Micro-SaaS Aggregation: The $50B Hidden Empire of Internet Businesses

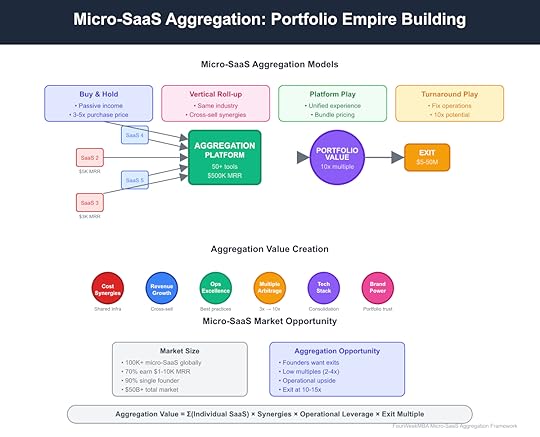

Micro-SaaS aggregation represents the most overlooked wealth-building opportunity in software—acquiring dozens of small, profitable SaaS businesses and transforming them into valuable portfolios worth 10x their individual sum. While VCs chase unicorns and founders dream of billion-dollar exits, a quiet revolution unfolds where aggregators buy $50K micro-SaaS businesses, optimize operations, and build empires generating millions in passive income.

The opportunity is massive yet hidden. Over 100,000 micro-SaaS businesses generate $1K-50K monthly revenue. Most founders want exits but can’t find buyers. Traditional investors ignore them as too small. This gap creates arbitrage—buying at 2-4x annual revenue and selling portfolios at 10-15x. The math is compelling: acquire 50 micro-SaaS at $100K each, optimize to double revenue, exit for $50-100M.

[image error]Micro-SaaS Aggregation: Building Empires From Internet AtomsThe Micro-SaaS PhenomenonMicro-SaaS businesses solve specific problems for niche audiences with minimal complexity. A Chrome extension for Amazon sellers making $5K/month. A Shopify app for inventory management at $10K MRR. A WordPress plugin for photographers generating $3K monthly. These aren’t venture-scale businesses, but they print money with 80%+ margins.

The economics are beautiful in their simplicity. No office, no employees, often no marketing spend. Just recurring revenue from customers who found a tool that saves them time or money. Customer acquisition happens through SEO, app stores, or word-of-mouth. Support is minimal—good products largely run themselves.

Founders build micro-SaaS for freedom, not scale. They wanted to escape corporate life, not build the next corporate giant. After 2-5 years, many achieve their lifestyle goals but face burnout, boredom, or life changes. They want exits but lack options—too small for traditional M&A, too valuable to shut down.

This creates unprecedented buying opportunities. Thousands of profitable, proven businesses available at reasonable multiples. Sellers motivated by factors beyond price. Minimal competition from institutional buyers. It’s like buying profitable real estate in 1980—obvious in hindsight, invisible today.

The Aggregation PlaybookSuccessful micro-SaaS aggregation follows a repeatable playbook perfected by pioneers like Tiny Capital and SureSwift Capital. Identify profitable micro-SaaS with stable revenue. Acquire at 2-4x annual profit. Implement operational improvements. Cross-sell to existing portfolio customers. Build towards strategic exit or hold for cash flow.

Due diligence focuses on sustainability over growth. Is the code maintainable? Are customers sticky? Does the business run without the founder? Can you improve it with minimal effort? The best acquisitions are boring businesses in boring markets with boring, predictable revenue.

Operational improvements unlock immediate value. Most micro-SaaS founders are developers, not marketers or operators. Simple changes—improved onboarding, email automation, pricing optimization, SEO improvements—can double revenue within months. What founders couldn’t or wouldn’t do becomes your value creation.

Portfolio effects multiply individual values. Shared infrastructure reduces hosting costs. Centralized support improves efficiency. Cross-promotion drives new customers. Bundle deals increase average order values. Twenty micro-SaaS businesses operating separately might be worth $2M; integrated properly, they’re worth $20M.

Acquisition StrategiesDirect outreach remains the most effective acquisition channel. Identify micro-SaaS through app stores, Product Hunt, indie hacker communities. Email founders with personalized messages showing you understand their business. Many receive their first serious acquisition interest this way.

Marketplaces democratize discovery but increase competition. MicroAcquire, Flippa, and FE International list hundreds of micro-SaaS monthly. Empire Flippers vets businesses before listing. Acquire.com connects buyers and sellers directly. Prices tend higher on marketplaces but due diligence is easier.

Broker relationships unlock off-market deals. Business brokers handling sub-$1M deals often have micro-SaaS in their portfolios. Building relationships gets you first look at new listings. Many deals never hit the public market.

Creative deal structures overcome capital constraints. Seller financing for 50-70% is common. Earnouts based on performance align incentives. Revenue shares let sellers participate in upside. You don’t need millions in cash to start aggregating—creativity and credibility matter more.

Operational Excellence at ScaleStandardization transforms chaotic micro-businesses into efficient operations. Migrate to common infrastructure. Implement shared monitoring and alerting. Standardize customer support processes. Create playbooks for common tasks. What was impossible for individual founders becomes trivial at scale.

Technology consolidation reduces complexity and cost. Move from 20 different hosting providers to one. Consolidate payment processing. Unify analytics and reporting. Implement single sign-on across properties. Each standardization reduces overhead and improves margins.

Talent leverage changes the game. One growth marketer can optimize 20 micro-SaaS. One DevOps engineer can maintain 50 applications. One customer success manager can handle support across the portfolio. Specialists at scale deliver results impossible for solo founders.

Data insights compound across the portfolio. Pattern recognition from dozens of SaaS reveals optimization opportunities. A/B tests on one property inform improvements on others. Customer behavior insights transfer between related tools. The portfolio becomes a learning machine.

Value Creation MechanismsRevenue optimization often doubles income within 12 months. Founders undercharge because they fear losing customers. Aggregators test price increases systematically. A $29/month tool becoming $49/month with grandfather pricing for existing customers adds 69% revenue growth instantly.

Customer expansion unlocks hidden value. Most micro-SaaS serve a fraction of their addressable market. SEO improvements, content marketing, and paid acquisition profitably grow customer bases. A tool with 1,000 customers in a 100,000-person market has 100x growth potential.

Product improvements drive retention and expansion. Founders often stop developing after reaching lifestyle income. Adding requested features, improving UX, and modernizing design re-energizes growth. Small improvements compound into transformation.

Strategic bundling multiplies value. Twenty WordPress plugins sold separately might generate $200K MRR. Bundled as “The Ultimate WordPress Toolkit” for $99/month, they could generate $1M MRR. Customers prefer one vendor, one bill, one support channel.

Exit Strategies and MultiplesPortfolio exits command premium multiples over individual sales. A single micro-SaaS might sell for 3x revenue. A portfolio of 20 integrated micro-SaaS can sell for 10-15x. Strategic buyers pay for customer base, technology stack, and operational efficiency.

Private equity interest in micro-SaaS portfolios grows rapidly. PE firms can’t diligence 50 micro acquisitions but gladly buy assembled portfolios. They bring operational expertise and capital to accelerate growth. Your aggregation work becomes their platform investment.

Strategic acquirers seek customer access and technology. A portfolio of developer tools might interest GitHub or Atlassian. E-commerce SaaS collections attract Shopify or BigCommerce. Marketing tools appeal to HubSpot or Salesforce. Your niche focus becomes their product expansion.

Permanent holding produces exceptional cash flow. A portfolio generating $500K monthly with 80% margins throws off $400K in free cash flow. At conservative growth rates, that’s $100M+ over 20 years. Some aggregators never plan to sell, building generational wealth through cash flow.

Risk Management and PitfallsTechnology debt accumulates without careful management. Old codebases, outdated frameworks, and security vulnerabilities hide in acquisitions. Budget for modernization or accept higher maintenance costs. Technical due diligence prevents expensive surprises.

Key person dependencies threaten continuity. Some micro-SaaS depend on founder relationships, specialized knowledge, or manual processes. Ensure knowledge transfer and process documentation before closing. The best acquisitions run themselves; the worst require constant founder involvement.

Platform risk concentrates in app ecosystems. Shopify apps face API changes and policy updates. Chrome extensions risk Google’s algorithm shifts. WordPress plugins depend on core updates. Diversify across platforms or accept concentrated risk.

Market shifts can obsolete entire categories. iOS privacy changes killed attribution tools. AI advances might replace simple automation tools. Build portfolios resilient to technology shifts or maintain reserves for pivots.

Building Your Aggregation EmpireStart small with one acquisition to learn the process. Your first micro-SaaS teaches due diligence, transfer procedures, and operations. Make mistakes on a $50K acquisition, not a $500K one. Experience compounds faster than capital.

Build systems before scaling acquisitions. Create templates for due diligence, contracts, and migrations. Document operational procedures. Establish financial reporting standards. Systems enable scaling; chaos ensures failure.

Network aggressively within micro-SaaS communities. Join indie hacker forums. Attend MicroConf and similar events. Build relationships with founders before they’re ready to sell. The best deals come through relationships, not marketplaces.

Consider partnership models to accelerate. Partner with operators who lack capital. Team with investors who need execution. Join existing aggregators as EIR (Entrepreneur in Residence). Learning from experienced aggregators accelerates your journey.

The Future of Micro-SaaS AggregationAI transforms both threats and opportunities in micro-SaaS. AI might obsolete simple tools but enables new categories. Smart aggregators buy AI-resistant businesses or quickly adapt portfolios to leverage AI. The disruption creates buying opportunities from panicked sellers.

Vertical integration strategies emerge among sophisticated aggregators. Instead of random acquisitions, focus on specific verticals—e-commerce tools, developer utilities, creative software. Deep vertical expertise enables better operations and strategic exits.

International arbitrage expands opportunities. US micro-SaaS sells for higher multiples than international equivalents. Buy profitable SaaS in emerging markets, improve operations, sell to US aggregators. Geographic arbitrage multiplies returns.

Democratization tools lower barriers further. No-code platforms enable faster micro-SaaS creation. AI accelerates development. Payment infrastructure simplifies monetization. More micro-SaaS means more aggregation opportunities.

The Aggregation ImperativeMicro-SaaS aggregation transforms from niche strategy to mainstream investment thesis as the market matures. Early movers build portfolios worth tens of millions. Fast followers still find opportunities. Laggards will pay premium prices for assembled portfolios.

The window remains open but won’t indefinitely. As success stories multiply, competition increases. Multiples rise. Quality deals become scarcer. The gold rush phase ends when institutional capital fully discovers the opportunity.

Master micro-SaaS aggregation to build wealth through small, profitable internet businesses. Whether seeking passive income, building toward major exits, or creating generational wealth, aggregation offers a proven path with manageable risks.

Start your aggregation journey today. Browse marketplaces. Email founders. Make offers. Learn by doing. The micro-SaaS aggregation opportunity rewards action over analysis, persistence over perfection.

Master micro-SaaS aggregation to build million-dollar portfolios from tiny internet businesses. The Business Engineer provides frameworks for identifying, acquiring, and optimizing micro-SaaS. Explore more concepts.

The post Micro-SaaS Aggregation: The $50B Hidden Empire of Internet Businesses appeared first on FourWeekMBA.