The AI Monetization Efficiency Revolution

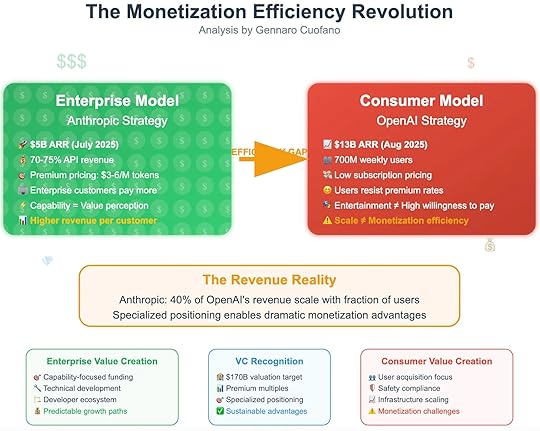

In the generative AI boom, two giants dominate the market: OpenAI on the consumer side and Anthropic on the enterprise side. Both boast billions in ARR, millions of users, and global reach. But under the surface, their models of value creation could not be more different.

The contrast highlights a deeper truth: scale does not equal monetization efficiency. While OpenAI commands hundreds of millions of weekly users, Anthropic achieves a disproportionate share of revenue with a fraction of the customer base. This marks the beginning of the Monetization Efficiency Revolution.

Enterprise Model: Anthropic’s StrategyAnthropic has built its business around enterprise monetization logic.

$5B ARR (July 2025).70–75% of revenue from APIs.Premium pricing: $3–6 per million tokens.Enterprise customers willing to pay more.The core of the model is straightforward: capability equals value perception. Enterprises do not care about friendliness or companionship; they care about accuracy, verifiability, and raw capability. This allows Anthropic to charge premium prices for fewer customers.

The result is higher revenue per customer—the defining feature of enterprise AI.

Consumer Model: OpenAI’s StrategyOpenAI dominates the consumer space but faces structural monetization limits.

$13B ARR (August 2025).700M weekly active users.Low subscription pricing.Users resist premium rates.Consumer AI is sticky but difficult to monetize. Companionship and entertainment are valuable emotionally, but they do not translate into high willingness to pay.

The paradox: OpenAI has scale without efficiency. Revenue grows, but margins remain constrained because each user contributes little.

The Efficiency GapThe diagram highlights the efficiency gap:

Anthropic generates 40% of OpenAI’s revenue with a fraction of the user base.Specialized positioning around enterprise workloads enables dramatic monetization advantages.Enterprise customers are “whales”—fewer in number but orders of magnitude more valuable than consumers.This inversion demonstrates why specialization beats scale.

The Revenue RealityThe truth is not about who has more users or more ARR. The truth lies in revenue efficiency.

Enterprise revenue per customer is exponentially higher.Consumer revenue per customer is capped by subscription psychology and entertainment value.Anthropic’s model shows that it is possible to achieve outsized revenue with smaller distribution if positioning is precise.

Enterprise Value CreationThe enterprise path creates predictable, compounding value.

Capability-focused funding. Investors reward technical depth and reliability.Developer ecosystem. Sticky APIs lock customers into workflows.Predictable growth paths. Recurring contracts and renewals stabilize revenue.Enterprise AI creates value not by reaching everyone, but by embedding deeply where it matters most.

Consumer Value CreationConsumer AI follows a very different logic.

User acquisition focus. Growth depends on onboarding millions of users.Safety compliance. Heavy RLHF tuning for emotional reliability.Infrastructure scaling. Billions of queries per day require enormous compute.Monetization challenges. Users resist price increases, keeping ARPU low.The consumer model looks like social media: massive engagement, but shallow monetization.

VC RecognitionThe market recognizes the divergence.

$170B valuation targets for enterprise-focused players.Premium multiples for sustainable revenue efficiency.Investors reward specialized positioning over sheer scale.Anthropic’s enterprise-native design positions it for sustainable advantages, while consumer-first players face pressure to justify infrastructure costs with low-margin revenue.

Why This Is a RevolutionThe Monetization Efficiency Revolution is not a minor adjustment. It represents a structural shift:

Specialization creates exponential efficiency.Enterprise AI generates higher revenue per customer.Consumer AI generates scale without proportionate revenue.Infrastructure burdens diverge.Consumer AI burns cash on scaling.Enterprise AI monetizes compute through premium APIs.Investor logic changes.Valuations favor efficiency over mass adoption.Funding flows to enterprise-native players.This marks the end of the assumption that “more users equals more value.”

The Strategic LessonsFor builders and investors, the lessons are clear:

Pick your lane. Straddling consumer and enterprise splits optimization and destroys efficiency.Monetize where value is clearest. Enterprise customers equate capability with value.Don’t confuse scale with sustainability. Millions of users mean little if they won’t pay.The real competition is not about who has the most users, but who extracts the most revenue per unit of infrastructure.

Conclusion: Efficiency Beats ScaleThe Monetization Efficiency Revolution reframes the AI race.

OpenAI demonstrates the power of scale.Anthropic demonstrates the power of specialization.The efficiency gap shows why enterprise-native design outperforms consumer-first growth.The long-term winners will be those who align capability with willingness to pay.

In AI, efficiency beats scale. Specialization beats breadth. Monetization discipline beats mass adoption.

The post The AI Monetization Efficiency Revolution appeared first on FourWeekMBA.