The AI Capital Expenditure Supernova

When Four Companies Spend Like Nations

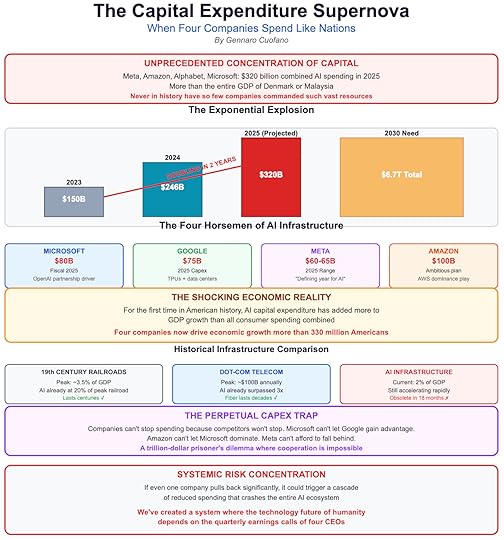

When Four Companies Spend Like NationsMeta, Amazon, Alphabet, and Microsoft plan to spend over $300 billion combined on AI infrastructure in 2025 alone. To put this in perspective, that’s more than the entire GDP of countries like Denmark or Malaysia, concentrated in the hands of four corporations betting on artificial intelligence.

The acceleration is breathtaking. In 2023, combined Big Tech capex was roughly $150 billion. By 2024, it had surged to over $200 billion. The 2025 projection of $300-320 billion represents a doubling in just two years. Microsoft alone expects to spend $80 billion in fiscal 2025, while Google’s capex will hit $75 billion. These aren’t gradual increases—they’re exponential explosions that rewrite the rules of corporate investment.

But here’s the shocking revelation: For the first time in American history, AI capital expenditure has added more to GDP growth than all consumer spending combined. Think about that. Four companies’ infrastructure investments now drive economic growth more than 330 million Americans buying homes, cars, food, and everything else. This isn’t capitalism as we know it—it’s something unprecedented, where corporate infrastructure investment becomes the primary engine of economic growth.

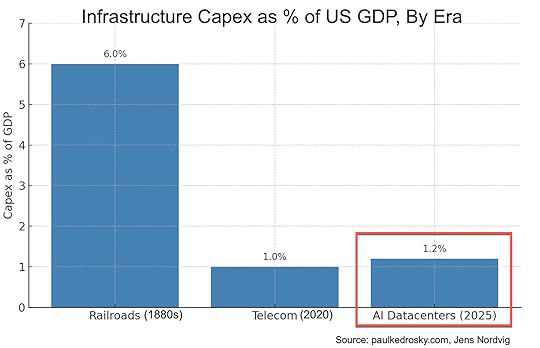

The comparison to historical infrastructure booms reveals the unique nature of this moment. Paul Kedrosky calculates that AI data center spending is already at 20% of peak railroad spending as a percentage of GDP from the 19th century, and it’s still accelerating.

Credit: Paul Kedrosky

Credit: Paul KedroskyWe’ve already surpassed the peak telecom spending of the dot-com bubble. But unlike railroads that last centuries or fiber that remains useful for decades, AI infrastructure depreciates faster than that.

This creates what I call the “Perpetual Capex Trap.” Companies can’t stop spending because their competitors won’t stop. Microsoft can’t let Google gain an advantage in model capabilities. Amazon can’t let Microsoft dominate cloud AI services. Meta can’t afford to fall behind in AI infrastructure. It’s a trillion-dollar prisoner’s dilemma where cooperation is impossible and competition demands endless escalation.

The financial markets initially celebrated this spending as visionary investment in the future. But cracks are appearing. Investors increasingly question whether revenue will ever justify these astronomical investments. The concern isn’t that AI doesn’t work—it clearly does.

The concern is that the infrastructure arms race might permanently destroy profit margins. When every competitor has similar capabilities, pricing power evaporates, and the massive fixed costs of AI infrastructure become an albatross rather than an advantage.

Most ominously, this concentration of investment in four companies creates systemic risk. If even one of these companies significantly pulls back, it could trigger a cascade of reduced spending that crashes the entire AI ecosystem.

And to be clear, that is a rational choice on the part of these players, as if you’re part of the race, you can pull up on infrastructure spend, if at all, you’ve got to double down!

The post The AI Capital Expenditure Supernova appeared first on FourWeekMBA.