Multi-Horizon Integration: Balancing Short, Mid, and Long-Term Strategies

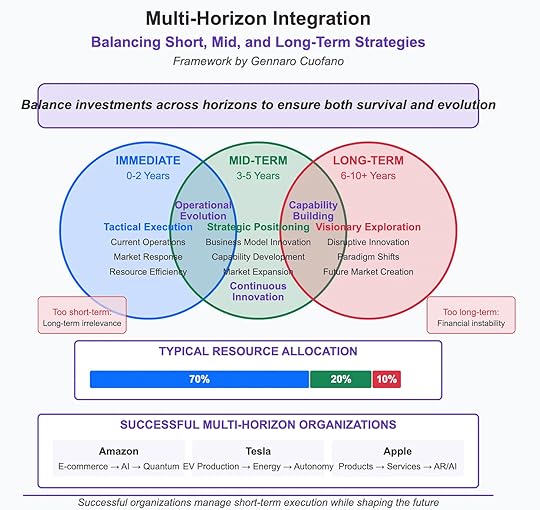

Every successful company must solve the same paradox: how to survive the present while preparing for the future. Too much focus on the immediate term creates irrelevance as new technologies and markets emerge. Too much focus on the long term creates financial fragility, as the company starves its core operations. The solution is not to choose one horizon over the other, but to integrate all three—short, mid, and long-term strategies—into a coherent system of execution.

This is the logic of multi-horizon integration: a discipline for balancing today’s tactical execution, tomorrow’s strategic positioning, and the distant future’s visionary bets.

Horizon 1: Immediate (0–2 Years)The immediate horizon is about tactical execution. Companies need to keep the lights on, meet current market demands, and optimize operations.

Key features:

Current operations must run efficiently.Market responses must be agile to capture short-term opportunities.Resource allocation is heavily weighted here—about 70% of total resources.The risk of neglecting this horizon is obvious: without short-term survival, there is no future. But the opposite risk is equally dangerous: becoming trapped in perpetual firefighting mode, mistaking efficiency for strategy. Companies that obsess over the immediate term risk long-term irrelevance, because optimization without evolution simply accelerates obsolescence.

Horizon 2: Mid-Term (3–5 Years)The mid-term horizon is about strategic positioning. Here, companies move beyond efficiency to invest in business model innovation, capability development, and market expansion.

This horizon bridges execution and exploration. It ensures that a company does not just run operations but evolves them into stronger competitive positions. Strategic positioning involves:

Building capabilities that compound advantage.Innovating business models to capture more value.Entering adjacent markets where current infrastructure provides leverage.Typical allocation here is around 20% of resources—enough to fuel evolution without starving today’s core.

The mid-term horizon is often the hardest to manage. It lacks the urgency of Horizon 1 and the visionary appeal of Horizon 3. Yet it is the most decisive. Companies that fail here get disrupted. Those that succeed lay the foundation for enduring relevance.

Horizon 3: Long-Term (6–10+ Years)The long-term horizon is about visionary exploration. Companies must make bets on disruptive innovations, paradigm shifts, and future market creation.

This is not about predicting the future with certainty—it’s about building options for multiple futures. Investments in Horizon 3 often feel speculative, but they are necessary to avoid being blindsided by systemic shifts.

Typical allocation is 10% of resources, but this small share carries outsized significance. Without Horizon 3, companies risk being overtaken by startups or incumbents who dared to imagine—and invest in—the next paradigm.

The challenge is balance: too much emphasis on long-term moonshots creates financial instability, while too little leads to decay when markets inevitably change.

The Integration ChallengeManaging these three horizons requires discipline across two tensions:

Time allocation vs. capital allocation:Short-term execution consumes resources, but long-term bets require patience. Companies must constantly rebalance as market conditions change.Exploration vs. exploitation:

Horizon 1 exploits existing systems for maximum efficiency. Horizon 3 explores entirely new possibilities. Horizon 2 must integrate both—renewing the core while experimenting at the edges.

Successful companies treat the three horizons as an interdependent system, not isolated silos. Tactical wins fund mid-term investments, which create the capabilities that enable long-term breakthroughs.

Case Studies in Multi-Horizon StrategyAmazonAmazon exemplifies multi-horizon integration.

Horizon 1: E-commerce optimization, logistics efficiency, customer service.Horizon 2: Marketplace expansion, Prime subscription, AWS cloud scaling.Horizon 3: Bets on AI, Alexa, robotics, quantum computing.By maintaining balance, Amazon avoided the trap of short-term retail margins while building long-term infrastructure plays. Its 70/20/10 allocation ensured survival and evolution simultaneously.

TeslaTesla’s story shows how to stretch across horizons under extreme risk.

Horizon 1: Vehicle production efficiency, cost reduction.Horizon 2: Expansion into energy storage, charging infrastructure.Horizon 3: Autonomous driving, humanoid robotics.Tesla demonstrates that Horizon 3 bets can shape market perception, even before they are fully realized. Investors buy into Tesla’s long-term vision, giving it the financial oxygen to sustain Horizon 1 struggles.

AppleApple mastered the sequencing of horizons.

Horizon 1: Continuous refinement of products (iPhone, Mac).Horizon 2: Expansion into services (App Store, Apple Pay, Apple Music).Horizon 3: Bets on AR/AI and new computing paradigms.Apple shows that disciplined short-term execution funds massive long-term R&D bets. The App Store turned Horizon 1 devices into Horizon 2 recurring revenue streams, which in turn finance Horizon 3 explorations into AR/AI.

Strategic LessonsBalance prevents collapseCompanies skewing too short-term suffer long-term irrelevance. Those skewing too long-term risk immediate financial instability. Balance is survival.Horizon 2 is the pivot

The mid-term horizon, often neglected, is the true battleground. Business model innovation and capability development ensure a company evolves rather than ossifies.Vision attracts capital

Horizon 3 bets not only prepare for the future but also signal ambition, attracting talent, partners, and investors.The integration edge

The real advantage is not excelling in one horizon but integrating all three. This creates a structural rhythm—today’s wins fuel tomorrow’s positioning, which unlocks future markets.Conclusion

Multi-horizon integration is the difference between companies that burn bright and fade, and those that sustain relevance for decades.

Horizon 1 ensures survival through tactical excellence.Horizon 2 ensures evolution through strategic positioning.Horizon 3 ensures transcendence through visionary bets.The discipline lies in balancing resource allocation, time horizons, and strategic priorities. Companies like Amazon, Tesla, and Apple prove that survival and evolution are not competing goals—they are mutually reinforcing when managed across horizons.

The lesson is simple but unforgiving: neglect one horizon, and the system collapses. Master all three, and the company not only survives—it shapes the future.

The post Multi-Horizon Integration: Balancing Short, Mid, and Long-Term Strategies appeared first on FourWeekMBA.