The New Macroeconomic Framework

When Geopolitics Overrides Economics

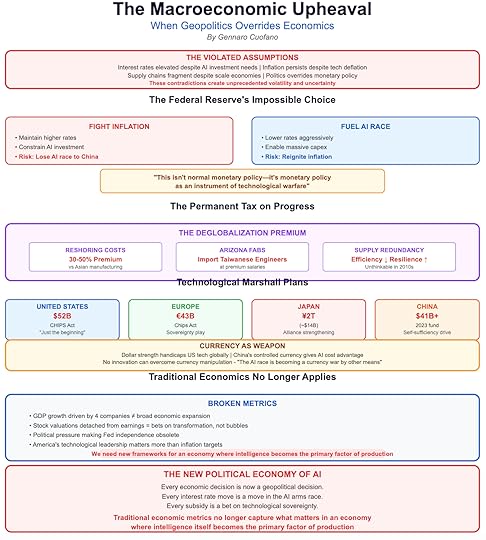

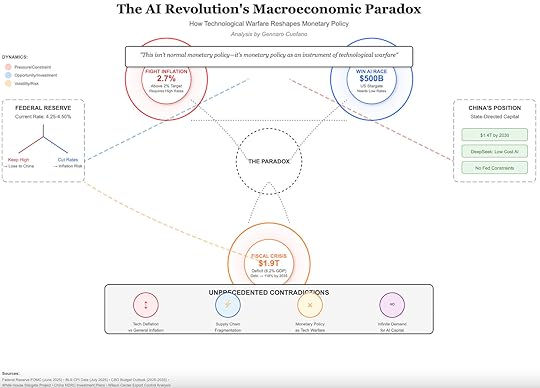

When Geopolitics Overrides EconomicsThe AI revolution is unfolding in a macroeconomic environment that violates all the assumptions of previous technology booms. Interest rates remain elevated even as governments desperately want to lower them to fuel AI investment. Inflation persists despite technological deflation. Supply chains fragment even as economies of scale demand integration. These contradictions create unprecedented volatility and uncertainty.

The interest rate dilemma exemplifies the new political economy of AI. The Federal Reserve faces an impossible choice: maintain higher rates to fight inflation, or lower rates to ensure America wins the AI race against China. This isn’t normal monetary policy—it’s monetary policy as an instrument of technological warfare. Political pressure to lower rates intensifies daily, with tech executives and defense officials united in arguing that America’s technological leadership matters more than inflation targets.

The deglobalization premium has become a permanent tax on technological progress. Reshoring semiconductor production might cost 30-50% more than Asian manufacturing. Building fabs in Arizona requires importing Taiwanese engineers at premium salaries because America lacks the expertise. Every layer of supply chain redundancy reduces efficiency but increases resilience—a trade-off that would have been unthinkable in the efficiency-obsessed 2010s.

The fiscal implications stagger the imagination. Governments worldwide are preparing massive subsidies for domestic semiconductor production—the U.S. CHIPS Act’s $52 billion is just the beginning. Europe plans €43 billion. Japan allocates ¥2 trillion. These aren’t normal industrial subsidies—they’re technological Marshall Plans where governments pick winners and losers in the AI race.

Currency dynamics add another layer of complexity. The dollar’s strength, traditionally a sign of American economic power, now handicaps U.S. tech companies competing globally. Meanwhile, China’s controlled currency gives its AI companies a cost advantage that no amount of innovation can overcome. The AI race is becoming a currency war by other means.

Most fundamentally, traditional economic metrics no longer capture what matters.

GDP growth driven by the capex spending of four companies isn’t the same as broad-based economic expansion. Stock market valuations detached from earnings multiples aren’t traditional bubbles—they’re bets on technological transformation. We need new frameworks for understanding an economy where intelligence itself becomes the primary factor of production.

The post The New Macroeconomic Framework appeared first on FourWeekMBA.