Apple’s $3.5 Trillion AI Panic: Why Tim Cook Is Frantically Shoving Intelligence Into Every Device (Even Your HomePod)

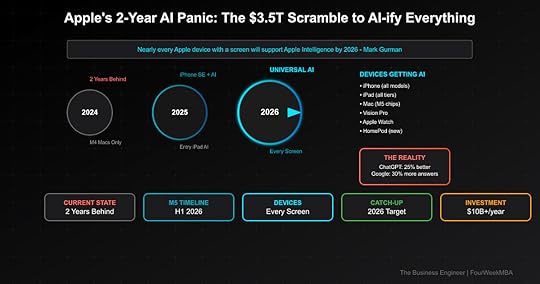

Apple’s internal studies show they’re 2 years behind OpenAI and Google in AI. ChatGPT is 25% more accurate than Siri and answers 30% more questions. Now Bloomberg reveals Apple’s desperate catch-up plan: stuff Apple Intelligence into literally every device with a screen by 2026. This isn’t innovation—it’s a $3.5 trillion company in full panic mode, trying to avoid becoming the BlackBerry of the AI era. The timeline? iPhone SE gets AI in March 2025, entry iPad later in 2025, and by 2026, even your HomePod will pretend to be intelligent.

The Brutal Reality CheckApple’s AI Report Card (Per Internal Studies)The Devastating Numbers:

2 Years Behind: Industry leaders (OpenAI, Google, Meta)ChatGPT vs Siri: 25% more accurateQuestion Coverage: ChatGPT answers 30% more queries“Wow Factor”: Zero (per Apple’s own employees)Current Coverage: Only newest devices with M4/A17 ProTranslation: The world’s most valuable company is getting embarrassed by a 2-year-old startup. No wonder they’re panicking.

The Universal AI Timeline2024 (Now):

iPhone 15 Pro/16 series onlyM4 MacsLatest iPad Pro~10% of Apple devices2025 (Scramble Phase):

March: iPhone SE 4 with AILate 2025: Entry-level iPadVision Pro integration~30% of devices2026 (Universal Rollout):

“Nearly every Apple device with a screen”M5 MacBooks (Pro and Air)Apple Watch full integrationNew AI-powered HomePod~95% of devicesThe M5 Chip: Apple’s AI Hail MaryWhat We KnowTimeline: H1 2026 for MacBook Pro/Air

Purpose: Native AI processing power

Competition: Qualcomm’s Snapdragon X Elite

The Technical Reality:

Apple needs chips that can run large language models locally. M4 barely handles it. M5 is the minimum viable AI processor for their ambitions.

Getting M5 First:

MacBook Pro (power users)MacBook Air (mass market)iPad Pro (creative pros)iMac (desktop users)Mac Studio (developers)Why This Order Matters:

Pro users pay premium for early access. Consumer devices get hand-me-down tech. Classic Apple margin optimization.

The Play:

Launch: March 2025Price: ~$429-499Feature: Full Apple IntelligenceGoal: Get AI to price-sensitive usersWhy It’s Desperate:

Apple NEVER puts cutting-edge features in SE models. They’re cannibalizing their own premium lineup because they need AI adoption numbers.

Traditional Apple:

Premium features for premium pricesYears-long trickle downClear product differentiationPanic Mode Apple:

AI in cheapest iPad (late 2025)Breaking their own segmentationAdmission that AI is table stakesThe Strategic ImplicationsFor Apple’s Business ModelThe Old Way:

Hardware differentiation drives upgradesPremium features for premium devicesControlled feature rolloutMargin protection paramountThe AI-Forced Way:

AI becomes universal baselineHardware margins compressServices must carry more weightEcosystem lock-in criticalFor CompetitorsSamsung’s Opportunity:

Already has Galaxy AI across lineupNo 2-year lag to overcomeCan claim “AI-first” positioningGoogle’s Advantage:

Pixel phones with superior AIGemini integration nativeYears of AI experienceMicrosoft’s Play:

Copilot everywhere strategyEnterprise dominanceOpenAI partnership leverageThe Hidden CrisisWhy Apple Is Really 2 Years BehindThe Cultural Problem:

Secrecy Obsession: Can’t collaborate like open AI researchHardware DNA: Software/AI is second-class citizenPerfectionism Paralysis: Ship when perfect vs iterateNIH Syndrome: Not-invented-here kills partnershipsSiri’s Failure: 13 years of broken promisesThe Talent Problem:

Best AI researchers go to OpenAI/Google/MetaApple’s secretive culture repels academicsCompensation can’t compete with pre-IPO equityRemote work policies hurt recruitingLost John Giannandrea momentumThe Catch-22Apple Needs To:

Move fast (against their DNA)Be open (against their culture)Partner deeply (against their control)Accept “good enough” (against their brand)But They Can’t Because:

Brand depends on perfectionMargins depend on controlCulture depends on secrecyStrategy depends on integrationThe $10 Billion QuestionWhat Apple Is SpendingAI Investment (Estimated):

R&D: $5B+ annuallyTalent acquisition: $2B+Infrastructure: $2B+Partnerships: $1B+Total: $10B+ per yearFor Context:

Entire Apple R&D budget: $30BAI now ~33% of all R&DMore than most companies’ revenueWhere It’s GoingThe Bets:

On-device processing: Privacy-preserving AISiri resurrection: Complete rebuildHealth AI: Doctor in your pocketVision Pro AI: Spatial computingCar AI: Even if car is deadHome automation: AI hub strategyThe ScenariosBest Case: The 2026 ComebackWhat Happens:

Universal AI rollout succeedsM5 chips leapfrog competitionPrivacy angle resonatesServices revenue explodesStock hits $4 trillionProbability: 20%

Base Case: Muddle ThroughWhat Happens:

AI everywhere but unremarkableStays 1-2 years behind leadersEcosystem lock-in preserves baseSlow services growthStock flat for 2 yearsProbability: 60%

Worst Case: The BlackBerry ScenarioWhat Happens:

AI gap widens to 3+ yearsPremium buyers defect to PixelServices can’t offset hardware declineForced to license Google AIStock corrects 30%Probability: 20%

The Investment AngleWhy Apple Might Be a BuyThe Bull Case:

2 billion device installed baseEcosystem lock-in powerfulM5 could surpriseServices still growingWarren Buffett won’t sellWhy Apple Might Be a SellThe Bear Case:

AI is the new platform shiftApple missed it like Microsoft missed mobileMargins compress permanentlyGrowth story overValuation assumes AI leadershipThe HedgeSmart Play:

Long Apple services revenueShort iPhone unit growthPair trade vs GOOGLBuy AI chip makers (NVDA, AMD)Wait for M5 reviewsWhat This Really MeansThe End of Premium AIBy putting AI in iPhone SE and entry iPad, Apple admits AI is now a commodity feature, not a differentiator. This fundamentally breaks their business model of premium features for premium prices.

The Beginning of AI EverywhereWhen Apple moves, the industry follows. “Every device with a screen” having AI means:

Your TV becomes intelligentYour car dashboard thinksYour refrigerator suggests recipesYour watch predicts health issuesThe Platform Shift RealityThe Last Three Shifts:

PC Era: Microsoft won, Apple almost diedMobile Era: Apple won, Microsoft almost diedAI Era: Apple playing catch-up, could be BlackBerryThe Pattern: Missing a platform shift is usually fatal for tech giants. Apple has 24 months to prove they’re different.

The Bottom LineApple’s plan to stuff Intelligence into every device by 2026 isn’t innovation—it’s admission of failure. Being 2 years behind in AI when you’re worth $3.5 trillion is like being a telegraph company when phones exist. The universal rollout timeline shows desperation: breaking their own premium model to get AI everywhere fast.

The Strategic Reality: Apple is in the unfamiliar position of playing catch-up in a platform shift. Their response—throw money at it and hope ecosystem lock-in saves them—might work, but it’s the first time in the Tim Cook era where Apple looks genuinely vulnerable. When you’re putting cutting-edge features in the iPhone SE, you’re not innovating; you’re surviving.

For Business Leaders: The lesson is brutal—no moat is permanent in technology. Apple’s premium pricing power, ecosystem lock-in, and brand loyalty might not matter if they’re selling yesterday’s technology. When a $3.5 trillion company panics, it’s a reminder that in tech, you’re either riding the wave or drowning in it. There’s no middle ground in platform shifts.

Three Predictions:Apple licenses Google’s Gemini by 2027: Pride loses to pragmatism when you’re 3 years behindiPhone SE 4 outsells iPhone 17: Cheap + AI beats expensive + incrementalApple acquires major AI company for $10B+: Desperation drives record acquisitionStrategic Analysis Framework Applied

The Business Engineer | FourWeekMBA

Want to analyze tech platform shifts and competitive dynamics? Visit [BusinessEngineer.ai](https://businessengineer.ai) for AI-powered business analysis tools and frameworks.

The post Apple’s $3.5 Trillion AI Panic: Why Tim Cook Is Frantically Shoving Intelligence Into Every Device (Even Your HomePod) appeared first on FourWeekMBA.