Fractional Executive Networks: The $20B Revolution in C-Suite Leadership

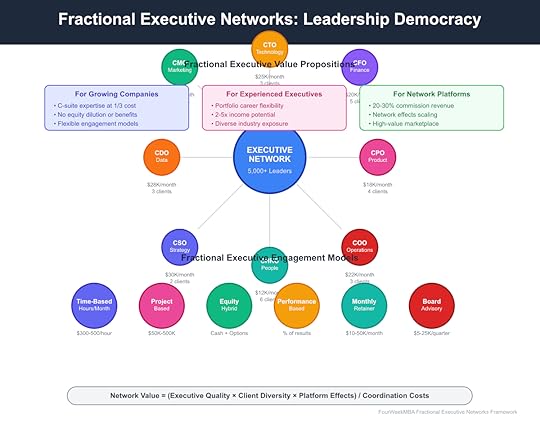

Fractional executive networks represent the most significant evolution in senior leadership since the invention of the modern corporation—enabling world-class executives to serve multiple companies simultaneously while startups and scale-ups access C-suite talent previously reserved for Fortune 500 companies. Instead of hiring full-time executives costing $500K annually plus equity, growing companies now access proven CMOs, CTOs, and CFOs for $15K monthly commitments that scale with business needs.

The transformation accelerates dramatically. Fractional executive platforms like Chief, Bolster, and Maven Collective manage thousands of senior leaders serving tens of thousands of companies. Top fractional executives earn $1M+ annually serving 4-6 companies simultaneously. Growing businesses access expertise that would have been impossible to afford or attract full-time. The rigid employment model breaks down as both sides discover better alternatives.

[image error]Fractional Executive Networks: Democratizing C-Suite Leadership Through Shared ExpertiseThe Employment Model BreakdownTraditional executive hiring assumes that the best leaders want full-time, exclusive commitments—an assumption that reality increasingly challenges. Experienced executives often prefer portfolio careers. Working with one company full-time limits learning and growth. Managing multiple businesses simultaneously provides diverse challenges that make executives better leaders.

The full-time executive model wastes talent catastrophically. A world-class CMO spending 40 hours weekly on one company’s marketing when they could transform four companies with 10 hours each. The fixed-cost mentality forces companies to justify full-time roles even when part-time expertise would suffice.

Geographic constraints multiply the waste. The best retail CFO might live in Denver while growing retail companies cluster in Austin. Remote work eliminates geography but full-time employment maintains artificial scarcity. Fractional models unlock talent from location constraints.

Lifecycle mismatches create additional inefficiency. Startups need different leadership at different stages. A growth-stage CMO is wrong for early-stage product-market fit. A turnaround CFO differs from a scale-up CFO. Fractional models match executive expertise to company lifecycle needs.

The Network Effects RevolutionFractional executive networks create compound value that exceeds individual relationships. Executives share learnings across portfolio companies. A CTO’s innovation at Company A becomes best practice at Company B. Marketing insights transfer between similar businesses. The network becomes a learning machine multiplying individual expertise.

Cross-pollination accelerates innovation. Healthcare executives apply fintech innovations to medical payments. Retail leaders bring e-commerce expertise to B2B marketplaces. Manufacturing veterans optimize SaaS operations. Industry silos break down as executives bridge different worlds.

Resource arbitrage creates win-win scenarios. High-growth companies overpay for scarce executive talent. Experienced executives underutilize their expertise in single roles. Fractional networks match oversupply of executive capacity with undersupply of executive access, creating value for everyone.

Platform effects compound through scale. Networks with 1,000+ executives can match any company need. Depth of expertise in each function. Breadth across industries. Geographic coverage. Specialized skill combinations. Scale transforms fractional work from consulting to infrastructure.

Business Model InnovationSubscription models align incentives better than traditional consulting hourly billing. Monthly retainers provide executives predictable income while giving companies budget certainty. No hour tracking. No scope creep. No billing disputes. Clean commercial relationships focused on outcomes.

Performance-based compensation links executive success to company success. Fractional CMOs take percentage of marketing-attributed revenue. CFOs earn bonuses for fundraising success. CTOs share in product launch achievements. Skin-in-the-game aligns interests like equity but without long-term commitment.

Tiered pricing enables market segmentation. Early startups access junior fractional executives. Growth companies engage senior veterans. Enterprise spinouts hire former Fortune 500 C-suite leaders. Each market segment gets appropriate expertise at appropriate prices.

Network revenue models multiply monetization. Commissions from placements. Subscription fees from executives. Training program revenues. Certification licensing. Event hosting. Multi-sided marketplace dynamics create diverse revenue streams.

Quality Control and VettingFractional executive networks succeed or fail based on quality control mechanisms. Anyone can claim executive experience. Networks must separate genuine leaders from imposters. Rigorous vetting processes evaluate track records, check references, and test competencies. Quality determines network value.

Peer evaluation strengthens over time. Executives rate each other’s contributions. Companies provide feedback on fractional leader performance. Network algorithms identify top performers and filter out underperformers. Self-policing maintains standards better than external audits.

Specialization certification emerges within networks. Healthcare executives complete medical industry training. Fintech leaders earn financial services certifications. E-commerce specialists demonstrate platform expertise. Credentials signal competence in saturated markets.

Performance tracking becomes scientific. Objective metrics replace subjective evaluations. Revenue impact. Cost reductions. Team satisfaction scores. Project success rates. Data-driven assessment removes bias while ensuring accountability.

Market Evolution and MaturationFractional executive markets evolve predictably from generalists to specialists. Early networks offer generic “experienced executives.” Mature platforms provide neurosurgeon-level specialization. Need a CMO for subscription e-commerce companies selling to enterprises in healthcare? The network has exactly that person.

Industry-specific networks emerge for complex domains. Healthcare fractional executives require deep regulatory knowledge. Financial services leaders need compliance expertise. Government contractors understand public sector procurement. General networks spawn specialized offspring.

Geographic expansion follows economic centers. Silicon Valley spawned the first networks. Austin, Denver, Seattle followed. International expansion adapts to local business cultures. European networks emphasize consensus-building. Asian platforms prioritize relationship management.

Technology automation reduces friction. AI matching algorithms connect executives with suitable companies. Automated onboarding reduces time-to-value. Digital collaboration tools enable seamless remote leadership. Platform efficiency improves while human expertise remains central.

Competitive DynamicsNetwork effects create winner-take-all dynamics in fractional executive platforms. The best executives join networks with the best companies. The best companies choose networks with the best executives. Success reinforces success. Second-tier networks struggle for quality on both sides.

Vertical specialization enables niche dominance. Instead of competing with horizontal giants, specialized networks dominate specific industries. The best healthcare executive network beats general platforms for medical companies. Focus wins against breadth.

Corporate competitors emerge as companies build internal fractional programs. Large consulting firms create fractional executive divisions. Boutique search firms pivot to fractional placements. Traditional executive search fights back with hybrid models.

Technology companies attempt platform disruption. LinkedIn builds fractional executive features. Upwork expands into executive services. New platforms launch targeting specific executive functions. Everyone wants marketplace economics in high-value services.

Cultural Shifts in LeadershipFractional models challenge fundamental assumptions about leadership commitment. Does effective leadership require physical presence? Can executives serve multiple masters? Does short-term thinking dominate fractional relationships? Evidence suggests traditional assumptions don’t hold.

Portfolio careers become aspirational. Instead of climbing one corporate ladder, ambitious executives build diverse portfolios. More learning opportunities. Higher income potential. Greater flexibility. The C-suite career path fragments into multiple possibilities.

Mentorship networks strengthen through fractional connections. Senior executives mentor multiple next-generation leaders simultaneously. Junior executives access guidance from multiple perspectives. The apprenticeship model scales through networks.

Corporate governance adapts to fractional leadership. Board responsibilities with part-time executives. Fiduciary duties across multiple companies. Confidentiality agreements between competitive situations. Legal frameworks evolve to support new models.

Economic Impact and ScaleFractional networks democratize access to elite business talent. Small businesses gain competitive advantages previously available only to large corporations. Innovation accelerates when startups access Fortune 500 expertise. Economic growth distributes more evenly across company sizes.

Cost arbitrage benefits all participants. Companies pay less than full-time salaries while executives earn more than single roles. Network platforms capture value from this arbitrage while facilitating valuable connections. Efficiency gains create value for everyone.

Knowledge transfer accelerates across the economy. Best practices spread faster through fractional networks than industry conferences or business schools. Real-time learning from multiple companies simultaneously beats theoretical education. The economy becomes more efficient.

Talent allocation improves dramatically. Great executives work where their skills matter most. Growing companies get appropriate leadership. Mature companies access fresh perspectives. Human capital optimization happens through market mechanisms rather than corporate politics.

Technology EnablementDigital collaboration tools make fractional leadership practical at scale. Video conferencing enables remote executive presence. Project management platforms coordinate across multiple companies. Digital whiteboards facilitate strategic planning. Communication tools maintain connection without physical presence.

AI assistants multiply executive leverage. Automated scheduling across multiple companies. AI-powered meeting summaries. Intelligent task prioritization. Performance analytics across portfolio companies. Technology amplifies human expertise rather than replacing it.

Blockchain enables trust and verification in fractional arrangements. Smart contracts automate payments. Credential verification prevents fraud. Reputation systems track performance. Decentralized networks reduce platform dependency.

Virtual reality might restore presence requirements. VR board meetings feel like physical presence. Immersive strategy sessions replicate in-person energy. Spatial computing enables new forms of remote leadership. Technology evolution shapes fractional model evolution.

Risk ManagementConflict of interest management becomes critical in fractional arrangements. Executives must navigate competitive information across portfolio companies. Clear boundaries prevent improper knowledge transfer. Legal agreements protect all parties. Professional ethics matter more in fractional relationships.

Attention allocation requires careful management. Companies fear fractional executives won’t prioritize their needs. Executives risk spreading themselves too thin. Successful fractional arrangements require clear expectations and boundaries. Over-communication prevents under-performance.

Quality variance increases with scale. Not every executive succeeds in fractional roles. Some need full-time focus. Others lack portfolio management skills. Networks must identify and remove poor performers quickly to maintain reputation.

Economic downturns test fractional models. Companies cut flexible costs before fixed costs. Fractional executives might face volatility during recessions. Diversification across multiple clients provides some protection but doesn’t eliminate cyclical risk.

Future EvolutionAI will augment but not replace fractional executives. Artificial intelligence handles routine executive tasks like data analysis and report generation. Human executives focus on strategy, relationship building, and complex decision-making. The combination multiplies effectiveness.

Global talent pools expand through remote-first models. The best marketing executive might live anywhere globally. Time zone challenges give way to follow-the-sun coverage. Cultural barriers decrease as business becomes increasingly digital.

Specialized networks proliferate for unique executive needs. Female executive networks. Minority leader platforms. Industry veteran communities. Technical executive specialized networks. Niche specialization serves underrepresented markets.

Corporate adoption accelerates as success cases proliferate. Fortune 500 companies experiment with fractional executives for specific projects. Private equity firms build portfolio company executive sharing. Success breeds broader acceptance.

The Fractional ImperativeFractional executive networks transform from alternative to mainstream as both companies and executives discover superior models. Growing companies access world-class leadership without full-time costs. Experienced executives build diverse, lucrative portfolios. The rigid employment model gives way to flexible expertise matching.

The opportunity remains enormous. Millions of growing companies need executive guidance. Thousands of executives want portfolio careers. Traditional search and consulting don’t serve either market well. Networks that connect supply and demand while ensuring quality will build billion-dollar businesses.

Master fractional executive networks to access elite leadership talent or build lucrative portfolio careers. Whether seeking executive guidance for your company or considering fractional leadership opportunities, understanding network dynamics determines success in the new leadership economy.

Start your fractional journey today. Companies: evaluate fractional needs and research quality networks. Executives: assess portfolio career potential and join relevant platforms. Entrepreneurs: identify underserved markets for specialized networks. The future of executive leadership is fractional.

Master fractional executive networks to democratize access to elite business leadership. The Business Engineer provides frameworks for building successful portfolio executive careers and accessing world-class leadership talent. Explore more concepts.

The post Fractional Executive Networks: The $20B Revolution in C-Suite Leadership appeared first on FourWeekMBA.