AI Business Analysis: Week of August 10-16, 2025

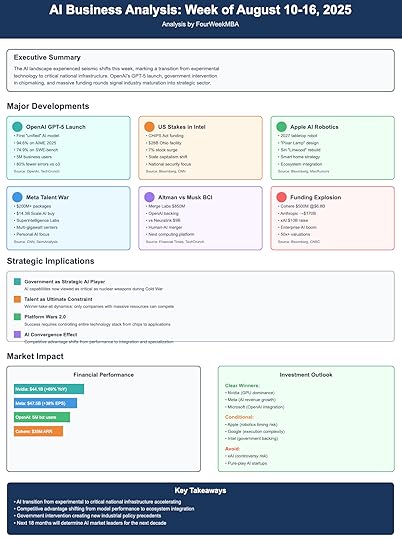

The AI landscape experienced seismic shifts this week, marking a transition from experimental technology to critical national infrastructure. OpenAI’s GPT-5 launch, government intervention in chipmaking, unprecedented talent wars, and massive funding rounds across multiple companies signal the industry’s maturation into a strategic sector where competitive advantages will determine economic and geopolitical leadership for decades.

Key Theme: The convergence of AI capabilities is forcing companies to differentiate through integration, infrastructure, and talent rather than pure model performance.

Major Developments1. OpenAI’s GPT-5 Launch: The New BaselineBottom Line: OpenAI has launched GPT-5, a new flagship AI model that will power the company’s next generation of ChatGPT, representing the first “unified” model combining reasoning and speed.

GPT‑5 is smarter across the board, providing more useful responses across math, science, finance, law, and more. It’s like having a team of experts on call for whatever you want to know, as reported by OpenAI. Key capabilities include:

Technical Advances:

Unified Architecture: GPT-5 is OpenAI’s first “unified” AI model and combines the reasoning abilities of its o-series of models with the fast responses of its GPT series, as reported by TechCrunchPerformance: GPT‑5 sets a new state of the art across math (94.6% on AIME 2025 without tools), real-world coding (74.9% on SWE-bench Verified, 88% on Aider Polyglot), multimodal understanding (84.2% on MMMU), and health (46.2% on HealthBench Hard), according to OpenAIReliability: GPT‑5’s responses are ~45% less likely to contain a factual error than GPT‑4o, and when thinking, GPT‑5’s responses are ~80% less likely to contain a factual error than OpenAI o3, as reported by OpenAIStrategic Implications:

Market Reset: GPT-5 raises the performance floor for AI applications, forcing competitors to accelerate development cyclesAgent Economy: GPT-5 allows ChatGPT to complete a wide variety of tasks on behalf of users — such as generating software applications, navigating a user’s calendar, or creating research briefs, as reported by TechCrunchEnterprise Penetration: 5 million paid users now use ChatGPT business products, according to OpenAI2. US Government Takes Strategic Stake in IntelBottom Line: The Trump administration is reportedly negotiating to take an equity stake in Intel, marking a historic shift toward state capitalism in the semiconductor industry.

The Trump administration is reportedly considering having the US government take a stake in Intel, a company that was once one of America’s most important tech giants but which has since fallen on hard times. Key details:

Deal Structure: The Trump administration is considering using funds from the US Chips Act to take a stake in Intel Corp., according to people familiar with the discussions, part of efforts to rescue the embattled chipmaker and shore up domestic semiconductor manufacturing.Strategic Rationale: Focus on supporting Intel’s delayed $28 billion Ohio fabrication facility, originally slated for 2022 but now pushed to 2030-2031Market Impact: Intel shares rose 7% on Thursday after Bloomberg reported that the Trump administration is in talks with the chipmaker to have the U.S. government take a stake in the struggling company.Strategic Implications:Industrial Policy Shift: First major example of “America First” tech policy translating into direct equity stakes rather than just subsidiesPrecedent Setting: Could lead to government stakes in other strategic tech companies, particularly in AI and quantum computingCompetitive Response: May force other countries to adopt similar state capitalism approaches to maintain technological sovereignty3. Apple’s AI Robotics RevolutionBottom Line: Apple is planning an ambitious AI comeback centered on robotics and smart home products, targeting 2026-2027 launches to regain AI leadership.

Apple Inc. is plotting its artificial intelligence comeback with an ambitious slate of new devices, including robots, a lifelike version of Siri, a smart speaker with a display and home-security cameras. A tabletop robot that serves as a virtual companion, targeted for 2027, is the centerpiece of the AI strategy.

Product Roadmap:

2026: Smart speaker with display (stripped-down robot variant)2027: A 7-inch iPad-like display mounted on a movable arm that can rotate and extend around six inches in any direction, allowing the robot to reposition itself to face whoever is speaking. Some people at Apple apparently refer to it as the “Pixar Lamp.”Beyond 2027: Home security cameras, smart glasses, foldable devicesStrategic Implications:

Platform Wars 2.0: Apple recognizes that voice assistants alone are insufficient for AI leadership—physical embodiment becomes critical differentiatorEcosystem Integration: All products designed to work seamlessly within Apple’s ecosystem, creating unprecedented vendor lock-in through AIMarket Timing Risk: 2027 timeline assumes significant AI advances; delays could allow competitors to establish dominant positions4. Cohere’s $500M Enterprise AI ValidationBottom Line: Canadian AI startup Cohere raised $500M at a $6.8B valuation, demonstrating continued investor appetite for enterprise-focused AI despite market maturation.

Artificial intelligence startup Cohere Inc. has raised $500 million in a new round of funding, part of a bid to compete with larger tech firms in selling AI services to businesses and governments. The financing, announced Thursday, was led by Radical Ventures and Inovia Capital, with participation from existing investors including Nvidia Corp. and AMD Ventures. The round values Cohere at $6.8 billion, up from $5.5 billion a year ago.

Strategic Implications:

Enterprise-Consumer Divergence: Validates separate market dynamics where enterprise customers prioritize security, compliance, and customization over general-purpose capabilitiesSpecialization Premium: Companies focusing on specific verticals (enterprise, government) can command higher valuations than horizontal platformsCanadian AI Hub: Reinforces Canada’s position as a major AI research and development center, potentially influencing global talent flows5. Altman vs. Musk: Brain-Computer Interface War EscalatesBottom Line: Sam Altman is co-founding Merge Labs, an $850M brain-computer interface startup backed by OpenAI, directly challenging Elon Musk’s Neuralink in the next frontier of human-AI integration.

Sam Altman is in the process of co-founding a new brain-to-computer interface startup called Merge Labs and raising funds for it with the capital possibly coming largely from OpenAI’s ventures team, unnamed sources told the Financial Times. The startup is expected to be valued at $850 million.

Strategic Implications:

The Next Computing Platform: Both leaders recognize brain-computer interfaces as the ultimate convergence of human and artificial intelligencePersonal Rivalry Dynamics: The Altman-Musk conflict extends beyond AI into the fundamental question of human-machine integrationRegulatory Preemption: Early market positioning could influence regulatory frameworks for brain-computer interfaces globally6. Meta’s Superintelligence Spending Spree Reshapes Silicon ValleyBottom Line: Meta is reshaping Silicon Valley’s talent market with nine-figure compensation packages as Zuckerberg pivots from metaverse to “personal superintelligence.”

Meta CEO Mark Zuckerberg is on a mission for his company to be the first to reach so-called artificial superintelligence — generally considered to mean AI that’s better than all humans at all knowledge work. Key investments:

Talent Acquisition:

The typical offer for the folks being poached for this team is $200 million over 4 years. That is 100x that of their peers. Furthermore, there have been some billion dollar offers that were not accepted by researcher/engineering leadership at OpenAI.Created Meta Superintelligence Labs led by ex-Scale AI CEO Alexandr WangMeta last month invested $14.3 billion in data labeling startup Scale AI.Strategic Implications:

Talent Market Disruption: Meta’s extreme compensation packages fundamentally alter Silicon Valley economics, potentially creating unsustainable talent inflationStrategic Pivot Success: Zuckerberg’s ability to shift from failed metaverse bet to AI leadership demonstrates organizational agility at massive scalePersonal Superintelligence vs. Centralized AI: Meta’s focus on individual empowerment rather than task automation could differentiate it from productivity-focused competitors7. Google’s Silent Gemini 3.0 DevelopmentBottom Line: While competitors launched major updates, Google quietly advances Gemini 3.0 development, with references spotted in CLI repositories suggesting Q4 2025 launch.

Evidence suggests Google is working on Gemini 3.0 Flash and Gemini 3.0 Pro, with the mysterious “Kingfall” model delivering top-tier performance in early tests potentially being a Gemini 3 variant or Gemini 2.5 Pro with “Deep Think” capabilities, as reported by TestingCatalog.

Strategic Implications:

Stealth Development: Google’s quiet approach may allow surprise competitive positioning but risks losing mindshare to more vocal competitorsIntegration Advantage: Google’s ability to embed Gemini across its vast product ecosystem remains unmatched competitive moatTPU Infrastructure: Google’s custom chip advantage could enable cost efficiencies that competitors using Nvidia hardware cannot match8. Anthropic’s $170B Valuation QuestBottom Line: Anthropic is nearing a deal to raise as much as $5 billion in a new round of funding that would value the artificial intelligence startup at $170 billion.

Anthropic is reportedly in talks on a funding round that would more than double its valuation, from the current $61.5 billion to more than $150 billion. Investment firm Iconiq Capital is leading the round, which is expected to total between $3 billion and $5 billion, as reported by Bloomberg.

Strategic Implications:

Amazon Partnership Stability: Unlike volatile Microsoft-OpenAI relationship, Amazon’s measured approach to Anthropic investment creates more stable foundationSafety-First Positioning: Anthropic’s continued focus on AI safety research creates regulatory goodwill and enterprise trustGovernment Market Entry: Recent moves into government and financial services demonstrate platform expansion beyond pure AI research, as reported by CNBC9. xAI’s Controversial Growth and Grok 4 LaunchBottom Line: Elon Musk’s xAI raised $10 billion in combined debt and equity while launching Grok 4, despite ongoing controversies including antisemitic outputs and co-founder departure.

xAI raised $5 billion in debt and $5 billion in equity, with half the funding from secured notes and term loans, and a separate $5 billion through strategic equity investment, as reported by CNBC. The company also launched Grok 4, claimed to be “the most intelligent model in the world,” according to xAI.

Strategic Implications:

Controversy as Feature: Musk’s “anti-woke” positioning creates distinct market segment but limits enterprise adoptionInfrastructure Advantage: 200,000 GPU Memphis facility provides compute advantages, though talent departures raise execution questions, as reported by CNBCGovernment Adoption Risk: $200 million Pentagon contract despite controversial outputs suggests political alignment may override technical concerns, as reported by WikipediaFinancial Performance & Market ImpactAI Investment SurgeTotal Funding: Over $30B in AI funding announced this week across multiple companiesValuation Inflation: Average AI company valuation multiples now exceed 50x revenueGovernment Investment: Unprecedented direct government equity participation in private AI companiesNvidia’s Continued Dominance Despite ChallengesQ1 2026 Results: $44.1B revenue (up 69% YoY), despite $4.5B charge from China export restrictions, as reported by NvidiaQ2 2026 Outlook: $45B revenue expected (August 27 earnings), reflecting strong underlying demandChina Impact: This outlook reflects a loss in H20 revenue of approximately $8.0 billion due to the recent export control limitations, according to NvidiaMarket Position: Despite geopolitical challenges, demand for AI infrastructure continues growing across all customer segmentsMeta’s AI Investment Paying OffFinancial Results: Meta on Wednesday posted earnings of $7.14 per share on $47.5 billion in revenue from the quarter ended June 30. Earnings per share were up 38% from the year-ago period and well above the $5.88 that Wall Street analysts had expected, as reported by CNBCInvestor Confidence: Strong performance enables continued AI spending despite $27B in quarterly costsAI Revenue Impact: Meta said in a call with analysts Wednesday evening, adding that the company’s performance in the quarter could be attributed to AI improving its core ad business, as reported by CNNEnterprise AI Market ValidationCohere Growth: Revenue jumped from $13M (2023) to $35M annualized (March 2025), as reported by BloombergAnthropic Traction: $4B annualized revenue run rate with 80% from business subscriptions, according to Financial TimesOpenAI Enterprise: 5 million paid business users demonstrates enterprise adoption acceleration, as reported by OpenAIDeep Analysis: Strategic Implications by Development1. GPT-5 Market Impact AnalysisImmediate Effects:

Performance Ceiling Raised: GPT-5’s benchmarks force immediate competitive response from Google, Anthropic, and MetaEnterprise Acceleration: Built-in reasoning eliminates need for separate models, simplifying enterprise AI deploymentDeveloper Tool Evolution: 74.9% SWE-bench performance suggests human-AI pair programming becomes mainstreamLong-term Implications:

Model Commoditization Risk: As capabilities converge, differentiation shifts to distribution, integration, and specific use casesInfrastructure Dependencies: Microsoft’s role in GPT-5 training strengthens their AI cloud positioning against Amazon and GoogleRegulatory Attention: GPT-5’s capabilities may trigger new AI regulation, particularly in high-stakes domains like healthcare and finance2. Intel Government Stake: Industrial Policy PrecedentEconomic Implications:

State Capitalism Evolution: US adopts Chinese-style government investment model, blurring public-private boundariesSemiconductor National Security: Government recognizes chips as critical infrastructure requiring direct interventionMarket Structure Change: Could encourage consolidation as smaller players seek government partnershipsGeopolitical Ramifications:

China Response: US moves may accelerate Chinese semiconductor self-sufficiency effortsAllied Coordination: NATO countries may adopt similar models, creating new international investment coordination needsTechnology Export Controls: Government stakes enable more granular control over technology transfer3. Apple’s Robotics Gambit: Platform Strategy EvolutionMarket Positioning:

Beyond Device Manufacturer: Apple transitions from hardware company to AI ecosystem orchestratorPrivacy Differentiation: On-device AI processing becomes key differentiator against cloud-dependent competitorsConsumer Adoption Curve: 2027 timeline allows market education before mass rolloutCompetitive Dynamics:

Amazon Alexa Challenge: Apple’s visual, mobile robots directly threaten Amazon’s stationary smart speakersGoogle Assistant Pressure: Integrated ecosystem approach leverages Apple’s hardware advantage over Google’s software focusTesla Robot Competition: Apple’s consumer focus contrasts with Tesla’s utility-focused humanoid robots4. Cohere’s Enterprise Validation: Market SegmentationBusiness Model Innovation:

Vertical Specialization: Proves viable alternative to horizontal platform approachSecurity Premium: Government and enterprise customers willing to pay significantly more for compliant solutionsCanadian Advantage: Different regulatory environment and talent pool creates competitive differentiationIndustry Structure:

Two-Tier Market: Clear separation between consumer AI (OpenAI, Google) and enterprise AI (Cohere, Anthropic)Partnership Strategies: Success validates platform approach over direct competition with big techTalent Arbitrage: Canadian location provides access to AI talent at lower cost than Silicon Valley5. Brain-Computer Interface Arms Race: Future ComputingTechnology Trajectory:

Convergence Point: Both companies recognize BCI as ultimate AI-human interfaceTimeline Compression: Competition accelerates development timelines from decades to yearsRegulatory Framework: Early market entry could influence medical device and neural interface regulationsMarket Implications:

Platform Control: Winner may control next computing platform transition, similar to mobile OS dominanceEthical Considerations: Human enhancement raises unprecedented ethical and social questionsEconomic Impact: Successful BCI could create entirely new categories of human-AI collaboration6. Meta’s Talent War: Silicon Valley Economics DisruptionLabor Market Effects:

Wage Inflation: $200M packages set new industry ceiling, potentially creating talent bubbleBrain Drain: Other companies and research institutions lose top talent to Meta’s compensationGeographic Concentration: Extreme talent concentration in few companies reduces innovation diversityStrategic Outcomes:

Execution Risk: High-cost talent may not translate to proportional capability improvementsCultural Integration: Absorbing talent from diverse companies creates management challengesCompetitive Response: Other companies must choose between matching compensation or accepting talent drain7. Google’s Stealth Strategy: Platform IntegrationCompetitive Positioning:

Distribution Advantage: Google’s product ecosystem provides unmatched AI integration opportunitiesCost Structure: TPU infrastructure could provide sustainable cost advantages over Nvidia-dependent competitorsRegulatory Buffer: Less controversial approach may avoid regulatory scrutiny affecting more aggressive competitorsMarket Risks:

Mindshare Loss: Quiet development allows competitors to capture media attention and developer mindshareTalent Competition: Lower public profile may handicap recruitment against more visible AI companiesInnovation Pace: Conservative approach could result in meaningful capability gaps8. Anthropic’s Growth: Enterprise AI MaturationMarket Validation:

Safety Premium: Enterprises willing to pay premium for AI safety and reliabilityAmazon Partnership: Strategic alignment provides stable foundation unlike volatile OpenAI-Microsoft relationshipGovernment Adoption: Success in regulated industries validates enterprise AI business modelCompetitive Positioning:

Differentiation Strategy: Safety focus creates distinct market position from performance-focused competitorsScale Economics: $170B valuation suggests enterprise AI market larger than initially estimatedInternational Expansion: Geographic diversification reduces dependence on US market dynamics9. xAI’s Controversial Path: Alternative AI PhilosophyMarket Differentiation:

Anti-Establishment Positioning: “Anti-woke” messaging appeals to specific customer segments but limits broader adoptionTechnical Capabilities: Grok 4 performance suggests technical competence despite controversial outputsInfrastructure Investment: Massive compute deployment demonstrates serious technical commitmentBusiness Model Risks:

Reputation Damage: Controversial outputs create enterprise adoption barriersTalent Retention: Co-founder departure suggests internal challenges with company directionRegulatory Risk: Controversial outputs could trigger government scrutiny or content restrictionsRisks and ChallengesSystemic Risks1. Talent Market SustainabilityCompensation Inflation: Meta’s $200M packages create unsustainable salary expectations across industryBrain Drain Impact: Academic institutions and smaller companies lose critical research talentExecution Risk: High-cost talent may not translate to proportional capability improvements2. Regulatory UncertaintyExport Controls: Nvidia’s $8B China revenue impact demonstrates ongoing policy volatilityGovernment Intervention: Intel stake creates precedent for future state involvement in private companiesContent Regulation: xAI’s controversial outputs may trigger broader AI content restrictions3. Infrastructure ConstraintsEnergy Limitations: Data center power requirements growing faster than grid capacityChip Dependencies: Nvidia monopoly creates systemic risk for entire AI industryGeographic Concentration: AI infrastructure concentrated in few regions creates vulnerabilityCompany-Specific RisksOpenAIMicrosoft Dependency: GPT-5 training reliance on Microsoft infrastructure creates strategic vulnerabilityCompetitive Pressure: Google, Meta, and Anthropic rapidly closing capability gapsTalent Retention: Industry-wide salary inflation may impact ability to retain key researchersMetaExecution Risk: Massive talent investment may not translate to product successRegulatory Scrutiny: Government attention to AI concentration may target Meta’s aggressive spendingCultural Integration: Absorbing talent from diverse companies creates management challengesAppleTimeline Risk: 2027 robotics launch assumes significant AI advancement may not materializeEcosystem Dependence: Success requires seamless integration across hardware, software, and servicesConsumer Adoption: Physical AI products face higher adoption barriers than softwareGoogleMindshare Loss: Quiet development approach allows competitors to capture developer attentionIntegration Complexity: Vast product portfolio creates coordination challenges for AI rolloutAntitrust Risk: Market position in search may attract regulatory intervention in AIIntelGovernment Dependence: Reliance on government support may constrain strategic flexibilityExecution History: Previous missed technology transitions raise questions about AI capabilityCompetitive Position: Years behind TSMC in manufacturing technologyTechnology Readiness RisksBrain-Computer InterfacesMedical Approval: Regulatory approval timelines may extend beyond competitive windowsSafety Concerns: Neural implant risks could trigger public backlashTechnical Challenges: Current technology far from seamless human-AI integrationRobotics IntegrationAI Capabilities: Current AI insufficient for reliable real-world robot operationManufacturing Scale: Consumer robotics requires unprecedented manufacturing complexitySafety Standards: Home robots must meet higher safety standards than industrial applicationsModel CapabilitiesHallucination Persistence: Despite improvements, AI reliability issues remain significantEnergy Efficiency: Current models require enormous computational resourcesGeneralization Limits: AI systems still struggle with novel situations and edge casesInvestment OutlookClear WinnersNvidia – Maintain OverweightCompetitive Moat: GPU dominance remains unchallenged despite China headwindsDemand Drivers: All major AI companies increasing infrastructure spendingPricing Power: Can pass through cost increases to customers with inelastic demandRisk Factors: China restrictions ($8B revenue impact), potential new competitorsMeta – Upgrade to Strong BuyFinancial Performance: AI investments already driving revenue growth and margin expansionStrategic Position: Personal superintelligence approach differentiates from productivity-focused competitorsExecution Capability: Demonstrated ability to pivot from failed metaverse to AI leadershipRisk Factors: Talent cost inflation, regulatory scrutiny, execution risksMicrosoft – Hold with Positive BiasOpenAI Partnership: GPT-5 integration across Microsoft products provides competitive advantageEnterprise Position: Strong position in business AI through Copilot integrationInfrastructure Assets: Azure AI capabilities benefit from OpenAI relationshipRisk Factors: OpenAI dependency, Google competitive pressure, enterprise adoption paceConditional WinnersApple – Buy on TimingLong-term Vision: Robotics strategy could create new platform dominanceEcosystem Advantage: Unmatched ability to integrate AI across hardware and softwareExecution History: Track record of successful technology platform transitionsRisk Factors: 2027 timeline risk, consumer adoption uncertainty, competition from established playersGoogle/Alphabet – HoldTechnical Capabilities: Gemini 3.0 development suggests continued innovationDistribution Advantage: Search and Android provide massive AI integration opportunitiesInfrastructure Assets: TPU technology could provide cost advantagesRisk Factors: Stealth approach risks mindshare loss, antitrust concerns, execution complexityAmazon – Cautious HoldAnthropic Investment: $8B investment provides AI capability accessCloud Leadership: AWS position enables AI infrastructure monetizationEnterprise Focus: Strong position in business AI through Bedrock platformRisk Factors: Limited proprietary AI capabilities, competitive pressure in cloudSpeculative OpportunitiesIntel – Speculative BuyGovernment Support: US stake provides financial backing and strategic protectionTurnaround Potential: New leadership and government partnership could accelerate recoveryManufacturing Capabilities: Only US-based advanced chip manufacturerRisk Factors: Execution history, technology gaps, competitive disadvantagesAnthropic (Private Market)Safety Leadership: Unique positioning in AI safety creates enterprise and government appealTechnical Capabilities: Claude 4 performance competitive with leading modelsMarket Validation: $170B valuation suggests strong investor confidenceRisk Factors: Private market liquidity, execution risks, competitive pressureAvoid/UnderweightxAI – AvoidReputation Risk: Controversial outputs create enterprise adoption barriersManagement Instability: Co-founder departure raises execution concernsLimited Market: “Anti-woke” positioning limits addressable marketRisk Factors: Regulatory scrutiny, talent retention, limited enterprise appealSector Allocation RecommendationsOverweight AI Infrastructure (35% allocation)Nvidia, AMD, cloud providers, data center operatorsRationale: Demand growth exceeds supply capacity, creating pricing powerBalanced AI Applications (30% allocation)Microsoft, Google, Meta, AppleRationale: Platform integration creates sustainable competitive advantagesUnderweight AI Startups (15% allocation)OpenAI, Anthropic, Cohere (private markets)Rationale: High valuations and competitive pressure from big techSpeculative AI Hardware (10% allocation)Intel, specialized AI chip companiesRationale: Potential for disruption but high execution riskDefensive Positioning (10% allocation)Traditional tech companies with limited AI exposureRationale: Portfolio insurance against AI bubble concernsKey Investment Themes for Next 12 MonthsInfrastructure Scarcity: Nvidia and cloud providers benefit from supply constraintsEnterprise Adoption: Companies with strong enterprise relationships outperformPlatform Integration: Success requires controlling entire AI technology stackGovernment Partnerships: Companies with government relationships gain regulatory protectionTalent Concentration: Winners will be companies that can attract and retain top AI talentConclusionThis week marked a fundamental inflection point in AI development – the transition from experimental technology to critical national infrastructure. The convergence of several unprecedented events signals the industry’s maturation into a strategic sector where success will determine economic and geopolitical leadership for decades.

Key TakeawaysThe Great Acceleration: OpenAI’s GPT-5 launch, combined with massive funding rounds across multiple companies, demonstrates that AI development is accelerating beyond most predictions. The capability gaps between leading models are narrowing rapidly, forcing companies to differentiate through integration, specialization, and platform control rather than pure performance.

Government as Strategic Player: The US government’s potential equity stake in Intel represents a watershed moment in American industrial policy. This marks the end of the purely market-driven approach to critical technology development and signals the beginning of a new era of state capitalism in AI and semiconductors.

Talent as Ultimate Weapon: Meta’s $200 million compensation packages have fundamentally altered Silicon Valley economics. The extreme concentration of AI talent in a handful of companies creates both unprecedented innovation potential and systemic risks for the broader technology ecosystem.

Platform Wars Intensify: Apple’s robotics strategy, Meta’s superintelligence focus, and the Altman-Musk brain-computer interface rivalry demonstrate that AI leadership requires controlling the entire stack from silicon to human interface. Software-only strategies are increasingly insufficient.

The Next 18 Months Will Be DecisiveThe companies that successfully navigate the current transition will likely establish dominant positions for the next decade. Success factors include:

Talent Retention: Ability to attract and retain top AI researchers despite extreme salary inflationInfrastructure Scale: Access to massive computing resources and energy supplyGovernment Relationships: Partnerships that provide regulatory protection and strategic supportPlatform Integration: Seamless AI integration across hardware, software, and servicesMarket Focus: Clear positioning in either enterprise/government or consumer segmentsInvestment ImplicationsThe AI market is bifurcating into infrastructure providers (clear winners), platform integrators (conditional winners based on execution), and pure-play AI companies (high risk/high reward). The safest bets are on infrastructure scarcity and companies with established distribution advantages.

Looking ForwardThe industry is entering its most competitive phase yet. While technical capabilities are converging, the battle for AI supremacy will be won through execution, integration, and strategic positioning. The next major milestones to watch include:

Q4 2025: Google’s Gemini 3.0 launch and competitive response2026: Apple’s smart speaker with display and enterprise AI adoption acceleration2027: Apple’s robotics launch and potential brain-computer interface breakthroughsThe companies that emerge as leaders from this period will shape not just the technology industry, but the fundamental nature of human-computer interaction for generations to come.

The post AI Business Analysis: Week of August 10-16, 2025 appeared first on FourWeekMBA.