The Wall St. Journal website no longer publishes the Merrill Lynch High Yield Index as regularly as it did in the past.

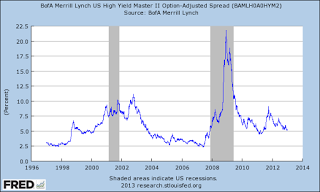

This index is important because it measures changes in investors' risk tolerance. This is the difference between the yield on lower quality bonds and safer US treasuries. As investors take on more risk, this spread becomes smaller. The fixed-income market often moves ahead of equities, so you may get advance notice of movements in the S&P.

You may want a simple tool from the Federal Reserve Bank in St. Louis:

http://research.stlouisfed.org/fred2/series/BAMLH0A0HYM2

Select the option "Last five observations" to see the spreads you need. Today's data shows the spread narrowing from 5.31% to 5.16% as investors take on more risk.

2013-01-02: 5.16 Percent

2012-12-31: 5.31

2012-12-28: 5.30 2012-12-27: 5.28 2012-12-26: 5.24 Daily, Close, Not Seasonally Adjusted, Updated: 2013-01-03 9:28 AM CST The Fed can deliver this information to you inbox every morning - at no charge. Just select "Notify Me" at the options on the left of the page.

Buy Timing the Market at Amazon.com

Buy Timing the Market at Amazon.com

Published on January 03, 2013 09:42