The Cantillon Effect: Who Gets Rich from AI Money Printing

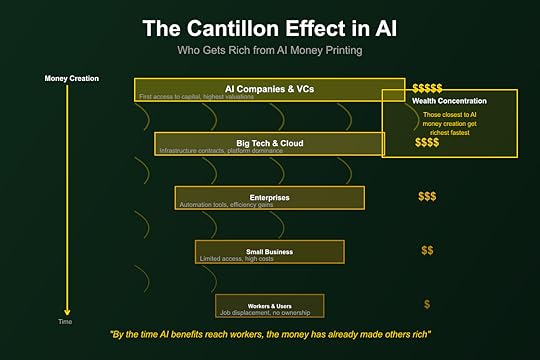

When billions flow into AI development, who gets rich first matters more than who creates value. Those closest to the capital spigot—venture capitalists, early employees at funded startups, compute providers—capture wealth before it reaches those actually building or using AI. This is the Cantillon Effect in the age of artificial intelligence: wealth flows to those nearest the money creation, not those creating actual value.

Richard Cantillon, an 18th-century economist, observed that new money doesn’t enter an economy uniformly. Those who receive it first benefit from purchasing power before prices adjust. By the time money reaches the periphery, inflation has eroded its value. In AI, we’re witnessing the largest Cantillon Effect in history as trillions in new capital flow first to Silicon Valley insiders.

The Original Monetary InsightCantillon’s ObservationCantillon noticed that when new gold entered the Spanish economy from the Americas, those nearest the ports got rich while inland peasants got poorer. The merchants who first received the gold could buy at old prices. By the time money reached farmers, prices had inflated. The distribution path of new money determined who won and who lost.

This wasn’t a temporary effect but a permanent wealth transfer. First receivers accumulated assets at pre-inflation prices. Later receivers bought inflated assets with devalued money. The sequence of money flow created lasting inequality.

Money Non-NeutralityClassical economics assumed money was neutral—just a medium of exchange that didn’t affect real economic outcomes. Cantillon showed this was false. The process of money creation and distribution fundamentally shapes economic structure.

The non-neutrality becomes extreme during rapid money creation. The faster new money enters, the greater the advantage to first receivers. The more concentrated the entry point, the more extreme the wealth effects. AI represents both: massive rapid capital creation flowing through narrow channels.

AI’s Capital CascadeThe Venture Capital SpigotVenture capital acts as the primary injection point for AI money creation. VCs with access to institutional capital deploy billions into AI startups. These VCs and their limited partners capture value before any AI product reaches market.

The cascade is immediate. VC partners earn management fees on committed capital, not deployed capital. They profit from raising funds, not creating value. The moment a new AI fund closes, partners are wealthy regardless of outcomes.

Early employees at funded startups form the second ring. They receive equity at low valuations using capital that hasn’t created value yet. By the time AI products generate revenue, early equity holders have already captured enormous paper wealth.

The Compute LandlordsCloud providers and chip manufacturers sit even closer to the money spigot. Every dollar invested in AI first flows through compute providers. NVIDIA, Amazon, Microsoft, and Google collect rent on AI capital before any model trains.

This positioning creates extraordinary wealth concentration. Compute providers can raise prices to capture any increase in AI investment. They benefit from competition between AI companies that bid up compute costs. The landlords get rich regardless of which AI companies succeed.

The effect compounds through scarcity. Limited chip supply means compute providers can extract maximum value from AI capital. They’re not just first receivers but toll collectors on all subsequent flows.

The Geography of EnrichmentThe Cantillon Effect in AI has stark geographic concentration. San Francisco and Seattle receive first-dollar advantage. By the time AI investment reaches other regions, valuations have inflated and opportunities have diminished. Geographic proximity to capital creation determines regional wealth.

This creates self-reinforcing cycles. Wealth concentration attracts more capital allocators. More allocators mean faster access to new money. The geographic Cantillon Effect becomes a permanent structural advantage.

VTDF Analysis: Distribution DistortionValue ArchitectureThe Cantillon Effect distorts value creation incentives. Being close to capital matters more than creating value. Raising funds becomes more profitable than building products. The entire value architecture optimizes for proximity to money, not utility creation.

Value capture precedes value creation. Companies achieve billion-dollar valuations before generating revenue. Founders become wealthy from funding rounds, not business success. The normal sequence of value creation then capture reverses.

This inversion changes what “value” means in AI. Value becomes ability to raise capital, not serve customers. Success means higher valuations, not better products. The Cantillon Effect redefines value itself.

Technology StackTechnology decisions reflect Cantillon dynamics. Companies choose expensive compute to signal capability to investors. They pursue benchmark improvements that impress VCs rather than features users want. Technical architecture optimizes for fundraising, not functionality.

The stack becomes unnecessarily complex to justify higher valuations. Simple solutions don’t attract billion-dollar investments. Complexity becomes a fundraising strategy rather than technical necessity.

Infrastructure providers exploit their Cantillon position. They know AI companies will pay any price with investors’ money. The entire stack becomes more expensive because of where it sits in the money flow.

Distribution StrategyDistribution strategies reflect Cantillon positioning. Companies focus on metrics that attract investment rather than sustainable growth. User acquisition at any cost. Revenue growth regardless of profitability. Distribution optimizes for the next funding round, not long-term viability.

The effect cascades to customers. Early adopters pay low prices subsidized by venture capital. Later adopters face full costs plus margin requirements. Even customer acquisition follows Cantillon patterns.

Financial ModelsFinancial models in AI assume continued Cantillon benefits. Valuations depend on access to cheap capital. Business plans require multiple funding rounds. Companies structure themselves as Cantillon beneficiaries rather than sustainable businesses.

The dependence becomes existential. Without continued position near money creation, companies fail regardless of technical merit. The financial model is actually a Cantillon position model.

Real-World Wealth TransfersThe NVIDIA EnrichmentNVIDIA exemplifies perfect Cantillon positioning. Every dollar of AI investment must purchase their chips. They collect revenue before any AI company generates value. Their market capitalization exceeds most of their customers’ combined valuations.

The wealth transfer is systematic. AI startups raise capital at dilutive valuations. They spend that capital on NVIDIA chips at premium prices. NVIDIA shareholders capture the value. Venture capital becomes a wealth transfer mechanism to chip manufacturers.

The Cloud Provider TaxAmazon, Microsoft, and Google collect Cantillon rents through cloud services. AI companies have no choice but to pay these rents with investor money. Cloud providers extract value from the AI ecosystem before that ecosystem creates value.

The tax compounds through lock-in. Once AI companies commit to a cloud provider, switching costs become prohibitive. The Cantillon advantage becomes permanent through technical dependence.

The Founder LotteryAI founders who achieve proximity to capital experience astronomical wealth creation. Not from building successful businesses but from successful fundraising. The ability to raise capital becomes more valuable than the ability to create products.

This creates perverse incentives. Founders optimize for narratives that attract investment. They pursue moonshot visions over sustainable businesses. The Cantillon Effect rewards storytelling over execution.

The Cascade MechanismsValuation InflationAs money flows through the AI ecosystem, valuations inflate at each stage. Seed rounds price higher because Series A exists. Series A prices higher because Series B exists. Each funding round creates inflationary pressure on the next.

The inflation doesn’t reflect value creation but Cantillon positioning. Companies further from capital must accept worse terms. The same technology commands different valuations based on proximity to money.

Talent Price SpiralThe Cantillon Effect drives AI talent costs to extraordinary levels. Those working at companies with better capital access earn more. Proximity to funding determines compensation more than contribution.

This creates talent migration toward Cantillon beneficiaries. The best people join companies not for mission but for proximity to capital. Human capital follows financial capital, reinforcing concentration.

Innovation DistortionThe Cantillon Effect distorts innovation incentives. Research focuses on what attracts funding, not what solves problems. Development prioritizes what VCs understand over what users need. Innovation serves capital allocators rather than value consumers.

Strategic ImplicationsFor EntrepreneursPosition yourself upstream in capital flows. Being early in funding sequences matters more than being good. First movers in new categories capture Cantillon benefits. Timing and positioning trump execution.

Recognize the game you’re playing. If you’re not near money creation, you’re subsidizing those who are. Your customer acquisition costs fund others’ wealth. Position accordingly or accept exploitation.

Build capital-light models if you’re periphery. Without Cantillon advantages, capital-intensive strategies fail. Use others’ Cantillon subsidies rather than competing against them.

For InvestorsAcknowledge your Cantillon privilege. Your returns don’t just reflect good judgment but positioned advantage. The game is rigged in your favor by design.

Earlier is always better. In Cantillon dynamics, being first matters more than being right. Early positions benefit from subsequent inflation. Speed beats accuracy.

Create new spigots. Establishing new funding categories creates new Cantillon advantages. Defining new spaces provides first-mover benefits.

For WorkersEquity in funded companies beats salary everywhere else. The Cantillon Effect makes pre-funding equity extraordinarily valuable. Join before funding, not after.

Geographic proximity matters. Remote work can’t fully escape Cantillon geography. Key decisions happen where capital concentrates. Physical proximity to money still matters.

Recognize you’re probably not a beneficiary. Most workers are Cantillon victims, not beneficiaries. Plan accordingly rather than hoping for trickle-down.

The Future of AI WealthPermanent InequalityThe Cantillon Effect in AI may create permanent inequality. First movers accumulated assets at pre-inflation prices. Latecomers face inflated costs with no path to catch up. The window for Cantillon benefits may have already closed.

This inequality compounds generationally. Cantillon beneficiaries pass advantages to descendants. Geographic concentration creates regional dynasties. AI wealth becomes hereditary rather than meritocratic.

Alternative StructuresEscaping Cantillon dynamics requires alternative funding structures. Open source development. Cooperative ownership. Public investment. Different money creation mechanisms could produce different distributions.

But these alternatives struggle against entrenched Cantillon beneficiaries. Existing winners have resources to maintain advantage. The Cantillon Effect resists its own disruption.

The Inflation EndgameEventually, Cantillon dynamics create their own collapse. Valuations disconnect entirely from value. Capital creation exceeds absorption capacity. The system inflates until it pops.

When this happens, proximity to money creation becomes proximity to loss. Cantillon beneficiaries hold overvalued assets. The advantage reverses catastrophically.

Conclusion: The Proximity PremiumThe Cantillon Effect reveals that in AI, where you stand in the flow of capital matters more than what you contribute. Those nearest money creation capture value regardless of value creation. Those furthest subsidize everyone above them.

This isn’t a market failure but market design. The mechanisms of capital creation and distribution determine wealth outcomes more than innovation or execution. The game’s rules matter more than how well you play.

Understanding Cantillon dynamics is essential for navigating AI economics. You’re either positioned to benefit from money creation or positioned to subsidize those who are. There’s no neutral position in a Cantillon economy.

The AI boom represents history’s largest Cantillon Effect—trillions in new capital flowing through narrow channels, creating enormous wealth for those positioned at the spigot while extracting value from everyone else. The question isn’t whether you’re part of the AI revolution, but where you stand in the waterfall of capital that funds it.

The post The Cantillon Effect: Who Gets Rich from AI Money Printing appeared first on FourWeekMBA.