The Platform Paradox: Why Meta Must Use Competitors’ AI

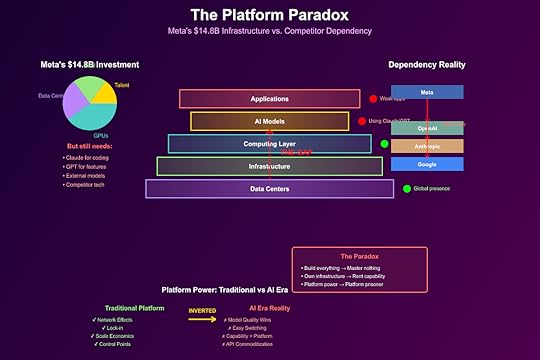

Meta’s reported consideration of using Google and OpenAI models, despite investing $14.8 billion in AI infrastructure, reveals the platform paradox: when you build everything yourself, you often end up with nothing that works. This isn’t weakness—it’s the logical endpoint of platform economics meeting AI reality.

The Platform Paradox DefinedThe platform paradox occurs when:

Control Everything: Vertical integration promises independenceMaster Nothing: Resources spread thin across the stackDepend on Competitors: Must adopt superior external solutionsLose Platform Power: Become customer of competing platformsMeta exemplifies this paradox perfectly.

Meta’s $14.8 Billion PredicamentThe Infrastructure InvestmentMeta’s AI spending breakdown reveals the trap:

600,000 GPUs: Massive compute capacityData Centers: Geographic distributionCustom Silicon: Internal chip developmentModel Training: LLaMA series developmentIntegration Costs: Retrofitting existing productsYet employees already use Anthropic’s Claude for coding.

The Capability GapDespite massive investment:

LLaMA Models: Open source but not best-in-classInternal Tools: Functional but inferiorConsumer Products: AI features lag competitorsEnterprise Solutions: Non-existentDeveloper Ecosystem: Minimal adoptionThe platform that connects billions can’t connect its own AI.

The Economics of Platform DependencyTraditional Platform PowerPlatforms historically dominated through:

Network Effects: More users attract more usersSwitching Costs: Lock-in through data and integrationEconomies of Scale: Marginal cost approaching zeroControl Points: Owning critical infrastructureAI’s Platform InversionAI inverts platform economics:

Capability Moats: Best model wins, regardless of platformSwitching Ease: API changes take minutesDiseconomies of Scale: Training costs increase exponentiallyCommodity Platforms: Compute and inference becoming utilitiesMeta discovered that platform power doesn’t translate to AI power.

The Build vs. Buy CalculationThe Build IllusionMeta’s build strategy assumed:

Cost Advantage: Internal development cheaper long-termStrategic Control: Independence from competitorsSynergy Benefits: Integration with existing productsCompetitive Differentiation: Unique capabilitiesThe Buy RealityMarket dynamics force buying:

Capability Gap: 18-month lag behind leadersOpportunity Cost: $14.8B could have bought accessTalent Constraints: Can’t hire fast enoughInnovation Velocity: External progress outpaces internalThe math no longer supports building everything.

VTDF Analysis: Platform Paradox DynamicsValue ArchitecturePlatform Value: Control and integration traditionallyAI Value: Raw capability and performance nowValue Shift: From ownership to accessMeta’s Position: Owns infrastructure, lacks capabilityTechnology StackInfrastructure Layer: Meta has massive computeModel Layer: Meta lacks competitive modelsApplication Layer: Meta needs better AI featuresIntegration Reality: Best models aren’t Meta’sDistribution StrategyTraditional: Platform controls distributionAI Reality: Model quality determines adoptionMeta’s Dilemma: Must distribute competitors’ modelsMarket Dynamic: Platforms become customersFinancial ModelSunk Costs: $14.8B already committedSwitching Costs: Minimal for AI modelsROI Challenge: Investment not yielding returnsDependency Costs: Paying competitors for core capabilityHistorical Platform ParallelsMicrosoft’s Mobile ParadoxMicrosoft built everything for mobile:

Windows Phone OSHardware (Nokia acquisition)Developer toolsApp ecosystem attemptsResult: Complete failure, adopted Android/iOS

Google’s Social ParadoxGoogle+ investment:

Massive engineering resourcesForced integration across productsPlatform leverage attemptsYears of investmentResult: Shutdown, relies on YouTube

Amazon’s Phone ParadoxFire Phone endeavor:

Custom Android forkHardware developmentUnique features (3D display)Ecosystem buildingResult: Billion-dollar write-off

The Dependency CascadeLevel 1: Model DependencyMust use Anthropic/OpenAI for competitive featuresPaying competitors for core technologyNo differentiation possibleLevel 2: Ecosystem DependencyDevelopers choose superior modelsMeta’s platform becomes pass-throughValue captured by model providersLevel 3: Strategic DependencyProduct roadmap determined by external AIInnovation pace set by competitorsPlatform reduced to distributionLevel 4: Existential DependencyCore products require external AIBusiness model relies on competitorsPlatform power evaporatesThe Cognitive DissonanceMeta’s Public Position“Leading AI research”“Open source leadership”“Massive AI investment”“Platform independence”Meta’s Private RealityEmployees prefer ClaudeConsidering OpenAI integrationLLaMA adoption limitedPlatform power erodingThis dissonance drives desperate spending.

The Innovator’s TrapWhy Meta Can’t Catch UpStructural Disadvantages:

Wrong Incentives: Ads optimize for engagement, not capabilityWrong Talent: Social media engineers, not AI researchersWrong Culture: Fast iteration vs. long researchWrong Metrics: Users and revenue vs. model performanceCompetitive Reality:

OpenAI: Pure AI focusAnthropic: Enterprise specializationGoogle: Research heritageMeta: Platform legacyThe Integration ImpossibilityEven if Meta builds competitive models:

Product Integration: Requires massive refactoringUser Expectations: Set by competitorsDeveloper Lock-in: Already using alternativesTime to Market: Years behindThe Strategic OptionsOption 1: Accept DependencyUse best external modelsFocus on application layerBecome AI customer, not providerPreserve platform for distributionProbability: Highest

Outcome: Gradual platform erosion

Option 2: Acquisition SpreeBuy AI companies for capabilityIntegrate through M&AShortcut development timeRegulatory challenges likelyProbability: Medium

Outcome: Expensive catch-up

Option 3: Radical PivotAbandon platform modelBecome pure AI companyCompete directly with OpenAIRequires cultural revolutionProbability: Lowest

Outcome: Organizational chaos

Option 4: Open Source GambitMake LLaMA truly competitiveBuild ecosystem around open modelsCommoditize complementsHope to control standardsProbability: Medium

Outcome: Uncertain value capture

The Market ImplicationsFor Platform CompaniesThe Meta paradox teaches:

Platform power doesn’t transfer to AIVertical integration creates capability gapsInfrastructure without innovation equals dependencyBuild-everything strategies fail in AIFor AI CompaniesMeta’s struggles validate:

Focus beats breadth in AICapability creates more value than platformsModel quality trumps distributionSpecialized players beat generalistsFor EnterprisesMeta’s dependency signals:

Choose specialized AI providersPlatform integration less importantCapability gaps are realMulti-vendor strategies necessaryThe Psychological DimensionThe Sunk Cost FallacyMeta’s $14.8B creates psychological lock-in:

Can’t admit failureMust justify investmentDoubles down on losing strategyThrows good money after badThe Identity CrisisMeta’s self-conception challenged:

From platform owner to platform userFrom innovator to integratorFrom leader to followerFrom independent to dependentThis identity threat drives irrational decisions.

The Future ScenariosScenario 1: Graceful AcceptanceMeta acknowledges reality:

Partners with leading AI companiesFocuses on application excellenceLeverages distribution advantageAccepts margin compressionScenario 2: Desperate EscalationMeta doubles down:

$50B+ additional investmentMassive hiring spreeAcquisition attemptsLikely failureScenario 3: Strategic RetreatMeta exits AI race:

Focuses on metaverseMaintains social platformsBecomes AI customerPreserves profitabilityConclusion: The Platform PrisonerMeta’s platform paradox demonstrates a fundamental truth: in AI, capability beats control. The company that built one of history’s most powerful platforms finds itself imprisoned by that very success. The infrastructure meant to ensure independence instead ensures dependency.

The $14.8 billion investment wasn’t just wrong—it was backwards. Meta built the body but needed the brain. They constructed the highway but lack the vehicles. They own the theater but must rent the show.

This paradox will define the next decade: platform companies discovering that in AI, the model is the platform, and if you don’t have the best model, you don’t have a platform at all.

—

Keywords: platform paradox, Meta AI, platform economics, AI dependency, build vs buy, platform strategy, AI infrastructure, competitive dynamics, Meta investment

Want to leverage AI for your business strategy?

Discover frameworks and insights at BusinessEngineer.ai

The post The Platform Paradox: Why Meta Must Use Competitors’ AI appeared first on FourWeekMBA.