Market Competitive Dynamics

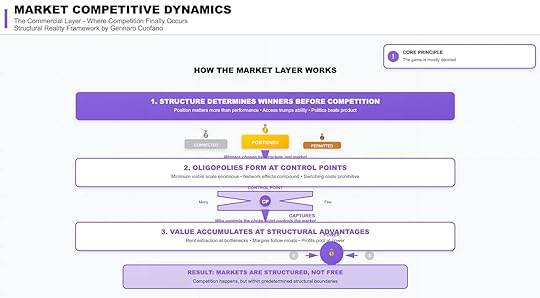

The market layer is the last and most visible layer of the structural reality framework. It is where competition appears to play out, where companies and products collide, and where narratives about “winners” and “losers” are told.

But the core principle here is blunt: the game is mostly decided before competition begins.

By the time companies meet in the open market, their fate is already shaped by structures—geopolitical permission, macroeconomic flows, and infrastructural constraints. Markets may look free, but they operate within boundaries set long before.

1. Structure Determines Winners Before CompetitionThe defining feature of markets is that position matters more than performance.

Access beats ability: Who can enter a market is often more decisive than who has the best product.Politics beats product: Regulatory approval, licensing, and national alignment matter more than technical merit.Position beats performance: Early control of platforms, standards, or channels tilts the board.Firms that are connected, positioned, and permitted dominate—not because they always outperform, but because structural placement determines opportunity.

Winners are chosen by structure, not by the market contest itself.

2. Oligopolies Form at Control PointsWhere structure sets the rules, control points capture the value.

Markets naturally consolidate into oligopolies because:

The minimum viable scale is enormous, making new entry prohibitive.Network effects compound, favoring incumbents exponentially.Switching costs trap customers, locking demand to dominant players.The outcome is predictable: whoever controls the choke point controls the market.

This is why in digital infrastructure, a handful of cloud providers dominate, or why in semiconductors, TSMC commands strategic leverage. Control points are where many funnel into few.

3. Value Accumulates at Structural AdvantagesMarkets appear to reward competition, but value actually pools at structural advantages.

Bottlenecks enable rent extraction—those who control scarce inputs capture margins.Profit flows follow control—whether of distribution, platforms, or resources.Power defines pricing—dominant players impose terms not through efficiency, but through position.This dynamic explains why companies at bottlenecks—like NVIDIA in GPUs, Apple in mobile ecosystems, or Visa in payments—earn outsized returns. It’s not just product excellence; it’s structural positioning.

Result: Markets Are Structured, Not FreeThe final truth of the market layer is that competition is real, but bounded.

Firms battle intensely—but only within boundaries already defined by power structures above. They fight over market share, but not over whether they can exist.

Markets are not arenas of perfect freedom; they are fields with predetermined lines.

Strategic ImplicationsFor strategists, this layer reframes how to think about competition:

Stop over-indexing on performance. The best product often loses. Position, access, and political alignment matter more.Locate control points. Oligopolies form at chokepoints. If you’re not at one, you’re downstream.Follow the structural rents. Profit pools are not evenly distributed. They concentrate where constraints and dependencies converge.Conclusion: The Illusion of the Free MarketThe Market Competitive Dynamics layer exposes the illusion of the “free market.” Competition exists, but only inside the structural cage built by geopolitics, economics, and infrastructure.

The visible fights—features, prices, marketing campaigns—are secondary. The real game is invisible: who is positioned, who controls the chokepoints, and who holds structural advantage.

In this sense, markets don’t crown winners. Structures do.

The post Market Competitive Dynamics appeared first on FourWeekMBA.