Jennifer’s Italian

Billionaires Collection will release in early May. In June, we’ll put out 2

more box sets, then follow those this summer with 12 backlist novels as we give

the box sets a rest. On top of that, we have a handful of Blake’s backlist

novellas waiting to be formatted, and new titles to come soon(ish) from Tamelia

Tumlin and me. By the end of 2013, we’ll have close to 80 titles available once

we bundle some more of them up in time for Christmas giving.

But having a

large inventory and selling them are two different things. Now, we could go

with the KKR-DWS approach of pricing high, publishing to all platforms and then

ignoring the books as we move on to publishing the next. Instead, we

concentrate our marketing on Amazon, use the tools available there, advertise

strategically, and price competitively and aggressively to gain the visibility

that leads to more sales. Using this approach on mainly backlist titles has

worked well for us as we’ve grown Steel Magnolia to its current 50 titles, the

majority of which are novels and box sets.

When reading our sales figures, keep in mind

that we did not start publishing out Jennifer’s backlist novels until last July, and

then it was only 4-6 books per month from July-October. October also saw the

release of a brand new book by Jennifer, The Tuscan’s Revenge Wedding, which

hit #1 Free in the Amazon store with 37,000 downloads, jumped to #91 Paid overall, then went on to sell

25,000+ copies. In November, we bundled

the existing books into virtual boxed sets and released 8 of those. We published nothing

new in December, and then published two more box sets in January, with no new

titles being published in February and March.

One of the

box sets, the Louisiana Plantation Collection hit #14 Paid in Amazon in

December, stayed in the Top 100 through January, hopscotched in and out of the

Top 100 through February and finally fell out in March after selling well over

65,000 copies. As I write this, it’s at #198.

In all, over

the past year, Steel Magnolia has had 10 separate titles in the overall Top 100

Paid bestseller list in the Amazon.com store, and several more ranked under

#1000.

Sales

Figures For Steel Magnolia Press, January 2012 – Feb/March, 2013

195,347 - Total

# of Books Sold (through March 22, 2013)

724,456 - Total

# of Books Given Away (through March 22, 2013)

$163,660 - Total

Royalties (through Feb 28, 2013)

96,581 of those sales have happened since January

1, 2013. I think, maybe, we’re finally getting the hang of this indie publishing thing ;o).

POP LIST

WATCH

Having been

among the first (maybe The First) to point out how Amazon uses the popularity

lists as tools in its internal marketing and recommendation engines -- and

changes those algos to better reflect the browsing and buying choices of its

readers and to better influence whatever buying choices it wants its customers

to be making -- I figured I should end by throwing out a couple of things for the

new Data Avengers among you to mull over.

First, the

UK is still using algorithms that are quite favorable to indies who run free,

whether via Select or price matching. Spoil of War was recently price-matched

to free in the UK for a couple of weeks, during which time it had 2077

downloads. When it came off free (by my choice, I no longer wanted it

price-matched so was actively trying to get Amazon to re-price the book to

paid), it was quite nicely ranked in the poplists:

#1 Arthurian

Fantasy

#1

Historical Fantasy

#5

Historical Fiction

#5 Fantasy

Those

rankings were true to the algorithms of the Golden Age of early 2012 that we

all knew and loved on the .com store. Sales

at the UK-equivalent of $3.78 began promisingly enough: 28 the first day after

it came off free, followed by 25 sales the next day. Followed by 4 sales the

next. Sigh. Amazon, in its infinite wisdom, had seen fit to re-price the book

to free again. Since it’s full price elsewhere, it could only be price-matching

some cached version of iTunes, or price-matching the US store.

Still,

enough of a glimpse to know the UK remains firmly entrenched in the Golden Age

algos. For now.

But here’s

the kicker on the .com site and the tease for all you data watchers. The higher

(better) SECTOR C climbed the poplists and the KOLL lists, the worse its sales

seemed to get, on average. Yes, even before that 30-Day Cliff that still looms ahead for SECTOR C. Yesterday was its best placement on those lists since being

free – but yesterday was its worst sales day yet.

Your

mission, should you decide to accept it, is to figure out why.

Peace out.

Published on March 23, 2013 13:19

No comments have been added yet.

Phoenix Sullivan's Blog

- Phoenix Sullivan's profile

- 43 followers

Phoenix Sullivan isn't a Goodreads Author

(yet),

but they

do have a blog,

so here are some recent posts imported from

their feed.